Good2Go Car Insurance Review [Rates, Coverage, & More]

Good2Go insurance reviews are positive with the Better Business Bureau, but the company doesn't have good customer reviews. Good2Go insurance rates can be cheap for minimum coverage policies, but this isn't the case in every state. Learn more about Good2Go insurance and compare insurance quotes below.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Nov 25, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 25, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- AM Best Rating: NR

- Monthly Rates From: $40-$100

- Types of Coverage: Aircraft, Auto, Commercial Auto, Earthquake, Flood, Homeowners

- Customer Service & Claims Number: 877-200-9912

Good2Go Insurance Average Monthly Rates vs U.S. Average

| Coverage Type | Good2Go | U.S. Average |

|---|---|---|

| Full Coverage | $100 | $119 |

| Minimum Coverage | $40 | $45 |

| Company Overview | Details |

|---|---|

| Year Founded | 1992 |

| Current Executives | CEO: Joe DeLago |

| Number of Employees | 251-500 |

| HQ Address | 2018 Powers Ferry Road SE, Ste 400 Atlanta, GA 30339 |

| Phone Number | 1-800-777-6664 |

| Company Website | https://www.good2go.com/ |

| Direct Premiums Written | $235.2 million worth |

| Best For | High-risk insurance Minimum insurance coverage |

Uncovering the Financial Aspects of Cost of Good2Go Car Insurance

When considering an auto insurance policy, cost is a pivotal factor that influences one’s decision. The price of Good2Go Car Insurance is determined by several key factors, which include your driving history, the type of coverage you need, your location, and more. Here are the crucial elements that influence the cost of Good2Go Car Insurance:

- Driving record: Your history as a driver plays a significant role in determining your insurance cost. If you have a clean record with no accidents or violations, you are likely to pay lower premiums.

- Coverage type: The level of coverage you choose affects your insurance cost. Good2Go offers various coverage options, from basic liability coverage to comprehensive policies, and the more coverage you select, the higher your premiums will be.

- Vehicle type: The make and model of your car are considered. More expensive or high-performance vehicles often come with higher insurance costs.

- Location: Your geographical location can impact your insurance cost. Areas with higher accident rates or crime may have higher premiums.

- Deductible amount: The deductible is the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premium, but it means you’ll pay more in case of a claim.

- Discounts: Good2Go may offer various discounts that can reduce your insurance cost. These can include safe driver discounts, multi-policy discounts, and more.

- Age and gender: Younger, less experienced drivers often pay more for insurance. Additionally, statistics show that gender can affect premiums in some locations.

- Credit score: In some states, your credit score can impact your insurance rate. A higher credit score may result in lower premiums.

- Driving habits: The number of miles you drive annually and your primary use for the vehicle can also influence your insurance cost.

Understanding these factors and how they impact your premium can help you make an informed decision when choosing your car insurance policy.

We’ll take a tour through Good2Go’s ratings, take a look at Good2Go’s partners, get into what its employees think about them, touch on rates, and more.

It’s comprehensive. Ready?

Before we get started, use the tool above to find the best rates for your area.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Exploring the Array of Coverage Choices Provided by Good2Go Car Insurance

We know that coverages and discounts are important to you. Getting the right coverage keeps you financially secure if an accident or incident happens. That means you and your family are safe. Getting discounts gives you the best rates.

While most companies make both of their coverages known before the quote process, Good2Go only makes it discounts known. We ran through the quote process to get access to the coverages.

Let’s get started.

Good2Go offers three types of insurance coverage, like most companies. They can be divided into personal auto coverages, vehicle coverages, and special auto coverages.

| Personal Auto Coverage | Purpose | Example |

|---|---|---|

| Bodily Injury Liability | Will pay for the other drivers' medical bills/loss of income in an accident you caused | When the 25-year-old rock star you hit has broken his strumming hand |

| Property Damage Liability | Will pay for the damage to the property in an accident you caused | When the policeman insists you pay for hitting his vehicle |

| Personal Injury Protection | Pays for your medical bills/loss of income after an accident | When someone T-bones you and you get a strained neck |

| Uninsured Motorist | Helps you when you are in an accident with a driver who's uninsured | Because drivers in American have no chill |

| Underinsured Motorist | Helps you when you are in an accident with a driver who's underinsured | Because some drivers in America have more chill than others |

| Medical Payments | Helps pay for you and your passengers' medical costs after an accident | When the hospital comes a-callin' |

Good2Go offers all the basic coverages for personal auto insurance.

The quotes process populates with the basics. It then gives you the option to have a quote with UM/UIM, PIP, or MedPay.

| Vehicle Coverages | Purpose | You might need it: |

|---|---|---|

| Collision | Pays for damages to your car in a collision with an object or vehicle | When an 80-year-old woman strikes your car from the rear |

| Comprehensive | Pays for damages to your car for situations not involved in a collision (theft, vandalism, etc.) | When a 16-year-old kid spray-paints your car |

Good2Go offers quotes for comprehensive and collision coverage.

| Special Auto Coverages | Purpose | You might need it: |

|---|---|---|

| Emergency Roadside Assistance | Will pay for when you need a tow, jump start, or more | When it's pouring rain and you're stranded on the side of the road |

Just emergency roadside assistance is available through Good2Go’s quote process.

Maximizing Your Savings and Discounts With Good2Go Car Insurance

Good2Go offers seven discounts. They can be divided into driver discounts and policy discounts.

| Driver Discounts | Details | Percent Saved |

|---|---|---|

| Defensive Driver | Must complete state-certified course | 5-15% |

| Good Driver | Review and monitoring of driving habits | 10-35% |

| Student Driver | Must maintain a B average or above | 5-20% |

Two of the three are based on a customer’s driving record or on improving driving habits.

| Policy Discounts | Details | Percent Saved |

|---|---|---|

| Homeownership | Must own a home | 5-10% |

| Multi-Vehicle | For two cars or more | 10-25% |

| Paid in Full | When paying for your entire policy | 5-10% |

| Renewal | When you remain an active customer | 3-5% |

Homeownership is somewhat demographic, and the other three either involve doing more business with the company or making things procedurally easier.

Navigating Good2go Car Insurance: A Smooth Claims Process

Ease of Filing a Claim

When it comes to filing a claim with Good2go car insurance, customers have several options available to them. They can file a claim online through the company’s website, call the customer service hotline, or use the mobile app for a convenient and quick claims process. This flexibility allows policyholders to choose the method that suits their preferences and needs.

