South Carolina Car Insurance (Coverage, Companies, & More)

South Carolina car insurance laws require drivers to carry 25/50/25 in minimum liability coverage, but you may choose to drive with more coverage. The average South Carolina car insurance rates are $101/mo, and State Farm is the cheapest South Carolina car insurance company, but you may find better rates with a different company. Enter your ZIP code to start comparing South Carolina car insurance quotes near you.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Nov 1, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 1, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| South Carolina Statistics Summary | Details |

|---|---|

| Road Miles | Total in State: 76,250 Vehicle Miles Driven: 51.7 billion |

| Vehicles | Registered: 4,046,410 Total Stolen: 12,970 |

| State Population | 5,084,127 |

| Most Popular Vehicle | Ford F150 |

| Uninsured Motorists | 9.40% State Rank: 37th |

| Total Driving Fatalities | 2008-2017 Speeding: 3362 Drunk Driving: 3414 |

| Annual Average Premiums | Collision: $265.07 Comprehensive: 180.94 Liability: $527.09 |

| Cheapest Providers | State Farm |

Want a taste of the South, check out South Carolina! Known for its rich history, beaches (Myrtle Beach, anyone?), iconic food and drink, beautiful landscapes, and more, South Carolina, known as the Palmetto State, has something for everyone.

Love animals? Morgan Island, one of the Sea Islands in South Carolina, is also known as Monkey Island. Visitors can see some of the approximately 4,000 rhesus monkeys in their natural habitat.

ACE Basin, found in the Lowcountry of South Carolina, is one of the largest estuaries in the eastern half of the United States and includes 217,000 acres of wildlife and vegetation.

Are you a history buff? South Carolina is for you! Civil War history can be found nearly everywhere in the state, including Fort Sumter, where shots were first fired at the start of the War.

Whether you live in South Carolina or just plan to visit, knowing the rules of the road, state insurance requirements, and more while traveling across the state is important. But knowing where to search, what questions to ask, and how to find all the information you need to know can be frustrating. Why not let us find all the information for you and conveniently locate it in one place?

Ready to get started? Read on to find out more! And while you’re at it, use your zip code to get a free quote on car insurance!

South Carolina Car Insurance Coverage and Rates

How does South Carolina’s insurance premiums compare to the rest of the nation?

| South Carolina Average | National Average | Percent Difference |

|---|---|---|

| $1,210 | $1,311 | -7.7% |

This table shows South Carolina’s average annual insurance premiums are 7.7 percent below the national average. If you live in South Carolina, this is good news for your wallet.

Looking for general information insurance coverage and rates in South Carolina? We are here for you. In the following sections, we will look at coverage requirements, liability, rates based on various demographics and locations within the state, financial responsibility, and more.

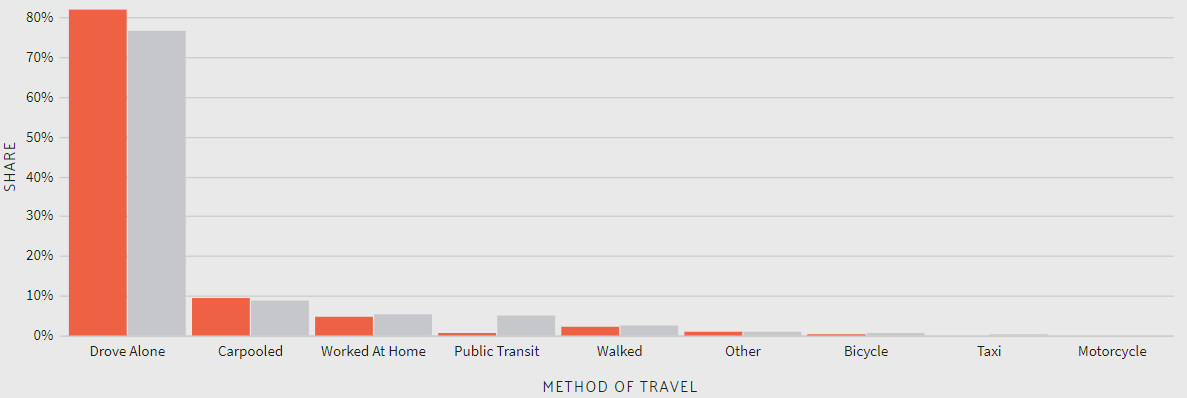

South Carolina’s Car Culture

South Carolinians love to drive. With an estimated 717 drivers per 1,000 residents, there are a lot of drivers on the road. The state’s love of the open road, motorized vehicles, and all things racing began over a hundred years ago and has never stopped.

South Carolina is home to hundreds of car manufacturing facilities as well as raceways for both professionals and amateurs.

South Carolina Minimum Coverage

In general, there is a minimum insurance coverage required to legally be able to operate your vehicle on the road. South Carolina is no exception and requires minimum liability coverage.

South Carolina is an “at-fault” state, which means the driver at fault for the accident (or the at-fault driver’s insurance) is financially responsible for any damages that resulted from the accident.

South Carolina’s liability coverage requirements are shown in the table below:

| Insurance Required | Minimum Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person $50,000 per accident |

| Property Damage Liability | $25,000 |

| Uninsured Motorist Coverage | $25,000 per person $50,000 per accident $25,000 property damage per accident |

Drivers are also required to have uninsured motorist coverage at the same values listed in the liability coverage requirements table above.

There is one exception to the minimum liability coverage requirement in South Carolina. In special cases, though it is not recommended, if you meet several qualifications, you can apply for an annual $600.00 Uninsured Motorist Fee, which allows drivers to use an uninsured vehicle on the road in South Carolina.

In the following sections, we will look in more detail at driver responsibility and additional coverage options. It is important to note that minimum insurance requirements are not always the best option for drivers. For more information about what level of coverage best suits your needs, speak with your insurance provider.

Forms of Financial Responsibility

State law requires all drivers to keep proof of financial responsibility, specifically valid proof of insurance, available in the vehicle at all times. South Carolina is one of the 48 states in the U.S. that allows drivers to use digital copies of proof of insurance, rather than paper proof, at a traffic stop. At any point during a traffic stop, the driver may be required to show this proof of insurance.

Premiums as a Percentage of Income

If you live in South Carolina, how much of your paycheck goes to car insurance? Below is a table showing the percentage of income spent on car insurance across a three-year span in the Palmetto State, compared to the national average of the same.

| 2014 | 2013 | 2012 | |

|---|---|---|---|

| South Carolina | 2.81% | 2.84% | 2.74% |

| National Average | 2.40% | 2.43% | 2.34% |

Average Monthly Car Insurance Rates in SC (Liability, Collision, Comprehensive)

Typically, auto insurance policies provide either liability, collision, or comprehensive coverage. A combination policy, which includes all three, is also an option.

This video provides a quick overview of auto insurance policy and coverage basics.

In South Carolina, the average core coverage costs are listed in the below table, compared to national averages of the same coverage options.

| Type of Coverage | Average Cost in South Carolina (2011-2015) | Average Cost Nationwide (2011-2015) |

|---|---|---|

| Liability | $497.50 | $516.39 |

| Collision | $247.62 | $299.73 |

| Comprehensive | $165.38 | $138.87 |

| Combined | $910.51 | $955 |

South Carolina is below the national average in three out of the four coverage options. However, it is worth noting that this data, pulled from the National Association of Insurance Commissioners website, is based on the states’ minimum requirements for insurance.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Is there an additional liability?

Additional liability coverage can be added to your policy to cover expenses beyond those already covered by typical policies. Examples of additional liability coverage include:

- Personal injury protection, or no-fault insurance, helps cover medical expenses for all individuals involved in an accident, regardless of who is at fault.

- Medical payments coverage helps pay medical costs for you and anyone else listed on your policy in the event of an accident, regardless of who is at fault.

- Uninsured/underinsured motorist coverage provides additional financial protection in the event you are in an accident with someone uninsured or underinsured.

Loss ratio is the percentage of premiums that are paid out in claims. An insurance provider may be losing money when their loss ratio is greater than one hundred percent. If their ratio is lower, claims are not being paid.

The below table provides an overview of theaverage loss ratio for the state in each of the additional liability types available for South Carolina. While the NAIC does not currently have data on personal injury protection, they do provide data on uninsured motorists and MedPay.

| Loss Ratio | 2013 | 2014 | 2015 |

|---|---|---|---|

| Medical Payments (MedPay) | 91% | 89% | 89% |

| Uninsured/Underinsured Motorist | 76% | 86% | 91% |

As of 2015, 9.4 percent of South Carolina drivers are uninsured, ranking them at 37th in the country for uninsured drivers.

Are there any add-ons, endorsements, & riders?

Additional endorsements, add-ons, and riders you can speak to your insurance provider about including in your policy, if they suit your needs, are listed below:

- Guaranteed Asset Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

What are the average monthly car insurance rates by age & gender in SC?

It is common practice for auto insurance providers to adjust rates based on gender. Some states, including California and North Carolina, have outlawed this practice, but currently, South Carolina still permits insurance providers to use gender as a factor in determining rates. The below table provides average rates for the primary auto insurance providers in South Carolina across a range of age and gender demographics. (For more information, read our “Best Cheap Car Insurance Companies That Accept Permits“).

| Company | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate | Single 17-year old female annual rate | Single 17-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $2,575.42 | $2,575.42 | $2,462.77 | $2,462.77 | $6,662.45 | $8,518.45 | $2,858.85 | $3,111.28 |

| Bristol West Select | $3,198.86 | $3,212.56 | $3,054.08 | $3,319.19 | $8,424.07 | $9,324.42 | $3,486.65 | $3,514.99 |

| Geico Govt Employees | $2,292.59 | $2,292.59 | $2,092.47 | $2,092.47 | $5,552.76 | $5,685.15 | $2,674.55 | $2,741.48 |

| Nationwide Mutual Fire | $2,469.20 | $2,501.59 | $2,223.66 | $2,308.30 | $5,970.02 | $7,692.64 | $2,792.80 | $3,045.71 |

| Progressive Northern | $2,477.19 | $2,286.14 | $2,128.88 | $2,225.14 | $10,287.93 | $11,361.20 | $2,848.88 | $2,969.28 |

| State Farm Mutual Auto | $1,938.66 | $1,938.66 | $1,755.90 | $1,755.90 | $5,564.16 | $6,994.35 | $2,175.82 | $2,447.27 |

| USAA | $1,836.27 | $1,842.82 | $1,688.20 | $1,690.25 | $7,341.34 | $8,041.03 | $2,414.03 | $2,544.18 |

Read more: Nationwide Mutual Fire Insurance Company Car Insurance Review

It is interesting to note that at ages 17 and 25, all seven providers charged higher premiums for males than for females. At age 35 and married, however, three of the companies (Allstate, Geico, and State Farm) charged the same rates for males and females, and the same is true at 60 and married.

This table ranks the premiums based on demographics (age, gender, and marital status) and providers.

| Company | Demographic | Average Annual Rate | Rank |

|---|---|---|---|

| Progressive Northern | Single 17-year old male | $11,361.20 | 1 |

| Progressive Northern | Single 17-year old female | $10,287.93 | 2 |

| Bristol West Select | Single 17-year old male | $9,324.42 | 3 |

| Allstate F&C | Single 17-year old male | $8,518.45 | 4 |

| Bristol West Select | Single 17-year old female | $8,424.07 | 5 |

| USAA | Single 17-year old male | $8,041.03 | 6 |

| Nationwide Mutual Fire | Single 17-year old male | $7,692.64 | 7 |

| USAA | Single 17-year old female | $7,341.34 | 8 |

| State Farm Mutual Auto | Single 17-year old male | $6,994.35 | 9 |

| Allstate F&C | Single 17-year old female | $6,662.45 | 10 |

| Nationwide Mutual Fire | Single 17-year old female | $5,970.02 | 11 |

| Geico Govt Employees | Single 17-year old male | $5,685.15 | 12 |

| State Farm Mutual Auto | Single 17-year old female | $5,564.16 | 13 |

| Geico Govt Employees | Single 17-year old female | $5,552.76 | 14 |

| Bristol West Select | Single 25-year old male | $3,514.99 | 15 |

| Bristol West Select | Single 25-year old female | $3,486.65 | 16 |

| Bristol West Select | Married 60-year old male | $3,319.19 | 17 |

| Bristol West Select | Married 35-year old male | $3,212.56 | 18 |

| Bristol West Select | Married 35-year old female | $3,198.86 | 19 |

| Allstate F&C | Single 25-year old male | $3,111.28 | 20 |

| Bristol West Select | Married 60-year old female | $3,054.08 | 21 |

| Nationwide Mutual Fire | Single 25-year old male | $3,045.71 | 22 |

| Progressive Northern | Single 25-year old male | $2,969.28 | 23 |

| Allstate F&C | Single 25-year old female | $2,858.85 | 24 |

| Progressive Northern | Single 25-year old female | $2,848.88 | 25 |

| Nationwide Mutual Fire | Single 25-year old female | $2,792.80 | 26 |

| Geico Govt Employees | Single 25-year old male | $2,741.48 | 27 |

| Geico Govt Employees | Single 25-year old female | $2,674.55 | 28 |

| Allstate F&C | Married 35-year old female | $2,575.42 | 29 |

| Allstate F&C | Married 35-year old male | $2,575.42 | 29 |

| USAA | Single 25-year old male | $2,544.18 | 31 |

| Nationwide Mutual Fire | Married 35-year old male | $2,501.59 | 32 |

| Progressive Northern | Married 35-year old female | $2,477.19 | 33 |

| Nationwide Mutual Fire | Married 35-year old female | $2,469.20 | 34 |

| Allstate F&C | Married 60-year old female | $2,462.77 | 35 |

| Allstate F&C | Married 60-year old male | $2,462.77 | 35 |

| State Farm Mutual Auto | Single 25-year old male | $2,447.27 | 37 |

| USAA | Single 25-year old female | $2,414.03 | 38 |

| Nationwide Mutual Fire | Married 60-year old male | $2,308.30 | 39 |

| Geico Govt Employees | Married 35-year old female | $2,292.59 | 40 |

| Geico Govt Employees | Married 35-year old male | $2,292.59 | 40 |

| Progressive Northern | Married 35-year old male | $2,286.14 | 42 |

| Progressive Northern | Married 60-year old male | $2,225.14 | 43 |

| Nationwide Mutual Fire | Married 60-year old female | $2,223.66 | 44 |

| State Farm Mutual Auto | Single 25-year old female | $2,175.82 | 45 |

| Progressive Northern | Married 60-year old female | $2,128.88 | 46 |

| Geico Govt Employees | Married 60-year old female | $2,092.47 | 47 |

| Geico Govt Employees | Married 60-year old male | $2,092.47 | 47 |

| State Farm Mutual Auto | Married 35-year old female | $1,938.66 | 49 |

| State Farm Mutual Auto | Married 35-year old male | $1,938.66 | 49 |

| USAA | Married 35-year old male | $1,842.82 | 51 |

| USAA | Married 35-year old female | $1,836.27 | 52 |

| State Farm Mutual Auto | Married 60-year old female | $1,755.90 | 53 |

| State Farm Mutual Auto | Married 60-year old male | $1,755.90 | 53 |

| USAA | Married 60-year old male | $1,690.25 | 55 |

| USAA | Married 60-year old female | $1,688.20 | 56 |

The Quadrant Data included in the above tables are based on actual purchased coverage in South Carolina and includes rates for high-risk drivers as well as drivers who purchase coverage beyond the required minimum and other kinds of non-required coverage like personal injury protection and MedPay.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What are the cheapest rates by zip code?

