Does having diabetes affect car insurance?

Diabetes can affect car insurance rates if you've been involved in accidents in the past related to diabetes. Symptoms of diabetes can include fatigue and blurry vision, which could impair your driving and make you more of a risk on the road. Diabetes may not affect your car insurance rates if you have a good driving record and no claims history. In other words, even with advanced diabetes, your rates are based on the risk you pose, not the disease itself. Start comparison shopping for cheap rates below.

Read more

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Nov 6, 2023

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 6, 2023

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- The symptoms people can suffer from diabetes vary

- Insurance companies will look at driving history to determine premiums

- Doctors might submit medical details to the DMV

Having diabetes can be a serious medical condition. It’s important to know how being diabetic will affect you on the road as well as what you pay in auto insurance premiums. Your auto insurance company cannot base your rates on diabetes or other medical conditions or disabilities.

If your glucose levels are not under control causing vision issues and neuropathy, the DMV could suspend or restrict your license. This would limit the coverage available to you. In addition, if you’ve been in an accident due to the side effects or symptoms of diabetes, your insurance rates could go up. Your state’s DMV will be the one to require medical documentation if needed as they control your license status.

If you are a diabetic in need of better auto insurance, compare at least three to four policies today to find the best rates for you! Enter your ZIP code above to get started!