Average Claim Processing Time

The average claim processing time with Good2go car insurance can vary depending on the nature of the claim and the specific circumstances. While the company does not provide specific data on claim processing times, customers can expect their claims to be handled as efficiently as possible. Good2go aims to get policyholders back on the road promptly, but actual processing times may differ based on individual cases.

Customer Feedback on Claim Resolutions and Payouts

Customer feedback plays a crucial role in assessing an insurance company’s performance in claim resolutions and payouts. Unfortunately, Good2go car insurance receives mixed reviews from customers in this regard. Some policyholders express satisfaction with the company’s claim resolutions and prompt payouts.

However, there are also complaints about difficulties in reaching customer service, delayed claim processing, and unsatisfactory outcomes. Customer experiences may vary, and it’s essential for potential customers to consider these factors when choosing an insurance provider.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Good2go Car Insurance: Unveiling Innovative Digital and Technological Features

Mobile App Features and Functionality

Good2go offers a mobile app to enhance the convenience and accessibility of its services. The app is designed to provide policyholders with various features and functionalities, including the ability to manage their insurance policies on the go.

Through the mobile app, users can access their policy information, view payment history, and even file claims directly from their smartphones. It serves as a valuable tool for those who prefer to handle their insurance-related tasks digitally.

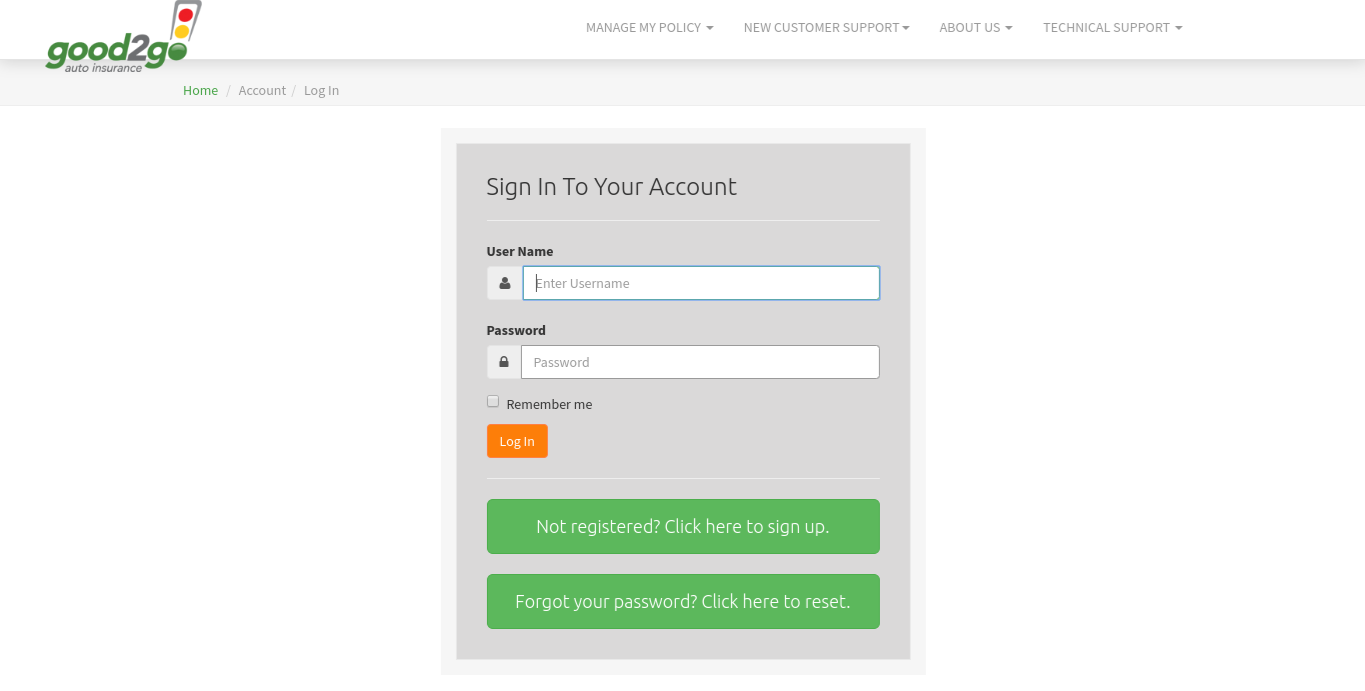

Online Account Management Capabilities

Managing insurance policies online is a key aspect of Good2go’s digital presence. The company’s online account management capabilities allow policyholders to log in to their accounts via the website. Here, they can review policy details, make payments, update personal information, and track claims. This online portal offers a user-friendly interface for efficient policy management.

Digital Tools and Resources

In addition to the mobile app and online account management, Good2go provides digital tools and resources to assist policyholders. These resources may include educational materials, FAQs, and guides to help customers better understand their insurance policies and coverage options. Having access to such digital tools can empower policyholders to make informed decisions and navigate their insurance needs effectively.

Customer Reviews for Good2Go Car Insurance

Customers have expressed mixed opinions about Good2Go Car Insurance. Some laud the affordability and the ease of obtaining insurance for high-risk drivers, while others criticize the website’s outdated design and the process of being redirected to Everquote for quotes.

Additionally, difficulties in reaching customer service and issues with the claims department have left some customers feeling frustrated. Ultimately, Good2Go may be a viable option for those with few alternatives, but it comes with notable drawbacks.

History and Mission for Good2Go Car Insurance

Good2Go Car Insurance was established with the objective of providing accessible and flexible insurance solutions to drivers, especially those facing challenges securing coverage elsewhere. Founded in 2011, the company aimed to address the needs of high-risk drivers and individuals seeking affordable options.

Over the years, Good2Go has partnered with several insurance underwriters to broaden its reach and offer a range of coverage options, striving to maintain a reputation as a reliable choice for those seeking minimum insurance requirements and a smooth, uncomplicated insurance process.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Good2Go’s Rating Agency

There’s not much out there on Good2Go when it comes to rating agencies. Here, we’ve got the Better Business Bureau (BBB), a document from the S&P, and overall customer ratings.

But they paint a picture that is not the most comforting.

Better Business Bureau

BBB gives an A rating to Good2Go auto insurance. This rating is its second-highest, after A+, and is based on a scale that factors complaint history, transparent business practices, and advertising issues.

The customers give it 1 star out of 39 reviews. We’ll get to that in a moment.

S&P Rating

The companies that underwrite Good2Go elected to remove their companies from S&P ratings earlier this decade. Some suggest that the reason was their flagging financial ratings.

That does not inspire confidence.

In 2018, S&P Global did an article overviewing the financial struggles of American Independent Insurance Company (AIIC), which does business under Good2Go’s name.