Below is a list of the premium rates in every zip code in South Carolina. Check it out to see how your zip code ranks against others in the state.

| Zipcode | Average Annual Rate | Allstate F&C | Bristol West Select | Geico Govt Employees | Nationwide Mutual Fire | Progressive Northern | State Farm Mutual Auto | USAA |

|---|---|---|---|---|---|---|---|---|

| 29933 | $4,519.05 | $4,163.06 | $6,522.32 | $4,320.69 | $4,265.18 | $5,092.35 | $3,329.79 | $3,939.94 |

| 29810 | $4,504.34 | $4,163.06 | $5,603.79 | $4,320.69 | $4,265.18 | $5,893.85 | $3,343.86 | $3,939.94 |

| 29918 | $4,499.47 | $4,163.06 | $5,824.91 | $4,320.69 | $4,265.18 | $5,611.39 | $3,371.09 | $3,939.94 |

| 29939 | $4,493.57 | $4,163.06 | $5,824.91 | $4,320.69 | $4,265.18 | $5,611.39 | $3,329.79 | $3,939.94 |

| 29913 | $4,449.78 | $4,163.06 | $6,522.32 | $4,320.69 | $4,265.18 | $4,607.45 | $3,329.79 | $3,939.94 |

| 29433 | $4,434.52 | $4,163.06 | $6,522.32 | $3,780.89 | $4,574.31 | $4,731.33 | $3,329.79 | $3,939.94 |

| 29827 | $4,412.90 | $4,163.06 | $5,282.19 | $4,320.69 | $4,265.18 | $5,607.56 | $3,311.69 | $3,939.94 |

| 29921 | $4,405.94 | $4,163.06 | $6,522.32 | $4,320.69 | $4,265.18 | $4,275.77 | $3,354.61 | $3,939.94 |

| 29934 | $4,396.05 | $4,163.06 | $5,601.37 | $4,320.69 | $4,176.19 | $5,227.88 | $3,343.22 | $3,939.94 |

| 29944 | $4,386.30 | $4,163.06 | $5,669.24 | $3,677.41 | $4,265.18 | $5,694.00 | $3,295.29 | $3,939.94 |

| 29481 | $4,369.12 | $4,157.97 | $5,486.93 | $3,707.18 | $4,574.31 | $5,358.73 | $3,358.76 | $3,939.94 |

| 29911 | $4,363.46 | $4,163.06 | $5,367.87 | $4,320.69 | $4,265.18 | $5,223.76 | $3,263.75 | $3,939.94 |

| 29923 | $4,338.69 | $4,163.06 | $5,259.85 | $4,320.69 | $4,265.18 | $5,092.35 | $3,329.79 | $3,939.94 |

| 29932 | $4,338.69 | $4,163.06 | $5,259.85 | $4,320.69 | $4,265.18 | $5,092.35 | $3,329.79 | $3,939.94 |

| 29924 | $4,333.58 | $4,163.06 | $5,178.39 | $4,320.69 | $4,265.18 | $5,172.50 | $3,295.29 | $3,939.94 |

| 29916 | $4,295.75 | $4,163.06 | $5,139.84 | $4,320.69 | $4,265.18 | $4,917.16 | $3,324.36 | $3,939.94 |

| 29486 | $4,291.55 | $4,326.42 | $4,486.60 | $3,363.86 | $4,364.41 | $6,330.20 | $3,335.97 | $3,833.40 |

| 29922 | $4,252.93 | $4,163.06 | $4,952.29 | $4,320.69 | $4,265.18 | $4,743.26 | $3,386.08 | $3,939.94 |

| 29046 | $4,248.92 | $3,990.16 | $5,797.64 | $3,779.59 | $4,101.45 | $4,870.51 | $3,320.82 | $3,882.28 |

| 29430 | $4,239.55 | $4,088.51 | $6,542.72 | $3,395.57 | $4,364.41 | $4,234.15 | $3,335.97 | $3,715.51 |

| 29104 | $4,229.62 | $3,990.16 | $5,718.85 | $3,779.59 | $4,101.45 | $4,931.71 | $3,203.35 | $3,882.28 |

| 29836 | $4,215.45 | $3,812.62 | $5,186.48 | $3,707.18 | $4,265.18 | $5,303.60 | $3,329.79 | $3,903.30 |

| 29450 | $4,214.87 | $4,326.42 | $5,333.72 | $3,512.70 | $4,364.41 | $5,068.38 | $3,228.14 | $3,670.35 |

| 29476 | $4,179.20 | $3,998.06 | $5,030.80 | $3,512.70 | $4,364.41 | $5,051.12 | $3,335.97 | $3,961.38 |

| 29468 | $4,174.40 | $3,998.48 | $5,236.46 | $3,395.57 | $4,364.41 | $5,172.71 | $3,091.77 | $3,961.38 |

| 29506 | $4,170.11 | $3,979.33 | $5,633.10 | $3,213.28 | $3,931.88 | $5,438.49 | $3,390.81 | $3,603.92 |

| 29456 | $4,169.64 | $4,326.42 | $5,333.30 | $3,497.76 | $3,918.07 | $5,144.85 | $3,248.56 | $3,718.52 |

| 29461 | $4,169.18 | $4,326.42 | $5,173.65 | $3,395.57 | $4,364.41 | $5,056.41 | $3,149.32 | $3,718.52 |

| 29418 | $4,168.61 | $4,326.42 | $5,212.74 | $3,497.76 | $3,918.07 | $4,970.26 | $3,593.05 | $3,662.02 |

| 29470 | $4,163.80 | $4,331.51 | $4,630.00 | $3,780.89 | $4,114.53 | $4,573.34 | $3,700.61 | $4,015.71 |

| 29475 | $4,160.36 | $4,163.06 | $4,599.79 | $3,707.18 | $4,574.31 | $4,549.54 | $3,588.72 | $3,939.94 |

| 29080 | $4,158.68 | $3,990.16 | $5,727.88 | $3,097.26 | $4,101.45 | $4,958.15 | $3,353.55 | $3,882.28 |

| 29168 | $4,157.19 | $4,040.96 | $6,190.94 | $3,245.48 | $3,717.49 | $5,212.06 | $3,294.81 | $3,398.60 |

| 29929 | $4,149.89 | $4,163.06 | $4,243.26 | $4,320.69 | $4,574.31 | $4,272.90 | $3,535.10 | $3,939.94 |

| 29943 | $4,145.42 | $4,238.06 | $5,188.43 | $3,125.14 | $4,176.19 | $5,105.27 | $3,244.91 | $3,939.94 |

| 29452 | $4,144.14 | $4,238.06 | $4,393.93 | $3,677.41 | $4,574.31 | $4,566.32 | $3,619.01 | $3,939.94 |

| 29449 | $4,142.88 | $4,395.06 | $4,588.96 | $3,677.41 | $4,114.53 | $4,558.37 | $3,650.13 | $4,015.71 |

| 29912 | $4,138.52 | $3,956.89 | $4,638.66 | $4,320.69 | $4,176.19 | $4,607.45 | $3,329.79 | $3,939.94 |

| 29530 | $4,135.28 | $4,083.76 | $5,462.41 | $3,097.26 | $3,895.28 | $5,339.16 | $3,439.70 | $3,629.40 |

| 29547 | $4,134.98 | $3,870.03 | $5,440.82 | $3,213.28 | $3,895.28 | $5,548.51 | $3,137.36 | $3,839.56 |

| 29936 | $4,130.49 | $3,956.89 | $4,638.66 | $4,320.69 | $4,176.19 | $4,607.45 | $3,273.61 | $3,939.94 |

| 29132 | $4,128.00 | $3,786.70 | $6,552.95 | $3,697.92 | $3,511.76 | $4,732.49 | $3,162.27 | $3,451.89 |

| 29447 | $4,124.55 | $4,232.99 | $4,734.79 | $3,707.18 | $4,229.33 | $4,670.20 | $3,335.97 | $3,961.38 |

| 29493 | $4,123.37 | $4,163.06 | $4,599.79 | $3,707.18 | $4,574.31 | $4,549.54 | $3,329.79 | $3,939.94 |

| 29518 | $4,120.52 | $3,998.06 | $5,486.53 | $3,265.18 | $3,798.99 | $5,348.04 | $3,053.29 | $3,893.58 |

| 29222 | $4,118.79 | $4,117.78 | $6,817.11 | $2,870.63 | $3,769.52 | $4,531.56 | $3,149.91 | $3,575.00 |

| 29436 | $4,113.22 | $4,129.24 | $5,049.59 | $3,395.57 | $4,364.41 | $4,822.06 | $3,070.32 | $3,961.38 |

| 29474 | $4,111.48 | $4,238.06 | $4,393.93 | $3,780.89 | $4,574.31 | $4,566.32 | $3,286.92 | $3,939.94 |

| 29945 | $4,110.22 | $4,238.06 | $4,786.18 | $3,677.41 | $4,265.18 | $4,529.02 | $3,335.72 | $3,939.94 |

| 29082 | $4,102.16 | $4,163.06 | $4,158.40 | $4,320.69 | $4,574.31 | $4,171.19 | $3,387.53 | $3,939.94 |

| 29724 | $4,098.12 | $4,096.27 | $6,552.95 | $3,268.46 | $3,511.76 | $4,930.91 | $3,162.27 | $3,164.25 |

| 29414 | $4,097.25 | $4,326.42 | $5,201.26 | $3,365.34 | $3,918.07 | $4,856.35 | $3,392.24 | $3,621.07 |

| 29849 | $4,094.43 | $3,812.62 | $4,841.73 | $3,707.18 | $4,265.18 | $4,764.55 | $3,329.79 | $3,939.94 |

| 29053 | $4,093.87 | $3,947.97 | $5,659.84 | $3,485.96 | $3,630.36 | $5,300.70 | $3,270.64 | $3,361.66 |

| 29435 | $4,091.68 | $4,238.06 | $4,473.61 | $3,780.89 | $4,574.31 | $4,376.90 | $3,258.07 | $3,939.94 |

| 29041 | $4,090.96 | $3,998.06 | $5,726.68 | $3,265.18 | $3,586.04 | $5,280.29 | $2,886.87 | $3,893.58 |

| 29446 | $4,089.74 | $4,238.06 | $4,286.93 | $3,677.41 | $4,574.31 | $4,338.15 | $3,573.41 | $3,939.94 |

| 29052 | $4,089.39 | $4,199.15 | $5,228.26 | $3,779.59 | $3,717.49 | $4,953.28 | $3,269.35 | $3,478.63 |

| 29425 | $4,088.80 | $4,326.42 | $6,718.66 | $3,061.23 | $3,653.40 | $4,254.64 | $3,335.64 | $3,271.62 |

| 29438 | $4,088.67 | $4,389.98 | $4,929.23 | $3,677.41 | $4,114.53 | $4,580.85 | $3,502.76 | $3,425.95 |

| 29565 | $4,088.31 | $3,869.61 | $5,238.85 | $3,213.28 | $3,895.28 | $5,377.33 | $3,184.30 | $3,839.56 |

| 29488 | $4,086.71 | $4,163.06 | $4,350.30 | $3,677.41 | $4,574.31 | $4,285.08 | $3,616.85 | $3,939.94 |

| 29479 | $4,084.29 | $3,998.06 | $5,030.80 | $3,512.70 | $3,844.76 | $5,051.12 | $3,191.25 | $3,961.38 |

| 29510 | $4,083.54 | $3,998.48 | $5,325.00 | $3,512.70 | $3,757.84 | $5,554.83 | $2,957.23 | $3,478.68 |

| 29550 | $4,077.59 | $3,973.00 | $5,317.33 | $3,097.26 | $3,895.28 | $5,028.68 | $3,378.04 | $3,853.55 |

| 29405 | $4,070.09 | $4,326.42 | $4,650.51 | $3,438.40 | $3,918.07 | $4,667.73 | $3,774.02 | $3,715.51 |

