Farmers Car Insurance Review [Rates, Coverage, & More]

Farmers insurance customer reviews are high with J.D. Power, and our Farmers insurance review finds the company an A+ from the Better Business Bureau and an A from A.M. Best. Read more to learn how these high ratings can turn into insurance savings for you and use our quote comparison tool to compare insurance quotes for free.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Nov 25, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 25, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

When it comes to safeguarding your journey on the open road, having the right car insurance is not just a choice; it’s a necessity. Farmers Car Insurance has been a trusted name in the industry for decades, providing peace of mind to countless drivers across the United States.

With a commitment to financial stability, excellent customer service, and a wide range of coverage options, Farmers Car Insurance is more than just a policy; it’s your partner in protection. In this comprehensive guide, we will explore the key features, benefits, and factors to consider when choosing Farmers Car Insurance, ensuring you have the knowledge to drive with confidence.

Whether you’re a new driver seeking affordable coverage or a seasoned motorist looking to enhance your protection, Farmers Car Insurance has something to offer everyone. Join us as we embark on a journey through the world of Farmers Car Insurance, where your safety and satisfaction are the top priorities.

Factors Affecting Farmers Car Insurance Costs

When shopping for car insurance, understanding the cost is a critical factor. Farmers Insurance offers a range of policies with varying rates based on several factors. In this section, we will explore the cost of Farmers Car Insurance, taking into account different elements that affect your premiums.

The cost of Farmers Car Insurance is influenced by multiple factors, and each policyholder’s situation is unique. Some key variables that can affect your insurance costs include:

- Location: Your geographical area can significantly impact your insurance premiums. Areas with higher population densities or greater incidents of accidents and theft may have higher rates.

- Coverage Level: The extent of coverage you choose plays a substantial role in determining your premium. Basic liability coverage is less expensive than comprehensive coverage.

- Driving Record: A history of accidents, violations, or claims may lead to higher premiums, as it suggests a higher risk to the insurer.

- Vehicle Type: The make and model of your car, its age, and its safety features can impact your insurance rates. Newer, safer vehicles may lead to lower premiums.

- Credit Score: In some states, insurance companies use credit scores to calculate rates. A higher credit score may lead to lower premiums.

- Age and Gender: Younger drivers and males tend to pay higher rates due to a perceived higher risk.

- Annual Mileage: The more you drive, the more likely you are to be involved in an accident. Thus, lower annual mileage can result in lower premiums.

- Discounts: Farmers Insurance offers various discounts, such as safe driver discounts, multi-policy discounts, and more, which can reduce your premium.

- Deductible Amount: The amount you choose to pay as a deductible in the event of a claim can impact your premium. Higher deductibles generally mean lower premiums.

The cost of Farmers Car Insurance varies depending on these factors, and it’s essential to consider them when seeking coverage. To get the most accurate estimate, it’s advisable to request a personalized quote from Farmers Insurance. Keep in mind that while cost is an important factor, the quality of coverage and service are equally significant when choosing the right car insurance policy.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Coverage Options Offered by Farmers Car Insurance

Farmers Car Insurance provides a comprehensive range of coverage options to ensure you have the protection you need. Whether you’re looking for basic liability coverage or more extensive protection, Farmers has you covered. Here are the various coverage options offered by Farmers Car Insurance, allowing you to make informed decisions about your insurance needs.

- Liability Coverage: Liability coverage is a fundamental part of any auto insurance policy. It helps cover bodily injury and property damage expenses if you’re at fault in an accident. Farmers offers both bodily injury liability and property damage liability coverage.

- Collision Coverage: Collision coverage steps in to help repair or replace your vehicle if it’s damaged in a collision with another vehicle or object, regardless of fault.

- Comprehensive Coverage: Comprehensive coverage provides protection against non-collision-related incidents, such as theft, vandalism, natural disasters, and more. It’s the safety net for a wide range of unexpected events.

- Uninsured/Underinsured Motorist Coverage: This coverage ensures that you’re protected even if you’re involved in an accident with a driver who has little or no insurance. It covers your medical expenses and damages when the at-fault driver is unable to pay.

- Personal Injury Protection (PIP): PIP coverage is designed to cover medical expenses and additional costs like lost wages and essential services if you’re injured in an accident.

- Medical Payments (MedPay): MedPay coverage takes care of medical expenses for you and your passengers, regardless of who is at fault in an accident.

- Rental Car Reimbursement: This coverage helps cover the cost of renting a vehicle while your insured car is being repaired after an accident.

- Towing and Roadside Assistance: In the event of a breakdown, this coverage provides support for towing and other roadside services, ensuring you’re not left stranded.

Farmers Car Insurance ensures that policyholders have access to a wide range of coverage options, allowing them to tailor their insurance to their specific needs.

Whether you prioritize liability coverage, protection against unforeseen events, or additional services like rental car reimbursement and roadside assistance, Farmers has a comprehensive selection of options to provide peace of mind on the road. It’s all about finding the right combination of coverages to meet your unique insurance needs.

[stumble]

| Farmers Auto Insurance | Info |

|---|---|

| Founded | 1928 |

| Premiums Written | 19,862,472 |

| Loss Ratio | 73.63 % |

| Contact Details | Farmers Insurance 6301 Owensmouth Avenue Woodland Hills, CA 91367 Customer Service: 1-888-327-6335 Florida Customer Service Only: 1-888-327-6335 Website: https://www.farmers.com/ |

| Best For | Auto Insurance Life Insurance Home Insurance Renters Insurance Landlord and Rental Properties Insurance Business Insurance Motorcycle Insurance Recreational Insurance Umbrella Insurance |

Farmers has an impressive selection of insurance options available and is a popular choice for many consumers. That said, it’s critical to understand exactly what this insurance carrier has to offer and where it falls short before taking the leap.

Start your journey to saving big on auto insurance today by using our FREE online rate tool. Just enter your zip code to get started!

The following Farmers auto insurance review will equip you with everything you need to know to make the right decision for your coverage needs. Ready to learn everything you need to know about Farmers’ consumer ratings, coverage options, claim process, and more?

Let’s get down to business.

Savings With Farmers Car Insurance: Exploring Discount Opportunities

Farmers Car Insurance recognizes the importance of affordability and offers a variety of discounts to help you maximize your savings. Here are the diverse range of discounts available with Farmers Car Insurance, ensuring you have the information you need to make your insurance more cost-effective and tailored to your needs.

- Safe Driver Discount: If you have a clean driving record with no accidents or violations, you may qualify for a safe driver discount.

- Multi-Policy Discount: Bundling your auto insurance with other policies, such as home or renters insurance, can lead to substantial savings.

- Good Student Discount: Students with a strong academic record often enjoy lower premiums. If you’re a student or have a student on your policy, ask about this discount.

- Distant Student Discount: If your student attends school far from home and doesn’t have regular access to the insured vehicle, you may be eligible for a discount.

- Multi-Car Discount: Insuring multiple vehicles under the same policy can result in a multi-car discount.

- Electronic Funds Transfer (EFT) Discount: Enrolling in automatic premium payments through EFT can lead to reduced rates.

- Pay-in-Full Discount: Paying your premium in a lump sum, rather than through installments, can result in a discount.

- Good Driver Discount: Maintaining a clean driving record for several years can qualify you for this additional discount.

- Alternative Fuel Discount: If your vehicle is environmentally friendly and runs on alternative fuels, you may be eligible for an eco-conscious discount.

Farmers Car Insurance offers a wide array of discounts to make your auto insurance more affordable and customized to your specific needs. Exploring these discount opportunities can help you save money while ensuring you have the coverage you require. By taking advantage of these savings options, you can enjoy peace of mind on the road while keeping more of your hard-earned money in your pocket.

Farmers Car Insurance Claims Process

Ease of Filing a Claim

Farmers Car Insurance offers multiple channels for filing claims, making it convenient for policyholders to report incidents. You can file a claim through their official website, over the phone by contacting their customer service, or by using their mobile app.