The findings were not indicative of a smartly run company.

According to S&P Global, which looked at data from the company’s financial reports, in 2017 the AIIC had to submit a report to regulators, as its capital had fallen well below its legal threshold.

This report, a corrective action, detailed a series of steps the company would take to increase its policyholders’ surplus, following consistent losses between 2016 and early 2017.

The statistics did not bode well at that time.

- $40.4 million net loss in 2016

- A surplus of $18.6 million at end of 3Q compared to $37.6 million at end of 2Q

- An underwriting loss of $36.8 million between January 1, 2017, and September 31, 2017

AIIC wrote that it was experiencing negative margins and cash flow. Its goal to combat this was to increase rates and reduce underwriting expenses.

So, how does all this affect you as a consumer?First, a company with these kinds of financial struggles, if they are not an aberration, can signal future bankruptcy.

Second, a company that has negative margins has a couple of options to make them positive. One of the most easily available is to raise rates.

And third, a company with a poor capital ratio with its consumers may not be able pay out on claims.

But we’ll get to all of that later in the article.

Customer Ratings

On other sites, Good2Go is consistently ranked with less than two stars. This is the case with the customers at BBB as well, with an emphasis on bad customer service.

- From Madison S (July 10, 2019): Awful company. I’ve been using this insurance bc it’s cheap and easy but I can never get on the phone with them. It’s ridiculous.

- From Maria C (July 7, 2019): You cant get customer service on the phone. You cant get your insurance ID cards on time, resulting in summons despite paying on time.

Other sites show similar concerns.

Good2Go’s Position for the Future

Position for the future can be financial, how many premiums are being written, or what its market share is. Without knowledge of the latter, we’ll go with financial.

A part of Good2Go’s business structure that is unique is that it does none of its underwriting in-house. It outsources it to partner companies, each of which is fairly small, except for one.

- American Independent Insurance Company

- Bankers Independent Insurance Company

- Bristol West Insurance Group

- Dairyland Auto Insurance Group

- The General Insurance

- Kemper Auto

- Personal Insurance Service Company

- Plymouth Rock Management Company of NJ

- Progressive

Read more:

- American Independent Insurance Company, A Good2Go Company Car Insurance Review

- Bankers Standard Insurance Company Car Insurance Review

- Bankers Specialty Insurance Company Car Insurance Review

- Bankers Insurance Company Car Insurance Review

You may ask, “What is the big deal with this?”

Underwriting is a process that takes a look at the risk of loss presented by someone seeking insurance and then decides if the risk is acceptable or not and if it is how much premium should be charged.

As stated earlier, the partners of Good2Go had their names withdrawn from major rating agencies. This was due, most likely, to the companies’ poor ratings.

Companies with poor ratings have a high credit risk, meaning they are less likely to meet their current and future insurance obligations.

This means they might not be financially able to pay out on claims.

According to the document by the S&P, the financial outlook of some of Good2Go’s partners (everything under the secondary AIIC umbrella) was poor.

They were losing money, suffering from underwriting expenses, with a low capital compared to its customers’ premiums. This meant they would struggle to pay out on claims.

It is possible Good2Go and its partners have reversed this. They may be on their way to financial solvency and growing in terms of premiums. It’s impossible to know.

In conclusion, the general climate around them, from reviews to customer ratings to news, is not positive. That can certainly impact an organization and its public image.

Ultimately, it’s just guesswork and hypothesizing. But the available signs aren’t pretty.

https://www.youtube.com/watch?v=fwnyOH7v_Cs

Good2Go’s Commercials

We know most insurance companies by their commercials. Geico has the Gecko, Progressive has Flo, and State Farm (which is probably overhauling its commercials) had the two stars from the Houston Rockets.

Good2Go has a different kind of commercial. It’s oriented around everyday people who could use car insurance.

A father getting a gift for his daughter:

Taking a sick daughter to the doctor:

Having to take the subway and bus:

Good2Go’s Employees

How employees feel about a company is often indicative of its inner culture and attitude of management. Employees are not positive about Good2Go. Employees on Indeed.com gave it a two and a half out of five stars.

| User Prompt | Rating (out of 5) |

|---|---|

| Overall Rating | 2.5 |

| Work-Life Balance | 2.2 |

| Pay & Benefits | 2.6 |

| Job Security & Advancement | 2.2 |

| Management | 2.3 |

| Culture | 2.3 |

There are just six reviews, making it hardly representative. However, a quick look at the titles reveals a mixture of feelings toward their employer.

- The place is just ok.

- Run far away

- Great working environment

There’s a slightly larger sample size on Glassdoor, a total of 18 reviews. The reviewers hold or have held a variety of positions, including QA analyst, territorial manager, and claims adjuster.

| User Prompt | Details |

|---|---|

| Rating | 2 out of 5 |

| Recommend to a Friend | 31% |

| Approve of CEO | 0% |

A two-out-of-five rating isn’t exactly sterling. A quick look at the titles of reviews shows another mix of feelings toward Good2Go.

- Cubicle Life

- Work at your own risk

- Poor Leadership

In general, not very positive. However, many top insurance companies have some of the same reviews and even though their ratings are higher, it’s usually not by much.

Good2Go’s Programs

If there is one thing Good2Go is an advocate for, it’s safe, non-distracted driving. To that end, it offers its LifeSaver app, which has been around a little over a year.

It is a discount app, meaning that as you use it to correct your behavior, it could be earning you discounts. It does this by pairing with the Cell Phone Safety Discount.

Ted Chen, Lifesaver’s co-founder, said, “LifeSaver is simple to set up, installs in seconds and proactively teaches drivers not to manipulate their phones behind the wheel.” He adds, “What’s more, it allows for setting of guidelines and monitoring of a loved one’s driving behavior”

CEO of Good2Go, Joe DeLago, said of the app, “It’s a simple way for our direct policyholders to ignore the urge to use their phones while driving and save money on their auto insurance….”

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

Cheap Car Insurance Rates

We know Good2Go has a rate machine that can generate quotes from wherever you are in the country. But how much do we know about Good2Go’s actual rates and policies?

That’s what this section aims to answer.

Good2Go bills itself as two parts. The first is that Good2Go can find you the cheapest rates, where you can sign up policies with only $20 down. The second is its role as a high-risk insurance provider.

We’ll take a look at both, starting with the part about the cheapest rates.

An important note is that rates with Good2Go are referring to Good2Go and its partners, which are part of the Good2Go ownership umbrella.

Rates by State

What do “the cheapest rates” mean, generally speaking? Usually, if you were to boil each companies’ rates down, it means the minimum insurance coverage. And that means just liability insurance.