| 29583 | $4,069.71 | $3,979.33 | $5,176.08 | $3,265.18 | $3,931.88 | $5,123.40 | $3,382.74 | $3,629.40 |

| 29487 | $4,068.90 | $4,389.98 | $4,964.52 | $3,365.34 | $3,821.29 | $4,812.02 | $3,483.52 | $3,645.62 |

| 29434 | $4,068.05 | $4,088.51 | $4,902.92 | $3,395.57 | $4,364.41 | $4,718.63 | $3,335.97 | $3,670.35 |

| 29440 | $4,065.82 | $3,934.92 | $5,619.64 | $3,512.70 | $3,757.84 | $5,433.35 | $2,913.28 | $3,289.01 |

| 29208 | $4,065.51 | $4,117.78 | $6,817.11 | $2,870.63 | $3,769.52 | $4,740.97 | $3,149.91 | $2,992.67 |

| 29410 | $4,063.86 | $4,326.42 | $5,065.26 | $3,176.71 | $3,821.29 | $5,034.39 | $3,307.48 | $3,715.51 |

| 29472 | $4,058.13 | $4,389.98 | $5,001.82 | $3,363.86 | $3,821.29 | $4,832.94 | $3,278.52 | $3,718.52 |

| 29161 | $4,055.03 | $3,990.16 | $5,148.56 | $3,097.26 | $3,895.28 | $5,096.25 | $3,378.35 | $3,779.34 |

| 29056 | $4,053.12 | $3,998.06 | $5,276.12 | $3,265.18 | $3,844.76 | $5,212.08 | $2,882.09 | $3,893.58 |

| 29469 | $4,048.85 | $4,065.68 | $4,950.78 | $3,395.57 | $4,364.41 | $4,730.43 | $3,209.90 | $3,625.21 |

| 29125 | $4,048.80 | $3,990.58 | $5,534.93 | $3,265.18 | $3,586.04 | $4,974.81 | $3,096.52 | $3,893.58 |

| 29453 | $4,047.67 | $3,934.92 | $5,060.46 | $3,512.70 | $3,798.99 | $5,040.58 | $3,315.67 | $3,670.35 |

| 29426 | $4,046.94 | $4,238.06 | $4,576.59 | $3,780.89 | $3,821.29 | $4,270.51 | $3,625.54 | $4,015.71 |

| 29201 | $4,045.24 | $4,117.78 | $5,682.73 | $2,870.63 | $3,769.52 | $5,311.42 | $3,269.52 | $3,295.07 |

| 29001 | $4,043.78 | $3,998.06 | $5,880.26 | $3,265.18 | $3,586.04 | $5,194.85 | $2,844.26 | $3,537.78 |

| 29111 | $4,043.11 | $3,998.06 | $5,385.20 | $3,265.18 | $3,586.04 | $5,325.87 | $2,847.82 | $3,893.58 |

| 29580 | $4,037.70 | $3,998.06 | $5,141.74 | $3,512.70 | $3,844.76 | $5,008.37 | $2,864.69 | $3,893.58 |

| 29153 | $4,036.90 | $3,990.16 | $5,298.42 | $3,779.59 | $3,717.49 | $4,542.18 | $3,279.06 | $3,651.42 |

| 29567 | $4,036.61 | $3,869.61 | $5,187.31 | $3,213.28 | $3,895.28 | $5,191.37 | $3,059.86 | $3,839.56 |

| 29536 | $4,033.60 | $3,870.03 | $5,234.07 | $3,213.28 | $3,895.28 | $5,071.40 | $3,111.57 | $3,839.56 |

| 29546 | $4,033.18 | $3,979.33 | $5,152.18 | $3,213.28 | $3,931.88 | $5,002.46 | $3,132.78 | $3,820.39 |

| 29003 | $4,032.63 | $3,807.54 | $5,263.65 | $3,707.18 | $3,651.22 | $5,017.07 | $2,841.83 | $3,939.94 |

| 29203 | $4,032.25 | $4,043.29 | $4,989.33 | $3,540.20 | $3,699.57 | $4,831.83 | $3,349.13 | $3,772.39 |

| 29541 | $4,032.08 | $4,083.76 | $5,188.45 | $3,097.26 | $3,895.28 | $4,885.75 | $3,294.72 | $3,779.34 |

| 29204 | $4,025.81 | $4,043.29 | $5,004.44 | $3,540.20 | $3,769.52 | $4,891.69 | $3,474.61 | $3,456.93 |

| 29102 | $4,023.94 | $3,998.06 | $5,726.68 | $3,265.18 | $3,586.04 | $5,280.29 | $2,773.55 | $3,537.78 |

| 29406 | $4,022.80 | $4,326.42 | $4,703.63 | $3,438.40 | $3,821.29 | $4,743.08 | $3,411.26 | $3,715.51 |

| 29477 | $4,017.82 | $4,232.99 | $4,734.79 | $3,707.18 | $4,229.33 | $4,670.20 | $3,188.58 | $3,361.66 |

| 29210 | $4,016.25 | $4,117.78 | $5,210.94 | $3,211.73 | $3,699.57 | $5,112.01 | $3,466.63 | $3,295.07 |

| 29590 | $4,015.37 | $3,998.06 | $5,200.99 | $3,265.18 | $3,844.76 | $5,021.77 | $2,883.25 | $3,893.58 |

| 29540 | $4,008.37 | $3,885.75 | $5,159.28 | $3,097.26 | $3,895.28 | $5,056.11 | $3,121.52 | $3,843.39 |

| 29432 | $4,007.76 | $4,015.89 | $5,068.87 | $3,707.18 | $3,651.22 | $4,731.33 | $2,939.86 | $3,939.94 |

| 29501 | $4,007.51 | $3,971.45 | $5,190.25 | $3,097.26 | $3,931.88 | $4,996.01 | $3,238.95 | $3,626.79 |

| 29122 | $4,003.74 | $3,884.11 | $6,317.94 | $3,010.43 | $3,393.47 | $5,114.55 | $2,898.82 | $3,406.88 |

| 29055 | $3,998.66 | $3,951.50 | $4,878.88 | $3,697.92 | $3,511.76 | $5,040.88 | $3,457.78 | $3,451.89 |

| 29483 | $3,998.59 | $4,326.42 | $4,656.10 | $3,363.86 | $3,821.29 | $4,515.45 | $3,509.97 | $3,797.05 |

| 29229 | $3,997.10 | $4,043.29 | $5,190.60 | $3,069.83 | $3,769.52 | $5,105.41 | $3,236.86 | $3,564.21 |

| 29581 | $3,996.42 | $3,894.06 | $5,255.34 | $3,386.54 | $3,779.45 | $5,313.04 | $2,921.46 | $3,425.04 |

| 29010 | $3,994.58 | $3,990.16 | $4,689.30 | $3,779.59 | $4,101.45 | $4,304.28 | $3,215.03 | $3,882.28 |

| 29455 | $3,991.61 | $4,326.42 | $5,054.78 | $3,365.34 | $3,821.29 | $4,587.28 | $3,224.86 | $3,561.34 |

| 29431 | $3,990.54 | $4,038.66 | $4,745.14 | $3,512.70 | $3,798.99 | $4,712.29 | $3,164.66 | $3,961.38 |

| 29135 | $3,988.95 | $3,709.12 | $4,997.14 | $3,485.96 | $3,630.36 | $4,807.95 | $3,382.43 | $3,909.72 |

| 29162 | $3,986.84 | $3,998.06 | $5,246.38 | $3,265.18 | $3,586.04 | $4,932.04 | $2,997.89 | $3,882.28 |

| 29569 | $3,986.19 | $3,934.92 | $5,133.05 | $3,386.54 | $3,779.45 | $5,207.50 | $3,036.82 | $3,425.04 |

| 29914 | $3,980.83 | $3,956.89 | $6,522.32 | $3,020.58 | $3,645.56 | $4,607.45 | $2,850.89 | $3,262.10 |

| 29592 | $3,978.81 | $3,869.61 | $4,907.15 | $3,213.28 | $3,931.88 | $4,928.15 | $3,181.23 | $3,820.39 |

| 29180 | $3,978.10 | $3,786.70 | $4,938.97 | $3,697.92 | $3,511.76 | $4,900.12 | $3,559.38 | $3,451.89 |

| 29223 | $3,978.02 | $4,043.29 | $4,982.39 | $3,300.10 | $3,769.52 | $4,815.21 | $3,371.43 | $3,564.21 |

| 29492 | $3,975.89 | $4,326.42 | $5,095.19 | $2,857.79 | $3,821.29 | $4,848.65 | $3,211.55 | $3,670.35 |

| 29154 | $3,975.70 | $3,973.00 | $5,513.36 | $3,245.48 | $3,717.49 | $4,675.02 | $3,279.37 | $3,426.21 |

| 29532 | $3,972.68 | $3,971.45 | $5,042.01 | $3,097.26 | $3,895.28 | $4,871.37 | $3,088.03 | $3,843.39 |

| 29720 | $3,971.96 | $4,096.27 | $4,960.07 | $3,268.46 | $3,545.02 | $4,930.91 | $3,551.11 | $3,451.89 |

| 29570 | $3,970.93 | $3,861.70 | $5,151.10 | $3,155.79 | $3,464.82 | $5,212.14 | $3,111.38 | $3,839.56 |

| 29543 | $3,968.75 | $3,783.91 | $4,939.18 | $3,213.28 | $3,931.88 | $4,955.08 | $3,118.36 | $3,839.56 |

| 29152 | $3,964.99 | $3,973.00 | $5,513.57 | $3,245.48 | $3,717.49 | $4,831.85 | $3,420.92 | $3,052.62 |

| 29209 | $3,964.47 | $4,043.29 | $4,962.93 | $3,170.40 | $3,769.52 | $4,756.59 | $3,389.03 | $3,659.52 |

| 29051 | $3,963.75 | $3,990.16 | $5,252.38 | $3,265.18 | $3,586.04 | $4,710.25 | $3,059.96 | $3,882.28 |

| 29420 | $3,963.08 | $4,326.42 | $4,470.50 | $3,497.76 | $3,918.07 | $4,342.19 | $3,629.72 | $3,556.89 |

| 29147 | $3,962.50 | $4,043.29 | $4,989.33 | $3,540.20 | $3,769.52 | $4,831.83 | $3,149.91 | $3,413.43 |

| 29205 | $3,962.33 | $4,117.78 | $5,194.11 | $2,870.63 | $3,769.52 | $5,100.96 | $3,275.03 | $3,408.25 |

| 29403 | $3,959.43 | $4,326.42 | $4,766.38 | $3,061.23 | $3,653.40 | $4,736.43 | $3,456.67 | $3,715.51 |

| 29594 | $3,956.29 | $3,776.01 | $5,151.10 | $3,155.79 | $3,464.82 | $4,985.92 | $3,320.82 | $3,839.56 |

| 29123 | $3,955.36 | $3,947.97 | $4,786.67 | $3,485.96 | $3,577.97 | $5,114.55 | $3,076.40 | $3,697.98 |

| 29040 | $3,953.99 | $3,973.00 | $4,879.14 | $3,202.72 | $4,101.45 | $4,294.37 | $3,344.95 | $3,882.28 |

| 29584 | $3,953.02 | $3,863.26 | $5,457.19 | $3,126.09 | $3,464.82 | $5,145.38 | $2,994.67 | $3,619.73 |

| 29554 | $3,952.59 | $3,893.65 | $5,011.84 | $3,213.28 | $3,798.99 | $5,051.33 | $2,805.45 | $3,893.58 |

| 29527 | $3,951.71 | $3,934.92 | $5,159.98 | $3,386.54 | $3,731.39 | $4,810.54 | $3,213.58 | $3,425.04 |

| 29571 | $3,950.90 | $3,979.33 | $4,794.56 | $3,213.28 | $3,931.88 | $4,824.48 | $3,092.39 | $3,820.39 |

| 29130 | $3,949.51 | $4,021.46 | $5,023.59 | $3,697.92 | $3,511.76 | $4,882.97 | $3,056.98 | $3,451.89 |

| 29579 | $3,948.76 | $3,925.65 | $5,606.52 | $2,954.34 | $3,731.39 | $5,149.39 | $2,895.94 | $3,378.08 |

| 29564 | $3,947.53 | $3,998.06 | $4,873.43 | $3,265.18 | $3,844.76 | $4,842.71 | $2,914.99 | $3,893.58 |

| 29556 | $3,947.02 | $3,998.06 | $4,749.26 | $3,265.18 | $3,798.99 | $4,912.53 | $3,011.54 | $3,893.58 |

| 29471 | $3,946.14 | $3,949.61 | $4,679.60 | $3,707.18 | $4,229.33 | $4,538.50 | $3,157.11 | $3,361.66 |

| 29544 | $3,945.94 | $3,893.65 | $5,016.55 | $3,386.54 | $3,779.45 | $5,040.29 | $3,080.04 | $3,425.04 |

| 29404 | $3,943.07 | $4,326.42 | $4,800.12 | $3,438.40 | $3,918.07 | $4,474.02 | $3,495.49 | $3,148.97 |

| 29577 | $3,940.61 | $3,925.65 | $5,575.82 | $2,954.34 | $3,731.39 | $5,214.23 | $2,851.60 | $3,331.25 |

| 29589 | $3,939.93 | $3,869.61 | $4,794.56 | $3,213.28 | $3,931.88 | $4,824.48 | $3,125.31 | $3,820.39 |

| 29566 | $3,939.31 | $3,925.65 | $5,290.83 | $3,386.54 | $3,482.68 | $5,081.12 | $2,983.30 | $3,425.04 |

| 29407 | $3,939.05 | $4,326.42 | $4,606.11 | $3,365.34 | $3,821.29 | $4,571.83 | $3,339.81 | $3,542.55 |

