Florida Car Insurance [Rates + Cheap Coverage Guide]

Florida car insurance costs $156 per month on average (see our complete list of Florida car insurance rates by ZIP code below), but your rates can vary based on your age and driving record. Car insurance in Florida is already over 30 percent more expensive than the national average, so keep your rates as low as possible by comparison shopping online. Enter your ZIP code below to start comparing Florida car insurance quotes now for free.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Mar 21, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 21, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Florida Statistics Summary | Details |

|---|---|

| Road Miles | Total Miles in State: 122,391 Vehicle Miles Driven: 201.04 Billion |

| Driving Deaths | Speeding: 299 Drunk-Driving: 839 |

| Vehicles | Registered: 14,946,691 Stolen: 42,579 |

| Most Popular Vehicle | Toyota Corolla |

| Average Premiums | Liability: $857.64 Collision: $282.96 Comprehensive: $116.53 Combined Premiums: $1,257.13 |

| Percent of Motorists Uninsured | 26.70% State Rank: 1 (Most Uninsured) |

Known as the Sunshine State, Florida is the best place to go if you’re looking to get some good R&R. What you might not expect to have to worry about while soaking up some rays, is your car insurance. Who wants to worry over their car insurance needs when you could be enjoying yourself on one of Florida’s many beaches or parks?

In this guide, we will cover everything you’ll need to know to arm you with the knowledge you’ll need to select the optimal car insurance coverage for yourself.

Want to get started with comparing your rates? Use our FREE online tool above to start comparing today.

How much are Florida car insurance rates?

The first thing most people want to know when they’re looking for car insurance? How much is it gonna cost, and what am I getting out of it? Both extremely valuable questions that we want to help you answer.

Here, we will discuss all the different factors of insurance coverage such as the minimum coverage, proof of insurance, core coverage, and even the different rates you can expect to find.

The chart below displays the average Floridian is paying for their car insurance compared to the national average.

On average, Florida is paying MORE than the national average. Keep reading below to find out why. (For more information, read our “How much car insurance do I need in Florida?“).

Florida Minimum Coverage

In order to legally drive in the state of Florida, or any state in the United States for that matter, there are minimum insurance requirements. What does this mean? The minimum coverage for car insurance is the lowest amount you can legally have in order to drive. No matter what.

Florida is what’s known as a no-fault state. This means that if you’re ever in a car accident, your insurance provider is the one (as well as anyone who is under your policy) who pays for your medical expenses and financial losses, no matter who was the one who caused the accident.

What does this mean for you? According to the Insurance Information Institute (III), the minimum coverage that is required for Florida motorist is 10,000/20,000/10,000.

- $10,000 for the payment of bodily injuries

- $20,000 for the payment of bodily injuries to MULTIPLE people

- $10,000 for the payment of property damage

Remember, this is just the minimum coverage you need to drive legally. In addition to the liability coverage above, you may also wish to purchase collision coverage and comprehensive coverage to round out your auto insurance policy.

Forms of Financial Responsibility

As it is a requirement to have car insurance for your vehicle, you will need to be able to have some sort of proof of this, known as a form of financial responsibility (also commonly known as proof of insurance).

There are several instances in which you might be required to provide this, such as an accident or if you are pulled over by a law enforcement officer.

So what exactly do you need to have that is valid for this? Any of the below forms of financial responsibility are acceptable:

- Insurance ID Card

- Copy of Insurance ID Card

- Copy of Insurance Policy

In addition to the above, according to Allstate, electronic proof of insurance is a valid form of financial responsibility in Florida. Meaning that if you have the app for your insurance provider that has your insurance ID, this is considered an acceptable form of financial responsibility.

Premiums as a Percentage of Income

Have you ever heard of the term ‘per capita disposable income’? It means the average amount of money that you make after taxes are taken out.

So let’s say that you make $50,000 per year, and after taxes, you are left with $45,000. That $45,000 is considered your per capita disposable income. Check out the chart below to see the average annual per capita disposable income in Florida from 2012 to 2014.

| Year | Full Coverage Cost | Disposable Income | Insurance as % of Income |

|---|---|---|---|

| 2012 | $1,196.57 | $37,195.00 | 3.22% |

| 2013 | $1,209.70 | $36,606.00 | 3.30% |

| 2014 | $1,208.77 | $38,350.00 | 3.15% |

So you can see that in 2014, the annual per capita disposable income for the average Floridian was $38,350. Of this, the average insurance premiums for this same year was $1,208.77. On average, this means that Florida car insurance takes up about 3.15 percent of your overall disposable income.

Average Monthly Car Insurance Rates in FL (Liability, Collision, Comprehensive)

We’ve gone through and collected all of the average costs for each type of core coverage type from 2015, according to the National Association of Insurance Commissioners.

| Coverage Type | Average Annual Costs (2015) |

|---|---|

| Liability | $857.64 |

| Collision | $282.96 |

| Comprehensive | $116.53 |

| Combined | $1,257.13 |

Additional Liability

As we mentioned previously, Florida is a no-fault state, meaning that Med Pay, Uninsured/Underinsured Motorist Coverage are all optional. However, considering that in 2015, 26.7 percent of all motorists in Florida didn’t have car insurance, this puts you at risk should you ever find yourself in a car accident.

Florida is ranked as number one in the United States for uninsured drivers!

Because of this, it is definitely advisable to get these coverage types on your policy, you may just thank yourself in the future for it!

| Loss Ratio | 2012 | 2013 | 2014 |

|---|---|---|---|

| Personal Injury Protection (PIP) | 75% | 62% | 76% |

| Medical Payments (MedPay) | 74% | 72.5% | 81% |

| Uninsured/Underinsured Motorist Coverage (UUM) | 73% | 80% | 86% |

In the table above, we’ve listed the loss ratios for the liability insurance categories listed above. What in the world is a loss ratio, and why should you worry about it?

A loss ratio works as a gauge that will tell you the financial health of an insurance company. Loss ratios are the costs paid out for claims as compared to the costs of premiums taken in from customers.

So, for instance, if a provider has to pay out $75 for a claim, but takes in $100 for a premium, their loss ratio would be 75:100 or 75 percent. The other 25 percent difference goes to paying overhead.

So, looking at the table above, you can see that all of the loss ratios are within a 60 to 80 percent region. This is relatively good, as you want a company to have a loss ratio that is high, but not too high.

Why? If a company has a loss ratio that is too high, over 100 percent, it means that they are collecting more premium than is needed to pay out the claims it receives. This puts the company at risk of going bankrupt.

Conversely, you don’t want a company that isn’t paying enough for their claims either. It’s all about balance. You want to be right in the middle!

Add-Ons, Endorsements, and Riders

One of the first goals that most car insurance buyers are looking for is to get affordable coverage with complete coverage.

There are several, and very valuable, coverage options that are available to Florida motorists. Click on any of the additional coverage options to learn more:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assitance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Low-Mileage Discount

Definitely consider adding one (or more) of these coverage options to your policy.

Average Car Insurance Rates by Age & Gender in FL

Did you know that your gender and age can play a factor in what your insurance will be? That’s right, whether you are a male or female can determine exactly what you’re going to pay for your car insurance.

| Company | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate | Single 17-year old female annual rate | Single 17-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $4,653.38 | $4,423.29 | $4,040.00 | $4,089.70 | $15,905.72 | $17,179.33 | $4,592.92 | $4,639.32 |

| Geico General | $2,986.89 | $3,001.17 | $2,793.99 | $2,793.99 | $5,342.74 | $6,713.47 | $3,292.51 | $3,344.27 |

| Liberty Mutual Ins Co | $3,711.14 | $3,711.14 | $3,398.94 | $3,398.94 | $7,859.88 | $12,116.72 | $3,711.14 | $5,037.27 |

| Allied P&C | $3,039.80 | $3,000.81 | $2,710.48 | $2,806.30 | $7,314.60 | $9,013.69 | $3,347.30 | $3,483.83 |

| Progressive Select | $3,736.10 | $3,523.35 | $3,200.74 | $3,428.17 | $10,512.83 | $11,453.56 | $4,508.82 | $4,302.83 |

| State Farm Mutual Auto | $2,158.99 | $2,158.99 | $1,954.51 | $1,954.51 | $6,166.09 | $7,832.79 | $2,399.41 | $2,556.07 |

| USAA | $1,646.31 | $1,619.33 | $1,536.18 | $1,525.12 | $5,638.10 | $6,551.72 | $2,060.09 | $2,226.40 |

You can see in the table above that older married women, are typically paying slightly more for their car insurance. Meanwhile, male teenagers and 25-year-old men are paying more than their female counterparts. Proving that the misconception that men tend to pay more for their car insurance isn’t always true.

Keep in mind, most auto insurers offer insurance discounts. If you have a poor credit rating or you don’t have a clean driving record, an auto insurance discount can help lower your rates. Many companies offer discount opportunities for taking a defensive driving course, or for bundling multiple policies together (like your homeowners insurance policy and your auto policy). Teenage drivers can lower their rates by asking about a good student discount.

You might also look into a usage-based insurance program. With these programs, a mobile app monitors your driving habits and rewards you with a discount for driving safely.

Rates by Zip Code and City

Want to know exactly what the average rate for city and zip code is? Check out the table below to find out!