Liability insurance is what keeps you financially protected during an accident you caused. If you’re found at-fault in an accident, you’re responsible for all bodily injury and property damage. In other words, anything you hit and or injure except yourself, your own car and your own property.

The bare-bones minimum is just the amount required by the state. It’s often a relatively small amount of protection, such as $50,000 to cover the injuries or deaths of two or more people. And because it has a small amount of protection, it doesn’t cost much.

Good2Go offers more than liability. You can receive quotes for collision, comprehensive, and uninsured motorist as well, but they’re not required.

When you go through Good2Go’s quote process, you’ll get the minimum coverage as a starting point, which is why its rates are probably beneath that of many providers.

But how cheap is it? We have a couple of quotes to show you and a quick glimpse at the average liability coverage costs in all 50 states.

There is a little uncertainty as to which states Good2Go operates in, compared to its competitors. We know it operates in Georgia, Pennsylvania, and Delaware, however.

We were able to get two quotes from Good2Go, one in Pennsylvania and one in Delaware. This, to show the discrepancy in Good2Go’s costs per state.

Both sets of information were the same. The person was a 31-year-old male, with a good driving background and a good credit score. The vehicle was a 2015 Ford Fiesta SE.

In Delaware, the city was Castle Rock. In Pennsylvania, the city was Shippensburg.

Let’s see if its promises for $25 and a low rate were true for these two situations.

For Delaware: $488 down payment, $385 monthly payment, and $4,550 annually (PIP included)

For Pennsylvania: $88 down payment, $55 monthly payment, and $524.65 annually (Med Pay included)

PIP and MedPay were included because they are required insurances in those states.

The averages of basic liability in both states for 2015 were lower than Good2Go’s quotes. This data comes from our partner Quadrant, which has the inside track within the insurance industry.

- The average annual cost for liability in Delaware: $799.30

- The average annual cost for liability in Pennsylvania: $499.06

We’ll add PIP and MedPay to those totals at $43 per month and $30 per month, respectively.

| State | Good2Go Annual Rates | Rates From Our Data |

|---|---|---|

| Delaware | $4,550.00 | $1,315.30 |

| Pennsylvania | $524.65 | $859.06 |

Good2Go’s quote in Delaware is higher than our total. Our total in Pennsylvania is higher than Good2Go’s quote. Good2Go keeps one of its promises in the latter, but not in the former. And in neither case was a $25 down payment possible.

Is it possible to compare Good2Go’s quotes in every state to the average liability?

| STATE | Liability Coverage Cost (2015) |

|---|---|

| Alabama | $394.21 |

| Alaska | $539.68 |

| Arizona | $508.76 |

| Arkansas | $394.13 |

| California | $489.66 |

| Colorado | $520.04 |

| Connecticut | $650.94 |

| Delaware | $799.30 |

| District of Columbia | $628.82 |

| Florida | $857.64 |

| Georgia | $557.38 |

| Hawaii | $458.54 |

| Idaho | $344.29 |

| Illinois | $446.72 |

| Indiana | $382.68 |

| Iowa | $299.18 |

| Kansas | $358.24 |

| Kentucky | $529.21 |

| Louisiana | $775.83 |

| Maine | $338.87 |

| Maryland | $609.74 |

| Massachusetts | $606.04 |

| Michigan | $795.32 |

| Minnesota | $456.82 |

| Mississippi | $460.50 |

| Missouri | $415.88 |

| Montana | $386.29 |

| Nebraska | $364.64 |

| Nevada | $681.56 |

| New Hampshire | $400.56 |

| New Jersey | $869.57 |

| New Mexico | $488.03 |

| New York | $804.51 |

| North Carolina | $359.42 |

| North Dakota | $298.18 |

| Ohio | $397.11 |

| Oklahoma | $461.01 |

| Oregon | $584.13 |

| Pennsylvania | $499.06 |

| Rhode Island | $759.80 |

| South Carolina | $527.09 |

| South Dakota | $300.22 |

| Tennessee | $413.91 |

| Texas | $528.75 |

| Utah | $497.53 |

| Vermont | $343.12 |

| Virginia | $425.61 |

| Washington | $596.67 |

| West Virginia | $491.83 |

| Wisconsin | $374.37 |

| Wyoming | $321.04 |

Read more:

- The Ultimate Alaska Car Insurance Guide (Costs + Coverage)

- The Ultimate Arkansas Insurance Car Guide

- Top 10 Louisiana Car Insurance Companies

- General Casualty Company of Wisconsin Car Insurance Review

- California General Underwriters Insurance Company, Inc. Car Insurance Review

That is a quick glimpse. Again, it’s not apples to apples. It may be imperfect, but it can give you a barometer from which to compare.

Male vs. Female Rates

If you’re labeled a high-risk driver, often you’ll be required to get an SR-22 or an FR-44. These are forms of financial responsibility. They prove you have insurance.

Getting that piece of paper can be tough. Insurers are less willing to cover high-risk drivers, as they are more likely to file claims. If you’re looking, you may be denied by certain companies.

That’s where Good2Go’s promise comes in. It markets itself as a high-quality market for high-risk drivers. This means you should be able to receive good rates from Good2Go or EverQuote.

There are a few factors that influence your status as a high-risk driver. We’re going to cover three. One of those is age.

If you’re new to driving, especially if you’re young, you have a higher possibility of being labeled a high-risk driver. A lot of this has to do with inexperience. However, there is a question about age.

Young people are prone to higher levels of risk-taking. Impulse control is weaker and feelings of immortality may be stronger in young people than in adults.

Hence, they may drive without much experience and take many risks.

We have data from Quadrant on 17-year-olds, which are some of the most inexperienced of the bunch. And, in terms of companies, we have the lowest rates for that age group, the ones that Good2Go would need to beat.

Both genders are over $5,500, which are the lowest rates at the highest end. Some companies, like Liberty Mutual, charge $10,000 or more per gender for 17-year-olds.

The next bracket is 25-year-olds, around $2,200 for both males and females.

Credit History Rates

If you have a poor credit history — one that has shown defaulting on credit cards, failing to pay home loans, and having your car repossessed — you might be more likely to have to get an SR-22.

The reason is that car insurance companies look at credit histories to predict the likelihood you’ll file a claim. They use their own models to do so, pulling from your credit history, according to Consumer Reports.

The average rate for a poor credit score among the top 10 companies is $5,150.76.

Liberty Mutual is the highest at $8,802.22. Nationwide is the lowest at $4,083.29. USAA is not included in the high-low calculations because it only serves a specific group in the population.