| 29560 | $3,936.29 | $4,083.76 | $4,793.54 | $3,265.18 | $3,844.76 | $4,648.23 | $3,024.99 | $3,893.58 |

| 29133 | $3,935.34 | $3,807.54 | $5,039.48 | $3,707.18 | $3,507.36 | $4,732.49 | $3,292.98 | $3,460.36 |

| 29563 | $3,932.93 | $3,784.32 | $4,834.84 | $3,213.28 | $3,895.28 | $4,795.68 | $3,167.55 | $3,839.56 |

| 29505 | $3,931.69 | $3,979.33 | $4,868.57 | $3,213.28 | $3,931.88 | $4,620.58 | $3,281.42 | $3,626.79 |

| 29437 | $3,930.12 | $4,024.61 | $4,463.43 | $3,363.86 | $4,229.33 | $4,306.72 | $3,161.55 | $3,961.38 |

| 29069 | $3,926.32 | $3,990.16 | $4,751.91 | $3,097.26 | $3,895.28 | $4,755.28 | $3,140.83 | $3,853.55 |

| 29409 | $3,923.99 | $4,326.42 | $4,766.38 | $3,061.23 | $3,653.40 | $4,736.43 | $3,331.40 | $3,592.70 |

| 29002 | $3,922.97 | $4,117.78 | $5,078.40 | $3,010.43 | $3,769.52 | $4,752.78 | $3,149.91 | $3,581.94 |

| 29511 | $3,919.26 | $3,934.52 | $4,803.26 | $3,386.54 | $3,779.45 | $5,025.96 | $3,080.04 | $3,425.04 |

| 29591 | $3,918.82 | $4,083.76 | $4,541.14 | $3,097.26 | $3,895.28 | $4,693.44 | $3,491.47 | $3,629.40 |

| 29593 | $3,918.32 | $3,758.83 | $4,822.64 | $3,155.79 | $3,895.28 | $4,767.20 | $3,174.93 | $3,853.55 |

| 29574 | $3,917.55 | $3,869.61 | $4,754.27 | $3,213.28 | $3,931.88 | $4,765.06 | $3,068.37 | $3,820.39 |

| 29114 | $3,916.85 | $4,075.85 | $4,582.71 | $3,265.18 | $3,895.28 | $4,489.02 | $3,480.52 | $3,629.40 |

| 29373 | $3,915.36 | $3,746.24 | $6,552.95 | $2,761.75 | $3,315.62 | $4,834.25 | $2,974.26 | $3,222.45 |

| 29065 | $3,909.27 | $3,786.70 | $4,868.38 | $3,697.92 | $3,511.76 | $4,886.00 | $3,162.27 | $3,451.89 |

| 29045 | $3,906.79 | $4,043.29 | $4,899.98 | $3,300.10 | $3,769.52 | $4,666.29 | $3,104.12 | $3,564.21 |

| 29729 | $3,902.04 | $4,096.27 | $5,000.35 | $3,268.46 | $3,511.76 | $4,953.93 | $3,319.26 | $3,164.25 |

| 29042 | $3,901.43 | $3,807.54 | $4,796.58 | $3,649.20 | $3,651.22 | $4,737.83 | $2,764.34 | $3,903.30 |

| 29568 | $3,901.03 | $3,925.65 | $5,152.44 | $3,386.54 | $3,397.99 | $5,246.67 | $2,772.87 | $3,425.04 |

| 29074 | $3,899.91 | $3,951.50 | $5,066.31 | $3,126.09 | $3,717.49 | $4,831.31 | $3,162.27 | $3,444.41 |

| 29081 | $3,899.41 | $3,954.70 | $4,307.45 | $4,320.69 | $3,651.22 | $4,155.86 | $2,966.02 | $3,939.94 |

| 29015 | $3,897.55 | $3,786.70 | $4,723.65 | $3,697.92 | $3,511.76 | $4,782.61 | $3,328.31 | $3,451.89 |

| 29555 | $3,896.16 | $3,893.65 | $4,558.60 | $3,265.18 | $3,895.28 | $4,800.00 | $3,231.04 | $3,629.40 |

| 29177 | $3,893.09 | $4,117.78 | $5,058.14 | $2,932.61 | $3,769.52 | $4,810.22 | $3,149.91 | $3,413.43 |

| 29225 | $3,892.80 | $4,117.78 | $5,170.74 | $2,870.63 | $3,769.52 | $4,792.79 | $3,535.48 | $2,992.67 |

| 29526 | $3,890.31 | $3,947.35 | $5,071.28 | $3,125.31 | $3,731.39 | $4,670.59 | $3,261.22 | $3,425.04 |

| 29072 | $3,884.83 | $4,022.45 | $5,236.91 | $3,010.43 | $3,777.46 | $4,894.24 | $2,911.38 | $3,340.92 |

| 29044 | $3,882.48 | $4,199.15 | $4,278.16 | $3,779.59 | $3,717.49 | $4,552.99 | $3,171.39 | $3,478.63 |

| 29063 | $3,881.93 | $4,117.78 | $5,078.40 | $3,010.43 | $3,699.57 | $4,752.78 | $3,215.34 | $3,299.23 |

| 29058 | $3,880.95 | $3,951.50 | $4,895.63 | $3,126.09 | $3,545.02 | $4,831.31 | $3,372.69 | $3,444.41 |

| 29596 | $3,880.48 | $3,758.83 | $5,151.10 | $3,155.79 | $3,464.82 | $4,985.92 | $3,103.14 | $3,543.75 |

| 29576 | $3,876.87 | $3,925.65 | $5,542.44 | $2,828.07 | $3,419.93 | $5,100.86 | $2,989.37 | $3,331.77 |

| 29516 | $3,874.73 | $3,971.45 | $4,790.10 | $3,155.79 | $3,464.82 | $4,718.93 | $3,182.47 | $3,839.56 |

| 29485 | $3,871.44 | $4,326.42 | $4,486.60 | $3,169.28 | $3,821.29 | $4,320.56 | $3,286.40 | $3,689.57 |

| 29728 | $3,867.82 | $3,793.33 | $4,937.38 | $3,126.09 | $3,464.82 | $5,108.78 | $3,024.65 | $3,619.73 |

| 29150 | $3,866.15 | $3,990.16 | $5,084.82 | $3,202.72 | $3,717.49 | $4,344.64 | $3,297.02 | $3,426.21 |

| 29905 | $3,865.85 | $3,956.89 | $6,522.32 | $3,020.58 | $3,645.56 | $4,149.66 | $2,795.01 | $2,970.91 |

| 29172 | $3,860.52 | $4,035.67 | $4,838.71 | $3,485.96 | $3,471.41 | $4,598.61 | $3,182.43 | $3,410.88 |

| 29128 | $3,856.78 | $4,058.13 | $4,575.00 | $3,779.59 | $3,717.49 | $4,134.88 | $3,143.38 | $3,589.00 |

| 29207 | $3,856.53 | $4,043.29 | $5,159.25 | $2,870.63 | $3,769.52 | $4,740.97 | $3,098.09 | $3,313.96 |

| 29062 | $3,856.13 | $4,058.13 | $4,575.00 | $3,779.59 | $3,717.49 | $4,134.88 | $3,329.21 | $3,398.60 |

| 29078 | $3,855.64 | $4,142.59 | $4,860.16 | $3,300.10 | $3,717.49 | $4,581.84 | $3,172.23 | $3,215.05 |

| 29073 | $3,852.13 | $4,022.45 | $4,957.59 | $3,485.96 | $3,577.97 | $4,625.81 | $2,960.22 | $3,334.90 |

| 29512 | $3,850.71 | $3,776.01 | $5,036.08 | $3,155.79 | $3,464.82 | $4,800.65 | $3,177.89 | $3,543.75 |

| 29175 | $3,848.00 | $3,964.89 | $4,833.85 | $3,126.09 | $3,717.49 | $4,851.07 | $2,998.18 | $3,444.41 |

| 29016 | $3,843.05 | $4,043.29 | $4,751.19 | $3,069.83 | $3,769.52 | $4,563.41 | $3,122.14 | $3,581.94 |

| 29733 | $3,841.93 | $3,712.60 | $6,552.95 | $3,268.46 | $3,371.22 | $3,985.83 | $2,948.24 | $3,054.23 |

| 29525 | $3,841.37 | $3,862.14 | $4,823.91 | $3,155.79 | $3,464.82 | $4,663.43 | $3,079.94 | $3,839.56 |

| 29812 | $3,839.82 | $3,807.54 | $4,339.10 | $3,707.18 | $3,584.83 | $4,603.81 | $2,932.96 | $3,903.30 |

| 29741 | $3,839.74 | $3,863.26 | $5,052.06 | $3,126.09 | $3,464.82 | $4,739.20 | $3,013.02 | $3,619.73 |

| 29061 | $3,839.66 | $4,043.29 | $4,517.42 | $3,170.40 | $3,717.49 | $4,238.87 | $3,510.22 | $3,679.90 |

| 29727 | $3,837.71 | $3,863.26 | $5,052.06 | $3,126.09 | $3,464.82 | $4,739.20 | $2,998.78 | $3,619.73 |

| 29020 | $3,836.99 | $3,964.89 | $4,306.16 | $3,126.09 | $4,101.45 | $4,240.99 | $3,237.09 | $3,882.28 |

| 29212 | $3,836.94 | $4,030.08 | $4,751.80 | $3,010.43 | $3,699.57 | $4,531.56 | $3,182.22 | $3,652.94 |

| 29588 | $3,836.67 | $3,925.65 | $5,003.54 | $3,125.31 | $3,731.39 | $4,668.09 | $3,053.57 | $3,349.14 |

| 29575 | $3,836.64 | $3,925.65 | $5,278.00 | $2,954.34 | $3,419.93 | $4,904.86 | $3,041.89 | $3,331.77 |

| 29146 | $3,834.52 | $3,807.54 | $4,872.66 | $3,649.20 | $3,507.36 | $4,536.18 | $3,008.37 | $3,460.36 |

| 29014 | $3,832.66 | $3,786.70 | $4,775.26 | $3,697.92 | $3,511.76 | $4,815.85 | $3,076.87 | $3,164.25 |

| 29448 | $3,831.07 | $4,024.61 | $4,466.26 | $3,363.86 | $3,507.36 | $4,336.92 | $3,157.11 | $3,961.38 |

| 29033 | $3,830.50 | $4,035.67 | $5,017.96 | $2,870.63 | $3,577.97 | $4,922.76 | $3,093.44 | $3,295.07 |

| 29445 | $3,829.86 | $4,326.42 | $4,517.26 | $3,176.71 | $3,821.29 | $4,446.19 | $3,357.48 | $3,163.72 |

| 29067 | $3,827.63 | $3,894.96 | $4,684.42 | $3,126.09 | $3,545.02 | $4,938.75 | $3,159.76 | $3,444.41 |

| 29206 | $3,825.60 | $4,043.29 | $5,093.33 | $2,870.63 | $3,769.52 | $4,794.98 | $3,002.11 | $3,205.33 |

| 29030 | $3,825.05 | $3,885.96 | $4,547.34 | $3,649.20 | $3,630.36 | $4,269.32 | $3,332.82 | $3,460.36 |

| 29169 | $3,823.24 | $4,022.45 | $4,772.35 | $3,211.73 | $3,577.97 | $4,573.56 | $3,114.48 | $3,490.17 |

| 29160 | $3,821.55 | $3,853.95 | $4,613.98 | $2,932.61 | $3,471.41 | $4,985.58 | $3,195.32 | $3,697.98 |

| 29826 | $3,819.78 | $3,807.54 | $4,455.56 | $3,649.20 | $3,584.83 | $4,484.80 | $2,853.20 | $3,903.30 |

| 29101 | $3,816.25 | $3,863.26 | $4,802.79 | $3,126.09 | $3,464.82 | $4,645.68 | $3,191.42 | $3,619.73 |

| 29439 | $3,811.84 | $4,326.42 | $4,340.53 | $3,365.34 | $3,653.40 | $4,188.83 | $3,382.40 | $3,425.95 |

| 29036 | $3,804.43 | $4,117.78 | $4,677.48 | $2,932.61 | $3,553.82 | $4,810.22 | $3,256.36 | $3,282.74 |

| 29341 | $3,803.69 | $3,746.24 | $4,926.45 | $3,033.45 | $3,511.76 | $5,070.75 | $2,927.01 | $3,410.15 |

| 29018 | $3,803.43 | $3,882.55 | $4,618.76 | $3,707.18 | $3,507.36 | $4,235.26 | $3,311.28 | $3,361.66 |

| 29038 | $3,797.92 | $3,807.54 | $4,653.80 | $3,707.18 | $3,507.36 | $4,374.75 | $3,074.46 | $3,460.36 |

| 29927 | $3,793.72 | $3,956.89 | $4,209.86 | $3,125.14 | $4,176.19 | $4,049.67 | $3,098.33 | $3,939.94 |

| 29831 | $3,790.57 | $3,730.09 | $5,188.34 | $2,674.96 | $3,362.03 | $5,330.80 | $3,034.44 | $3,213.29 |

| 29112 | $3,789.98 | $3,882.55 | $4,545.89 | $3,649.20 | $3,507.36 | $4,353.37 | $3,131.12 | $3,460.36 |

| 29458 | $3,789.08 | $3,934.92 | $4,881.55 | $2,857.79 | $3,653.40 | $4,560.42 | $3,144.76 | $3,490.70 |

| 29113 | $3,788.65 | $3,807.54 | $4,652.04 | $3,707.18 | $3,507.36 | $4,369.25 | $3,016.79 | $3,460.36 |

| 29545 | $3,788.37 | $3,894.06 | $4,549.95 | $3,386.54 | $3,779.45 | $4,434.28 | $3,049.29 | $3,425.04 |