| City | Zip Code | Annual Average |

|---|---|---|

| MIAMI | 32003 | $4,195.73 |

| MIAMI | 32007 | $4,077.98 |

| MIAMI | 32008 | $3,713.48 |

| MIAMI | 32009 | $4,061.05 |

| MIAMI | 32011 | $4,120.94 |

| MIAMI | 32024 | $3,826.13 |

| MIAMI | 32025 | $3,868.18 |

| HIALEAH | 32030 | $4,207.37 |

| MIAMI | 32033 | $3,836.69 |

| MIAMI | 32034 | $4,108.56 |

| HIALEAH | 32038 | $3,803.26 |

| MIAMI | 32040 | $4,089.95 |

| HIALEAH | 32042 | $4,523.13 |

| MIAMI | 32043 | $4,126.30 |

| MIAMI | 32044 | $3,965.69 |

| MIAMI | 32046 | $4,062.90 |

| MIAMI | 32052 | $3,775.04 |

| MIAMI | 32053 | $3,726.17 |

| MIAMI | 32054 | $3,910.22 |

| MIAMI | 32055 | $3,840.06 |

| OPA LOCKA | 32058 | $3,995.84 |

| MIAMI | 32059 | $3,727.51 |

| HIALEAH | 32060 | $3,723.18 |

| MIAMI | 32061 | $3,871.34 |

| MIAMI | 32062 | $3,717.73 |

| MIAMI | 32063 | $4,126.59 |

| MIAMI | 32064 | $3,723.18 |

| HIALEAH | 32065 | $4,195.73 |

| HOMESTEAD | 32066 | $3,747.46 |

| MIAMI | 32068 | $4,195.73 |

| MIAMI | 32071 | $3,713.48 |

| MIAMI | 32072 | $4,527.98 |

| TAMPA | 32073 | $4,248.62 |

| MIAMI | 32080 | $3,855.03 |

| MIAMI | 32081 | $3,873.37 |

| TAMPA | 32082 | $3,916.43 |

| MIAMI | 32083 | $3,993.09 |

| HOMESTEAD | 32084 | $3,858.80 |

| MIAMI | 32086 | $3,840.45 |

| MIAMI | 32087 | $4,059.80 |

| TAMPA | 32091 | $3,995.84 |

| MIAMI | 32092 | $3,858.80 |

| MIAMI | 32094 | $3,750.24 |

| OPA LOCKA | 32095 | $3,858.80 |

| OPA LOCKA | 32096 | $3,769.59 |

| HIALEAH | 32097 | $4,113.81 |

| HOMESTEAD | 32099 | $4,494.42 |

| HOMESTEAD | 32102 | $3,837.18 |

| HOMESTEAD | 32105 | $4,013.60 |

| MIAMI | 32110 | $3,919.81 |

| MIAMI | 32111 | $3,828.05 |

| HOMESTEAD | 32112 | $3,978.67 |

| TAMPA | 32113 | $3,752.97 |

| TAMPA | 32114 | $4,031.15 |

| HIALEAH | 32117 | $4,031.15 |

| MIAMI | 32118 | $4,037.60 |

| TAMPA | 32119 | $3,943.69 |

| MIAMI | 32124 | $3,970.69 |

| TAMPA | 32127 | $3,962.36 |

| HOMESTEAD | 32128 | $3,955.91 |

| MIAMI | 32129 | $3,955.91 |

| MIAMI | 32130 | $4,073.57 |

| MIAMI | 32131 | $3,996.97 |

| MIAMI | 32132 | $3,942.87 |

| MIAMI | 32133 | $3,752.97 |

| TAMPA | 32134 | $3,808.63 |

| TAMPA | 32136 | $3,919.81 |

| MIAMI | 32137 | $3,919.81 |

| MIAMI | 32138 | $3,978.67 |

| KEY BISCAYNE | 32139 | $3,978.67 |

| MIAMI | 32140 | $3,929.81 |

| TAMPA | 32141 | $3,997.24 |

| MIAMI | 32143 | $3,958.88 |

| MIAMI | 32145 | $3,865.58 |

| MIAMI | 32147 | $3,978.67 |

| MIAMI BEACH | 32148 | $3,978.67 |

| MIAMI | 32157 | $3,978.67 |

| NORTH MIAMI BEACH | 32159 | $3,710.73 |

| MIAMI | 32160 | $3,959.78 |

| MIAMI | 32162 | $3,698.88 |

| TAMPA | 32163 | $3,858.02 |

| TAMPA | 32164 | $3,919.81 |

| HALLANDALE | 32168 | $3,962.36 |

| MIAMI | 32169 | $3,942.87 |

| MIAMI | 32174 | $3,970.69 |

| MIAMI | 32176 | $4,031.15 |

| MIAMI | 32177 | $4,077.98 |

| LAKE WORTH | 32179 | $3,752.97 |

| DANIA | 32180 | $3,977.67 |

| HOLLYWOOD | 32181 | $3,978.67 |

| MIAMI | 32182 | $3,752.97 |

| MIAMI BEACH | 32185 | $3,978.67 |

| MIAMI | 32187 | $3,996.97 |

| HOLLYWOOD | 32189 | $3,978.67 |

| FORT LAUDERDALE | 32190 | $3,959.37 |

| MIAMI BEACH | 32192 | $3,752.97 |

| LAKE WORTH | 32193 | $3,978.67 |

| LAKE WORTH | 32195 | $3,817.86 |

| LAKE WORTH | 32202 | $4,540.13 |

| WEST PALM BEACH | 32204 | $4,551.79 |

| WEST PALM BEACH | 32205 | $4,688.66 |

| FORT LAUDERDALE | 32206 | $4,548.58 |

| WEST PALM BEACH | 32207 | $4,659.87 |

| WEST PALM BEACH | 32208 | $4,637.20 |

| TAMPA | 32209 | $4,548.58 |

| TAMPA | 32210 | $4,655.01 |

| HOLLYWOOD | 32211 | $4,646.26 |

| TAMPA | 32212 | $4,489.16 |

| MIAMI BEACH | 32216 | $4,404.35 |

| PALM BEACH | 32217 | $4,428.97 |

| FORT LAUDERDALE | 32218 | $4,539.33 |

| FORT LAUDERDALE | 32219 | $4,539.33 |

| FORT LAUDERDALE | 32220 | $4,494.42 |

| DELRAY BEACH | 32221 | $4,494.42 |

| FORT LAUDERDALE | 32222 | $4,493.80 |

| TAMPA | 32223 | $4,297.99 |

| TAMPA | 32224 | $4,297.99 |

| BOYNTON BEACH | 32225 | $4,333.47 |

| BOYNTON BEACH | 32226 | $4,424.47 |

| LAKE WORTH | 32227 | $4,297.99 |

| POMPANO BEACH | 32233 | $4,297.99 |

| DELRAY BEACH | 32234 | $4,336.33 |

| POMPANO BEACH | 32244 | $4,547.56 |

| WEST PALM BEACH | 32246 | $4,333.47 |

| WEST PALM BEACH | 32250 | $4,297.99 |

| WEST PALM BEACH | 32254 | $4,547.34 |

| WEST PALM BEACH | 32256 | $4,297.99 |

| TAMPA | 32257 | $4,428.97 |

| DELRAY BEACH | 32258 | $4,297.99 |

| DELRAY BEACH | 32259 | $3,857.32 |

| BOYNTON BEACH | 32266 | $4,295.77 |

| BOYNTON BEACH | 32277 | $4,509.06 |

| LAKE WORTH | 32301 | $3,930.22 |

| POMPANO BEACH | 32303 | $3,930.22 |

| DELRAY BEACH | 32304 | $3,930.22 |

| HOLLYWOOD | 32305 | $3,978.28 |

| BOYNTON BEACH | 32306 | $3,930.22 |

| BOYNTON BEACH | 32307 | $3,930.22 |

| FORT LAUDERDALE | 32308 | $3,930.22 |

| WEST PALM BEACH | 32309 | $3,930.22 |

| WEST PALM BEACH | 32310 | $3,930.22 |

| FORT LAUDERDALE | 32311 | $3,930.22 |

| FORT LAUDERDALE | 32312 | $3,930.22 |

| POMPANO BEACH | 32313 | $3,930.22 |

| DEERFIELD BEACH | 32317 | $3,930.22 |

| POMPANO BEACH | 32320 | $3,855.07 |

| POMPANO BEACH | 32321 | $3,841.94 |

| BOCA RATON | 32322 | $3,857.79 |

| BOCA RATON | 32323 | $3,857.79 |

| WEST PALM BEACH | 32324 | $3,787.33 |

| WELLINGTON | 32327 | $3,799.48 |

| POMPANO BEACH | 32328 | $3,857.79 |

| POMPANO BEACH | 32330 | $3,773.68 |

| TAMPA | 32331 | $3,646.33 |

| TAMPA | 32332 | $3,787.33 |

| TAMPA | 32333 | $3,773.68 |

| HOLLYWOOD | 32334 | $3,841.94 |

| MIAMI BEACH | 32335 | $4,384.55 |

| POMPANO BEACH | 32336 | $3,845.52 |

| TAMPA | 32337 | $3,868.15 |

| BOCA RATON | 32340 | $3,727.51 |

| BOCA RATON | 32343 | $3,773.68 |

| BOCA RATON | 32344 | $3,845.52 |

| BOCA RATON | 32346 | $3,799.48 |

| BOCA RATON | 32347 | $3,702.07 |

| DEERFIELD BEACH | 32348 | $3,702.07 |

| FORT LAUDERDALE | 32350 | $3,727.51 |

| BRANDON | 32351 | $3,773.68 |

| POMPANO BEACH | 32352 | $3,787.33 |

| POMPANO BEACH | 32355 | $3,799.48 |

| BOCA RATON | 32356 | $3,716.93 |

| POMPANO BEACH | 32357 | $3,702.07 |

| FORT LAUDERDALE | 32358 | $3,799.48 |

| BOCA RATON | 32359 | $3,700.56 |

| TAMPA | 32360 | $4,384.55 |

| FORT LAUDERDALE | 32401 | $3,773.01 |

| HOLLYWOOD | 32403 | $3,779.37 |

| FORT LAUDERDALE | 32404 | $3,773.01 |

| FORT LAUDERDALE | 32405 | $3,773.01 |

| FORT LAUDERDALE | 32407 | $3,773.01 |

| FORT LAUDERDALE | 32408 | $3,773.01 |

| FORT LAUDERDALE | 32409 | $3,773.01 |

| FORT LAUDERDALE | 32410 | $3,773.01 |

| FORT LAUDERDALE | 32413 | $3,773.01 |

| FORT LAUDERDALE | 32420 | $3,732.83 |

| FORT LAUDERDALE | 32421 | $3,882.41 |

| FORT LAUDERDALE | 32422 | $3,684.30 |

| TAMPA | 32423 | $3,740.42 |

| FORT LAUDERDALE | 32424 | $3,889.99 |

| FORT LAUDERDALE | 32425 | $3,761.04 |

| HOLLYWOOD | 32426 | $3,740.42 |

| TAMPA | 32427 | $3,719.90 |

| FORT LAUDERDALE | 32428 | $3,726.32 |

| FORT LAUDERDALE | 32430 | $3,874.81 |

| HOLLYWOOD | 32431 | $3,740.42 |

| FORT LAUDERDALE | 32433 | $3,684.30 |

| RIVERVIEW | 32434 | $3,684.30 |

| HOLLYWOOD | 32435 | $3,684.30 |

| FORT LAUDERDALE | 32437 | $3,707.52 |

| FORT LAUDERDALE | 32438 | $3,784.04 |

| TAMPA | 32439 | $3,678.84 |

| HOLLYWOOD | 32440 | $3,767.46 |

| DURANT | 32442 | $3,740.42 |

| SYDNEY | 32443 | $3,740.42 |

| SUN CITY | 32444 | $3,773.01 |

| WEST PALM BEACH | 32445 | $3,740.42 |

| BRANDON | 32446 | $3,740.42 |

| LUTZ | 32448 | $3,740.42 |

| GIBSONTON | 32449 | $3,882.40 |