This flexibility allows you to choose the method that suits your preferences and needs. Whether you prefer the convenience of digital filing or the assistance of speaking with a representative, Farmers has you covered.

Average Claim Processing Time

The speed at which claims are processed can be a critical factor for policyholders. Farmers Car Insurance aims to expedite the claims process to minimize the inconvenience caused by accidents or damage.

While the exact processing time can vary based on the complexity of the claim and other factors, Farmers strives to process claims efficiently. It’s advisable to reach out to their customer service or consult your claims representative for more specific information on processing times for your claim.

Customer Feedback on Claim Resolutions and Payouts

To gauge the effectiveness of Farmers Car Insurance’s claim resolutions and payouts, it’s valuable to consider customer feedback. Many policyholders share their experiences online through reviews and testimonials.

Additionally, you can explore customer satisfaction ratings from sources like J.D. Power and the Better Business Bureau. These ratings and reviews provide insights into how Farmers handles claim resolutions and whether policyholders are generally satisfied with the outcomes.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Farmers Car Insurance Digital and Technological Features

Mobile App Features and Functionality

Farmers Insurance offers a mobile app designed to streamline policy management and claims processing. The app includes features like online claims reporting, enabling you to initiate the claims process directly from your mobile device.

You can also access your policy documents, including digital ID cards for proof of insurance. The app provides options for convenient payment processing, including setting up automatic payments. It’s a comprehensive tool that allows you to manage your insurance needs on the go.

Online Account Management Capabilities

For policyholders who prefer managing their insurance accounts online, Farmers Car Insurance offers a user-friendly web platform. This online account management system allows you to access your policy details, review coverage, and make policy changes as needed.

You can also view and download policy documents, making it easy to access essential information when required. The online portal ensures that you have control over your insurance needs at your convenience.

Digital Tools and Resources

Farmers provides a range of digital tools and resources to enhance your insurance experience. These may include educational materials, calculators to help you assess your insurance needs, and informative blog posts.

Additionally, they may offer resources to help you better understand your policy and coverage options. These digital tools and resources serve to empower policyholders with knowledge and information to make informed decisions about their insurance coverage.

Customer Reviews for Farmers Car Insurance

Customers have lauded Farmers Car Insurance for its competitive rates and diverse coverage options. The efficient claims process and ease of online account management were particularly praised. However, some mentioned minor technical glitches with the mobile app. Overall, Farmers Insurance stands out for its responsive customer service and commitment to meeting diverse insurance needs.

History and Mission of Farmers Car Insurance

Established in 1928, Farmers Car Insurance has a rich history rooted in providing reliable insurance solutions to individuals and businesses across the United States. With a mission to ensure financial security and peace of mind for all, Farmers Car Insurance consistently evolves to meet the changing needs of its customers, leveraging innovation and a customer-centric approach.

Committed to fostering trust and delivering quality service, Farmers Car Insurance remains a trusted name in the insurance industry, dedicated to safeguarding what matters most to its policyholders.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

AM Best

AM Best’s rating system is widely respected by insurers everywhere, as a positive or negative rating from them can make all the difference in whether consumers decide to purchase coverage or not. AM Best assesses both the insurance carrier’s financial strength along with the likelihood that they will continue to fulfill policies and contracts with insureds.

AM Best’s financial strength rating for Farmers Insurance is A. Just one notch below the superior A+ rating, an A means that the insurance carrier has excellent financial strength and will continue to meet consumer needs and contractual obligations with insureds.

In short, this is great news for Farmers Insurance! If you noted the loss ratio listed at the beginning of our Farmers auto insurance review, you’ll notice that the company comes in at 73.63 percent.

But what does this mean?

Well, an insurer’s loss ratio is the cost of claims they are paying in comparison to the premiums they are earning. So, if an insurance company has a loss ratio above 100 percent, this means they’re losing money. If they have a loss ratio under 100 percent, this is a good sign that they are experiencing a healthy proportion of paid claims to earned premiums.

Better Business Bureau

The Better Business Bureau is a non-profit entity that measures rankings for businesses based on its Accredited Business System. The BBB is not government-affiliated or sanctioned, but they are a reliable and helpful source insureds can use to assess a potential carrier’s performance.

One thing you should know is that the BBB assigns different ratings to the same insurance carrier based on state. For example, in the state of California, Farmers currently has an A+ rating, which is the highest rating they offer.

The BBB has several rating elements or criterion they use to determine its rating for any given company. These include:

- The company’s complaint history

- The type of business

- The length of time the company has been in business

- The transparency of the company’s business practices

- Any failure to honor commitments made to the BBB

- Government and licensing actions (such as failure to obtain a particular license)

- Advertising problems

So, while the BBB’s rating is not the only one you should take into account from our Farmers auto insurance review to determine if this carrier is the right one for you, rest assured that each company is thoroughly vetted before being assigned a rating.

Moody’s Rating

Moody’s has a somewhat different rating scale for companies, ranging from Aaa as the highest rating to C as the lowest. In addition to the letter modifiers, Moody’s also adds numbers for ratings Aa through Caa.

In October 2018, Moody’s actually altered Farmers’ ratings to a negative outlook, citing:

The negative outlook reflects Farmers persistently high gross underwriting and financial leverage relative to peers. While Farmers has made good progress toward improving its personal auto underwriting results by raising rates and implementing underwriting actions, surplus has remained relatively flat and earnings modest. For the first half of 2018, Farmers reported statutory net income of $130 million compared to a net loss of $148 million in the prior year period.

Moody’s current financial strength rating for Farmers Insurance Exchange, the primary insurer from Farmers’ carrier pool, is A2. This rating indicates that the company has a mid-range ranking, with obligations cited to be upper-medium grade with low credit risk.

The surplus note grade (insurer issued securities) for Farmers is rated Baa2. This means that Farmers has a mid-range ranking, with medium grade obligations subject to moderate credit risk, which could be speculative in nature. Speculative characteristics indicate the potential for investors to lose in the long run.

Of course, there are more factors at play than the Baa2 rating, but this is something to bear in mind when making your choice.

Time to move on to the S&P rating. Let’s go!

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

S&P Rating

S&P Global has an array of criterion they use to determine a company’s rating, including credit and potential risk factors. S&P uses a letter grade system to rank each company.

Currently, Farmers Insurance has an A rating with S&P Global. This means its capacity to repay financial obligations is strong.

However, it is interesting to note that similar to Moody’s, S&P Global has ranked Farmers’ credit outlook as negative. Before you let that deter you, let’s pause and examine another significant factor you should be taking into account when deciding to go with Farmers or not—consumer complaints.

Let’s take a closer look

NAIC Complaint Index

The NAIC (National Association of Insurance Commissioners) is the chief insurance regulatory body for insurance companies in the U.S. Check out the table below, featuring the consumer complaint index for Farmers.

| Criteria | Info |

|---|---|

| Policy Type | Private Passenger |

| Complaint Year | 2018 |

| Premium Year | 2018 |

| Complaint Index | 0.98 |

| National Median Complaint Index | 1.18 |

| Complaint Share | 0.0094 |

| Total Complaints | 144 |

| U.S. Market Share | 0.96% |

| Total Premiums Written | $2,373,976,208 |

Given the fact that the national median complaint ratio is 1.00, Farmers is definitely receiving far fewer complaints than other competitors in the insurance market. When you compare the small number of customer complaints against the vast number of premiums written, it’s safe to say the majority of Farmers consumers are satisfied with the carrier.