| 29709 | $3,786.46 | $3,863.26 | $4,882.86 | $3,126.09 | $3,464.82 | $4,607.32 | $2,941.13 | $3,619.73 |

| 29429 | $3,784.37 | $4,326.42 | $4,705.93 | $2,857.79 | $3,653.40 | $4,234.15 | $3,222.19 | $3,490.70 |

| 29115 | $3,784.13 | $3,882.55 | $4,552.65 | $3,649.20 | $3,507.36 | $4,191.01 | $3,344.51 | $3,361.66 |

| 29126 | $3,781.06 | $3,787.77 | $4,627.49 | $3,697.92 | $3,393.47 | $4,828.76 | $2,725.14 | $3,406.88 |

| 29712 | $3,780.21 | $3,711.53 | $4,777.28 | $3,268.46 | $3,511.76 | $4,923.65 | $3,104.53 | $3,164.25 |

| 29107 | $3,779.77 | $3,807.54 | $4,526.88 | $3,707.18 | $3,507.36 | $4,259.49 | $3,189.58 | $3,460.36 |

| 29170 | $3,779.64 | $4,022.45 | $4,817.67 | $2,870.63 | $3,777.46 | $4,505.94 | $3,168.24 | $3,295.07 |

| 29817 | $3,774.02 | $3,807.54 | $4,215.42 | $3,707.18 | $3,584.83 | $4,385.17 | $2,814.69 | $3,903.30 |

| 29148 | $3,773.55 | $3,998.48 | $4,675.01 | $3,265.18 | $3,586.04 | $4,555.69 | $2,796.69 | $3,537.78 |

| 29070 | $3,770.87 | $3,846.34 | $4,682.73 | $2,932.61 | $3,553.82 | $5,081.24 | $2,993.58 | $3,305.79 |

| 29379 | $3,764.16 | $3,787.77 | $4,848.13 | $2,761.75 | $3,511.76 | $4,919.11 | $3,112.56 | $3,408.05 |

| 29714 | $3,763.37 | $4,096.27 | $4,416.15 | $3,268.46 | $3,511.76 | $4,626.36 | $2,972.67 | $3,451.89 |

| 29718 | $3,761.55 | $3,793.33 | $4,676.96 | $3,126.09 | $3,464.82 | $4,671.83 | $2,978.14 | $3,619.73 |

| 29048 | $3,755.45 | $4,132.66 | $4,479.22 | $3,395.57 | $3,507.36 | $4,409.26 | $3,002.45 | $3,361.66 |

| 29163 | $3,753.86 | $3,885.96 | $4,631.85 | $3,395.57 | $3,507.36 | $4,432.91 | $3,061.69 | $3,361.66 |

| 29365 | $3,753.70 | $3,931.95 | $4,911.83 | $3,033.45 | $3,396.59 | $4,819.89 | $2,959.74 | $3,222.45 |

| 29412 | $3,751.38 | $4,326.42 | $4,340.53 | $3,061.23 | $3,653.40 | $4,188.83 | $3,259.99 | $3,429.27 |

| 29075 | $3,751.18 | $3,884.11 | $4,730.35 | $3,010.43 | $3,393.47 | $5,083.34 | $2,749.71 | $3,406.88 |

| 29142 | $3,751.05 | $3,885.96 | $4,566.28 | $3,363.86 | $3,507.36 | $4,375.88 | $3,196.38 | $3,361.66 |

| 29117 | $3,748.67 | $3,882.55 | $4,450.36 | $3,649.20 | $3,507.36 | $4,245.97 | $3,143.57 | $3,361.66 |

| 29706 | $3,747.20 | $3,787.77 | $4,606.95 | $3,268.46 | $3,511.76 | $4,544.14 | $3,059.43 | $3,451.89 |

| 29322 | $3,745.24 | $3,889.93 | $5,039.38 | $3,033.45 | $3,315.62 | $4,907.15 | $2,835.79 | $3,195.39 |

| 29323 | $3,744.47 | $3,694.75 | $5,016.58 | $3,033.45 | $3,315.62 | $5,052.80 | $2,902.73 | $3,195.39 |

| 29032 | $3,742.58 | $3,894.96 | $4,565.85 | $3,126.09 | $3,717.49 | $4,490.00 | $2,959.25 | $3,444.41 |

| 29401 | $3,741.29 | $4,326.42 | $4,228.63 | $3,061.23 | $3,653.40 | $4,254.64 | $3,393.08 | $3,271.62 |

| 29572 | $3,738.66 | $3,925.65 | $5,055.20 | $2,954.34 | $3,419.93 | $4,757.52 | $2,812.44 | $3,245.52 |

| 29843 | $3,736.61 | $3,807.54 | $4,195.47 | $3,707.18 | $3,651.22 | $4,019.10 | $2,872.45 | $3,903.30 |

| 29424 | $3,733.08 | $4,326.42 | $4,228.63 | $3,061.23 | $3,653.40 | $4,254.64 | $3,335.64 | $3,271.62 |

| 29054 | $3,728.59 | $3,947.97 | $4,524.74 | $2,932.61 | $3,553.82 | $4,589.31 | $3,099.87 | $3,451.81 |

| 29482 | $3,727.70 | $4,326.42 | $4,694.59 | $2,857.79 | $3,653.40 | $4,269.74 | $3,021.16 | $3,270.81 |

| 29118 | $3,726.78 | $3,726.69 | $4,463.66 | $3,649.20 | $3,507.36 | $4,143.62 | $3,235.28 | $3,361.66 |

| 29702 | $3,726.53 | $3,746.24 | $4,586.79 | $3,033.45 | $3,511.76 | $4,876.23 | $2,863.73 | $3,467.53 |

| 29611 | $3,725.79 | $4,034.83 | $4,677.37 | $3,053.87 | $3,299.30 | $4,584.65 | $3,461.10 | $2,969.43 |

| 29039 | $3,724.86 | $3,807.54 | $4,441.30 | $3,649.20 | $3,507.36 | $4,127.19 | $3,081.09 | $3,460.36 |

| 29451 | $3,723.70 | $4,326.42 | $4,576.44 | $2,857.79 | $3,653.40 | $4,170.55 | $3,169.00 | $3,312.30 |

| 29321 | $3,722.01 | $3,932.53 | $4,599.93 | $2,761.75 | $3,511.76 | $4,850.33 | $2,989.72 | $3,408.05 |

| 29464 | $3,722.00 | $4,326.42 | $4,570.96 | $2,857.79 | $3,653.40 | $4,304.27 | $3,140.00 | $3,201.15 |

| 29059 | $3,711.56 | $4,129.24 | $4,369.59 | $3,363.86 | $3,507.36 | $4,210.07 | $3,039.16 | $3,361.66 |

| 29006 | $3,711.30 | $3,730.09 | $4,422.31 | $2,932.61 | $3,553.82 | $4,777.37 | $3,149.91 | $3,412.99 |

| 29047 | $3,707.65 | $3,885.96 | $4,167.76 | $3,649.20 | $3,630.36 | $3,998.05 | $3,260.57 | $3,361.66 |

| 29520 | $3,701.88 | $3,758.83 | $4,702.31 | $3,155.79 | $3,464.82 | $4,343.93 | $2,943.71 | $3,543.75 |

| 29684 | $3,699.96 | $3,440.89 | $4,680.57 | $2,932.61 | $3,362.57 | $5,039.19 | $3,174.75 | $3,269.15 |

| 29340 | $3,699.35 | $3,893.27 | $4,589.79 | $3,033.45 | $3,416.41 | $4,558.32 | $2,936.69 | $3,467.53 |

| 29009 | $3,699.00 | $3,863.26 | $4,293.68 | $3,126.09 | $3,717.49 | $4,365.11 | $3,082.92 | $3,444.41 |

| 29585 | $3,696.26 | $3,913.23 | $5,098.15 | $2,828.07 | $3,419.93 | $4,692.06 | $2,851.13 | $3,071.27 |

| 29920 | $3,687.97 | $3,956.89 | $4,254.51 | $3,677.41 | $3,645.56 | $4,275.77 | $2,743.54 | $3,262.10 |

| 29609 | $3,677.05 | $4,034.83 | $4,661.70 | $2,964.02 | $3,396.59 | $4,551.05 | $3,161.77 | $2,969.43 |

| 29353 | $3,673.05 | $3,893.27 | $4,528.79 | $2,761.75 | $3,511.76 | $4,663.25 | $2,944.49 | $3,408.05 |

| 29137 | $3,672.00 | $3,789.95 | $4,360.99 | $3,649.20 | $3,362.03 | $4,662.26 | $2,666.29 | $3,213.29 |

| 29853 | $3,671.91 | $3,807.54 | $4,455.56 | $3,649.20 | $3,362.03 | $4,484.80 | $2,730.93 | $3,213.29 |

| 29302 | $3,666.63 | $3,858.83 | $4,755.89 | $2,761.75 | $3,416.41 | $4,701.18 | $3,001.86 | $3,170.49 |

| 29617 | $3,660.67 | $4,008.97 | $4,689.97 | $2,964.02 | $3,396.59 | $4,543.08 | $3,079.52 | $2,942.55 |

| 29582 | $3,659.36 | $3,925.65 | $4,664.19 | $2,954.34 | $3,482.68 | $4,375.41 | $2,835.15 | $3,378.08 |

| 29108 | $3,659.21 | $3,819.09 | $4,680.16 | $2,761.75 | $3,393.47 | $4,872.74 | $2,680.41 | $3,406.88 |

| 29847 | $3,658.61 | $3,634.19 | $4,708.58 | $2,932.61 | $3,479.57 | $4,776.08 | $2,954.38 | $3,124.86 |

| 29127 | $3,658.15 | $3,787.77 | $4,526.56 | $2,932.61 | $3,393.47 | $4,906.98 | $2,652.77 | $3,406.88 |

| 29386 | $3,655.71 | $3,858.83 | $4,755.89 | $2,761.75 | $3,315.62 | $4,701.18 | $2,974.26 | $3,222.45 |

| 29306 | $3,652.97 | $3,858.83 | $4,697.83 | $2,761.75 | $3,315.62 | $4,756.68 | $3,144.97 | $3,035.10 |

| 29614 | $3,648.68 | $4,034.83 | $4,661.70 | $2,964.02 | $3,396.59 | $4,551.05 | $3,013.22 | $2,919.38 |

| 29372 | $3,647.69 | $3,746.24 | $4,521.75 | $2,945.43 | $3,377.23 | $4,834.25 | $2,886.52 | $3,222.45 |

| 29704 | $3,643.71 | $3,711.53 | $4,780.70 | $3,268.46 | $3,371.22 | $4,695.71 | $2,649.81 | $3,028.56 |

| 29031 | $3,643.37 | $3,787.77 | $4,558.75 | $2,761.75 | $3,511.76 | $4,557.25 | $2,876.85 | $3,449.47 |

| 29307 | $3,640.44 | $3,746.24 | $4,618.13 | $2,945.43 | $3,416.41 | $4,599.03 | $2,987.34 | $3,170.49 |

| 29605 | $3,639.33 | $4,034.83 | $4,322.33 | $2,964.02 | $3,604.09 | $4,134.46 | $3,446.19 | $2,969.43 |

| 29707 | $3,633.67 | $3,712.60 | $4,478.62 | $2,966.45 | $3,391.92 | $4,368.56 | $3,073.12 | $3,444.41 |

| 29303 | $3,633.23 | $3,746.24 | $4,519.71 | $2,945.43 | $3,315.62 | $4,585.88 | $3,136.63 | $3,183.10 |

| 29374 | $3,632.23 | $3,746.24 | $4,656.57 | $2,717.44 | $3,315.62 | $4,914.59 | $2,852.71 | $3,222.45 |

| 29316 | $3,630.43 | $3,694.75 | $4,696.42 | $2,945.43 | $3,315.62 | $4,644.71 | $2,905.90 | $3,210.16 |

| 29466 | $3,629.84 | $4,326.42 | $4,340.51 | $2,857.79 | $3,653.40 | $4,051.76 | $2,941.00 | $3,238.02 |

| 29624 | $3,628.55 | $3,440.89 | $4,495.07 | $3,053.87 | $3,471.66 | $4,635.47 | $3,154.91 | $3,147.97 |

| 29178 | $3,628.30 | $3,787.77 | $4,032.24 | $3,697.92 | $3,393.47 | $4,363.68 | $2,716.13 | $3,406.88 |

| 29324 | $3,627.73 | $3,746.24 | $4,618.13 | $2,945.43 | $3,315.62 | $4,599.03 | $2,974.26 | $3,195.39 |

| 29356 | $3,627.50 | $3,842.24 | $4,622.71 | $3,033.45 | $3,396.59 | $4,608.33 | $2,919.74 | $2,969.43 |

| 29329 | $3,625.97 | $3,746.24 | $4,618.13 | $2,945.43 | $3,315.62 | $4,599.03 | $2,974.26 | $3,183.10 |

| 29333 | $3,625.97 | $3,746.24 | $4,618.13 | $2,945.43 | $3,315.62 | $4,599.03 | $2,974.26 | $3,183.10 |

| 29346 | $3,624.17 | $3,746.24 | $4,618.13 | $2,945.43 | $3,315.62 | $4,599.03 | $2,974.26 | $3,170.49 |

| 29687 | $3,621.40 | $4,034.83 | $4,669.12 | $2,744.89 | $3,415.59 | $4,446.48 | $3,069.44 | $2,969.43 |

| 29385 | $3,620.94 | $3,736.75 | $4,545.54 | $2,945.43 | $3,315.62 | $4,507.90 | $3,072.91 | $3,222.45 |