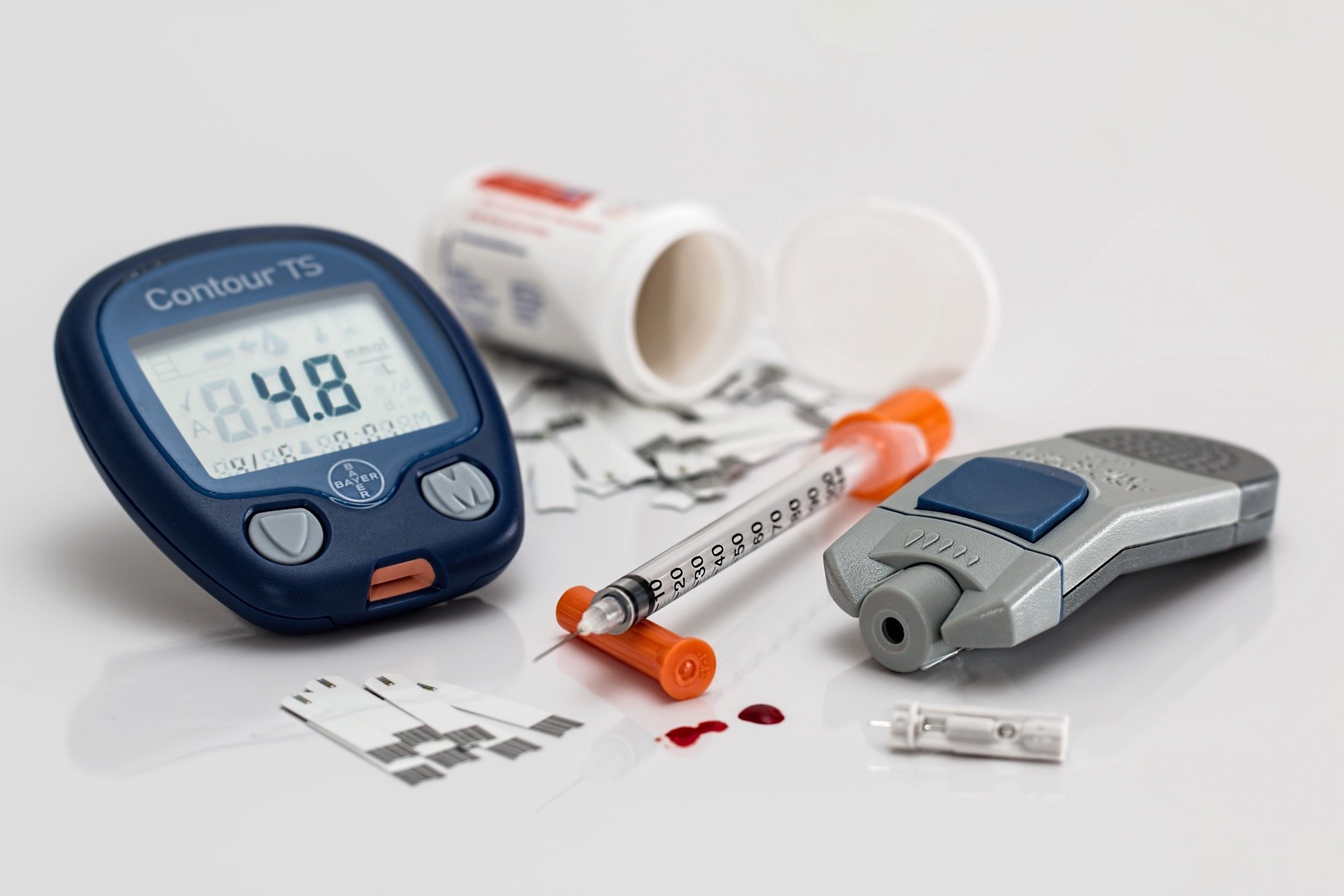

How Does Diabetes Affect Your Driving?

Everyone who has diabetes deals with it differently. You could have type one or type two diabetes, and in some cases, you may even be insulin-dependent. Generally speaking, diabetes can shorten your lifespan and cause complications including neuropathy, diabetic coma, and much more.

There is much debate about how much sugar is too much and the best ways to control glucose levels. If your blood glucose levels swing wildly causing vision issues or other more severe symptoms, it could leave you unable to safely operate a motor vehicle. Others check their blood glucose values regularly, keep it in check, and suffer only minor discomfort. If you’re just looking at their diabetes, these drivers are perfectly safe.

You will need to take a close look at your medical history in order to determine how being diabetic will affect you on the road. In any case, you should work with your doctor. Just as you’d ideally listen to them if they told you to change your diet or medications, you should listen to them if they tell you to stop or limit your driving at certain times of day.

Some symptoms you might experience with diabetes include:

- Fatigue

- Blurry vision

- Numbness in hands and/or feet

All of these are going to impact how you drive as well as the risk you pose to insurance companies. The higher the risk, the more your premiums are likely to cost. If you do not have a valid license, insurance companies will not insure you.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

How Do Insurance Companies Determine Insurance Premiums?

Insurance companies use complicated algorithms to determine the cost of insurance premiums. Everything about you and your driving history will be taken into consideration, including:

- Gender

- Age

- Zip code

- Driving history

- Commute distance

- Type of car you drive

Your doctor might decide to submit a letter to the DMV regarding your medical health, which may include various medical limitations as well as issues that you may have encountered.

If your blood sugar is not under control, it could lead to going into sugar comas as well as various states of confusion.

Doctors and physicians are under a legal and ethical requirement to report issues. This requirement is designed for your safety as well as for the safety of everyone on the roads.

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

Once the DMV receives the information, it becomes a part of your driving record. Insurance companies will be able to access the information as well.

Especially if medical conditions are in place and you have had accidents in the past related to diabetes, it might be difficult to find insurance. If you do find an insurance company willing to insure you, the premiums might be high.

State regulations vary. Some states might revoke your license if you have gotten into a major accident while having diabetes.

You may need to go a certain period of time showing that you have your blood sugar maintained before driving privileges are granted once again.

To ensure you get the best deal, it’s best to get quotes from multiple companies. Comparing quotes allows you to see how the companies factor in your details to come up with a premium.

Determining Risk

Ultimately, many insurance companies look at the risk you pose on the roads. There are millions of people diagnosed with diabetes in the United States. Many are able to hold driver’s licenses and pose no threat when out on the roads.

It all comes down to how risky it is for the insurance companies to insure you.

If you have a clean driving record and your symptoms are under control, your diabetes shouldn’t be an issue.

If you don’t have a clean driving record but you can show that your diabetes doesn’t affect your driving, there are ways to get lower premiums. Such things include:

- Low-mileage discounts

- Multiple cars on a policy

- Multiple policies from one insurance company

- Other discounts

There are also various ways for you to stay safer on the roads so you are less of a risk. Depending on the type of diabetes you have, it might be a good idea to have glucose tablets or orange juice in the car.

This way, if you do feel as though your blood sugar is dropping, you can control the situation. Otherwise, you run the risk of something happening and then your insurance premiums will go up following the claim.

Diabetes only has an effect on car insurance for some people. The only time the insurance companies will even know if you have diabetes is if a doctor decides to notify the DMV.

Your doctor notifying the DMV is only going to happen if they feel as though your symptoms are uncontrolled or make you a danger.

When you know how diabetes affects your driving and how the insurance companies calculate risk, it makes it easier for you to have greater control over what you pay on premiums.

Are you at risk of needing better and more affordable auto insurance? Enter your ZIP code below and start comparison shopping today!

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.