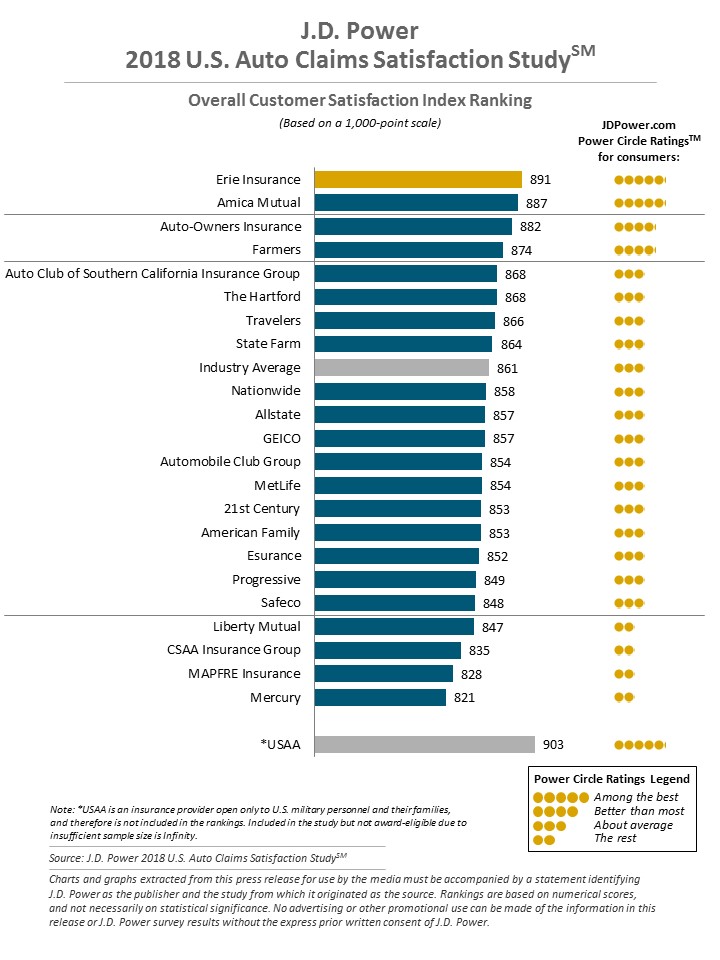

JD Power

| Rating Factor | Score (with 5 being the highest) |

|---|---|

| Overall Satisfaction | 4 |

| First Notice of Loss | 3 |

| Estimation Process | 4 |

| Repair Process | 4 |

| Rental Experience | 4 |

| Claims Servicing | 4 |

| Settlement | 4 |

As you can see from the table above, Farmers is doing very well overall in terms of customer satisfaction. One area JD Power’s 2018 U.S. Auto Satisfaction Claims Study noted that Farmers needs to work on is the first notice of loss or initial claim reporting process.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Consumer Reports

We understand that it’s not only important to understand an insurer’s financial outlooks from rating agencies, but their overall consumer satisfaction too. At the end of the day, that will be one of your major decision-making factors when choosing whether you want to go with Farmers or move on to another carrier.

Another fantastic rating resource for overall insureds’ satisfaction is Consumer Reports. The table below reveals the most recent data from Consumer Reports, gathered from various customer surveys. Check it out for yourself!

| Claims Process | Rating |

|---|---|

| Ease of Reaching an Agent | Excellent |

| Simplicity of the Process | Very Good |

| Promptness of Response | Very Good |

| Damage Amount | Very Good |

| Agent Courtesy | Very Good |

| Timely Payment | Very Good |

| Freedom to Select Repair Shop | Very Good |

| Being Kept Informed of Claim Status | Very Good |

As you can see, Farmers is doing a great job at handling claims and overall, customers are very satisfied.

Market share

The higher a company’s market share is, the more competitive it is against other carriers in the market. As you can see from the table below, Farmers’ market share actually decreased by 0.12 percent between 2015 and 2017.

| Year | Market Share |

|---|---|

| 2015 | 3.20% |

| 2016 | 3.19% |

| 2017 | 3.08% |

Service options

Farmers has an impressive array of service options to meet any consumer preference. You can contact them by going to their website and submitting a query through the contact form. You can also contact customer service, a claims representative, or local independent agent directly by phone.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Community service

Farmers has a long history of community involvement, both through corporate giving and community outreach programs. In fact, they have created what is known as Farmers Pillars of Corporate Responsibility, including assisting with disaster resilience, education, and civic engagement.

According to their Farmers In Our Communities webpage, the company was awarded a spot among the Top 150 Military Friendly Employers in the U.S., with a special program called Suits for Soldiers that provides professional clothing to veterans and military members to ease the move back to civilian life.

Farmers has a Volunteer Incentive Program where employees can give back to their favorite non-profit charities in the community. The company also offers the Matching Education Gifts Program, where Farmers matches employee donations to qualifying institutions for amounts up to $500.

Future outlook for Farmers

After delving into the ratings and company details our Farmers auto insurance review has covered so far, it looks like the carrier has a good future ahead of it. Not only do they have a low complaint ratio and excellent customer satisfaction ratings, but their loss ratio is in a healthy range as well. Their market share is a factor that bears watching, as it has decreased slightly over the last few years.

While Moody’s and S&P were the only two with negative outlook projections for the company, the former still rated Farmers with low credit risk and noted that the carrier was working on improving its underwriting results.

In 2018, Farmers increased their rates to improve their personal auto underwriting results. If Farmers wants to continue to improve their underwriting outcomes to balance out their annual losses (and therefore increase their financial stability), they’ll need to continue offering excellent customer service and affordable rates to consumers. Otherwise, those underwriting results could look bleak and customer satisfaction would have the potential to drop considerably in 2019 and onward.

Which states does Farmers operate in?

Farmers is a chain of insurance providers, currently licensed and practicing across all 50 states. Policies and discounts could vary depending on the state you live in.

The good news is that no matter where you are, you’ll have no issue finding a Farmers insurance branch near you.

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

How to get car insurance rates

At the end of the day, finding the car insurance carrier to suit your needs often comes down to rates. So, it’s important to understand what your rate options are before making a decision to go with an insurer. For everything from state rates to mileage rate comparisons, keep scrolling through our Farmers auto insurance review.

Let’s go!

Does the state you live in affect your rates?

| State | Group | Annual Premium | Higher/Lower than State Average | Percentage Compared to State Average |

|---|---|---|---|---|

| Alabama | Farmers | $4,185.80 | $618.84 | 14.78% |

| Arkansas | Farmers | $4,257.87 | $132.89 | 3.12% |

| Arizona | Farmers | $5,000.08 | $1,229.11 | 24.58% |

| California | Farmers | $4,998.78 | $1,309.85 | 26.20% |

| Colorado | Farmers | $5,290.24 | $1,413.85 | 26.73% |

| Hawaii | Farmers | $4,763.82 | $2,208.18 | 46.35% |

| Iowa | Farmers | $2,435.72 | -$545.56 | -22.40% |

| Idaho | Farmers | $3,168.28 | $189.19 | 5.97% |

| Illinois | Farmers | $4,605.20 | $1,299.72 | 28.22% |

| Indiana | Farmers | $3,437.55 | $22.58 | 0.66% |

| Kansas | Farmers | $3,703.77 | $424.15 | 11.45% |

| Maine | Farmers | $2,770.15 | -$183.13 | -6.61% |

| Michigan | Farmers | $8,503.60 | -$1,995.04 | -23.46% |

| Minnesota | Farmers | $3,137.45 | -$1,265.80 | -40.34% |

| Missouri | Farmers | $4,312.19 | $983.26 | 22.80% |

| Montanta | Farmers | $3,907.55 | $686.71 | 17.57% |

| North Dakota | Farmers | $3,092.49 | -$1,073.35 | -34.71% |

| Nebraska | Farmers | $3,997.29 | $713.61 | 17.85% |

| New Jersey | Farmers | $7,617.00 | $2,101.79 | 27.59% |

| New Mexico | Farmers | $4,315.53 | $851.89 | 19.74% |

| Nevada | Farmers | $5,595.56 | $733.86 | 13.12% |

| Ohio | Farmers | $3,423.01 | $713.30 | 20.84% |

| Oklahoma | Farmers | $4,142.40 | $0.08 | 0.00% |

| Oregon | Farmers | $3,753.52 | $285.75 | 7.61% |

| South Carolina | Farmers | $4,691.85 | $910.71 | 19.41% |

| South Dakota | Farmers | $3,768.80 | -$213.47 | -5.66% |

| Tennessee | Farmers | $3,430.07 | -$230.82 | -6.73% |

| Utah | Farmers | $3,907.99 | $296.10 | 7.58% |

| Washington | Farmers | $2,962.00 | -$97.32 | -3.29% |

| Wisconsin | Farmers | $3,777.49 | $171.43 | 4.54% |

| Wyoming | Farmers | $3,069.35 | -$130.73 | -4.26% |

| Median | Farmers | $3,907.99 | $247.10 | 6.32% |

Read more:

- Farmers Insurance Company of Arizona Car Insurance Review

- Farmers Insurance Company of Idaho Car Insurance Review

- Farmers Insurance Company of Oregon Car Insurance Review

- Farmers Insurance Company of Washington Car Insurance Review

- Top 10 Wyoming Car Insurance Companies

- Maine Car Insurance Guide (Cost + Coverage)

- Farmers vs. Geico: Best Car Insurance

The table above reveals just how much your rates can change depending on the state you live in. Take Michigan vs. Minnesota for example. That’s over a $5,000 rate difference!

Company rates comparison

| State | Average by State | Allstate | American Family | Farmers | Geico | Liberty Mutual | Nationwide | Progressive | Group | Annual Premium | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Alaska | $3,421.51 | $3,145.31 | $4,153.07 | Data Not Available | $2,879.96 | $5,295.55 | Data Not Available | $3,062.85 | State Farm | $2,228.12 | Data Not Available | $2,454.21 |

| Alabama | $3,566.96 | $3,311.52 | Data Not Available | $4,185.80 | $2,866.60 | $4,005.48 | $2,662.66 | $4,450.52 | State Farm | $4,798.15 | $3,697.80 | $2,124.09 |

| Arkansas | $4,124.98 | $5,150.03 | Data Not Available | $4,257.87 | $3,484.63 | Data Not Available | $3,861.79 | $5,312.09 | State Farm | $2,789.03 | $5,973.33 | $2,171.06 |

| Arizona | $3,770.97 | $4,904.10 | Data Not Available | $5,000.08 | $2,264.71 | Data Not Available | $3,496.08 | $3,577.50 | State Farm | $4,756.25 | $3,084.74 | $3,084.29 |

| California | $3,688.93 | $4,532.96 | Data Not Available | $4,998.78 | $2,885.65 | $3,034.42 | $4,653.19 | $2,849.67 | State Farm | $4,202.28 | $3,349.54 | $2,693.87 |

| Colorado | $3,876.39 | $5,537.17 | $3,733.02 | $5,290.24 | $3,091.69 | $2,797.74 | $3,739.47 | $4,231.92 | State Farm | $3,270.77 | Data Not Available | $3,338.87 |

| Connecticut | $4,618.92 | $5,831.60 | Data Not Available | Data Not Available | $3,073.66 | $7,282.87 | $3,672.34 | $4,920.35 | State Farm | $2,976.24 | $6,004.29 | $3,190.00 |

| District of Columbia | $4,439.24 | $6,468.92 | Data Not Available | Data Not Available | $3,692.81 | Data Not Available | $4,848.98 | $4,970.26 | State Farm | $4,074.05 | Data Not Available | $2,580.44 |

| Delaware | $5,986.32 | $6,316.06 | Data Not Available | Data Not Available | $3,727.29 | $18,360.02 | $4,330.21 | $4,181.83 | State Farm | $4,466.85 | $4,182.36 | $2,325.98 |

| Florida | $4,680.46 | $7,440.46 | Data Not Available | Data Not Available | $3,783.63 | $5,368.15 | $4,339.60 | $5,583.30 | State Farm | $3,397.67 | Data Not Available | $2,850.41 |

| Georgia | $4,966.83 | $4,210.70 | Data Not Available | Data Not Available | $2,977.20 | $10,053.44 | $6,484.90 | $4,499.22 | State Farm | $3,384.88 | Data Not Available | $3,157.46 |

| Hawaii | $2,555.64 | $2,173.49 | Data Not Available | $4,763.82 | $3,358.86 | $3,189.55 | $2,551.83 | $2,177.93 | State Farm | $1,040.28 | Data Not Available | $1,189.35 |

| Iowa | $2,981.28 | $2,965.86 | $3,021.81 | $2,435.72 | $2,296.16 | $4,415.28 | $2,735.44 | $2,395.50 | State Farm | $2,224.51 | $5,429.38 | $1,852.57 |

| Idaho | $2,979.09 | $4,088.76 | $3,728.79 | $3,168.28 | $2,770.68 | $2,301.51 | $3,032.19 | Data Not Available | State Farm | $1,867.96 | $3,226.29 | $1,877.61 |

| Illinois | $3,305.48 | $5,204.41 | $3,815.31 | $4,605.20 | $2,779.16 | $2,277.65 | $2,711.81 | $3,536.65 | State Farm | $2,344.88 | $2,499.76 | $2,770.21 |

| Indiana | $3,414.97 | $3,978.81 | $3,679.68 | $3,437.55 | $2,261.07 | $5,781.35 | Data Not Available | $3,898.00 | State Farm | $2,408.94 | $3,393.75 | $1,630.86 |

| Kansas | $3,279.62 | $4,010.23 | $2,146.40 | $3,703.77 | $3,220.65 | $4,784.42 | $2,475.59 | $4,144.38 | State Farm | $2,720.00 | $4,341.43 | $2,382.61 |

| Kentucky | $5,195.40 | $7,143.92 | Data Not Available | Data Not Available | $4,633.59 | $5,930.97 | $5,503.23 | $5,547.63 | State Farm | $3,354.32 | $6,551.68 | $2,897.89 |

| Louisiana | $5,711.34 | $5,998.79 | Data Not Available | Data Not Available | $6,154.60 | Data Not Available | Data Not Available | $7,471.10 | State Farm | $4,579.12 | Data Not Available | $4,353.12 |

| Maine | $2,953.28 | $3,675.59 | Data Not Available | $2,770.15 | $2,823.05 | $4,331.39 | Data Not Available | $3,643.59 | State Farm | $2,198.68 | $2,252.97 | $1,930.79 |

| Maryland | $4,582.70 | $5,233.17 | Data Not Available | Data Not Available | $3,832.63 | $9,297.55 | $2,915.69 | $4,094.86 | State Farm | $3,960.87 | Data Not Available | $2,744.14 |

| Massachusetts | $2,678.85 | $2,708.53 | Data Not Available | Data Not Available | $1,510.17 | $4,339.35 | Data Not Available | $3,835.11 | State Farm | $1,361.86 | $3,537.94 | $1,458.99 |

| Michigan | $10,498.64 | $22,902.59 | Data Not Available | $8,503.60 | $6,430.11 | $20,000.04 | $6,327.38 | $5,364.55 | State Farm | $12,565.52 | $8,773.97 | $3,620.00 |

| Minnesota | $4,403.25 | $4,532.01 | $3,521.29 | $3,137.45 | $3,498.54 | $13,563.61 | $2,926.49 | Data Not Available | State Farm | $2,066.99 | Data Not Available | $2,861.60 |

| Missouri | $3,328.93 | $4,096.15 | $3,286.90 | $4,312.19 | $2,885.33 | $4,518.67 | $2,265.35 | $3,419.14 | State Farm | $2,692.91 | Data Not Available | $2,525.78 |

| Mississippi | $3,664.57 | $4,942.11 | Data Not Available | Data Not Available | $4,087.21 | $4,455.94 | $2,756.53 | $4,308.85 | State Farm | $2,980.48 | $3,729.32 | $2,056.13 |

| Montana | $3,220.84 | $4,672.10 | Data Not Available | $3,907.55 | $3,602.35 | $1,326.11 | $3,478.26 | $4,330.76 | State Farm | $2,417.74 | Data Not Available | $2,031.89 |