| 29607 | $3,618.37 | $4,034.83 | $4,533.44 | $2,964.02 | $3,359.50 | $4,417.31 | $3,050.05 | $2,969.43 |

| 29330 | $3,618.35 | $3,746.24 | $4,478.27 | $2,945.43 | $3,315.62 | $4,624.78 | $3,022.71 | $3,195.39 |

| 29655 | $3,617.93 | $3,505.23 | $4,515.68 | $2,932.61 | $3,362.57 | $4,822.36 | $3,005.14 | $3,181.92 |

| 29613 | $3,616.84 | $4,034.83 | $4,546.54 | $2,964.02 | $3,396.59 | $4,392.37 | $3,041.00 | $2,942.55 |

| 29915 | $3,614.18 | $3,956.89 | $4,321.61 | $3,125.14 | $3,645.56 | $4,126.74 | $2,861.24 | $3,262.10 |

| 29377 | $3,612.42 | $3,807.33 | $4,516.49 | $2,945.43 | $3,315.62 | $4,507.90 | $2,971.72 | $3,222.45 |

| 29742 | $3,607.34 | $3,932.53 | $4,449.28 | $2,966.45 | $3,377.23 | $4,606.56 | $2,787.17 | $3,132.19 |

| 29627 | $3,606.58 | $3,607.14 | $4,314.65 | $3,053.87 | $3,471.66 | $4,602.74 | $3,048.02 | $3,147.97 |

| 29710 | $3,603.00 | $3,782.55 | $4,480.66 | $2,966.45 | $3,371.22 | $4,503.77 | $2,966.84 | $3,149.50 |

| 29320 | $3,600.24 | $3,858.83 | $4,436.12 | $2,945.43 | $3,315.62 | $4,400.55 | $3,022.71 | $3,222.45 |

| 29697 | $3,599.86 | $3,607.14 | $4,500.72 | $3,053.87 | $3,362.57 | $4,647.28 | $2,879.50 | $3,147.97 |

| 29683 | $3,598.01 | $3,663.17 | $4,648.17 | $2,744.89 | $3,396.59 | $4,695.63 | $3,068.18 | $2,969.43 |

| 29166 | $3,596.02 | $3,633.12 | $4,327.64 | $2,932.61 | $3,493.09 | $4,497.39 | $2,850.65 | $3,437.65 |

| 29910 | $3,595.04 | $3,956.89 | $4,222.13 | $3,125.14 | $3,645.56 | $4,042.43 | $2,989.44 | $3,183.67 |

| 29378 | $3,593.32 | $3,858.83 | $4,436.12 | $2,945.43 | $3,315.62 | $4,400.55 | $2,974.26 | $3,222.45 |

| 29842 | $3,587.96 | $3,730.09 | $4,373.34 | $2,674.96 | $3,362.03 | $4,512.47 | $3,056.48 | $3,406.33 |

| 29376 | $3,587.32 | $3,807.33 | $4,600.82 | $2,761.75 | $3,315.62 | $4,536.91 | $2,866.37 | $3,222.45 |

| 29673 | $3,587.18 | $3,689.04 | $4,303.67 | $3,053.87 | $3,396.59 | $4,189.08 | $3,304.97 | $3,173.07 |

| 29145 | $3,586.55 | $3,794.62 | $4,404.25 | $2,761.75 | $3,393.47 | $4,446.05 | $2,898.82 | $3,406.88 |

| 29940 | $3,585.81 | $3,956.89 | $4,237.44 | $3,020.58 | $3,645.56 | $4,087.51 | $2,946.91 | $3,205.79 |

| 29941 | $3,584.15 | $3,956.89 | $4,256.55 | $3,020.58 | $3,645.56 | $4,152.79 | $2,850.89 | $3,205.79 |

| 29856 | $3,580.61 | $3,730.09 | $4,622.64 | $2,674.96 | $3,362.03 | $4,731.56 | $2,729.72 | $3,213.29 |

| 29703 | $3,580.13 | $3,782.55 | $4,480.66 | $2,966.45 | $3,371.22 | $4,503.77 | $2,927.72 | $3,028.56 |

| 29661 | $3,575.04 | $3,663.17 | $4,648.17 | $2,744.89 | $3,235.80 | $4,695.63 | $3,068.18 | $2,969.43 |

| 29690 | $3,574.96 | $3,884.24 | $4,649.32 | $2,744.89 | $3,235.80 | $4,506.67 | $3,061.26 | $2,942.55 |

| 29301 | $3,574.21 | $3,858.83 | $4,436.12 | $2,945.43 | $3,315.62 | $4,400.55 | $3,027.81 | $3,035.10 |

| 29639 | $3,573.33 | $3,706.34 | $4,346.88 | $2,932.61 | $3,362.57 | $4,517.91 | $2,965.11 | $3,181.92 |

| 29601 | $3,572.92 | $4,034.83 | $4,288.68 | $2,964.02 | $3,299.30 | $4,267.07 | $3,187.12 | $2,969.43 |

| 29654 | $3,572.70 | $3,654.84 | $4,068.46 | $2,932.61 | $3,471.66 | $4,630.83 | $3,068.59 | $3,181.92 |

| 29902 | $3,561.66 | $3,956.89 | $4,294.45 | $3,020.58 | $3,645.56 | $4,149.66 | $2,776.69 | $3,087.79 |

| 29743 | $3,561.35 | $3,782.55 | $4,305.63 | $2,966.45 | $3,416.41 | $4,398.54 | $2,927.72 | $3,132.19 |

| 29355 | $3,558.31 | $3,735.83 | $4,269.65 | $2,761.75 | $3,393.47 | $4,441.79 | $2,898.82 | $3,406.88 |

| 29636 | $3,555.69 | $4,034.83 | $4,322.33 | $2,964.02 | $3,396.59 | $4,134.46 | $3,068.18 | $2,969.43 |

| 29615 | $3,554.85 | $4,034.83 | $4,369.57 | $2,964.02 | $3,604.09 | $4,179.78 | $2,868.91 | $2,862.73 |

| 29369 | $3,554.70 | $3,816.83 | $4,409.40 | $2,761.75 | $3,315.62 | $4,338.43 | $3,018.44 | $3,222.45 |

| 29129 | $3,553.62 | $3,633.12 | $4,275.12 | $2,932.61 | $3,362.03 | $4,594.43 | $2,864.75 | $3,213.29 |

| 29906 | $3,552.70 | $3,956.89 | $4,097.44 | $3,233.01 | $3,645.56 | $3,944.79 | $2,854.78 | $3,136.44 |

| 29717 | $3,548.37 | $3,782.55 | $4,353.88 | $2,966.45 | $3,377.23 | $4,502.15 | $2,724.14 | $3,132.19 |

| 29715 | $3,542.33 | $3,712.60 | $4,478.62 | $2,966.45 | $3,391.92 | $4,385.63 | $2,806.89 | $3,054.23 |

| 29334 | $3,540.79 | $3,807.33 | $4,295.17 | $2,945.43 | $3,315.62 | $4,218.79 | $2,980.74 | $3,222.45 |

| 29909 | $3,539.50 | $3,956.89 | $4,069.00 | $3,125.14 | $3,645.56 | $3,942.64 | $2,775.16 | $3,262.10 |

| 29931 | $3,537.21 | $3,956.89 | $4,237.44 | $3,020.58 | $3,645.56 | $4,087.51 | $2,850.89 | $2,961.59 |

| 29824 | $3,534.83 | $3,735.83 | $4,229.58 | $2,932.61 | $3,479.57 | $4,488.43 | $2,752.92 | $3,124.86 |

| 29821 | $3,527.09 | $3,735.83 | $4,154.27 | $2,932.61 | $3,479.57 | $4,267.86 | $2,792.45 | $3,327.03 |

| 29726 | $3,525.02 | $3,932.53 | $4,169.24 | $2,966.45 | $3,371.22 | $4,106.47 | $2,997.06 | $3,132.19 |

| 29349 | $3,524.64 | $3,931.95 | $4,067.84 | $3,033.45 | $3,315.62 | $4,058.03 | $3,070.22 | $3,195.39 |

| 29105 | $3,522.90 | $3,730.09 | $4,353.41 | $2,932.61 | $3,013.77 | $4,592.24 | $2,824.87 | $3,213.29 |

| 29331 | $3,520.43 | $3,746.24 | $4,307.77 | $2,761.75 | $3,315.62 | $4,314.92 | $2,974.26 | $3,222.45 |

| 29138 | $3,518.15 | $3,734.76 | $4,047.39 | $2,932.61 | $3,493.09 | $4,279.07 | $2,702.51 | $3,437.65 |

| 29835 | $3,518.14 | $3,735.83 | $4,149.77 | $2,932.61 | $3,479.57 | $4,335.58 | $2,666.60 | $3,327.03 |

| 29907 | $3,517.23 | $3,956.89 | $4,097.44 | $3,020.58 | $3,645.56 | $3,944.79 | $2,835.04 | $3,120.32 |

| 29388 | $3,503.76 | $3,694.75 | $4,296.45 | $2,717.44 | $3,315.62 | $4,298.88 | $2,980.74 | $3,222.45 |

| 29669 | $3,502.88 | $3,607.14 | $4,140.81 | $3,053.87 | $3,362.57 | $4,109.83 | $3,072.87 | $3,173.07 |

| 29335 | $3,497.46 | $3,746.24 | $4,307.77 | $2,761.75 | $3,315.62 | $4,314.92 | $2,813.51 | $3,222.45 |

| 29650 | $3,496.84 | $4,034.83 | $4,260.91 | $2,744.89 | $3,415.59 | $4,223.66 | $2,962.07 | $2,835.94 |

| 29666 | $3,491.31 | $3,608.76 | $3,919.34 | $2,932.61 | $3,362.72 | $4,420.45 | $3,103.74 | $3,091.57 |

| 29651 | $3,491.09 | $4,002.53 | $4,294.92 | $2,744.89 | $3,396.59 | $4,065.96 | $2,963.33 | $2,969.43 |

| 29621 | $3,488.22 | $3,542.82 | $4,112.63 | $3,053.87 | $3,362.57 | $4,269.70 | $2,927.98 | $3,147.97 |

| 29935 | $3,487.36 | $3,956.89 | $3,964.90 | $3,020.58 | $3,645.56 | $3,897.32 | $2,838.45 | $3,087.79 |

| 29845 | $3,487.35 | $3,735.83 | $4,171.08 | $2,932.61 | $3,362.72 | $4,204.64 | $2,677.55 | $3,327.03 |

| 29860 | $3,480.96 | $3,634.19 | $4,141.07 | $2,869.49 | $3,362.03 | $4,239.40 | $2,907.25 | $3,213.29 |

| 29805 | $3,480.11 | $3,730.09 | $4,384.24 | $2,674.96 | $3,013.77 | $4,490.97 | $2,853.44 | $3,213.29 |

| 29816 | $3,478.42 | $3,633.12 | $4,379.80 | $2,674.96 | $3,362.03 | $4,290.44 | $2,998.52 | $3,010.08 |

| 29037 | $3,478.11 | $3,694.86 | $4,001.28 | $2,932.61 | $3,393.47 | $4,067.07 | $2,819.82 | $3,437.65 |

| 29734 | $3,475.02 | $3,712.60 | $4,110.39 | $3,268.46 | $3,371.22 | $3,880.53 | $2,927.72 | $3,054.23 |

| 29662 | $3,470.37 | $3,954.82 | $4,173.52 | $2,964.02 | $3,359.50 | $4,031.14 | $2,840.18 | $2,969.43 |

| 29625 | $3,467.17 | $3,440.89 | $4,064.72 | $3,053.87 | $3,362.57 | $4,210.52 | $2,989.67 | $3,147.97 |

| 29841 | $3,466.60 | $3,634.19 | $4,327.00 | $2,869.49 | $3,121.84 | $4,190.83 | $2,968.08 | $3,154.80 |

| 29730 | $3,466.50 | $3,712.60 | $4,110.39 | $3,268.46 | $3,371.22 | $3,880.53 | $2,893.72 | $3,028.56 |

| 29682 | $3,461.81 | $3,556.83 | $4,269.06 | $2,565.72 | $3,235.80 | $4,717.15 | $2,740.16 | $3,147.97 |

| 29164 | $3,461.56 | $3,730.09 | $4,204.41 | $2,932.61 | $3,013.77 | $4,397.50 | $2,739.26 | $3,213.29 |

| 29708 | $3,449.04 | $3,712.60 | $4,085.48 | $2,966.45 | $3,391.92 | $3,988.54 | $2,893.71 | $3,104.56 |

| 29657 | $3,447.09 | $3,663.17 | $4,188.95 | $2,565.72 | $3,362.57 | $4,158.49 | $3,042.74 | $3,147.97 |

| 29638 | $3,439.91 | $3,561.60 | $3,911.79 | $2,932.61 | $3,362.57 | $4,189.19 | $2,939.69 | $3,181.92 |

| 29838 | $3,437.69 | $3,735.83 | $3,873.59 | $2,932.61 | $3,362.72 | $4,055.93 | $2,776.13 | $3,327.03 |

| 29635 | $3,433.09 | $3,454.91 | $4,234.70 | $2,744.89 | $3,235.80 | $4,124.50 | $3,267.39 | $2,969.43 |

| 29640 | $3,431.98 | $3,663.17 | $4,213.46 | $2,744.89 | $3,396.59 | $4,195.86 | $2,760.10 | $3,049.79 |

| 29819 | $3,429.69 | $3,735.83 | $3,839.66 | $2,932.61 | $3,362.72 | $3,985.16 | $3,060.26 | $3,091.57 |

| 29829 | $3,425.60 | $3,634.19 | $4,150.75 | $2,869.49 | $3,362.03 | $4,180.68 | $2,808.65 | $2,973.44 |