Good2Go needs to be lower than Nationwide to live up to its promise.

Driving Record Rates

If you’re convicted of a DUI, have too many reckless moving violations, or have been in an accident without insurance, you may be required to get an SR-22.

This may be spelled out as an automatic consequence if you were to look at your state department website and depending on the offense.

DUIs lead to the highest rate jumps, according to our calculations. Ironically, they are typically lower than rates for a poor credit score.

Liberty Mutual has the highest at $7,613.48. State Farm has the lowest at $3,636.80.

Good2Go needs to be lower than State Farm to live up to its promise.

Canceling Your Policy

If you’re frustrated with your current insurance provider, you may think about canceling your policy, but you may find the lack of information on doing so frustrating.

We understand and have got you covered. Canceling a policy should be a simple process but some companies give little information about how to do it. That’s why we’ve set up this step-by-step guide to canceling your policy. It has an emphasis on Good2Go, but the practices here are pretty standard.

Let’s rock and roll.

Cancellation Fee

Good2Go doesn’t give much out about its cancellation policy procedures.

There is uncertainty as to whether there’s a cancellation fee. However, this can be rare, unless you’re canceling well before your policy is supposed to end.

Is there a refund?

Generally, prorated refunds are issued when you cancel your policy.

Although this has a serious impact when talking about six-month or year-long plans, Good2Go’s plans are generally month-to-month.

There is likely a refund policy, but you won’t be affected as much as you would if you were with another company.

How to Cancel (Step-by-Step Guide)

But even if you’re ready to cancel your policy, there are things you should consider. There are the personal impacts, the legal impacts, and who you’d need to contact. This is a five-step step-by-step guide to answer those questions.

Step #1 Decide What Time Is Right for You

First, you should decide whether this is the right time to cancel your policy. There are three standard situations where you might want to cancel:

- You’re moving. It may be time to change policies or providers or you just can’t take your current plan or provider with you.

- You’re putting the car into storage. You may be looking to go green, get more exercise walking around, or moving overseas. If you don’t use the car, you won’t need insurance on it.

- You dislike your provider. Its customer service is terrible, it won’t fulfill claims, and its website isn’t user-friendly. You want to switch.

Step #2 Cancel Old Policy

To actually cancel, you’ll need to talk with your company. Most companies refer you to their agents first. Good2Go, however, doesn’t have any in-person agents to talk to.

Good2Go gives some instructions on its FAQ page:

- Call customer service at 1-888-303-3430

- Email customer service at [email protected]

This is a sticking point in many of the customer reviews. Reaching Good2Go’s customer service, whether to cancel or to deal with a claim, is difficult.

People have reported calling and leaving messages for weeks. Others have reported reaching someone, only for them to be rude and hang up on them.

Emailing might be your best option, but some people have reported no responses to emails for months as well.

Step #3 Avoid These Two Mistakes

There are two mistakes people make when canceling their insurance:

- Canceling without another plan in place. If you have a car registered, it must be insured at all times. This is true for almost every state.

- Just stop paying your policy and expect the policy to be canceled. Generally, yes, your policy will be canceled. But you might pay for the grace period, a period after you stop making payments before they cut off the policy. And it’s unknown how Good2Go would respond to this situation in the first place.

The insurance provider has a legal obligation to notify the DMV when you cancel your policy. If you don’t have a new one by the time the old one ends, you’ll have to answer to the government.

Step #4 Contact Necessary Parties

You’ll want to contact the DMV if you’re moving to a new state and the lienholder on your car if you have one. Essentially, anyone who has a legal or financial stake in the car.

When can I cancel?

Any time.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

How to Get a Quote Online

Getting a quote may be your first step to selecting your new car insurance company. It cuts right to the meat, that big rate number you need to make a decision.

With most companies, this is easy. With Good2Go, it can be a little bit confusing, if for no other reason than you don’t know where your quote is coming from.

We’ll take you step-by-step through the process.

Go to the Good2Go Homepage

It pulls up like this, with an easily accessible way to get a quote. Enter your zip code in the bar and click Go.

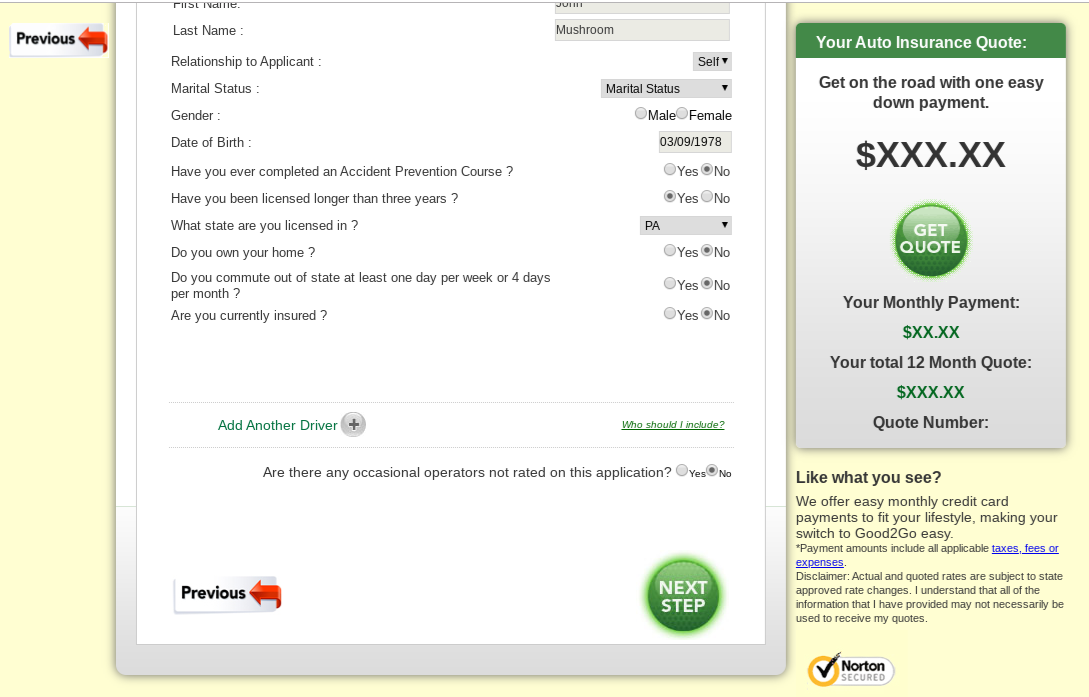

Insert Your Personal Information

If you’re successful and can find coverage with Good2Go, it’ll pull you to this page.