| North Carolina | $3,393.11 | $7,190.43 | Data Not Available | Data Not Available | $2,936.69 | $2,182.71 | $2,848.03 | $2,382.61 | State Farm | $3,078.65 | $3,132.66 | Data Not Available |

| North Dakota | $4,165.84 | $4,669.31 | $3,812.40 | $3,092.49 | $2,668.24 | $12,852.83 | $2,560.35 | $3,623.06 | State Farm | $2,560.53 | Data Not Available | $2,006.80 |

| Nebraska | $3,283.68 | $3,198.83 | $2,215.13 | $3,997.29 | $3,837.49 | $6,241.52 | $2,603.94 | $3,758.01 | State Farm | $2,438.71 | Data Not Available | $2,330.78 |

| New Hampshire | $3,151.77 | $2,725.01 | Data Not Available | Data Not Available | $1,615.02 | $8,444.41 | $2,491.10 | $2,694.45 | State Farm | $2,185.46 | Data Not Available | $1,906.96 |

| New Jersey | $5,515.21 | $5,713.58 | Data Not Available | $7,617.00 | $2,754.94 | $6,766.62 | Data Not Available | $3,972.72 | State Farm | $7,527.16 | $4,254.49 | Data Not Available |

| New Mexico | $3,463.64 | $4,200.65 | Data Not Available | $4,315.53 | $4,458.30 | Data Not Available | $3,514.38 | $3,119.18 | State Farm | $2,340.66 | Data Not Available | $2,296.77 |

| Nevada | $4,861.70 | $5,371.62 | $5,441.18 | $5,595.56 | $3,662.09 | $6,201.55 | $3,477.14 | $4,062.57 | State Farm | $5,796.34 | $5,360.41 | $3,069.07 |

| New York | $4,289.88 | $4,740.97 | Data Not Available | Data Not Available | $2,428.24 | $6,540.73 | $4,012.93 | $3,771.15 | State Farm | $4,484.58 | $4,578.79 | $3,761.69 |

| Ohio | $2,709.71 | $3,197.22 | $1,515.17 | $3,423.01 | $1,867.19 | $4,429.74 | $3,300.89 | $3,436.96 | State Farm | $2,507.88 | $3,135.16 | $1,478.46 |

| Oklahoma | $4,142.33 | $3,718.62 | Data Not Available | $4,142.40 | $3,437.34 | $6,874.62 | Data Not Available | $4,832.35 | State Farm | $2,816.80 | Data Not Available | $3,174.15 |

| Oregon | $3,467.77 | $4,765.95 | $3,527.28 | $3,753.52 | $3,220.12 | $4,334.55 | $3,176.83 | $3,629.13 | State Farm | $2,731.48 | $2,892.19 | $2,587.15 |

| Pennsylvania | $4,034.50 | $3,984.12 | Data Not Available | Data Not Available | $2,605.22 | $6,055.20 | $2,800.37 | $4,451.00 | State Farm | $2,744.23 | $7,842.47 | $1,793.37 |

| Rhode Island | $5,003.36 | $4,959.45 | Data Not Available | Data Not Available | $5,602.63 | $6,184.12 | $4,409.63 | $5,231.09 | State Farm | $2,406.51 | $6,909.45 | $4,323.98 |

| South Carolina | $3,781.14 | $3,903.43 | Data Not Available | $4,691.85 | $3,178.01 | Data Not Available | $3,625.49 | $4,573.08 | State Farm | $3,071.34 | Data Not Available | $3,424.77 |

| South Dakota | $3,982.27 | $4,723.72 | $4,047.47 | $3,768.80 | $2,940.29 | $7,515.99 | $2,737.66 | $3,752.81 | State Farm | $2,306.23 | Data Not Available | Data Not Available |

| Tennessee | $3,660.89 | $4,828.85 | Data Not Available | $3,430.07 | $3,283.42 | $6,206.69 | $3,424.96 | $3,656.91 | State Farm | $2,639.30 | $2,738.52 | $2,739.28 |

| Texas | $4,043.28 | $5,485.44 | $4,848.72 | Data Not Available | $3,263.28 | Data Not Available | $3,867.55 | $4,664.69 | State Farm | $2,879.94 | Data Not Available | $2,487.89 |

| Utah | $3,611.89 | $3,566.42 | $3,698.77 | $3,907.99 | $2,965.57 | $4,327.76 | $2,986.57 | $3,830.10 | State Farm | $4,645.83 | Data Not Available | $2,491.10 |

| Virginia | $2,357.87 | $3,386.80 | Data Not Available | Data Not Available | $2,061.53 | Data Not Available | $2,073.00 | $2,498.58 | State Farm | $2,268.95 | Data Not Available | $1,858.38 |

| Vermont | $3,234.13 | $3,190.38 | Data Not Available | Data Not Available | $2,195.71 | $3,621.08 | $2,128.21 | $5,217.14 | State Farm | $4,382.84 | Data Not Available | $1,903.55 |

| Washington | $3,059.32 | $3,540.52 | $3,713.02 | $2,962.00 | $2,568.65 | $3,994.73 | $2,129.84 | $3,209.52 | State Farm | $2,499.78 | Data Not Available | $2,262.16 |

| West Virginia | $2,595.36 | $3,820.68 | Data Not Available | Data Not Available | $2,120.80 | $2,924.39 | Data Not Available | Data Not Available | State Farm | $2,126.32 | Data Not Available | $1,984.62 |

| Wisconsin | $3,606.06 | $4,854.41 | $1,513.27 | $3,777.49 | $3,926.20 | $6,758.85 | $5,224.99 | $3,128.91 | State Farm | $2,387.53 | Data Not Available | $2,975.74 |

| Wyoming | $3,200.08 | $4,373.93 | Data Not Available | $3,069.35 | $3,496.56 | $1,989.36 | $3,187.20 | $4,401.17 | State Farm | $2,303.55 | Data Not Available | $2,779.53 |

| Median | $3,660.89 | $4,532.96 | $3,698.77 | $3,907.99 | $3,073.66 | $5,295.55 | $3,187.20 | $3,935.36 | State Farm | $2,731.48 | $3,729.32 | $2,489.49 |

As you can see from the table above, Farmers is in the upper range for average annual rates when compared to other providers, but definitely not at the top. So, both the state you live in and the insurance carrier you pick can have a huge effect on the rates you can expect to pay.

Farmers is available to consumers in all 50 states.

Let’s take a look at how different auto insurance companies handle commute rates compared to Farmers.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What are the average commute rates?

| Group | 10 miles commute. 6000 annual mileage. | 25 miles commute. 12000 annual mileage. |

|---|---|---|

| Allstate | $4,841.71 | $4,934.20 |

| American Family | $3,401.30 | $3,484.88 |

| Farmers | $4,179.32 | $4,209.22 |

| Geico | $3,162.64 | $3,267.37 |

| Liberty Mutual | $5,995.27 | $6,151.63 |

| Nationwide | $3,437.33 | $3,462.67 |

| Progressive | $4,030.02 | $4,041.01 |

| State Farm | $3,175.98 | $3,344.01 |

| Travelers | $4,399.85 | $4,469.96 |

| USAA | $2,482.69 | $2,591.91 |

Once again, Farmers comes in the median range rate-wise based on the commute. In fact, their average annual rates only increase by around $30 for 10 vs. 25-mile commutes.