| 29839 | $3,423.16 | $3,730.09 | $4,215.64 | $2,674.96 | $3,362.03 | $4,144.46 | $2,824.87 | $3,010.08 |

| 29671 | $3,418.37 | $3,556.83 | $4,164.19 | $2,744.89 | $3,235.80 | $4,104.94 | $2,973.96 | $3,147.97 |

| 29745 | $3,418.21 | $3,782.55 | $3,969.68 | $2,966.45 | $3,371.22 | $3,975.95 | $2,729.42 | $3,132.19 |

| 29732 | $3,415.68 | $3,712.60 | $3,993.79 | $2,966.45 | $3,221.40 | $3,985.83 | $2,941.71 | $3,087.95 |

| 29626 | $3,414.84 | $3,440.89 | $3,845.66 | $2,932.61 | $3,471.66 | $4,053.55 | $2,890.36 | $3,269.15 |

| 29644 | $3,410.82 | $3,647.04 | $4,233.46 | $2,717.44 | $3,299.30 | $4,108.09 | $2,900.97 | $2,969.43 |

| 29620 | $3,410.56 | $3,608.76 | $3,864.28 | $2,932.61 | $3,362.57 | $4,170.93 | $2,752.86 | $3,181.92 |

| 29926 | $3,406.51 | $3,956.89 | $3,799.09 | $2,874.69 | $3,645.56 | $3,668.37 | $2,844.19 | $3,056.80 |

| 29692 | $3,401.29 | $3,577.44 | $3,711.62 | $2,932.61 | $3,362.57 | $4,158.70 | $2,884.18 | $3,181.92 |

| 29851 | $3,400.37 | $3,633.12 | $4,379.80 | $2,674.96 | $3,083.86 | $4,290.44 | $2,730.33 | $3,010.08 |

| 29325 | $3,393.15 | $3,648.78 | $3,854.01 | $2,761.75 | $3,362.72 | $4,170.42 | $2,829.50 | $3,124.86 |

| 29681 | $3,389.86 | $3,954.82 | $4,046.38 | $2,717.44 | $3,396.59 | $3,846.03 | $2,950.36 | $2,817.42 |

| 29850 | $3,388.66 | $3,634.19 | $4,119.41 | $2,674.96 | $3,362.03 | $4,131.69 | $2,824.87 | $2,973.44 |

| 29832 | $3,387.15 | $3,730.09 | $3,621.36 | $2,932.61 | $3,479.57 | $4,014.32 | $2,807.22 | $3,124.86 |

| 29803 | $3,381.80 | $3,730.09 | $4,215.64 | $2,674.96 | $3,083.86 | $4,144.46 | $2,812.38 | $3,011.23 |

| 29628 | $3,379.21 | $3,608.76 | $3,832.18 | $2,932.61 | $3,362.57 | $3,991.73 | $2,744.68 | $3,181.92 |

| 29828 | $3,373.46 | $3,633.12 | $4,301.92 | $2,674.96 | $3,083.86 | $4,203.24 | $2,707.07 | $3,010.08 |

| 29656 | $3,373.33 | $3,516.93 | $3,925.33 | $2,565.72 | $3,362.57 | $4,074.82 | $2,898.82 | $3,269.15 |

| 29801 | $3,373.02 | $3,730.09 | $4,119.41 | $2,674.96 | $3,013.77 | $4,131.69 | $2,727.96 | $3,213.29 |

| 29659 | $3,371.88 | $3,545.13 | $3,753.18 | $2,932.61 | $3,362.57 | $3,928.95 | $2,898.82 | $3,181.92 |

| 29667 | $3,369.05 | $3,516.93 | $3,980.45 | $2,565.72 | $3,235.80 | $4,235.51 | $2,900.94 | $3,147.97 |

| 29351 | $3,359.15 | $3,664.62 | $3,654.86 | $2,761.75 | $3,362.72 | $4,016.04 | $2,929.19 | $3,124.86 |

| 29848 | $3,358.51 | $3,735.83 | $3,604.23 | $2,932.61 | $3,362.72 | $3,768.46 | $3,014.13 | $3,091.57 |

| 29928 | $3,358.20 | $3,956.89 | $3,676.12 | $2,874.69 | $3,645.56 | $3,576.89 | $2,815.68 | $2,961.59 |

| 29809 | $3,357.60 | $3,730.09 | $4,183.76 | $2,674.96 | $3,083.86 | $4,197.17 | $2,623.30 | $3,010.08 |

| 29642 | $3,356.53 | $3,663.17 | $3,961.96 | $3,053.87 | $3,299.30 | $3,819.33 | $2,675.24 | $3,022.82 |

| 29677 | $3,356.02 | $3,516.93 | $3,925.33 | $2,565.72 | $3,362.57 | $4,074.82 | $2,898.82 | $3,147.97 |

| 29680 | $3,354.24 | $3,759.62 | $3,826.74 | $2,717.44 | $3,396.59 | $3,742.97 | $3,066.90 | $2,969.43 |

| 29840 | $3,352.98 | $3,735.83 | $3,642.00 | $2,932.61 | $3,362.72 | $3,839.66 | $2,776.13 | $3,181.92 |

| 29658 | $3,333.92 | $3,415.04 | $3,941.61 | $2,565.72 | $3,235.80 | $4,274.73 | $2,772.98 | $3,131.57 |

| 29643 | $3,323.71 | $3,440.89 | $3,859.49 | $2,565.72 | $3,235.80 | $4,266.56 | $2,787.44 | $3,110.08 |

| 29370 | $3,320.32 | $3,648.78 | $3,687.20 | $2,761.75 | $3,362.72 | $3,903.48 | $2,773.66 | $3,104.65 |

| 29646 | $3,307.52 | $3,608.76 | $3,603.99 | $2,694.51 | $3,362.57 | $3,652.20 | $3,139.03 | $3,091.57 |

| 29670 | $3,307.03 | $3,516.93 | $3,925.33 | $2,565.72 | $3,362.57 | $4,074.82 | $2,712.82 | $2,990.99 |

| 29645 | $3,306.89 | $3,694.75 | $3,474.62 | $2,717.44 | $3,362.72 | $3,824.81 | $2,949.06 | $3,124.86 |

| 29332 | $3,305.73 | $3,695.94 | $3,662.47 | $2,761.75 | $3,362.72 | $3,807.26 | $2,745.30 | $3,104.65 |

| 29689 | $3,300.97 | $3,440.89 | $3,805.52 | $2,565.72 | $3,362.57 | $4,137.45 | $2,803.61 | $2,990.99 |

| 29685 | $3,297.56 | $3,454.91 | $3,930.35 | $2,565.72 | $3,020.16 | $4,227.89 | $2,735.92 | $3,147.97 |

| 29632 | $3,293.34 | $3,415.04 | $3,924.92 | $2,565.72 | $3,235.80 | $4,245.12 | $2,772.98 | $2,893.80 |

| 29634 | $3,284.03 | $3,516.93 | $3,924.92 | $2,565.72 | $3,235.80 | $4,245.12 | $2,605.92 | $2,893.80 |

| 29653 | $3,282.69 | $3,577.44 | $3,418.71 | $2,932.61 | $3,362.72 | $3,703.61 | $2,801.83 | $3,181.92 |

| 29693 | $3,282.69 | $3,415.04 | $3,775.24 | $2,565.72 | $3,235.80 | $4,249.81 | $2,710.30 | $3,026.89 |

| 29686 | $3,281.99 | $3,415.04 | $3,820.09 | $2,565.72 | $3,020.16 | $4,231.99 | $2,772.98 | $3,147.97 |

| 29360 | $3,274.83 | $3,577.44 | $3,508.63 | $2,694.51 | $3,362.72 | $3,742.80 | $2,933.08 | $3,104.65 |

| 29649 | $3,265.18 | $3,608.76 | $3,540.15 | $2,694.51 | $3,362.57 | $3,500.48 | $3,058.20 | $3,091.57 |

| 29664 | $3,249.79 | $3,454.91 | $3,766.09 | $2,565.72 | $3,020.16 | $4,144.41 | $2,665.68 | $3,131.57 |

| 29678 | $3,243.62 | $3,415.04 | $3,671.68 | $2,565.72 | $3,235.80 | $3,919.60 | $2,787.44 | $3,110.08 |

| 29384 | $3,225.08 | $3,577.44 | $3,418.71 | $2,694.51 | $3,362.72 | $3,703.61 | $2,713.91 | $3,104.65 |

| 29696 | $3,217.19 | $3,415.04 | $3,667.62 | $2,565.72 | $3,020.16 | $3,969.16 | $2,751.09 | $3,131.57 |

| 29676 | $3,206.09 | $3,454.91 | $3,623.51 | $2,565.72 | $3,020.16 | $3,940.77 | $2,689.60 | $3,147.97 |

| 29631 | $3,197.43 | $3,415.04 | $3,710.66 | $2,565.72 | $3,235.80 | $3,861.76 | $2,699.23 | $2,893.80 |

| 29691 | $3,166.58 | $3,415.04 | $3,508.45 | $2,565.72 | $3,020.16 | $3,790.86 | $2,734.29 | $3,131.57 |

| 29675 | $3,155.03 | $3,415.04 | $3,368.30 | $2,565.72 | $3,235.80 | $3,579.43 | $2,772.98 | $3,147.97 |

| 29665 | $3,149.62 | $3,415.04 | $3,368.30 | $2,565.72 | $3,235.80 | $3,579.43 | $2,772.98 | $3,110.08 |

| 29630 | $3,145.58 | $3,516.93 | $3,404.77 | $2,565.72 | $3,235.80 | $3,566.99 | $2,737.87 | $2,990.99 |

| 29672 | $3,115.58 | $3,415.04 | $3,368.30 | $2,565.72 | $3,020.16 | $3,579.43 | $2,833.51 | $3,026.89 |

What are the cheapest rates by city?

In addition to a zip code breakdown, below is a list of the premium rates in every city in South Carolina. Check it out to see how your city ranks against others in the state.

