What information do I need for car insurance?

The information you need for car insurance will include your own driving record, claims history, and important vehicle information regarding the safety features and anti-theft technology. Refer to this guide to find out what information you need for auto insurance quotes and start comparing insurance quotes for free with our comparison tool below.

Read more

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Nov 25, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 25, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Whenever you are shopping around for car insurance, one of the things you should know if what information is needed to start a car insurance plan.

If you are a first-time buyer or a young driver, you will not have a record of driving or insurance and even the information regarding your identity may not be as easily searched in an insurance company’s database.

So you will need to get certain paperwork together before starting a new insurance policy.

Make sure your rates are competitive by entering your zip code into our FREE comparison tool above!

- You will need certain identifying documents when you obtain a car insurance policy

- The information may not be readily available for new drivers

- Have your documents, such as driver’s license, social security number, and place of address, ready to save time as you shop for insurance

- Giving an insurance company certain information protects you from identity theft

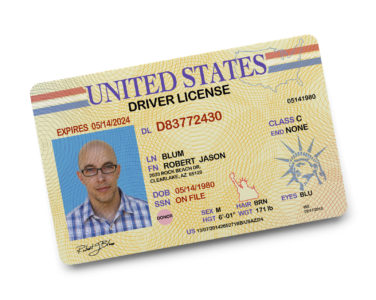

Driver’s License

First of all, you will need some specific documents and information to verify your identity to the potential car insurance company that you choose.

Some limited information is available on the databases such insurance companies have at their disposal. But young or new drivers will need more information than the agent will be able to locate on their own in most cases.

Of course one of the most important pieces of information that car insurance companies will ask for is a copy of your driver’s license. In some cases, your number is enough. If you are a new insurance applicant, they may ask you to scan and send it to them via email.

By having a copy of your driver’s license, they may obtain information on your driving record that may influence the deals they offer you, as well as your overall premium rates and services.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Name and Social Security Number

At the most basic level, your name and social security number will always be the first thing that is required to get the process of car insurance going, whether you are renewing a policy, trying to locate an old policy, or purchasing a policy for the first time.

Your social security number is a number that was assigned to you at birth, and every American citizen has one. If you do not have a social security card, you will need to get one from the Social Security Office.

Typically young people ask for a copy of their social security card upon their fourteenth birthday or at the time they obtain their first job. But if you do not have one, you must complete this step as soon as possible.

As long as you know your number, you may still be able to apply for car insurance. Tell the agent online that you know your social security number but do not yet have your card.

You may be required to get the card and scan it before they issue your first policy. But it is possible they will be able to verify your identity this way by running your social security number.

Address and Phone Number

Another important piece of information you will need to get car insurance is your home address and phone number. A landline phone is preferred since it can be traced to your home address through phone records. However, nowadays, with so many using cell phones, a cell phone number is often enough to meet this qualification.

Your home address is an absolute must to obtain a car insurance policy. If you still live with your parents, you can put down their address, and this will usually be fine. But, if you move, you will be required to tell the insurance company your new address.

Job Information

Also, you must provide and maintain your employment. The insurance providers use this information as another way to track your identity, as well as verify that you are a U.S. citizen.

It also assured them that you have a means of steady income to pay your premiums and gives them another point of reference to find you if they needed to get in touch with you. They will usually want the following information about your employment status:

- Place and location of employment

- Your role in the company

- How long you have been at the job

- Your estimated salary

- Field of industry

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Car Make, Model, and Year

The insurance company will also ask for the make, model, and year of your car before issuing a policy. This information is usually a part of the online form, but they may also verify it with you and want to know if it is financed or leased.

This information is required so that they can make sure they are following the requirements of your lease or finance company when offering you a policy.

As you can probably guess, insurance companies may use this information for more reasons than instating you as a car insurance policyholder.

They will use it with their internal marketing system to identify certain professions and their vehicle insurance records and driving behavior, as well as using it to better their services and offer special discounts to their policyholders.

Insurance companies know that all information they hold on you is confidential, so they are not allowed to share it with third parties. They only use this information to improve their services and to help you (and other consumers) to get the most out of their policy in the future and to consider add-on services to offer in the future.

If you have questions about your privacy or the policies of your insurance company, you can call or write them anytime.

Banking Information

Some people are afraid to put their banking information up online or give it to an agent on the phone. But you will have to give an insurance company this information to get a policy issued in most cases.

Alternately, you could use a credit card, but many car insurance companies offer discounts for setting up an automatic bank withdrawal at a set time each month, so it may be worth the savings to do this.

The specific banking information you’ll need usually includes:

- Name of your bank and location

- Routing number

- Checking Account number

- Your name and address

Why do insurance companies need so much information from me?

Some may ask why insurance companies need so much information about their identity to start an insurance policy. There are many reasons, but the most important are that it identifies that you are who you say you are (so no one else).

It also gives an officer who stops you valid means of determining your identity and who your car is registered to. Finally, when you file a claim, it guarantees that the demand money can be awarded only to you and no one else.

Any of these questions can be answered by a professional insurance agent on our site. Start by shopping and comparing policies and deciding what you want to carry on your policy. But have the required documents ready and all together when you call. It will save a lot of time later on.

Once you know what kind of policy you want, use our FREE comparison tool, enter your zip, and choose the plan that fits your needs best!

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.