What are the coverage level rates?

| Group | High | Low | Medium |

|---|---|---|---|

| Allstate | $5,139.02 | $4,628.03 | $4,896.81 |

| American Family | $3,416.40 | $3,368.49 | $3,544.37 |

| Farmers | $4,494.13 | $3,922.47 | $4,166.22 |

| Geico | $3,429.14 | $3,001.91 | $3,213.97 |

| Liberty Mutual | $6,356.04 | $5,805.75 | $6,058.57 |

| Nationwide | $3,505.37 | $3,394.83 | $3,449.80 |

| Progressive | $4,350.96 | $3,737.13 | $4,018.46 |

| State Farm | $3,454.80 | $3,055.40 | $3,269.80 |

| Travelers | $4,619.07 | $4,223.63 | $4,462.02 |

| USAA | $2,667.92 | $2,404.11 | $2,539.87 |

What are the credit history rates?

| Group | Fair | Good | Poor |

|---|---|---|---|

| Allstate | $4,581.16 | $3,859.66 | $6,490.65 |

| American Family | $3,169.53 | $2,691.74 | $4,467.98 |

| Farmers | $3,899.41 | $3,677.12 | $4,864.14 |

| Geico | $2,986.79 | $2,434.82 | $4,259.50 |

| Liberty Mutual | $5,604.24 | $4,388.18 | $8,802.22 |

| Nationwide | $3,254.83 | $2,925.94 | $4,083.29 |

| Progressive | $3,956.31 | $3,628.85 | $4,737.64 |

| State Farm | $2,853.00 | $2,174.26 | $4,951.20 |

| Travelers | $4,344.10 | $4,058.97 | $5,160.22 |

| USAA | $2,219.83 | $1,821.20 | $3,690.73 |

A good credit score can make all the difference between affordable car insurance rates and exorbitant ones. The average U.S. resident’s credit score is 675, meaning that most individuals in the States have fair to good credit.

As the table above shows, Farmers doesn’t have a significant rate jump for poor vs. good credit as some other companies do, which could be good news if you are trying to rebuild your credit and don’t have the best history just yet. Other companies have much wider rate gaps, such as Liberty Mutual with an over $3,000 rate difference!

Even if you don’t have the best credit, don’t let that discourage you. As you now know from our Farmers auto insurance review, there are many factors that go into determining rates, from location to coverage levels and more.

Speaking of which, let’s see how driving record could affect your insurance premiums with Farmers.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What are the driving record rates?

| Group | Clean record | With 1 accident | With 1 DUI | With 1 speeding violation |

|---|---|---|---|---|

| Allstate | $3,819.90 | $4,987.68 | $6,260.73 | $4,483.51 |

| American Family | $2,693.61 | $3,722.75 | $4,330.24 | $3,025.74 |

| Farmers | $3,460.60 | $4,518.73 | $4,718.75 | $4,079.01 |

| Geico | $2,145.96 | $3,192.77 | $4,875.87 | $2,645.43 |

| Liberty Mutual | $4,774.30 | $6,204.78 | $7,613.48 | $5,701.26 |

| Nationwide | $2,746.18 | $3,396.95 | $4,543.20 | $3,113.68 |

| Progressive | $3,393.09 | $4,777.04 | $3,969.65 | $4,002.28 |

| State Farm | $2,821.18 | $3,396.01 | $3,636.80 | $3,186.01 |

| Travelers | $3,447.69 | $4,289.74 | $5,741.40 | $4,260.80 |

| USAA | $1,933.68 | $2,516.24 | $3,506.03 | $2,193.25 |

Some insurance companies take a very hard line with driving record rates, with huge rate differences for drivers with clean records vs. a violation like a speeding ticket or DUI. However, Farmers comes in with a moderate approach once more, and a far narrower gap for driving record rates than some other carriers, like Nationwide.

Remember! If you opt to add Farmers’ Accident Forgiveness Coverage, with three accident-free years, one accident won’t affect your rates. After that, your premiums could go up.

How to obtain a quote online

Now that you’re an expert from our Farmers auto insurance review on all the key factors you need to know when examining a carrier, let’s take a look at the process for obtaining a quote online. Once you obtain you’re quote, you’ll be one step closer to making the decision that is best for you.

Before you obtain your quote, it will be helpful if you have the following information on hand:

- License plate number

- Driver’s license number

- Vehicle identification number (VIN)

- Odometer reading

- Purchase date

- Current insurance information

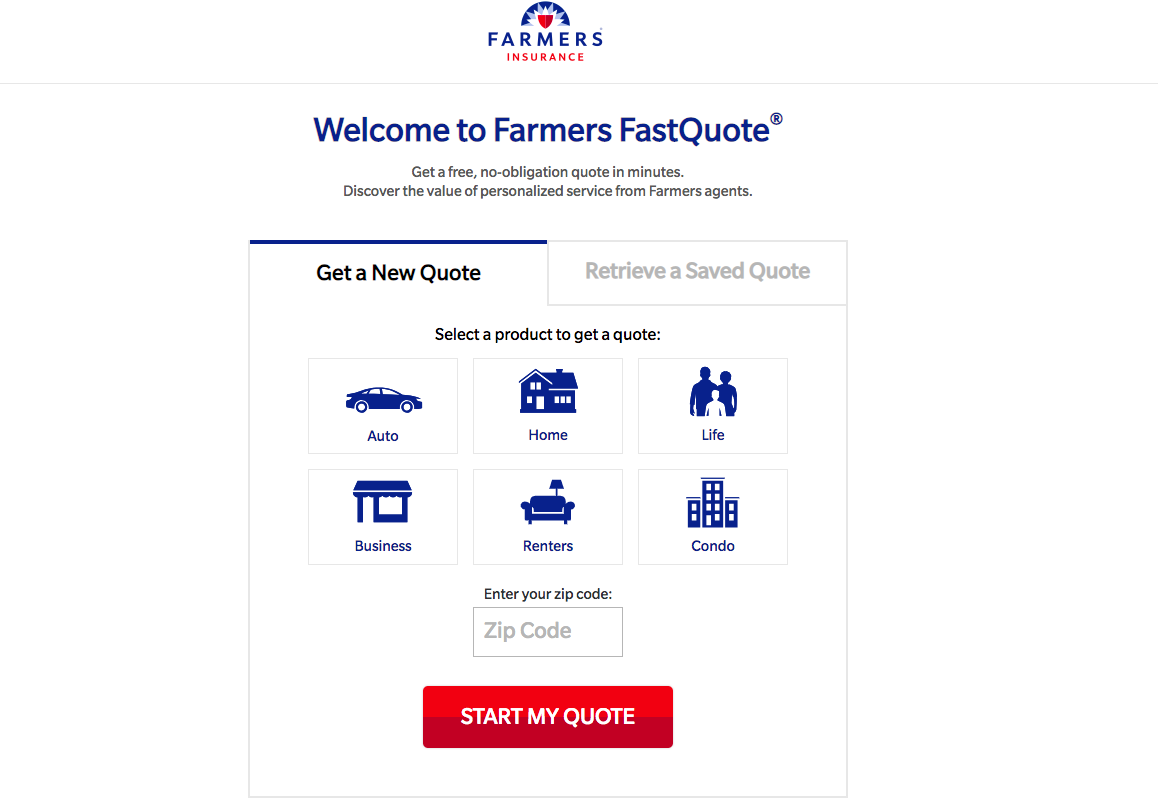

Next, you’ll need to visit the quote page on Farmers Insurance website, here.

This page will prompt you to select the insurance product you desire and enter your zip code to start your quote. Select “auto” and enter your zip code in the box below. Then, hit “start my quote.”