Look for the word direct in your address bar to make sure you’re still with Good2Go. There’s a chance you’ll be pulled to a whole separate page with the word “EverQuote” in the address bar.

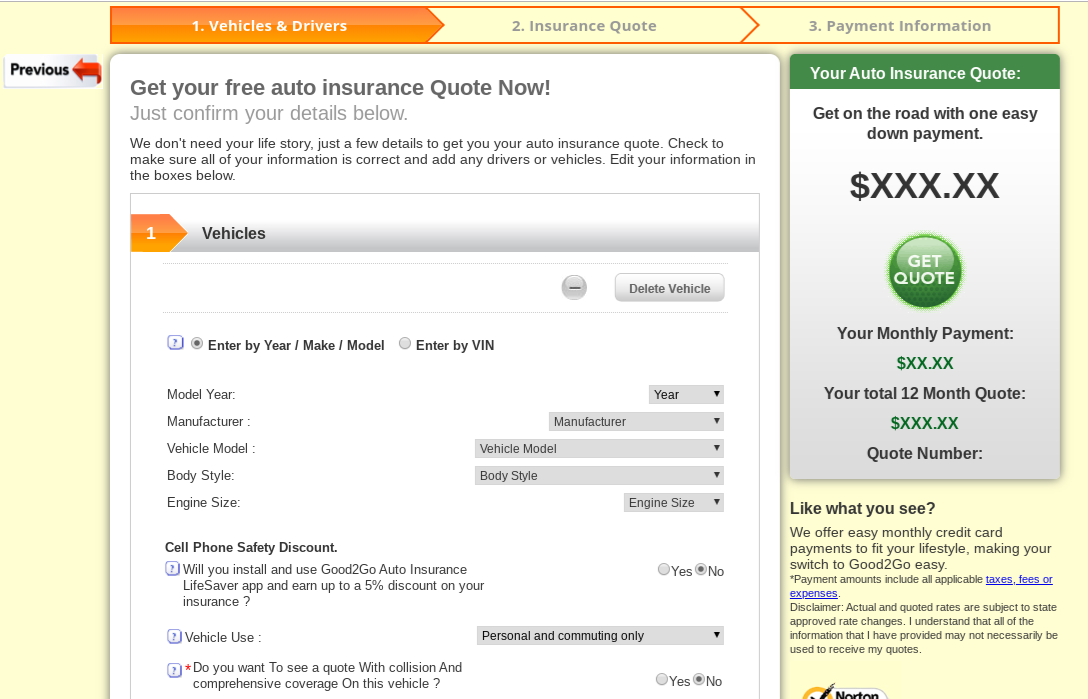

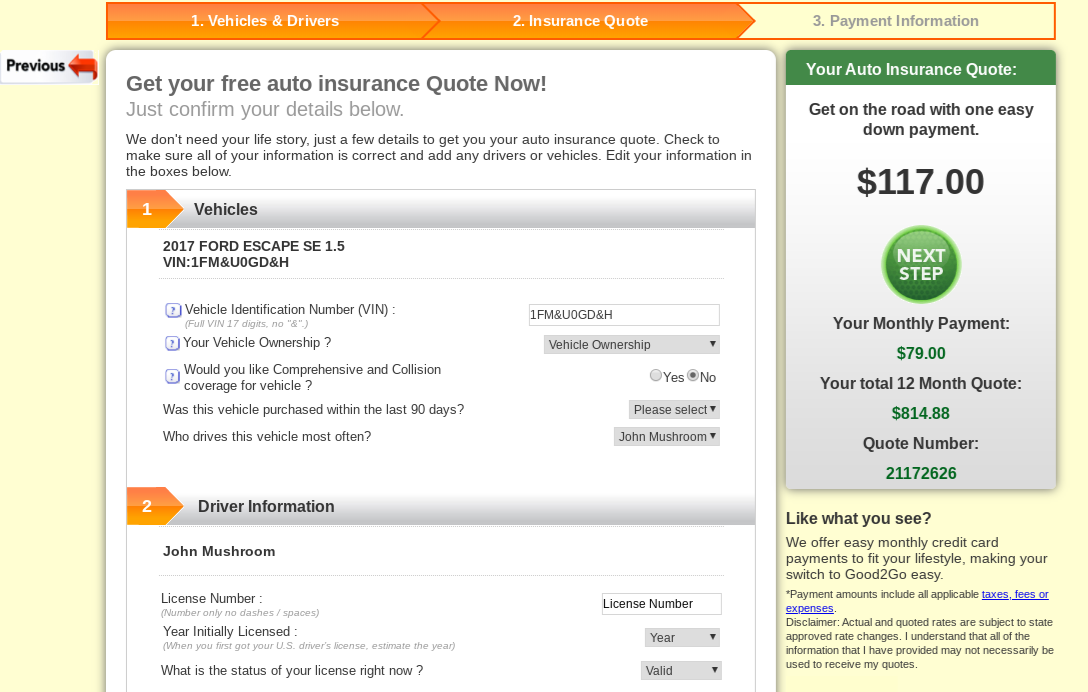

Fill Out Your Vehicle and Driver Information

When it comes to vehicle information, you can put in your VIN number.