| ODESSA | 32452 | $3,761.04 |

| TAMPA | 32455 | $3,752.24 |

| SEFFNER | 32456 | $3,821.54 |

| LUTZ | 32459 | $3,675.48 |

| RIVERVIEW | 32460 | $3,740.42 |

| THONOTOSASSA | 32461 | $3,743.34 |

| LUTZ | 32462 | $3,711.10 |

| RIVERVIEW | 32463 | $3,726.32 |

| LOXAHATCHEE | 32464 | $3,752.24 |

| LUTZ | 32465 | $3,821.54 |

| NEW PORT RICHEY | 32466 | $3,784.04 |

| NEW PORT RICHEY | 32501 | $4,114.16 |

| PORT RICHEY | 32502 | $4,131.70 |

| HOLIDAY | 32503 | $4,131.70 |

| PALM HARBOR | 32504 | $4,131.70 |

| VALRICO | 32505 | $4,131.70 |

| SAINT PETERSBURG | 32506 | $4,131.70 |

| SAINT PETERSBURG | 32507 | $4,131.70 |

| SAINT PETERSBURG | 32508 | $4,131.70 |

| SAINT PETERSBURG | 32514 | $4,184.02 |

| SAINT PETERSBURG | 32526 | $4,131.70 |

| HOLIDAY | 32531 | $3,763.29 |

| NEW PORT RICHEY | 32533 | $4,202.55 |

| ARIPEKA | 32534 | $4,166.48 |

| PALM HARBOR | 32535 | $3,965.35 |

| CANAL POINT | 32536 | $3,725.92 |

| LITHIA | 32537 | $3,725.92 |

| PINELLAS PARK | 32538 | $3,726.26 |

| BELLE GLADE | 32539 | $3,725.92 |

| SOUTH BAY | 32541 | $3,653.93 |

| VALRICO | 32542 | $3,652.75 |

| SAINT PETERSBURG | 32544 | $3,652.75 |

| CLEARWATER | 32547 | $3,652.75 |

| DUNEDIN | 32548 | $3,652.75 |

| PAHOKEE | 32550 | $3,597.34 |

| SAINT PETERSBURG | 32561 | $3,842.12 |

| SAINT PETERSBURG | 32563 | $3,842.12 |

| SAINT PETERSBURG | 32564 | $3,763.29 |

| NEW PORT RICHEY | 32565 | $3,793.82 |

| SAINT PETERSBURG | 32566 | $3,842.12 |

| SAINT PETERSBURG | 32567 | $3,725.92 |

| SAINT PETERSBURG | 32568 | $3,965.35 |

| CLEARWATER | 32569 | $3,652.75 |

| CLEARWATER | 32570 | $3,965.75 |

| SAINT PETERSBURG | 32571 | $3,961.67 |

| SAINT PETERSBURG | 32577 | $4,137.28 |

| TARPON SPRINGS | 32578 | $3,652.75 |

| OZONA | 32579 | $3,652.75 |

| OLDSMAR | 32580 | $3,652.75 |

| CRYSTAL BEACH | 32583 | $3,971.78 |

| PINELLAS PARK | 32601 | $3,489.42 |

| DOVER | 32603 | $3,494.66 |

| CLEARWATER | 32605 | $3,494.66 |

| CLEARWATER | 32606 | $3,494.66 |

| CLEARWATER | 32607 | $3,494.66 |

| LARGO | 32608 | $3,494.66 |

| CLEARWATER | 32609 | $3,489.42 |

| SAFETY HARBOR | 32610 | $3,504.58 |

| HUDSON | 32611 | $3,494.66 |

| HUDSON | 32612 | $3,492.52 |

| CLEARWATER | 32615 | $3,490.52 |

| LAND O LAKES | 32617 | $3,752.97 |

| LARGO | 32618 | $3,486.59 |

| LARGO | 32619 | $3,665.61 |

| SEMINOLE | 32621 | $3,673.62 |

| WESLEY CHAPEL | 32622 | $3,932.71 |

| CLEARWATER | 32625 | $3,677.88 |

| PALM BEACH GARDENS | 32626 | $3,677.88 |

| LAND O LAKES | 32628 | $3,679.57 |

| NORTH PALM BEACH | 32631 | $3,523.03 |

| PALM HARBOR | 32633 | $3,646.11 |

| LARGO | 32634 | $3,758.20 |

| CLEARWATER BEACH | 32639 | $3,664.09 |

| LARGO | 32640 | $3,646.11 |

| LAKE HARBOR | 32641 | $3,489.42 |

| SAINT PETERSBURG | 32643 | $3,486.23 |

| ZEPHYRHILLS | 32648 | $3,663.20 |

| TARPON SPRINGS | 32653 | $3,494.66 |

| SAINT PETERSBURG | 32654 | $3,646.11 |

| SAINT PETERSBURG | 32656 | $3,889.41 |

| SEMINOLE | 32658 | $3,490.52 |

| SEMINOLE | 32662 | $3,646.11 |

| INDIAN ROCKS BEACH | 32663 | $3,758.20 |

| BELLEAIR BEACH | 32664 | $3,610.75 |

| ORLANDO | 32666 | $3,873.81 |

| DADE CITY | 32667 | $3,486.59 |

| DADE CITY | 32668 | $3,673.62 |

| ZEPHYRHILLS | 32669 | $3,486.59 |

| SAN ANTONIO | 32680 | $3,679.57 |

| ORLANDO | 32681 | $3,610.75 |

| PLANT CITY | 32683 | $3,664.09 |

| PLANT CITY | 32686 | $3,758.20 |

| PLANT CITY | 32692 | $3,679.57 |

| WIMAUMA | 32693 | $3,664.79 |

| PLANT CITY | 32694 | $3,481.35 |

| WESLEY CHAPEL | 32696 | $3,673.62 |

| PALM BEACH GARDENS | 32701 | $4,248.40 |

| RUSKIN | 32702 | $3,817.39 |

| APOLLO BEACH | 32703 | $4,514.27 |

| SUN CITY CENTER | 32706 | $4,157.26 |

| LAND O LAKES | 32707 | $4,282.27 |

| ZEPHYRHILLS | 32708 | $4,216.77 |

| WESLEY CHAPEL | 32709 | $4,552.27 |

| SAINT LEO | 32712 | $4,521.37 |

| TRILBY | 32713 | $4,127.05 |

| ORLANDO | 32714 | $4,282.27 |

| ORLANDO | 32720 | $3,971.43 |

| SPRING HILL | 32722 | $4,100.98 |

| ORLANDO | 32723 | $4,164.15 |

| ORLANDO | 32724 | $4,164.15 |

| JUPITER | 32725 | $4,235.82 |

| JUPITER | 32726 | $3,843.20 |

| JUPITER | 32730 | $4,362.23 |

| ORLANDO | 32732 | $4,179.60 |

| KISSIMMEE | 32735 | $3,837.18 |

| ORLANDO | 32736 | $3,875.81 |

| SPRING HILL | 32738 | $4,235.82 |

| ORLANDO | 32744 | $4,112.60 |

| SPRING HILL | 32745 | $4,172.50 |

| SPRING HILL | 32746 | $4,179.60 |

| BROOKSVILLE | 32747 | $4,161.67 |

| SPRING HILL | 32750 | $4,211.79 |

| ORLANDO | 32751 | $4,397.77 |

| ORLANDO | 32754 | $3,913.84 |

| JUPITER | 32757 | $4,479.24 |

| BROOKSVILLE | 32759 | $4,100.43 |

| BROOKSVILLE | 32763 | $4,157.70 |

| ISTACHATTA | 32764 | $4,099.16 |

| ORLANDO | 32765 | $4,173.00 |

| KISSIMMEE | 32766 | $4,179.60 |

| KISSIMMEE | 32767 | $3,869.80 |

| KISSIMMEE | 32768 | $4,497.35 |

| KISSIMMEE | 32771 | $4,161.67 |

| INTERCESSION CITY | 32773 | $4,168.37 |

| ORLANDO | 32775 | $3,990.52 |

| ORLANDO | 32776 | $3,875.81 |

| SAINT CLOUD | 32778 | $3,843.20 |

| BRADENTON | 32779 | $4,215.19 |

| BRADENTON | 32780 | $3,913.84 |

| BRADENTON | 32784 | $3,851.31 |

| ORLANDO | 32789 | $4,673.30 |

| ORLANDO | 32792 | $4,488.64 |

| ORLANDO | 32796 | $3,913.84 |

| ORLANDO | 32798 | $4,490.25 |

| ORLANDO | 32799 | $4,164.27 |

| ORLANDO | 32801 | $4,685.45 |

| BROOKSVILLE | 32803 | $4,672.43 |

| SAINT CLOUD | 32804 | $4,872.35 |

| ORLANDO | 32805 | $5,104.32 |

| BROOKSVILLE | 32806 | $4,777.97 |

| NOBLETON | 32807 | $4,803.23 |

| ORLANDO | 32808 | $5,185.50 |

| JACKSONVILLE | 32809 | $5,116.71 |

| ORLANDO | 32810 | $4,924.58 |

| ORLANDO | 32811 | $5,104.32 |

| SAINT CLOUD | 32812 | $4,801.95 |

| WINTER PARK | 32814 | $4,651.11 |

| KISSIMMEE | 32816 | $4,692.63 |

| ORLANDO | 32817 | $4,726.65 |

| ORLANDO | 32818 | $5,195.54 |

| ORLANDO | 32819 | $4,656.58 |

| ORLANDO | 32820 | $4,633.32 |

| JACKSONVILLE | 32821 | $4,690.51 |

| ORLANDO | 32822 | $4,902.83 |

| JACKSONVILLE | 32824 | $5,014.30 |

| ORLANDO | 32825 | $4,834.48 |

| JACKSONVILLE | 32826 | $4,726.65 |

| ANNA MARIA | 32827 | $4,731.81 |

| KENANSVILLE | 32828 | $4,687.51 |

| JACKSONVILLE | 32829 | $4,726.18 |

| ORLANDO | 32831 | $4,666.22 |

| ORLANDO | 32832 | $4,633.36 |

| PALMETTO | 32833 | $4,666.22 |

| TERRA CEIA | 32834 | $4,660.70 |

| ORLANDO | 32835 | $4,873.49 |

| PORT SAINT LUCIE | 32836 | $4,624.95 |

| PORT SAINT LUCIE | 32837 | $4,766.98 |

| KISSIMMEE | 32839 | $5,116.71 |

| PORT SAINT LUCIE | 32901 | $4,104.18 |

| PORT SAINT LUCIE | 32903 | $3,948.38 |

| WINDERMERE | 32904 | $3,999.26 |

| CHRISTMAS | 32905 | $4,134.60 |

| JACKSONVILLE | 32907 | $4,134.60 |

| JACKSONVILLE | 32908 | $4,132.48 |

| JACKSONVILLE | 32909 | $4,134.60 |

| FORT PIERCE | 32920 | $3,930.71 |

| KILLARNEY | 32922 | $3,990.44 |

| WINTER GARDEN | 32925 | $3,930.71 |

| JACKSONVILLE | 32926 | $3,989.52 |

| JACKSONVILLE | 32927 | $3,913.84 |

| JACKSONVILLE | 32931 | $3,930.71 |

| JACKSONVILLE | 32934 | $4,016.93 |

| JACKSONVILLE | 32935 | $4,045.39 |

| ISLAMORADA | 32937 | $3,930.71 |

| TAVERNIER | 32940 | $3,969.04 |

| SAINT CLOUD | 32948 | $4,177.17 |

| OLUSTEE | 32949 | $4,134.60 |

| LONG KEY | 32950 | $4,134.60 |

| KEY WEST | 32951 | $3,930.71 |

| SUMMERLAND KEY | 32952 | $3,930.71 |

| BIG PINE KEY | 32953 | $3,923.13 |

| MARATHON | 32955 | $3,989.57 |

| KEY COLONY BEACH | 32958 | $4,105.22 |