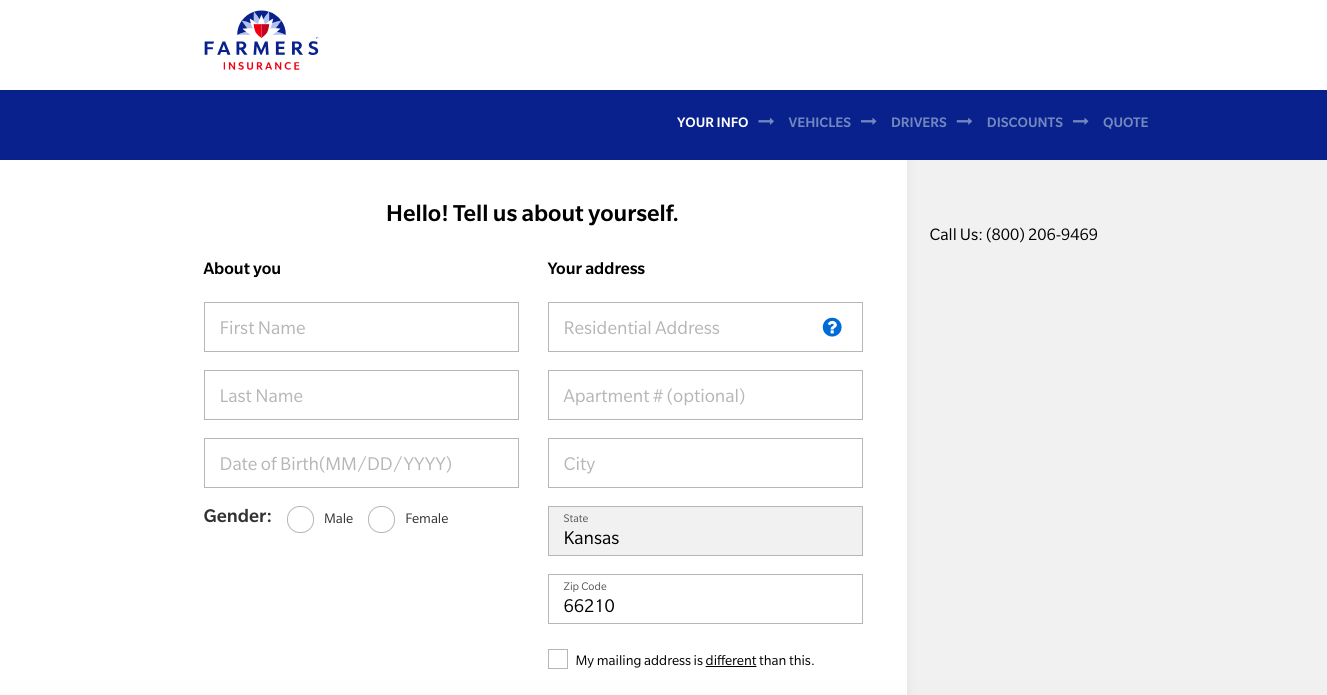

The next page will look like the one you see below.

Enter your personal information as requested to continue. Farmers has a five-step quote process with forms on each page to fill in. Here’s what the next page looks like.

Simply fill in each form, hit continue, and follow the prompts all the way until the end of step five to obtain your free quote!

Once you’ve received your personal insurance quote from Farmers, you might decide you’re ready to move forward with your application. You can purchase your policy online or go through an agent, the choice is yours.

To apply, you will need the following documents.

| Paperwork | Info |

|---|---|

| Driver's License | Mandatory |

| Social Security Number | Mandatory |

| Vehicle Identification (VIN) Number | Mandatory |

| Bank Documentation | May be required along with credit check |

| Declarations Page | May be required to confirm current coverage and policy selections |

What do you get with Farmers mobile app?