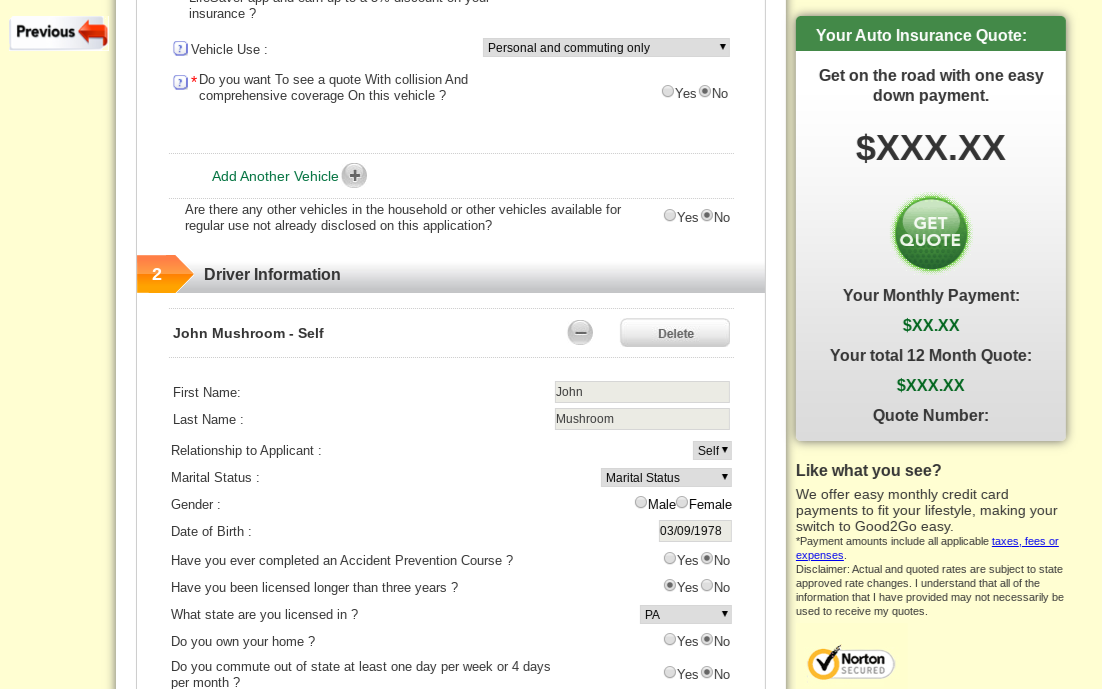

Enter your driver information.

Finish with some general questions, like if you own your own home. Some of these can lead to discounts.

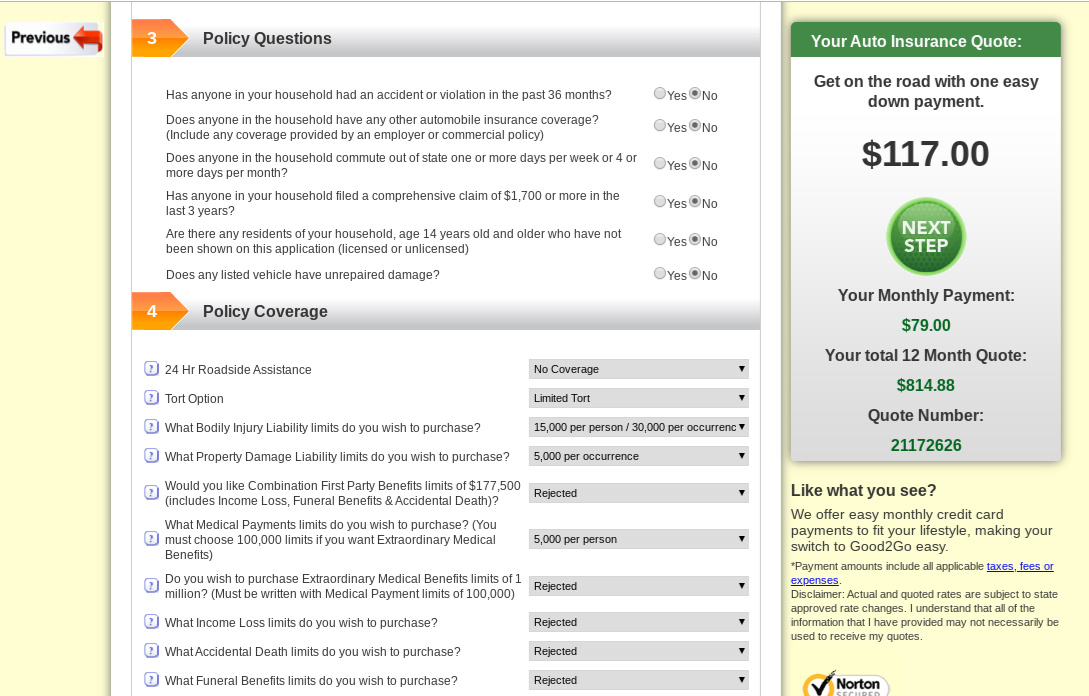

Finish Your Quote

Review your vehicle information and start answering some additional driver information questions.

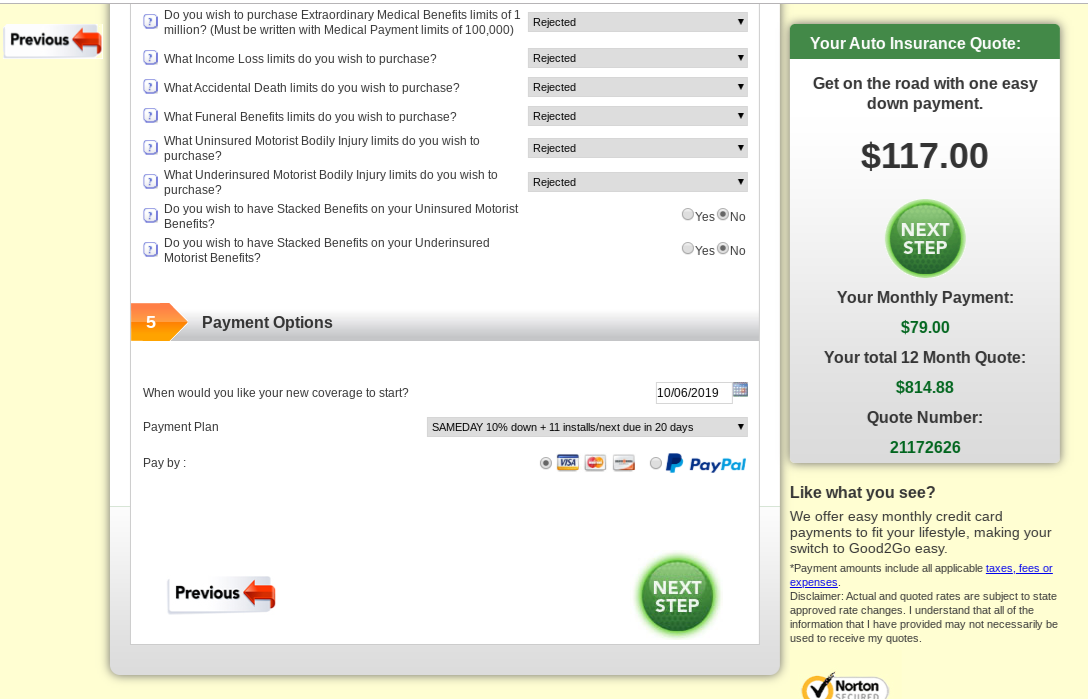

Answer some policy questions and make adjustments to your policy.

Finish with your payment method.

Design of Good2Go’s Website

The website is every company’s online storefront, a place where people can find information, interact with the company, and manage their accounts.

How does Good2Go’s rank? First, when you type in https://www.good2go.com you’ll be brought to the homepage. You have a couple of options from there. If you’re looking to manage your account, you click on that orange tab. It takes you to this page.