| Statewide | $3,781.14 | Most Expensive/Least Expensive Cities | ||

|---|---|---|---|---|

| Zipcode | Grand Total | Rank | Compared to Average | City |

| 29933 | $4,519.05 | 1 | $737.91 | MILEY |

| 29810 | $4,504.34 | 2 | $723.20 | ALLENDALE |

| 29918 | $4,499.47 | 3 | $718.33 | ESTILL |

| 29939 | $4,493.57 | 4 | $712.43 | SCOTIA |

| 29913 | $4,449.78 | 5 | $668.64 | CROCKETVILLE |

| 29433 | $4,434.52 | 6 | $653.38 | CANADYS |

| 29827 | $4,412.90 | 7 | $631.76 | FAIRFAX |

| 29921 | $4,405.94 | 8 | $624.80 | FURMAN |

| 29934 | $4,396.05 | 9 | $614.91 | PINELAND |

| 29944 | $4,386.30 | 10 | $605.16 | VARNVILLE |

| 29481 | $4,369.12 | 11 | $587.98 | SMOAKS |

| 29911 | $4,363.46 | 12 | $582.32 | BRUNSON |

| 29923 | $4,338.69 | 13 | $557.55 | GIFFORD |

| 29932 | $4,338.69 | 13 | $557.55 | LURAY |

| 29924 | $4,333.58 | 15 | $552.44 | HAMPTON |

| 29916 | $4,295.75 | 16 | $514.61 | EARLY BRANCH |

| 29486 | $4,291.55 | 17 | $510.41 | SUMMERVILLE |

| 29922 | $4,252.93 | 18 | $471.79 | GARNETT |

| 29046 | $4,248.92 | 19 | $467.78 | ELLIOTT |

| 29430 | $4,239.55 | 20 | $458.41 | BETHERA |

| 29104 | $4,229.63 | 21 | $448.49 | MAYESVILLE |

| 29836 | $4,215.45 | 22 | $434.31 | MARTIN |

| 29450 | $4,214.87 | 23 | $433.73 | HUGER |

| 29476 | $4,179.20 | 24 | $398.06 | RUSSELLVILLE |

| 29468 | $4,174.40 | 25 | $393.26 | PINEVILLE |

| 29506 | $4,170.12 | 26 | $388.98 | FLORENCE |

| 29456 | $4,169.64 | 27 | $388.50 | LADSON |

| 29461 | $4,169.18 | 28 | $388.04 | MONCKS CORNER |

| 29418 | $4,168.62 | 29 | $387.48 | NORTH CHARLESTON |

| 29470 | $4,163.80 | 30 | $382.66 | RAVENEL |

| 29475 | $4,160.36 | 31 | $379.22 | RUFFIN |

| 29080 | $4,158.68 | 32 | $377.54 | LYNCHBURG |

| 29168 | $4,157.19 | 33 | $376.05 | WEDGEFIELD |

| 29929 | $4,149.89 | 34 | $368.75 | ISLANDTON |

| 29943 | $4,145.42 | 35 | $364.28 | TILLMAN |

| 29452 | $4,144.14 | 36 | $363.00 | JACKSONBORO |

| 29449 | $4,142.88 | 37 | $361.74 | HOLLYWOOD |

| 29912 | $4,138.52 | 38 | $357.38 | COOSAWHATCHIE |

| 29530 | $4,135.28 | 39 | $354.14 | COWARD |

| 29547 | $4,134.98 | 40 | $353.84 | HAMER |

| 29936 | $4,130.49 | 41 | $349.35 | RIDGELAND |

| 29132 | $4,128.00 | 42 | $346.86 | RION |

| 29447 | $4,124.55 | 43 | $343.41 | GROVER |

| 29493 | $4,123.37 | 44 | $342.23 | WILLIAMS |

| 29518 | $4,120.52 | 45 | $339.38 | CADES |

| 29222 | $4,118.79 | 46 | $337.65 | COLUMBIA |

| 29436 | $4,113.22 | 47 | $332.08 | CROSS |

| 29474 | $4,111.48 | 48 | $330.34 | ROUND O |

| 29945 | $4,110.22 | 49 | $329.08 | YEMASSEE |

| 29082 | $4,102.16 | 50 | $321.02 | LODGE |

| 29724 | $4,098.12 | 51 | $316.98 | LANDO |

| 29414 | $4,097.25 | 52 | $316.11 | CHARLESTON |

| 29849 | $4,094.43 | 53 | $313.29 | ULMER |

| 29053 | $4,093.87 | 54 | $312.73 | GASTON |

| 29435 | $4,091.68 | 55 | $310.54 | COTTAGEVILLE |

| 29041 | $4,090.96 | 56 | $309.82 | DAVIS STATION |

| 29446 | $4,089.74 | 57 | $308.60 | GREEN POND |

| 29052 | $4,089.39 | 58 | $308.25 | GADSDEN |

| 29425 | $4,088.80 | 59 | $307.66 | CHARLESTON |

| 29438 | $4,088.67 | 60 | $307.53 | EDISTO ISLAND |

| 29565 | $4,088.32 | 61 | $307.18 | LATTA |

| 29488 | $4,086.71 | 62 | $305.57 | WALTERBORO |

| 29479 | $4,084.29 | 63 | $303.15 | SAINT STEPHEN |

| 29510 | $4,083.54 | 64 | $302.40 | ANDREWS |

| 29550 | $4,077.59 | 65 | $296.45 | HARTSVILLE |

| 29405 | $4,070.09 | 66 | $288.95 | NORTH CHARLESTON |

| 29583 | $4,069.71 | 67 | $288.57 | PAMPLICO |

| 29487 | $4,068.90 | 68 | $287.76 | WADMALAW ISLAND |

| 29434 | $4,068.05 | 69 | $286.91 | CORDESVILLE |

| 29440 | $4,065.82 | 70 | $284.68 | GEORGETOWN |

| 29208 | $4,065.51 | 71 | $284.37 | COLUMBIA |

| 29410 | $4,063.87 | 72 | $282.73 | HANAHAN |

| 29472 | $4,058.13 | 73 | $276.99 | RIDGEVILLE |

| 29161 | $4,055.03 | 74 | $273.89 | TIMMONSVILLE |

| 29056 | $4,053.12 | 75 | $271.98 | GREELEYVILLE |

| 29469 | $4,048.85 | 76 | $267.71 | PINOPOLIS |

| 29125 | $4,048.81 | 77 | $267.67 | PINEWOOD |

| 29453 | $4,047.67 | 78 | $266.53 | JAMESTOWN |

| 29426 | $4,046.94 | 79 | $265.80 | ADAMS RUN |

| 29201 | $4,045.24 | 80 | $264.10 | COLUMBIA |

| 29001 | $4,043.78 | 81 | $262.64 | ALCOLU |

| 29111 | $4,043.11 | 82 | $261.97 | NEW ZION |

| 29580 | $4,037.70 | 83 | $256.56 | NESMITH |

| 29153 | $4,036.90 | 84 | $255.76 | SUMTER |

| 29567 | $4,036.61 | 85 | $255.47 | LITTLE ROCK |

| 29536 | $4,033.60 | 86 | $252.46 | DILLON |

| 29546 | $4,033.18 | 87 | $252.04 | GRESHAM |

| 29003 | $4,032.63 | 88 | $251.49 | BAMBERG |

| 29203 | $4,032.25 | 89 | $251.11 | COLUMBIA |

| 29541 | $4,032.08 | 90 | $250.94 | EFFINGHAM |

| 29204 | $4,025.81 | 91 | $244.67 | COLUMBIA |

| 29102 | $4,023.94 | 92 | $242.80 | MANNING |

| 29406 | $4,022.80 | 93 | $241.66 | CHARLESTON |

| 29477 | $4,017.82 | 94 | $236.68 | SAINT GEORGE |

| 29210 | $4,016.25 | 95 | $235.11 | COLUMBIA |

| 29590 | $4,015.37 | 96 | $234.23 | SALTERS |

| 29540 | $4,008.37 | 97 | $227.23 | DARLINGTON |

| 29432 | $4,007.76 | 98 | $226.62 | BRANCHVILLE |

| 29501 | $4,007.51 | 99 | $226.37 | FLORENCE |

| 29122 | $4,003.74 | 100 | $222.60 | PEAK |

| 29055 | $3,998.66 | 101 | $217.52 | GREAT FALLS |

| 29483 | $3,998.59 | 102 | $217.45 | SUMMERVILLE |

| 29229 | $3,997.10 | 103 | $215.96 | COLUMBIA |

| 29581 | $3,996.42 | 104 | $215.28 | NICHOLS |

| 29010 | $3,994.59 | 105 | $213.45 | BISHOPVILLE |

| 29455 | $3,991.61 | 106 | $210.47 | JOHNS ISLAND |

| 29431 | $3,990.55 | 107 | $209.41 | BONNEAU |

| 29135 | $3,988.95 | 108 | $207.81 | SAINT MATTHEWS |

| 29162 | $3,986.84 | 109 | $205.70 | TURBEVILLE |

| 29569 | $3,986.19 | 110 | $205.05 | LORIS |

| 29914 | $3,980.83 | 111 | $199.69 | DALE |

| 29592 | $3,978.81 | 112 | $197.67 | SELLERS |

| 29180 | $3,978.10 | 113 | $196.96 | WINNSBORO |

| 29223 | $3,978.02 | 114 | $196.88 | COLUMBIA |

| 29492 | $3,975.89 | 115 | $194.75 | CHARLESTON |

| 29154 | $3,975.70 | 116 | $194.56 | SUMTER |

| 29532 | $3,972.68 | 117 | $191.54 | DARLINGTON |

| 29720 | $3,971.96 | 118 | $190.82 | LANCASTER |

| 29570 | $3,970.93 | 119 | $189.79 | MC COLL |

| 29543 | $3,968.75 | 120 | $187.61 | FORK |

| 29152 | $3,964.99 | 121 | $183.85 | SHAW A F B |

| 29209 | $3,964.47 | 122 | $183.33 | COLUMBIA |

| 29051 | $3,963.75 | 123 | $182.61 | GABLE |

| 29420 | $3,963.08 | 124 | $181.94 | NORTH CHARLESTON |

| 29147 | $3,962.50 | 125 | $181.36 | STATE PARK |

| 29205 | $3,962.33 | 126 | $181.19 | COLUMBIA |

| 29403 | $3,959.43 | 127 | $178.29 | CHARLESTON |

| 29594 | $3,956.29 | 128 | $175.15 | TATUM |

| 29123 | $3,955.36 | 129 | $174.22 | PELION |

| 29040 | $3,953.99 | 130 | $172.85 | DALZELL |

| 29584 | $3,953.02 | 131 | $171.88 | PATRICK |

| 29554 | $3,952.59 | 132 | $171.45 | HEMINGWAY |

| 29527 | $3,951.71 | 133 | $170.57 | CONWAY |

| 29571 | $3,950.90 | 134 | $169.76 | MARION |

| 29130 | $3,949.51 | 135 | $168.37 | RIDGEWAY |

| 29579 | $3,948.76 | 136 | $167.62 | MYRTLE BEACH |

| 29564 | $3,947.53 | 137 | $166.39 | LANE |

| 29556 | $3,947.02 | 138 | $165.88 | KINGSTREE |

| 29471 | $3,946.14 | 139 | $165.00 | REEVESVILLE |

| 29544 | $3,945.94 | 140 | $164.80 | GALIVANTS FERRY |

| 29404 | $3,943.07 | 141 | $161.93 | CHARLESTON AFB |

| 29577 | $3,940.61 | 142 | $159.47 | MYRTLE BEACH |

| 29589 | $3,939.93 | 143 | $158.79 | RAINS |

| 29566 | $3,939.31 | 144 | $158.17 | LITTLE RIVER |

| 29407 | $3,939.05 | 145 | $157.91 | CHARLESTON |

| 29560 | $3,936.29 | 146 | $155.15 | LAKE CITY |

| 29133 | $3,935.34 | 147 | $154.20 | ROWESVILLE |

| 29563 | $3,932.93 | 148 | $151.79 | LAKE VIEW |

| 29505 | $3,931.69 | 149 | $150.55 | FLORENCE |

| 29437 | $3,930.13 | 150 | $148.99 | DORCHESTER |

| 29069 | $3,926.32 | 151 | $145.18 | LAMAR |

| 29409 | $3,923.99 | 152 | $142.85 | CHARLESTON |

| 29002 | $3,922.97 | 153 | $141.83 | BALLENTINE |

| 29511 | $3,919.26 | 154 | $138.12 | AYNOR |

| 29591 | $3,918.82 | 155 | $137.68 | SCRANTON |

| 29593 | $3,918.32 | 156 | $137.18 | SOCIETY HILL |

| 29574 | $3,917.55 | 157 | $136.41 | MULLINS |

| 29114 | $3,916.85 | 158 | $135.71 | OLANTA |

| 29373 | $3,915.36 | 159 | $134.22 | PACOLET MILLS |

| 29065 | $3,909.28 | 160 | $128.14 | JENKINSVILLE |

| 29045 | $3,906.79 | 161 | $125.65 | ELGIN |

| 29729 | $3,902.04 | 162 | $120.90 | RICHBURG |

| 29042 | $3,901.43 | 163 | $120.29 | DENMARK |

| 29568 | $3,901.03 | 164 | $119.89 | LONGS |

| 29074 | $3,899.91 | 165 | $118.77 | LIBERTY HILL |

| 29081 | $3,899.41 | 166 | $118.27 | EHRHARDT |

| 29015 | $3,897.55 | 167 | $116.41 | BLAIR |

| 29555 | $3,896.16 | 168 | $115.02 | JOHNSONVILLE |

| 29177 | $3,893.09 | 169 | $111.95 | WHITE ROCK |

| 29225 | $3,892.80 | 170 | $111.66 | COLUMBIA |

| 29526 | $3,890.31 | 171 | $109.17 | CONWAY |

| 29072 | $3,884.83 | 172 | $103.69 | LEXINGTON |

| 29044 | $3,882.48 | 173 | $101.34 | EASTOVER |

| 29063 | $3,881.93 | 174 | $100.79 | IRMO |

| 29058 | $3,880.95 | 175 | $99.81 | HEATH SPRINGS |

| 29596 | $3,880.48 | 176 | $99.34 | WALLACE |

| 29576 | $3,876.87 | 177 | $95.73 | MURRELLS INLET |

| 29516 | $3,874.73 | 178 | $93.59 | BLENHEIM |

| 29485 | $3,871.44 | 179 | $90.30 | SUMMERVILLE |

| 29728 | $3,867.82 | 180 | $86.68 | PAGELAND |

| 29150 | $3,866.15 | 181 | $85.01 | SUMTER |

| 29905 | $3,865.85 | 182 | $84.71 | BEAUFORT |

| 29172 | $3,860.52 | 183 | $79.38 | WEST COLUMBIA |

| 29128 | $3,856.78 | 184 | $75.64 | REMBERT |

| 29207 | $3,856.53 | 185 | $75.39 | COLUMBIA |

| 29062 | $3,856.13 | 186 | $74.99 | HORATIO |

| 29078 | $3,855.64 | 187 | $74.50 | LUGOFF |

| 29073 | $3,852.13 | 188 | $70.99 | LEXINGTON |

| 29512 | $3,850.71 | 189 | $69.57 | BENNETTSVILLE |

| 29175 | $3,848.00 | 190 | $66.86 | WESTVILLE |

| 29016 | $3,843.05 | 191 | $61.91 | BLYTHEWOOD |

| 29733 | $3,841.93 | 192 | $60.79 | ROCK HILL |

| 29525 | $3,841.37 | 193 | $60.23 | CLIO |

| 29812 | $3,839.82 | 194 | $58.68 | BARNWELL |

| 29741 | $3,839.74 | 195 | $58.60 | RUBY |

| 29061 | $3,839.66 | 196 | $58.52 | HOPKINS |

| 29727 | $3,837.71 | 197 | $56.57 | MOUNT CROGHAN |

| 29020 | $3,836.99 | 198 | $55.85 | CAMDEN |

| 29212 | $3,836.94 | 199 | $55.80 | COLUMBIA |

| 29588 | $3,836.67 | 200 | $55.53 | MYRTLE BEACH |

| 29575 | $3,836.64 | 201 | $55.50 | MYRTLE BEACH |

| 29146 | $3,834.52 | 202 | $53.38 | SPRINGFIELD |

| 29014 | $3,832.66 | 203 | $51.52 | BLACKSTOCK |

| 29448 | $3,831.07 | 204 | $49.93 | HARLEYVILLE |

| 29033 | $3,830.50 | 205 | $49.36 | CAYCE |

| 29445 | $3,829.86 | 206 | $48.72 | GOOSE CREEK |

| 29067 | $3,827.63 | 207 | $46.49 | KERSHAW |

| 29206 | $3,825.60 | 208 | $44.46 | COLUMBIA |

| 29030 | $3,825.05 | 209 | $43.91 | CAMERON |

| 29169 | $3,823.24 | 210 | $42.10 | WEST COLUMBIA |

| 29160 | $3,821.55 | 211 | $40.41 | SWANSEA |

| 29826 | $3,819.78 | 212 | $38.64 | ELKO |

| 29101 | $3,816.25 | 213 | $35.11 | MC BEE |

| 29439 | $3,811.84 | 214 | $30.70 | FOLLY BEACH |

| 29036 | $3,804.43 | 215 | $23.29 | CHAPIN |

| 29341 | $3,803.69 | 216 | $22.55 | GAFFNEY |