| MARATHON SHORES | 32960 | $4,105.22 |

| OCOEE | 32962 | $4,120.56 |

| GOTHA | 32963 | $4,295.63 |

| GRAHAM | 32966 | $4,100.07 |

| KEY LARGO | 32967 | $4,100.07 |

| APOPKA | 32968 | $4,115.41 |

| APOPKA | 32970 | $4,105.22 |

| JACKSONVILLE | 32976 | $4,063.73 |

| FORT PIERCE | 33001 | $4,526.69 |

| FORT PIERCE | 33004 | $6,331.99 |

| FORT PIERCE | 33009 | $6,446.92 |

| FORT PIERCE | 33010 | $7,448.04 |

| HOBE SOUND | 33012 | $7,304.68 |

| INDIANTOWN | 33013 | $7,275.81 |

| PALM CITY | 33014 | $7,025.36 |

| STUART | 33015 | $6,836.28 |

| STUART | 33016 | $7,146.88 |

| OKEECHOBEE | 33018 | $6,873.10 |

| BRADENTON | 33019 | $6,311.94 |

| CORTEZ | 33020 | $6,329.66 |

| PLYMOUTH | 33021 | $6,255.33 |

| JACKSONVILLE | 33023 | $6,080.97 |

| JACKSONVILLE | 33024 | $5,888.44 |

| JACKSONVILLE | 33025 | $5,987.49 |

| JACKSONVILLE | 33026 | $5,778.15 |

| ZELLWOOD | 33027 | $5,726.98 |

| DAVENPORT | 33028 | $5,639.35 |

| DAVENPORT | 33029 | $5,672.30 |

| JACKSONVILLE | 33030 | $6,870.04 |

| WINTER PARK | 33031 | $6,870.04 |

| JENSEN BEACH | 33032 | $7,024.81 |

| STUART | 33033 | $6,859.88 |

| MOUNT DORA | 33034 | $6,870.04 |

| LAKE ALFRED | 33035 | $6,811.45 |

| LAKE HAMILTON | 33036 | $4,529.72 |

| HAINES CITY | 33037 | $4,523.06 |

| WINTER HAVEN | 33039 | $6,913.51 |

| PORT SAINT LUCIE | 33040 | $4,526.69 |

| PORT SAINT LUCIE | 33042 | $4,526.69 |

| OKEECHOBEE | 33043 | $4,526.69 |

| JACKSONVILLE | 33050 | $4,526.69 |

| JACKSONVILLE | 33051 | $4,526.69 |

| BRADENTON | 33052 | $4,526.69 |

| JACKSONVILLE | 33054 | $7,162.08 |

| DUNDEE | 33055 | $6,880.57 |

| ELLENTON | 33056 | $6,874.79 |

| LAKELAND | 33060 | $6,085.96 |

| HOMELAND | 33062 | $5,964.28 |

| LAKESHORE | 33063 | $5,931.87 |

| INDIAN LAKE ESTATES | 33064 | $6,028.54 |

| NALCREST | 33065 | $6,022.32 |

| RIVER RANCH | 33066 | $5,931.87 |

| JACKSONVILLE | 33067 | $5,998.07 |

| MAITLAND | 33068 | $6,151.92 |

| EAGLE LAKE | 33069 | $6,132.34 |

| WINTER HAVEN | 33070 | $4,529.72 |

| SUMATRA | 33071 | $6,022.32 |

| TELOGIA | 33073 | $5,926.07 |

| PARRISH | 33076 | $5,998.07 |

| BABSON PARK | 33109 | $6,635.48 |

| BARTOW | 33122 | $7,163.83 |

| LAKE WALES | 33125 | $7,606.64 |

| LAKE WALES | 33126 | $7,297.22 |

| LAKE WALES | 33127 | $7,517.24 |

| POLK CITY | 33128 | $7,404.00 |

| DAVENPORT | 33129 | $6,921.54 |

| BRADENTON | 33130 | $7,592.83 |

| BRADLEY | 33131 | $6,764.17 |

| NICHOLS | 33132 | $6,830.71 |

| CASSELBERRY | 33133 | $6,950.58 |

| BRADENTON BEACH | 33134 | $6,990.92 |

| EATON PARK | 33135 | $7,606.64 |

| LAKELAND | 33136 | $7,592.83 |

| LAKELAND | 33137 | $6,820.17 |

| LAKELAND | 33138 | $6,726.34 |

| BRADENTON | 33139 | $5,967.90 |

| AUBURNDALE | 33140 | $6,304.97 |

| WINTER HAVEN | 33141 | $6,327.92 |

| MYAKKA CITY | 33142 | $7,631.16 |

| BRADENTON | 33143 | $6,328.58 |

| BRADENTON | 33144 | $7,197.53 |

| LAKELAND | 33145 | $7,199.47 |

| LAKELAND | 33146 | $6,418.37 |

| LAKELAND | 33147 | $7,626.18 |

| LAKELAND | 33149 | $6,683.63 |

| BRADENTON | 33150 | $7,428.68 |

| ONECO | 33154 | $6,228.41 |

| JACKSONVILLE | 33155 | $6,965.52 |

| JACKSONVILLE | 33156 | $6,375.97 |

| JACKSONVILLE | 33157 | $6,435.23 |

| FORT PIERCE | 33158 | $6,314.10 |

| FORT PIERCE | 33160 | $6,570.63 |

| FORT MEADE | 33161 | $6,983.18 |

| FROSTPROOF | 33162 | $7,110.30 |

| FORT OGDEN | 33165 | $7,078.68 |

| FORT PIERCE | 33166 | $6,800.86 |

| MULBERRY | 33167 | $7,216.08 |

| CLEWISTON | 33168 | $7,240.81 |

| LAKELAND | 33169 | $7,078.91 |

| KATHLEEN | 33170 | $6,884.67 |

| JACKSONVILLE | 33172 | $6,905.20 |

| JACKSONVILLE | 33173 | $6,645.51 |

| JACKSONVILLE | 33174 | $7,178.70 |

| ATLANTIC BEACH | 33175 | $7,127.61 |

| JACKSONVILLE BEACH | 33176 | $6,384.00 |

| JACKSONVILLE | 33177 | $6,884.67 |

| JACKSONVILLE | 33178 | $6,554.46 |

| NEPTUNE BEACH | 33179 | $6,863.46 |

| VERO BEACH | 33180 | $6,549.09 |

| WEBSTER | 33181 | $6,769.70 |

| CASSELBERRY | 33182 | $6,904.95 |

| ALTAMONTE SPRINGS | 33183 | $6,682.41 |

| TALLEVAST | 33184 | $7,153.93 |

| ORANGE PARK | 33185 | $6,705.63 |

| AVON PARK | 33186 | $6,587.52 |

| ALTAMONTE SPRINGS | 33187 | $6,666.36 |

| DELTONA | 33189 | $6,777.07 |

| DELTONA | 33190 | $6,868.71 |

| PALMDALE | 33193 | $6,753.02 |

| FELDA | 33194 | $7,023.28 |

| LABELLE | 33196 | $6,666.36 |

| WINTER SPRINGS | 33199 | $7,178.70 |

| LONGWOOD | 33301 | $5,844.67 |

| LONGWOOD | 33304 | $5,841.64 |

| DOCTORS INLET | 33305 | $5,834.52 |

| CANTONMENT | 33306 | $5,823.32 |

| FLEMING ISLAND | 33308 | $5,823.32 |

| ORANGE PARK | 33309 | $6,225.37 |

| MIDDLEBURG | 33311 | $6,305.41 |

| SARASOTA | 33312 | $6,216.48 |

| PENSACOLA | 33313 | $6,276.35 |

| GENEVA | 33314 | $6,203.21 |

| LAKE MARY | 33315 | $5,889.43 |

| OVIEDO | 33316 | $5,836.74 |

| FELLSMERE | 33317 | $5,848.86 |

| SARASOTA | 33319 | $6,190.56 |

| LONGBOAT KEY | 33321 | $6,041.03 |

| OVIEDO | 33322 | $6,047.39 |

| MID FLORIDA | 33323 | $5,939.29 |

| SANFORD | 33324 | $5,846.95 |

| LEHIGH ACRES | 33325 | $5,846.95 |

| PENSACOLA | 33326 | $5,750.11 |

| MID FLORIDA | 33327 | $5,655.48 |

| DELAND | 33328 | $5,784.74 |

| DELAND | 33330 | $5,727.38 |

| LAKE MONROE | 33331 | $5,704.74 |

| SANFORD | 33332 | $5,670.75 |

| ORANGE CITY | 33334 | $5,922.43 |

| CASSADAGA | 33351 | $6,041.03 |

| MOLINO | 33388 | $5,852.01 |

| PALM BAY | 33394 | $5,783.07 |

| PALM BAY | 33401 | $6,276.25 |

| PALM BAY | 33403 | $6,041.67 |

| GRANT | 33404 | $6,041.67 |

| MALABAR | 33405 | $6,276.25 |

| PALM BAY | 33406 | $6,278.75 |

| PENSACOLA | 33407 | $6,123.88 |

| PENSACOLA | 33408 | $5,254.51 |

| PENSACOLA | 33409 | $6,278.75 |

| PENSACOLA | 33410 | $5,259.51 |

| PENSACOLA | 33411 | $6,004.71 |

| PENSACOLA | 33412 | $5,615.98 |

| PENSACOLA | 33413 | $6,120.90 |

| PENSACOLA | 33414 | $6,004.71 |

| DEBARY | 33415 | $6,116.81 |

| MACCLENNY | 33417 | $6,116.81 |

| GREEN COVE SPRINGS | 33418 | $5,151.65 |

| SARASOTA | 33426 | $6,159.33 |

| CALLAHAN | 33428 | $5,926.72 |

| VERO BEACH | 33430 | $5,357.60 |

| VERO BEACH | 33431 | $5,957.82 |

| FORT MYERS | 33432 | $5,957.82 |

| PENSACOLA | 33433 | $5,954.38 |

| YULEE | 33434 | $5,910.50 |

| LAKE HELEN | 33435 | $6,159.33 |

| LEHIGH ACRES | 33436 | $6,096.01 |

| LEHIGH ACRES | 33437 | $6,096.01 |

| LEHIGH ACRES | 33438 | $5,366.43 |

| LEHIGH ACRES | 33440 | $4,305.88 |

| LEHIGH ACRES | 33441 | $6,028.54 |

| FERNANDINA BEACH | 33442 | $5,947.46 |

| SEBASTIAN | 33444 | $6,102.38 |

| VERO BEACH | 33445 | $6,200.91 |

| WABASSO | 33446 | $6,138.53 |

| MELBOURNE | 33449 | $6,095.30 |

| ONA | 33455 | $4,504.37 |

| GLENWOOD | 33458 | $4,863.64 |

| OAK HILL | 33459 | $5,237.37 |

| VERO BEACH | 33460 | $6,292.81 |

| VERO BEACH | 33461 | $6,297.92 |

| OSTEEN | 33462 | $6,290.16 |

| BOWLING GREEN | 33463 | $6,344.28 |

| GLEN SAINT MARY | 33467 | $6,153.40 |

| SARASOTA | 33469 | $5,066.94 |

| LAKE PLACID | 33470 | $5,417.48 |

| LORIDA | 33471 | $4,067.18 |

| SEBRING | 33472 | $6,057.63 |

| SEBRING | 33473 | $6,057.63 |

| SEBRING | 33476 | $5,346.40 |

| SEBRING | 33477 | $5,098.69 |

| SARASOTA | 33478 | $5,058.40 |

| SARASOTA | 33480 | $6,225.52 |

| VENUS | 33483 | $6,082.78 |

| BOSTWICK | 33484 | $6,096.51 |

| PALATKA | 33486 | $5,957.82 |

| DE LEON SPRINGS | 33487 | $5,957.82 |

| SARASOTA | 33493 | $5,357.60 |

| SARASOTA | 33496 | $6,007.61 |