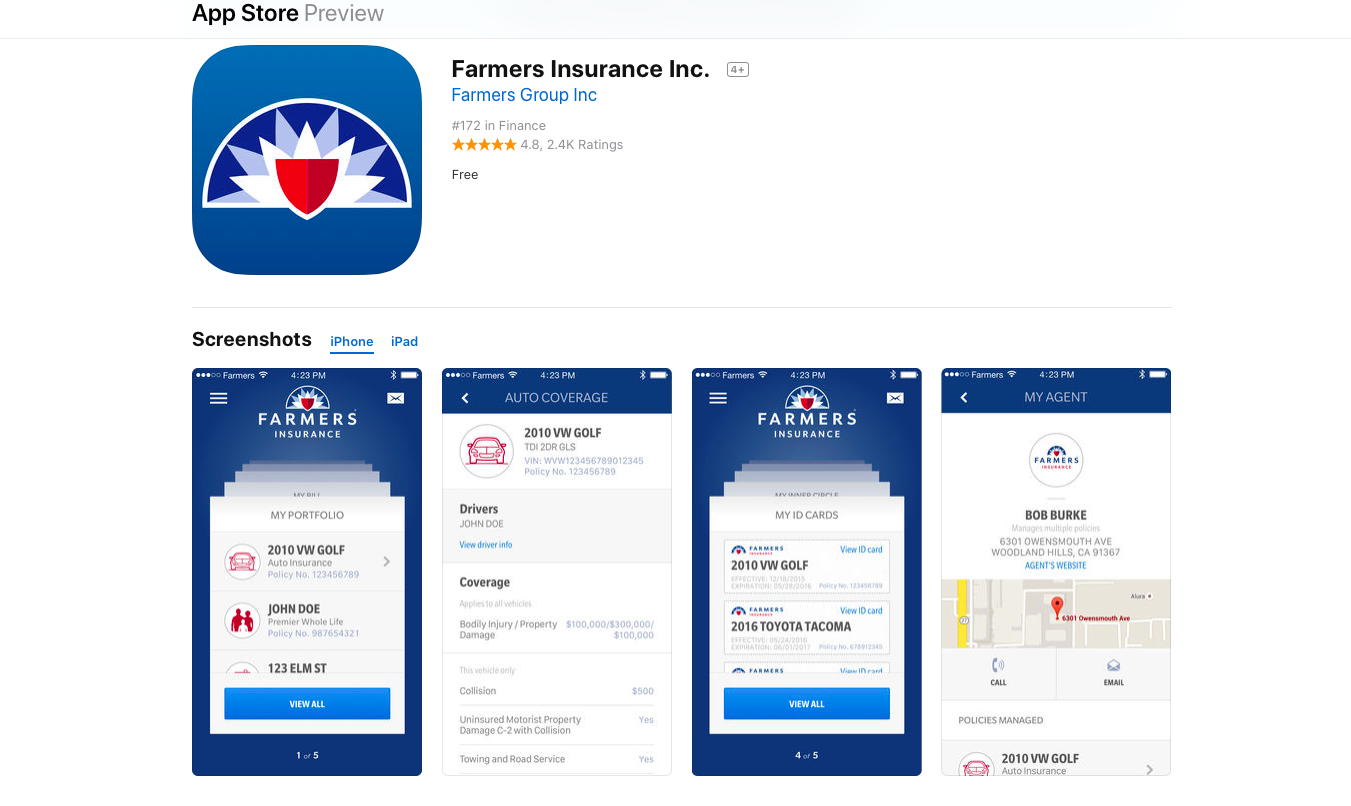

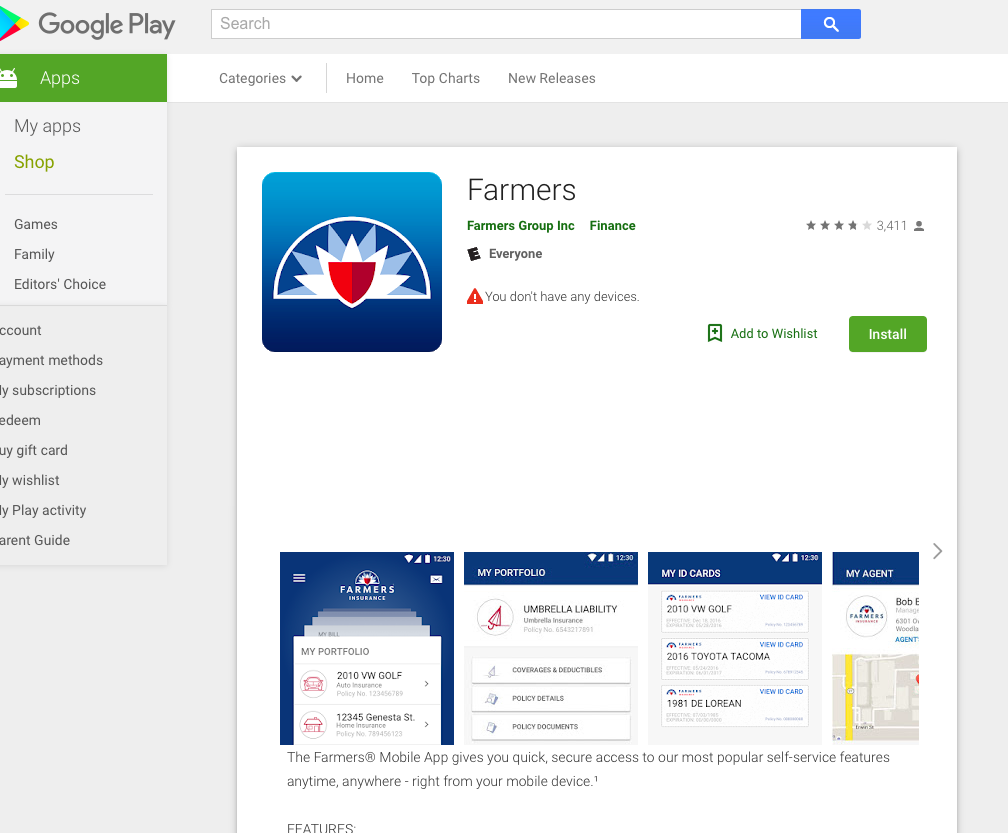

If you want to access your policy and key information while on the go, you’re in luck because Farmers has a mobile app available on both the App Store and Google Play.

The Farmers App has an impressive 4.8 rating on the Apple Store out of over 2,400 ratings, with the Google Play version garnering a 3.8 rating from over 3,400 users.

Here’s what you can do on the Farmers mobile app:

- View your policy or policies

- Access proof of insurance ID cards

- Get in touch with your agent

- Pay your insurance bill

- Sign up to receive all notices electronically

- Report a claim

- Get billing alerts via push notification

Consumers love the ease and efficiency of the app. Some reviewers have commented on minor bugs like being prompted to enter their location when it’s already switched on or having to reinstall the app after updates. That said, those bugs seem to lie mostly with the Google Play Version of the app, and users are still very pleased overall.

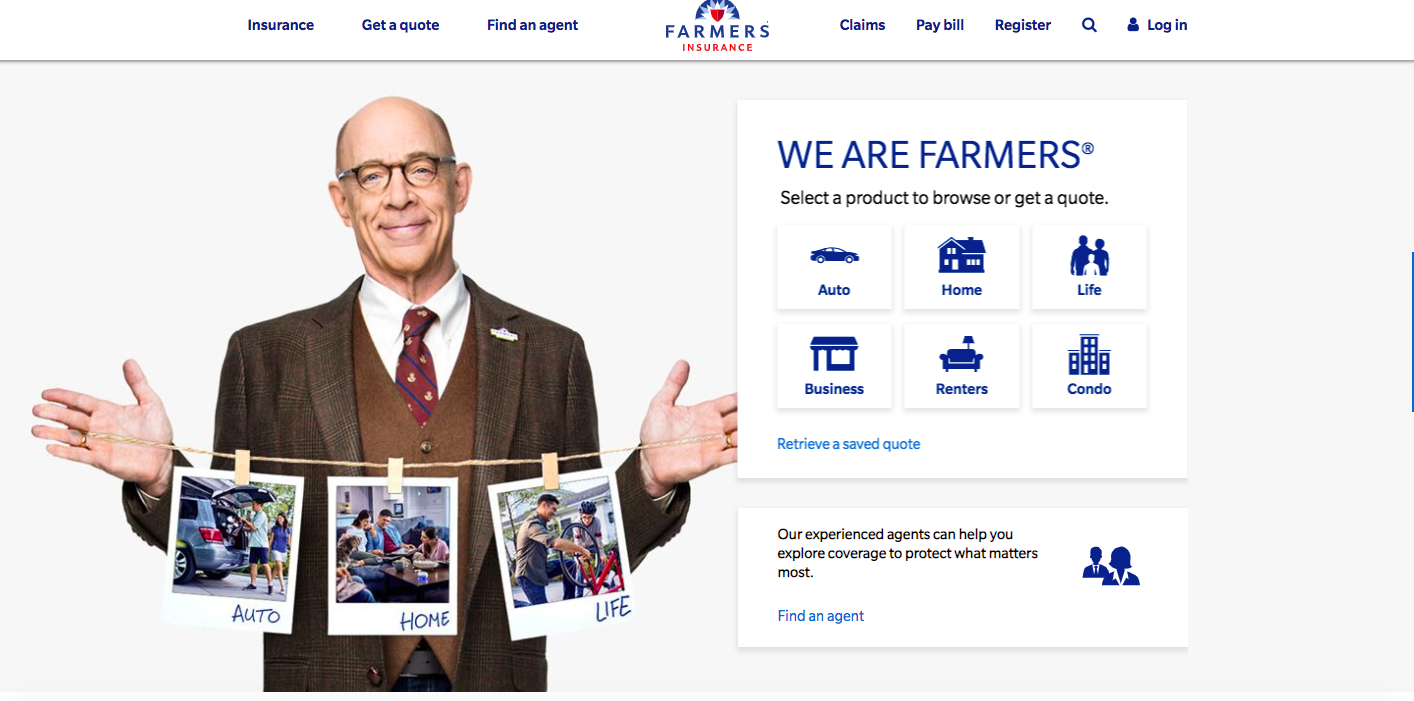

The Farmers website itself is super easy to use and navigate. This is what the main page looks like below.

The menus at the top of the page let you do everything from making a claim to paying your bill to finding an agent. You can use the search bar to look up any questions you might have. Click on the icons in the middle to start your free quote.

If you scroll to the bottom of the Farmers home page, you can select from a range of options to be directed to the contact page, social media pages, or whatever else you might be looking for.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What are the pros and cons?

Let’s do a quick recap of the pros and cons so you can make the best decision for your driving needs.

| Pros | Cons |

|---|---|

| Available in all 50 U.S. States | Loss ratio has risen in recent years |

| Excellent consumer ratings | Moody's and S&P's ratings projected negative outlooks |

| Wide range of coverage options | Lacking some key discount options |

Bear in mind, your rates can and will change based on the area you live in, so check out the average annual premiums in your area before making a final decision.

FAQ

Here are some frequently asked questions we bet you’re just itching to know the answers to! Check out Farmers’ Frequently Asked Questions page for additional information.

1. Who do I call to report a loss?

If you get into an accident or experience any type of loss, you must alert your Farmers insurance agent. You should also make a claim right away, by calling Farmers Claims Services at 1-800-435-7764, reporting it online through the Farmers website, or via the mobile app.

2. What discounts can I receive?

The exact discounts you’ll be able to receive depend on your eligibility, but generally, apply to individuals in certain occupations (like doctors and dentists), teens with safe driving histories, homeowners, drivers with vehicles featuring traditional safety elements, and drivers with multiple vehicles. However, there are lots of other discounts you could be eligible for. Check out the Farmers Insurance Discounts page to view discounts in your state.

3. What if I’m considered an at-risk driver?

Farmers insures drivers with a range of backgrounds and driving records, with highly affordable, competitive coverage rates when compared to other carriers. Farmers Risk Assessment Indicator tool is one factor they leverage to assess your rates if you’re a high-risk driver. Don’t worry though, just because you have a citation on your record doesn’t automatically mean you won’t be able to obtain coverage.

https://www.youtube.com/watch?v=7_25Um0UVfE

While we would say the most significant downside to Farmers is the company’s less than ideal ratings and outlook awarded by S&P and Moody’s, in terms of consumer satisfaction, affordable rates, and coverage options, this insurer is hard to beat. What’s more, Farmers’ quotes, claims, website, and mobile app are user-friendly and highly navigable, which is a huge plus for insureds.

Ready to start saving on insurance providers today? Just enter your zip code in the FREE rate calculator below to get started.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.