| WAUCHULA | 33498 | $6,007.61 |

| FORT MYERS | 33510 | $5,933.28 |

| ZOLFO SPRINGS | 33511 | $5,608.68 |

| FORT MYERS | 33513 | $3,948.53 |

| FORT MYERS | 33514 | $3,948.53 |

| MOORE HAVEN | 33521 | $3,915.92 |

| SEBASTIAN | 33523 | $5,186.49 |

| HILLIARD | 33525 | $5,186.49 |

| BRYCEVILLE | 33527 | $5,315.37 |

| FORT MYERS | 33530 | $5,636.98 |

| FORT MYERS | 33534 | $5,601.96 |

| SANDERSON | 33538 | $3,897.63 |

| SARASOTA | 33540 | $5,186.49 |

| NORTH FORT MYERS | 33541 | $5,230.84 |

| CAPE CORAL | 33542 | $5,117.09 |

| CAPE CORAL | 33543 | $5,264.76 |

| CAPE CORAL | 33544 | $5,161.44 |

| CAPE CORAL | 33545 | $5,117.09 |

| CAPE CORAL | 33547 | $5,365.64 |

| CAPE CORAL | 33548 | $5,405.44 |

| MELBOURNE | 33549 | $5,602.29 |

| BOKEELIA | 33556 | $5,576.04 |

| SAINT JAMES CITY | 33558 | $5,571.04 |

| SARASOTA | 33559 | $5,516.67 |

| DAYTONA BEACH | 33563 | $5,183.29 |

| DAYTONA BEACH | 33565 | $5,183.75 |

| DAYTONA BEACH | 33566 | $5,183.29 |

| ORMOND BEACH | 33567 | $5,172.95 |

| SARASOTA | 33569 | $5,527.55 |

| SARASOTA | 33570 | $5,148.29 |

| MELBOURNE | 33572 | $5,148.29 |

| NORTH FORT MYERS | 33573 | $5,148.29 |

| BARBERVILLE | 33574 | $5,117.09 |

| ARCADIA | 33576 | $5,186.49 |

| SARASOTA | 33578 | $5,695.36 |

| ARCADIA | 33579 | $5,476.07 |

| ALVA | 33584 | $5,573.93 |

| CLERMONT | 33585 | $3,971.68 |

| MELBOURNE | 33586 | $5,636.26 |

| EDGEWATER | 33587 | $5,636.98 |

| EAST PALATKA | 33592 | $5,517.60 |

| SAN MATEO | 33593 | $5,117.09 |

| LAWTEY | 33594 | $5,383.52 |

| STARKE | 33596 | $5,354.97 |

| FORT MYERS | 33597 | $4,293.79 |

| FORT MYERS | 33598 | $5,181.56 |

| RAIFORD | 33602 | $6,894.71 |

| SCOTTSMOOR | 33603 | $6,931.90 |

| COCOA | 33604 | $6,815.74 |

| ROCKLEDGE | 33605 | $6,854.53 |

| COCOA | 33606 | $6,737.80 |

| FORT MYERS | 33607 | $6,976.36 |

| FORT MYERS | 33609 | $6,107.87 |

| CRESCENT CITY | 33610 | $6,495.30 |

| GRANDIN | 33611 | $5,990.83 |

| GEORGETOWN | 33612 | $6,850.08 |

| HOLLISTER | 33613 | $6,265.76 |

| INTERLACHEN | 33614 | $6,828.10 |

| LAKE COMO | 33615 | $6,673.01 |

| POMONA PARK | 33616 | $5,988.68 |

| PUTNAM HALL | 33617 | $5,760.45 |

| SATSUMA | 33618 | $5,906.63 |

| WELAKA | 33619 | $6,514.39 |

| TALLAHASSEE | 33620 | $5,961.95 |

| PIERSON | 33621 | $5,822.92 |

| MILTON | 33624 | $6,264.18 |

| SUMTERVILLE | 33625 | $6,236.56 |

| DELAND | 33626 | $5,651.99 |

| DAYTONA BEACH | 33629 | $5,990.83 |

| ORMOND BEACH | 33634 | $6,733.02 |

| OSPREY | 33635 | $6,188.84 |

| MELBOURNE | 33637 | $6,188.52 |

| MILTON | 33647 | $5,575.56 |

| HAMPTON | 33701 | $5,328.73 |

| CENTURY | 33702 | $5,334.99 |

| MC DAVID | 33703 | $5,334.99 |

| PORT ORANGE | 33704 | $5,328.73 |

| NEW SMYRNA BEACH | 33705 | $5,369.59 |

| MILTON | 33706 | $5,205.41 |

| LAKE GENEVA | 33707 | $5,343.70 |

| SEVILLE | 33708 | $5,231.32 |

| PALM COAST | 33709 | $5,343.70 |

| PORT ORANGE | 33710 | $5,354.18 |

| PORT ORANGE | 33711 | $5,369.59 |

| BOCA GRANDE | 33712 | $5,369.59 |

| BUSHNELL | 33713 | $5,369.59 |

| CENTER HILL | 33714 | $5,369.59 |

| INDIALANTIC | 33715 | $5,215.88 |

| DAYTONA BEACH | 33716 | $5,334.99 |

| EDGEWATER | 33730 | $5,338.61 |

| NEW SMYRNA BEACH | 33755 | $5,298.60 |

| CHOKOLOSKEE | 33756 | $5,329.43 |

| EVERGLADES CITY | 33759 | $5,350.57 |

| BROOKER | 33760 | $5,311.92 |

| CAPE CANAVERAL | 33761 | $5,308.69 |

| PATRICK AFB | 33762 | $5,333.41 |

| COCOA BEACH | 33763 | $5,311.92 |

| SATELLITE BEACH | 33764 | $5,311.92 |

| MELBOURNE BEACH | 33765 | $5,259.94 |

| MERRITT ISLAND | 33767 | $5,245.84 |

| TALLAHASSEE | 33770 | $5,290.77 |

| TALLAHASSEE | 33771 | $5,311.92 |

| TALLAHASSEE | 33772 | $5,202.66 |

| TALLAHASSEE | 33773 | $5,268.74 |

| TALLAHASSEE | 33774 | $5,241.27 |

| TALLAHASSEE | 33776 | $5,202.66 |

| TALLAHASSEE | 33777 | $5,268.74 |

| TALLAHASSEE | 33778 | $5,247.59 |

| TALLAHASSEE | 33781 | $5,364.76 |

| TALLAHASSEE | 33782 | $5,322.39 |

| TALLAHASSEE | 33785 | $5,202.66 |

| TALLAHASSEE | 33786 | $5,202.66 |

| FLORAHOME | 33801 | $4,305.40 |

| PINELAND | 33803 | $4,358.57 |

| FORT MYERS | 33805 | $4,345.65 |

| ESTERO | 33809 | $4,342.43 |

| MERRITT ISLAND | 33810 | $4,345.65 |

| CLERMONT | 33811 | $4,358.57 |

| MONTVERDE | 33812 | $4,414.38 |

| CLERMONT | 33813 | $4,358.57 |

| FERNDALE | 33815 | $4,345.09 |

| GROVELAND | 33823 | $4,353.34 |

| MASCOTTE | 33825 | $4,248.51 |

| BUNNELL | 33827 | $4,373.58 |

| FLAGLER BEACH | 33830 | $4,372.05 |

| PALM COAST | 33834 | $4,095.15 |

| PALM COAST | 33835 | $4,362.39 |

| FORT MYERS BEACH | 33837 | $4,489.58 |

| FLORAL CITY | 33838 | $4,421.02 |

| PONTE VEDRA BEACH | 33839 | $4,389.49 |

| COLEMAN | 33840 | $4,359.91 |

| CAPTIVA | 33841 | $4,323.58 |

| SANIBEL | 33843 | $4,322.35 |

| MIMS | 33844 | $4,458.40 |

| TITUSVILLE | 33847 | $4,408.19 |

| TITUSVILLE | 33848 | $4,821.71 |

| COCOA | 33849 | $4,302.18 |

| NOKOMIS | 33850 | $4,464.79 |

| LAKE BUTLER | 33851 | $4,464.79 |

| NORTH PORT | 33852 | $4,086.54 |

| NORTH PORT | 33853 | $4,372.05 |

| LECANTO | 33854 | $4,408.19 |

| IMMOKALEE | 33855 | $4,408.19 |

| HOMOSASSA | 33856 | $4,408.19 |

| HOMOSASSA | 33857 | $4,086.54 |

| INVERNESS | 33859 | $4,372.05 |

| INVERNESS | 33860 | $4,316.23 |

| ENGLEWOOD | 33863 | $4,362.39 |

| LAKE PANASOFFKEE | 33865 | $4,103.66 |

| CRYSTAL RIVER | 33867 | $4,406.96 |

| ASTATULA | 33868 | $4,369.91 |

| NORTH PORT | 33870 | $4,086.23 |

| HOWEY IN THE HILLS | 33872 | $4,086.23 |

| NORTH PORT | 33873 | $4,072.79 |

| BLOUNTSTOWN | 33875 | $4,086.23 |

| KEYSTONE HEIGHTS | 33876 | $4,086.54 |

| OCHOPEE | 33880 | $4,389.49 |

| ALTHA | 33881 | $4,439.69 |

| WEWAHITCHKA | 33884 | $4,353.34 |

| BONITA SPRINGS | 33890 | $4,071.55 |

| EUSTIS | 33896 | $4,489.58 |

| SORRENTO | 33897 | $4,368.67 |

| CLARKSVILLE | 33898 | $4,370.81 |

| MELROSE | 33901 | $4,060.27 |

| PONTE VEDRA | 33903 | $4,052.08 |

| HERNANDO | 33904 | $4,047.28 |

| HOLDER | 33905 | $4,114.55 |

| INVERNESS | 33907 | $3,981.36 |

| MURDOCK | 33908 | $3,981.36 |

| VENICE | 33909 | $4,052.08 |

| VENICE | 33912 | $4,060.27 |

| LULU | 33913 | $4,070.88 |

| DUNNELLON | 33914 | $4,047.28 |

| PAISLEY | 33916 | $4,070.88 |

| PUNTA GORDA | 33917 | $4,015.66 |

| LAKE CITY | 33919 | $3,925.64 |

| LLOYD | 33920 | $4,000.80 |

| PUNTA GORDA | 33921 | $3,954.64 |

| HASTINGS | 33922 | $4,042.48 |

| NORTH PORT | 33924 | $3,915.87 |

| VENICE | 33927 | $3,851.67 |

| CRYSTAL RIVER | 33928 | $3,923.52 |

| BEVERLY HILLS | 33930 | $4,223.85 |

| DUNNELLON | 33931 | $3,919.21 |

| SAINT AUGUSTINE | 33935 | $4,223.85 |

| SAINT AUGUSTINE | 33936 | $4,112.43 |

| SAINT AUGUSTINE | 33938 | $3,871.72 |

| OCALA | 33944 | $4,227.32 |

| OCALA | 33945 | $3,927.14 |

| THE VILLAGES | 33946 | $3,850.68 |

| OXFORD | 33947 | $3,850.68 |

| WILDWOOD | 33948 | $3,851.67 |

| CARRABELLE | 33950 | $3,844.14 |

| LANARK VILLAGE | 33952 | $3,844.14 |

| EASTPOINT | 33953 | $3,851.67 |

| SAINT JOHNS | 33954 | $3,852.87 |

| APALACHICOLA | 33955 | $3,865.72 |

| SAINT AUGUSTINE | 33956 | $4,042.48 |

| PORT CHARLOTTE | 33957 | $3,915.87 |

| EL JOBEAN | 33960 | $4,079.50 |

| PORT CHARLOTTE | 33965 | $3,993.21 |

| PORT CHARLOTTE | 33966 | $4,072.12 |

| UMATILLA | 33967 | $3,993.21 |

| PLACIDA | 33971 | $4,168.14 |

| ROTONDA WEST | 33972 | $4,112.43 |

| OCALA | 33973 | $4,112.43 |

| PORT CHARLOTTE | 33974 | $4,112.43 |

| ENGLEWOOD | 33976 | $4,112.43 |

| LAMONT | 33980 | $3,844.14 |

| MONTICELLO | 33981 | $3,846.14 |

| PUNTA GORDA | 33982 | $3,869.54 |

| PORT CHARLOTTE | 33983 | $3,844.14 |

| PUNTA GORDA | 33990 | $4,052.08 |

| PUNTA GORDA | 33991 | $4,047.94 |

| EUSTIS | 33993 | $4,048.93 |

| TAVARES | 34102 | $3,783.36 |

| OCALA | 34103 | $3,783.36 |

| GULF BREEZE | 34104 | $3,797.43 |

| GULF BREEZE | 34105 | $3,797.43 |

| NAVARRE | 34108 | $3,783.36 |

| BRISTOL | 34109 | $3,797.43 |

| HOSFORD | 34110 | $3,797.43 |

| OCALA | 34112 | $3,783.36 |

| SAINT AUGUSTINE | 34113 | $3,783.36 |

| LAKE CITY | 34114 | $3,797.43 |

| NAPLES | 34116 | $3,797.43 |

| ASTOR | 34117 | $3,797.43 |

| GRAND ISLAND | 34119 | $3,797.43 |

| LEESBURG | 34120 | $3,839.84 |

| ELKTON | 34134 | $3,797.43 |

| CANDLER | 34135 | $3,881.12 |

| LAKE CITY | 34137 | $3,797.43 |

| PORT SAINT JOE | 34138 | $3,942.52 |

| WEWAHITCHKA | 34139 | $3,942.52 |

| WEIRSDALE | 34140 | $3,797.43 |

| ALTOONA | 34141 | $3,885.56 |

| DUNNELLON | 34142 | $3,901.52 |

| DUNNELLON | 34145 | $3,783.36 |

| FORT MC COY | 34201 | $4,365.26 |

| FORT WHITE | 34202 | $4,351.75 |

| OCALA | 34203 | $4,341.09 |

| CRAWFORDVILLE | 34205 | $4,783.59 |

| PANACEA | 34207 | $4,782.57 |

| SAINT MARKS | 34208 | $4,783.59 |

| SOPCHOPPY | 34209 | $4,426.85 |

| NAPLES | 34210 | $4,500.02 |

| NAPLES | 34211 | $4,347.16 |

| NAPLES | 34212 | $4,358.27 |

| NAPLES | 34215 | $4,498.15 |

| NAPLES | 34216 | $4,645.27 |

| NAPLES | 34217 | $4,361.71 |

| NAPLES | 34219 | $4,378.70 |

| NAPLES | 34221 | $4,632.04 |

| BONITA SPRINGS | 34222 | $4,418.43 |

| COPELAND | 34223 | $3,899.53 |

| GOODLAND | 34224 | $3,846.14 |

| JAY | 34228 | $4,173.22 |

| SUMMERFIELD | 34229 | $3,969.52 |

| OCALA | 34231 | $4,028.02 |

| CHATTAHOOCHEE | 34232 | $4,054.63 |

| GRETNA | 34233 | $4,029.02 |

| QUINCY | 34234 | $4,079.69 |

| OCALA | 34235 | $4,089.73 |

| OCALA | 34236 | $4,073.06 |

| FOUNTAIN | 34237 | $4,124.20 |

| YOUNGSTOWN | 34238 | $4,073.53 |

| NAPLES | 34239 | $4,080.81 |

| NAPLES | 34240 | $4,174.77 |

| NAPLES | 34241 | $4,005.33 |

| NAPLES | 34242 | $4,038.64 |

| NAPLES | 34243 | $4,191.02 |

| MARCO ISLAND | 34250 | $4,631.02 |

| BELLEVIEW | 34251 | $4,352.55 |

| PANAMA CITY | 34264 | $4,339.22 |

| FRUITLAND PARK | 34266 | $4,013.34 |

| LEESBURG | 34267 | $4,320.27 |

| OKAHUMPKA | 34269 | $4,001.40 |

| YALAHA | 34270 | $4,250.01 |

| JASPER | 34275 | $3,911.89 |

| GREENSBORO | 34285 | $3,871.67 |

| HAVANA | 34286 | $3,865.34 |

| MIDWAY | 34287 | $3,890.16 |

| QUINCY | 34288 | $3,893.21 |

| PANAMA CITY | 34289 | $3,907.71 |

| PANAMA CITY | 34291 | $3,907.71 |

| PANAMA CITY | 34292 | $3,864.68 |

| PANAMA CITY BEACH | 34293 | $3,871.67 |

| PANAMA CITY | 34420 | $3,779.94 |

| PANAMA CITY | 34428 | $3,863.02 |

| MEXICO BEACH | 34429 | $3,895.63 |

| PANAMA CITY BEACH | 34431 | $3,816.24 |

| LYNN HAVEN | 34432 | $3,816.24 |

| WHITE SPRINGS | 34433 | $3,861.23 |

| GRACEVILLE | 34434 | $3,870.76 |

| OCALA | 34436 | $3,918.22 |

| BAKER | 34442 | $3,872.55 |

| HOLT | 34445 | $3,872.55 |

| BONIFAY | 34446 | $3,899.93 |

| NOMA | 34448 | $3,899.93 |

| FAIRFIELD | 34449 | $3,664.09 |

| LOWELL | 34450 | $3,899.93 |

| REDDICK | 34452 | $3,899.93 |

| OCALA | 34453 | $3,872.55 |

| CITRA | 34461 | $3,905.16 |

| EASTLAKE WEIR | 34465 | $3,863.02 |

| OCKLAWAHA | 34470 | $3,842.22 |

| ORANGE SPRINGS | 34471 | $3,858.02 |

| SPARR | 34472 | $3,841.88 |

| ANTHONY | 34473 | $3,847.11 |

| PONCE DE LEON | 34474 | $3,858.02 |

| WESTVILLE | 34475 | $3,764.47 |

| WELLBORN | 34476 | $3,789.08 |

| MAYO | 34479 | $3,799.99 |

| ROSEMARY BEACH | 34480 | $3,784.18 |

| BASCOM | 34481 | $3,784.18 |

| CAMPBELLTON | 34482 | $3,753.90 |

| COTTONDALE | 34484 | $3,858.02 |

| GRAND RIDGE | 34488 | $3,716.67 |

| GREENWOOD | 34491 | $3,790.85 |

| MALONE | 34498 | $3,664.09 |

| MARIANNA | 34601 | $4,692.22 |

| MARIANNA | 34602 | $4,715.36 |

| SNEADS | 34604 | $4,885.76 |

| ALFORD | 34606 | $4,875.27 |

| LEE | 34607 | $4,909.00 |

| MADISON | 34608 | $4,898.41 |

| PINETTA | 34609 | $4,898.41 |

| CHIPLEY | 34610 | $5,116.51 |

| WAUSAU | 34613 | $4,862.62 |

| PAXTON | 34614 | $4,862.62 |

| JENNINGS | 34636 | $4,862.62 |

| CRESTVIEW | 34637 | $5,134.11 |

| MILLIGAN | 34638 | $5,254.61 |

| CRESTVIEW | 34639 | $5,295.11 |

| LAUREL HILL | 34652 | $5,395.44 |

| LIVE OAK | 34653 | $5,367.21 |

| LIVE OAK | 34654 | $5,398.09 |

| CARYVILLE | 34655 | $5,335.33 |

| MC ALPIN | 34660 | $5,327.88 |

| SALEM | 34661 | $4,692.22 |

| SILVER SPRINGS | 34667 | $5,299.90 |

| BRANFORD | 34668 | $5,395.44 |

| O BRIEN | 34669 | $5,299.90 |

| VERNON | 34677 | $5,327.88 |

| LADY LAKE | 34679 | $5,367.21 |

| EBRO | 34681 | $5,327.88 |

| PERRY | 34683 | $5,366.53 |

| PERRY | 34684 | $5,386.26 |

| SHADY GROVE | 34685 | $5,252.15 |

| STEINHATCHEE | 34688 | $5,221.27 |

| THE VILLAGES | 34689 | $5,328.57 |

| ARGYLE | 34690 | $5,368.63 |

| DEFUNIAK SPRINGS | 34691 | $5,395.44 |

| MOSSY HEAD | 34695 | $5,308.69 |

| DEFUNIAK SPRINGS | 34698 | $5,347.35 |

| CROSS CITY | 34705 | $3,893.74 |

| OLD TOWN | 34711 | $3,923.05 |

| SUWANNEE | 34714 | $4,000.17 |

| FREEPORT | 34715 | $3,921.19 |

| CEDAR KEY | 34729 | $3,919.95 |

| CHIEFLAND | 34731 | $3,779.28 |

| SANTA ROSA BEACH | 34734 | $4,523.75 |

| BRONSON | 34736 | $3,919.95 |

| MORRISTON | 34737 | $3,892.50 |

| WILLISTON | 34739 | $4,641.48 |

| BELL | 34740 | $4,547.56 |

| TRENTON | 34741 | $4,830.20 |

| GULF HAMMOCK | 34743 | $4,983.28 |

| OTTER CREEK | 34744 | $4,827.66 |

| INGLIS | 34746 | $4,826.67 |

| YANKEETOWN | 34747 | $4,673.29 |

| HORSESHOE BEACH | 34748 | $3,779.28 |

| DESTIN | 34753 | $3,919.95 |

| EGLIN AFB | 34756 | $3,923.05 |

| HURLBURT FIELD | 34758 | $4,826.67 |

| FORT WALTON BEACH | 34759 | $4,591.24 |

| FORT WALTON BEACH | 34761 | $4,525.80 |

| MARY ESTHER | 34762 | $3,779.28 |

| NICEVILLE | 34769 | $4,791.82 |

| SHALIMAR | 34771 | $4,694.47 |

| VALPARAISO | 34772 | $4,678.87 |

| GREENVILLE | 34773 | $4,528.08 |

| EVINSTON | 34785 | $3,858.02 |

| HAWTHORNE | 34786 | $4,554.63 |

| ISLAND GROVE | 34787 | $4,547.56 |

| LOCHLOOSA | 34788 | $3,837.18 |

| MC INTOSH | 34797 | $3,779.28 |

| ORANGE LAKE | 34945 | $4,316.64 |

| MIRAMAR BEACH | 34946 | $4,331.97 |

| EARLETON | 34947 | $4,507.05 |

| GAINESVILLE | 34949 | $4,548.56 |

| GAINESVILLE | 34950 | $4,507.05 |

| GAINESVILLE | 34951 | $4,331.97 |

| GAINESVILLE | 34952 | $4,574.94 |

| GAINESVILLE | 34953 | $4,592.86 |

| GAINESVILLE | 34956 | $4,504.37 |

| GAINESVILLE | 34957 | $4,486.44 |

| GAINESVILLE | 34972 | $4,500.88 |

| GAINESVILLE | 34974 | $4,430.16 |

| ALACHUA | 34981 | $4,507.05 |

| LA CROSSE | 34982 | $4,507.05 |

| GAINESVILLE | 34983 | $4,574.94 |

| GAINESVILLE | 34984 | $4,592.86 |

| GAINESVILLE | 34986 | $4,434.21 |

| ARCHER | 34987 | $4,434.21 |

| MICANOPY | 34990 | $4,504.37 |

| NEWBERRY | 34994 | $4,504.37 |

| HIGH SPRINGS | 34996 | $4,486.44 |

| WALDO | 34997 | $4,504.37 |

Read more:

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What are the best Florida car insurance companies?

There is a countless number of car insurance providers out there that want your business. It can seem overwhelming, with all of them fighting for your business, but that’s what we’re here for.

Read more: Top 10 Florida Car Insurance Companies

In this section, we’ll go over all of the information you’ll need to know about the different car insurance companies in Florida. We’ll touch on the largest companies, the companies with the best ratings, the companies with the most complaints, and more.

Continue reading to find out the best car insurance companies in Florida.

Largest Companies Financial Rating

One of the first things you’ll want to know about a company is what their financial strength is like. Do they have a higher rating, meaning they’re more likely to provide you the best coverage you need? Or do they have a lower rating, meaning that they’re less responsible than their counterparts?

| Providers (by Size – Largest at Top) | A.M. Best Rating |

|---|---|

| Berkshire Hathaway | A++ |

| State Farm | B++ |

| Progressive | A+ |

| Allstate Insurance | A+ |

| USAA | A++ |

| Liberty Mutual | A |

| Travelers | A++ |

| AmTrust | A- |

| Windhaven | Not Rated |

| Infinity Insurance | A |

Read more:

- Amtrust Insurance Company Car Insurance Review

- State Farm Florida Insurance Company Car Insurance Review

Companies with Best Ratings

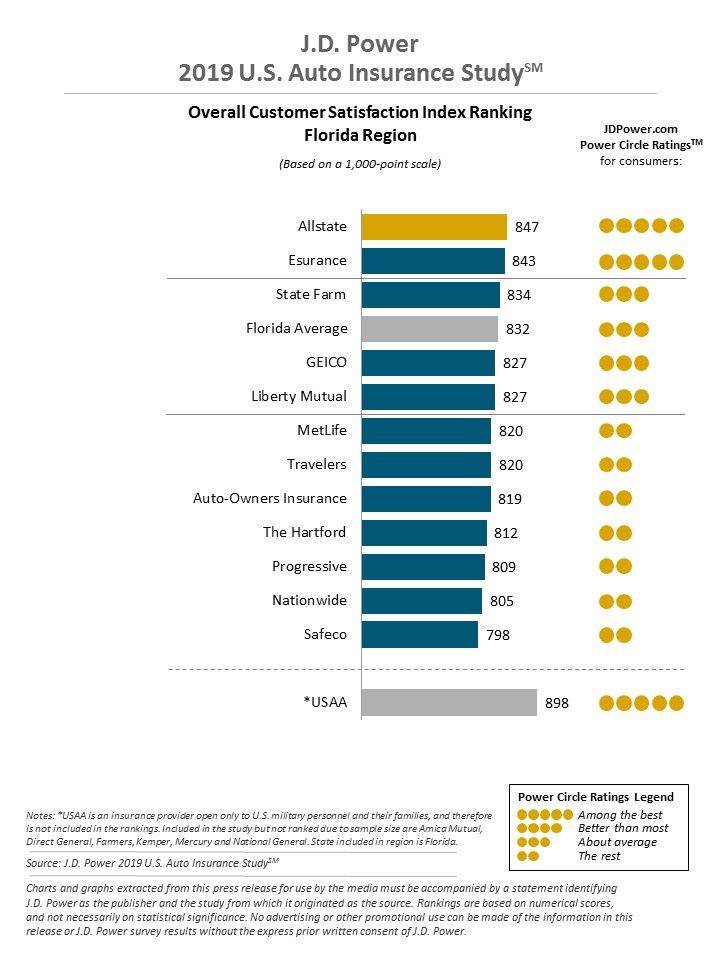

J.D. Power did a study in 2019 to compare the overall customer satisfaction of customers for their insurance companies based on their region. The chart below shows the overall customer satisfaction index ranking that the Florida region received.

Companies with Most Complaints in Florida

Another factor to consider is exactly how many complaints do these providers have? Are their customers generally satisfied with their coverage? Or is there a large portion of customers who are not?

| Number of Customer Complaints | 2017 | 2016 | 2015 | Total |

|---|---|---|---|---|

| Geico | 75 | 72 | 52 | 199 |

| State Farm | 351 | 349 | 394 | 1,094 |

| Progressive | 140 | 153 | 149 | 442 |

| Allstate | 46 | 49 | 57 | 152 |

| USAA | 53 | 33 | 21 | 107 |

| Liberty Mutual | 25 | 15 | 23 | 63 |

| Travelers | 2 | 1 | 1 | 4 |

| Windhaven | 544 | 629 | 398 | 1571 |

| Infinity | 137 | 141 | 179 | 457 |

You can find more customer complaint statistics from the Florida Office of Insurance Regulation, which shows statistics for other types of insurance as well (such as home and life insurance).

Cheapest Companies in Florida

Cost is obviously going to be near the top of most people’s checklist for purchasing car insurance. Who has the most expensive car insurance, and who has the cheapest? Well, we’ve taken the hard work out of the equation for you and have listed the top five most expensive and top five least expensive car insurance providers in Florida. Take a look at the list below to see which company might offer you the lowest rate.

| Company | Annual Average | Compared to State Average | Percent Compared to Average |

|---|---|---|---|

| Allstate F&C | $7,440.46 | $2,760.00 | 37.09% |

| Geico General | $3,783.63 | -$896.83 | -23.70% |

| Liberty Mutual Ins Co | $5,368.15 | $687.69 | 12.81% |

| Allied P&C | $4,339.60 | -$340.86 | -7.85% |

| Progressive Select | $5,583.30 | $902.84 | 16.17% |

| State Farm Mutual Auto | $3,397.67 | -$1,282.79 | -37.75% |

| USAA | $2,850.41 | -$1,830.05 | -64.20% |

Commute Rates by Companies

| Group | 25 Miles Commute / 12000 Annual Mileage | 10 Miles Commute / 6000 Annual Mileage |

|---|---|---|

| Allstate | $7,653.06 | $7,227.85 |

| Progressive | $5,583.30 | $5,583.30 |

| Liberty Mutual | $5,542.32 | $5,193.97 |

| Nationwide | $4,339.60 | $4,339.60 |

| Geico | $3,802.25. | $3,765.00 |

| State Farm | $3,517.12 | $3,278.22 |

| USAA | $2,882.80 | $2,818.01 |

Coverage Level Rates by Companies

Did you know that for only slightly more, you could be getting a better high coverage insurance plan? By comparing high coverage plans between the different car insurance companies, you could save hundreds of dollars!

| Company | Annual Rate with High Coverage | Annual Rate with Medium Coverage | Annual Rate with Low Coverage |

|---|---|---|---|

| Allstate | $8,737.79 | $7,820.73 | $5,762.84 |

| Progressive | $6,356.27 | $5,712.27 | $4,681.36 |

| Liberty Mutual | $5,726.09 | $5,456.65 | $4,921.70 |

| Nationwide | $5,079.97 | $4,511.14 | $3,427.69 |

| Geico | $4,330.61 | $3,915.19 | $3,105.08 |

| State Farm | $3,799.88 | $3,477.29 | $2,915.85 |

| USAA | $3,145.87 | $2,954.56 | $2,450.79 |

You can see in the table above that a low coverage plan with State Farm is $2,915.85, while a high coverage plan with USAA is $3,145.87. That means that for only $230.02 MORE a year, you could get a plan that will give you more protection.

It can be tempting to stick with the lower coverage plans, as they tend to be the cheapest plans, but getting that extra coverage is definitely something to consider.

Credit History Rates by Companies

| Group | Annual Rate with Good Credit | Annual Rate with Fair Credit | Annual Rate with Poor Credit |

|---|---|---|---|

| Allstate | $5,314.82 | $6,574.17 | $10,432.38 |

| Geico | $2,505.51 | $3,335.60 | $5,509.78 |

| Liberty Mutual | $4,109.70 | $5,073.66 | $6,921.08 |

| Nationwide | $3,596.12 | $3,981.62 | $5,441.06 |

| Progressive | $4,302.18 | $5,169.65 | $7,278.07 |

| State Farm | $2,495.39 | $3,045.80 | $4,651.82 |

| USAA | $1,645.31 | $2,266.46 | $4,639.45 |

Driving Record Rates by Companies

| Group | Driving Record | Annual Average |

|---|---|---|

| Allstate | With 1 DUI | $8,524.13 |

| Allstate | With 1 accident | $7,700.66 |

| Allstate | With 1 speeding violation | $7,119.64 |

| Allstate | Clean record | $6,417.39 |

| Geico | With 1 DUI | $5,012.72 |

| Geico | With 1 speeding violation | $4,116.12 |

| Geico | With 1 accident | $3,368.94 |

| Geico | Clean record | $2,636.72 |

| Liberty Mutual | With 1 DUI | $7,291.64 |

| Liberty Mutual | With 1 speeding violation | $5,285.32 |

| Liberty Mutual | With 1 accident | $5,026.31 |

| Liberty Mutual | Clean record | $3,869.33 |

| Nationwide | With 1 DUI | $5,472.37 |

| Nationwide | With 1 speeding violation | $4,114.99 |

| Nationwide | With 1 accident | $4,065.71 |

| Nationwide | Clean record | $3,705.32 |

| Progressive | With 1 accident | $6,519.19 |

| Progressive | With 1 speeding violation | $5,915.72 |

| Progressive | With 1 DUI | $5,490.35 |

| Progressive | Clean record | $4,407.95 |

| State Farm | With 1 accident | $3,690.25 |

| State Farm | With 1 DUI | $3,397.66 |

| State Farm | With 1 speeding violation | $3,397.66 |

| State Farm | Clean record | $3,105.11 |

| USAA | With 1 DUI | $4,070.81 |

| USAA | With 1 accident | $2,755.24 |

| USAA | With 1 speeding violation | $2,341.64 |

| USAA | Clean record | $2,233.94 |

Largest Car Insurance Companies in Florida

You’ve seen the ten largest car insurance companies previously, as well as their financial ratings. Here, we will give you the exact scope of what makes these companies the largest.

| Rank | Company/Group Name | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|---|

| 1 | Geico | $4,678,326 | 78.78% | 24.44% |

| 2 | State Farm Group | $3,042,871 | 79.80% | 15.89% |

| 3 | Progressive Group | $3,031,444 | 66.17% | 15.84% |

| 4 | Allstate Insurance Group | $1,842,800 | 55.45% | 9.63% |

| 5 | USAA Group | $1,357,367 | 82.20% | 7.09% |

| 6 | Liberty Mutual Group | $617,089 | 68.42% | 3.22% |

| 7 | Travelers Group | $444,623 | 67.79% | 2.32% |

| 8 | Amtrust NGH Group | $413,351 | 61.98% | 2.16% |

| 9 | J. Whited Group (Windhaven) | $385,885 | 56.59% | 2.02% |

| 10 | InFinanciality Prop & Casualty Insurance Group | $357,011 | 67.06% | 1.86% |

Number of Insurers

There are two types of insurers in every state, a domestic provider and a foreign provider.

A domestic provider is an insurer which is admitted by and formed under the laws under the state in which insurance is written

A foreign provider is an insurer which is formed under the laws of another state and is doing business in a state other than that in which it was formed. For example, Progressive is a domestic carrier in Ohio and a foreign carrier in all other states.

So how many do you have to work within Florida? There are 114 domestic providers and 953 foreign providers, making the total number of providers you can choose from in Florida at 1067. That’s a lot!

What are Florida’s driving laws?

Every state has laws that are particular to that state, driving is no exception. In order to follow the laws of Florida, you’ll need to know all of the most important laws. After all, the last thing we want for you is to get a ticket for breaking a law you didn’t even know existed.

Car insurance Laws

There are specific laws pertaining to just car insurance that is applicable in all states, although they all vary to some degree as to how they handle it.

Keep reading to find out more about the different Florida specific car insurance laws you’ll want to know.

How State Laws for Insurance are Determined

The good news for drivers is that car insurance companies are not the ones who get to dictate what car insurance laws and rates get approved. There’s a process that must occur for the different laws and rates to get approved.

Any and all car insurance forms and rates are required to be filed and approved by Florida’s Office of Insurance Regulation and must wait for a period of 30 days before it will be enacted.

Windshield Coverage

According to a Florida statute, if you have comprehensive insurance, there is no deductible you have to meet for car windshields.

Companies are not required to use OEM parts should you need to fix/repair your windshield, but have to meet a standard for replacement parts.

High-Risk Insurance

A high-risk driver is typically someone who has been caught driving without insurance or has been caught driving under the influence. If this applies to you, you may be wondering, well how can I get insurance?

It’s required that you carry car insurance in order to legally drive, but it can be hard to find a provider who is willing to provide affordable coverage given this kind of record.

In Florida, this may mean that you will need to file for an SR-22 or FR-44. These two forms will work as your proof of insurance. What’s the difference between the two?

You would need to file for an SR-22 form if you’ve been caught in any of the following situations:

- Driving without insurance

- Too many points on your driver’s license

- Revoked/Suspended driver’s license

- Been in a car accident that caused injury/property damage

With the SR-22 form, you may be required to carry this form for up to two years, or three years in other high-risk reasons.

An FR-44 form, on the other hand, is for drivers that are even higher risk.

According to the Florida DMV:

FR-44 certificates are required when a driver has been convicted of a DUI and did not hold the following amounts of coverage for bodily injury liability and property damage liability insurance on the date of the arrest:

- $100,000 for the injuries of any one person

- $300,000 for the injuries to all people in one accident

- $50,000 for property damage liability (PDL)

So if you are in need of some form of insurance and have gone through any of the situations above, you have options!

Automobile Insurance Fraud in Florida

Did you know that insurance companies lose, on average, about 10 percent due to fraud? Don’t think that sounds that bad? Well, according to the Insurance Information Institute (III), that equates to about $30 billion, EACH YEAR!

What makes this worse is that according to a study conducted in 2008, of the 12 no-fault states, Florida had the highest rate of car insurance fraud for BOTH bodily injury and person injury protection.

Unfortunately, this is a common issue in no-fault states. To combat this, however, Florida implemented a no-fault auto insurance bill that, as a result, reduced the fraud rate in the state. This law states that if a Florida citizen does commit insurance fraud, they get a civil penalty which comes with the following consequences:

- First Time Offense: up to $5,000 fine

- Second Time Offense: fine between $5,000 and $10,000

- Third Time Offense: fine between $10,000 and $15,000

Have any questions or concerns? Make sure to check out the Florida Office of Insurance Regulation!

We recommend that you avoid all of these costly consequences and only submit claims to your insurance company for valid claims. It’s simply not worth all of the hassle!

Statute of Limitations

If you are involved in an accident, chances are that you’ll want to submit claims for personal injury, property damage, or both. If you are, you will want to know the statute of limitations laws in Florida.

What is the statute of limitations? It’s essentially the amount of time that you have in order to file and resolve your claim.

In Florida, you have four years for both personal injury and property damage claims.

This may sound like a lot of time, however, time can fly quickly if you are dealing with the repercussions of an accident. Things such as hospital stays and vehicle repairs can take time to do. So make sure you have the time you need to make the claims you need.

Vehicle Licensing Laws

Just like with car insurance, there are laws regarding vehicle licensing. Whether you’re a newer driver or an older driver, there are rules that you will need to adhere to in order to be able to legally drive in the state.

Penalties for Driving Without Insurance

If you are ever caught driving without insurance, there are penalties that you will be facing. We mentioned the SR-22 form you will be required to have and hold, but there are other consequences as well!

| First Offense | Second Offense | Third Offense (and Beyond) |

|---|---|---|

| Suspension of license and registration until reinstatement fee ($150) is paid and non-cancelable coverage is secured | Suspension of license and registration until reinstatement fee ($250) is paid and non-cancelable coverage is secured | Suspension of license and registration until reinstatement fee ($500) is paid and non-cancelable coverage is secured |

Teen Driver Laws

Do you have a teen driver ready for the road and ready to jump behind the wheel? Not so fast. There are a few requirements and restrictions that will need to be followed.

| Type of License | Age Requirements | Pre-Requisites | Passenger Restrictions | Driving Restrictions |

|---|---|---|---|---|

| Learners Permit | Minimum 15 | –Complete the DATA course (can take it at age 14) –Take the DMV test (can take it at age 14.5 –At age 15, take a vision test at DMV | Must be a licensed driver of 21 or older in the front passenger seat | Can't drive after sunset for the first 3 months and then can't drive after 10 p.m. |

| Restricted License | Minimum 16 | –12-month holding period –Minimum supervised 50 hours of driving (10 must be at night) | none | No driving from 11 p.m.-6 a.m. for 16 year-olds; No driving from 1 a.m.-5 a.m. for 17 year-olds |

| Unrestricted License | Minimum 18 | Must satisfy all previous requirements | none | none |

License Renewal Procedures

According to the Insurance Insitute for Highway Safety (IIHS), the following license renewal procedures are required for Florida citizens:

| Requirements | General Population | Older Population |

|---|---|---|

| License Renewal Cycle | every 8 years | every 6 years for people 80 years and older |

| Proof of Adequate Vision | when renewing in person | 80 and older, every renewal |

| Mail/Online Renewal Permitted | both, every other renewal | both, every other renewal |

If you are an elderly citizen, there are a few extra things you will want to remember in order to keep your driver’s license.

In addition, according to the Florida Statute Section 627.052, drivers who are 55 years and older are authorized to complete a Mature Driver (Senior Citizen) Discount course, which is approved by the Florida Department of Highway Safety and Motor Vehicles (FLHSMV).

If this course is completed, you are able to turn in a certificate to your insurance provider for an insurance discount. This discount lasts for approximately three years as long as the driver maintains a safe driving record.

New Residents

Decided to make Florida your home? Well, in order to make the transition, you will need to exchange your out-of-state license for a Florida one. Luckily you won’t need to take any sort of knowledge test, but you will be required to perform a vision exam!

Rules of the Road

Safe driver, safe roads. That’s what we all want! In order to drive safely, you’ll want to know what rules you need to follow on the road. Not knowing what rules you need to follow can lead to tickets, fines, and worse, accidents.

Keep reading to find out more about Florida’s rules of the road!

– Fault Versus No-Fault

As mentioned previously, Florida is a no-fault state. This means that no matter who is at fault for the accident, your insurance provider is the one who will pay for your expenses.

So making sure you have more than the minimum insurance coverage could mean the difference if you are ever in an accident!

Seat Belt and Car Seat Laws

Click it, or ticket. It’s a commonly heard phrase on the road, and it’s an important one. You are required to wear a seat belt in Florida. Anyone from the age of six years and older are allowed to ride in the front passenger seat and therefore required to wear a seatbelt.

If you are caught without your seat belt, you could be facing a $30 fine (not including any additional fees that may apply) just for a first-time offense.

It’s a little different though for car seat laws. Children who are five years and younger must be in a car seat, no exceptions. They are not permitted to be in an adult seat belt unless in the situation of an emergency.

Keep Right and Move Over Laws

Keep Right and Move Over Laws are very simple to understand, and kind of bleed into one another. We’ll show you what we mean.

If you are driving slower than the traffic around you, you will need to move out of the left lane so that you don’t block traffic.

Think of it this way: If you are slower than the traffic around you, keep in the right lane.

Speed Limits

| Road Type | Speed Limit |

|---|---|

| Rural interstates (mph) | 70 |

| Urban interstates (mph) | 65 |

| Other limited access roads (mph) | 70 |

| Other roads (mph) | 65 |

Ridesharing

Everyone in this day and age has heard of ridesharing services such as Uber and Lyft. With their increased popularity for use, as well as popularity as a side job for the everyday working citizen, the need for laws and regulations for these services has been addressed.

In Florida, there are only two companies that provide coverage specifically for ridesharing: Foremost (of Farmers) and Prime.

If you are a rider using these services, you can rest assured that there are many insurance requirements that drivers must follow:

- Drivers need to have their own insurance policies with at least the minimum liability coverage

- When the rideshare app is opened, the company (such as Uber, Lyft, etc) are required to provide higher coverage

In addition, these companies want to make sure that the riders are safe, and have the following restrictions for hiring drivers:

- Can’t be a registered sex offender

- Must have a valid license and registration

- Can’t have had your license revoked/suspended within the past three years

- Can’t have been convicted of a DUI, hit-and-run, or other serious driving violations within the past five years

Automation on the Road

Did you know that automated driving in Florida is legal? This means that you can drive any sort of automated vehicle as long as you have a license.

This is a new topic of conversation with all of the new technology coming out in vehicles, so make sure to visit the Florida Department of Transportation to find out more about automated driving.

Safety Laws

In addition to knowing some of the basic rules of the road, you’ll want to know the specific safety laws that are enacted in Florida. These rules have been put into place to keep you safe, so knowing what to expect in Florida will help keep you and your loved ones as safe as possible.

DUI Laws

Drinking and driving is one of the most avoidable offenses for any driver. If you are caught driving with a blood alcohol content (BAC) of 0.08 percent or more, you will be immediately charged with a DUI.

Check out some of the DUI laws in Florida in the table down below.

| Penalty Type | First Offense | Second Offense | Third Offense | Fourth (or Subsequent) Offense |

|---|---|---|---|---|

| License Suspension or Revocation | 180 days to 1 year | – 2nd in 5 years= min 5-year revocation – 2nd in 6+ years= 180 days to 1 year revocation | – 3rd in 10 years of 2nd conviction= min 10-year revocation, may be eligible for hardship – Reinstatement after 2 years | Mandatory permanent revocation with no hardship reinstatement allowed |

| Imprisonment | – 8 hours to 6 months – High BAC (.15) or minor in car= 9 months or less – For a first conviction, total period of probation and incarceration may not exceed 1 year | – 9 months or less – High BAC or minor in car= 12 months or less – 2nd in 5 years= mandatory imprisonment at least 10 days with 48 hours consecutive confinement | – If 3rd in 10 years, mandatory 30 days with 48 consecutive hours – If 3rd in over 10 years, imprisonment no more than 12 months | 5 years or less |

| Fine | – $500-$1000 – High BAC or minor in car= $1000-$2000 | – $1000-$2000 – High BAC or minor in car= $2000-$4000 | – More than 10 years from 2nd conviction= $2000-$5000 – High BAC or minor in car= $4000 min | $2000 min |

| Other | – Car impounded for 10 days unless family has no other transportation – Mandatory 50 hours community service (CS) or additional fine of $10 for each hour of CS required | 2nd in 5 years= car impounded for 30 days unless family has no other transportation | 3rd in 10 years= car impounded for 90 days unless family has no other transportation | – |

After three offenses a DUI is considered a felony in Florida. Save yourself the trouble and don’t drink and drive! Make sure you have a safe ride home after drinking, it’s not worth your life or the life of someone else!

Marijuana-Impaired Driving Laws

With the legalization of marijuana in many states, new laws and restrictions have been created surrounding it. Florida, who has not legalized marijuana recreationally, there are currently no laws specific to driving while marijuana-impaired.

Distracted Driving Laws

Ever since the dawn of the cellphone age, there have been many concerns about distracted driving.

Since then, there have been many laws created and enforced to help protect drivers on the road.