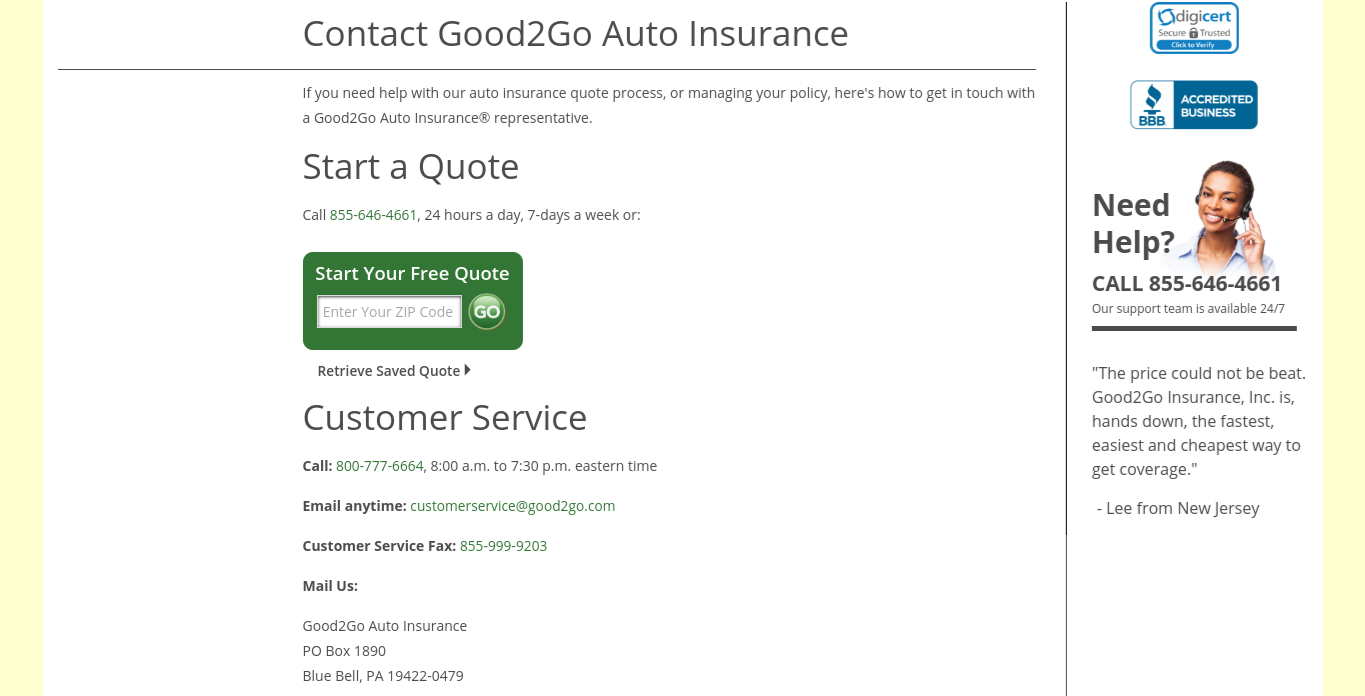

If you’re looking to contact the company, you can click on its orange contact tab. It takes you to this page.

If you’re looking for general information about car insurance topics, you’ll want to scroll down on the homepage and find the blog link. It takes you here.

How easily can you find answers?

Not very.

There are few options on its main navigation bar, there is no search bar or button, and there’s a cluster of links at the bottom that are hard to read due to the font color and layout.

Then there’s the issue of finding a quote.

As far as answers when you look for a quote, if you cannot find one through Good2Go, you are taken to EverQuote, which is a separate company. It generates quotes for companies all around the country.

Is that system easy to manage?

Not very. The quote generator will have you input all the information as if you were using the Good2Go’s quote process. After, it will generate a few companies from which you can get quotes from. If you click the “see my quote” button, it’ll take you to their page.

At that point, it’ll either give you the quote, pulled from your information from the generator, or will have you input all your information over again.

There’s also the issue of privacy. When you go through the EverQuote process and reach the final page, you’re consenting to receive phone calls and emails from dozens of other companies.

It’s in the fine print.

Is the design a plus or minus?

A minus. The website looks like something out of 2005.

Pros & Cons

| Pros | Cons |

|---|---|

| Good2Go’s quote process is simple | The split between and EverQuote is confusing |

| It specializes in minimum insurance and high-risk drivers | It may not write premiums in many states |

| It offers the standard personal auto insurance coverages | It outsources its claims process to companies with questionable financial ratings |

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

The Bottom Line

Good2Go should be considered a last resort for most people. Its website is laid out poorly. Its quote system is split between itself and EverQuote, leading to confusion as to which one you’re using.It outsources its underwriting process to partner companies that withdrew their names from major credit rating agencies. For the two quotes we pulled, it did not fulfill its promise on just $25 down to get insurance.

And its claims and customer service departments are notoriously tough to reach, according to some customer reviews. If you have to have insurance and can’t get it anywhere, Good2Go might be for you. Good2Go might be a market for those looking for high-risk insurance. It is considered a last-ditch market compared to the regular market and state programs, but it can be considered an option.

Good2Go Car Insurance FAQs

Every car insurance company brings up questions. Here are five about Good2Go.

Who underwrites Good2Go?

Its partners. They are American Independent Insurance Company, Bankers Independent Insurance Company, Bristol West Insurance Group, Dairyland Auto Insurance Group, The General Insurance, Kemper Auto, Personal Insurance Service Company, Plymouth Rock Management Company of NJ, and Progressive.

Who owns Good2Go?

Good2Go’s ultimate parent company is Inverness Management LLC, which is “a privately held investment firm that provides equity for leveraged acquisitions, recapitalizations, and companies seeking additional strategic capital.”

What is Good2Go insurance?

Good2Go Insurance offers the standard five personal auto coverages (bodily liability, property liability, PIP, Med Pay, and UM/UIM) along with collision, comprehensive, and emergency roadside assistance. It markets itself towards those want minimum insurance and high-risk drivers.

How does Good2Go work?

You pay month-to-month (though you get a discount if you pay in full) and receive support for claims. In a larger sense, it hands off some of its core business functions to other companies, which may put it in a financially weaker position.

How do I cancel Good2Go insurance?

You can call customer service at 1-888-303-3430 or email them at [email protected]. Other customers have reported that it takes sometimes weeks or months from them to respond back.

Before making any final decisions on your insurance company, it is important to learn as much as you can about your local insurance providers, and the coverages they offer. Call your local insurance agent to clear up any questions that you might have. Questions to consider asking include, “What is the best coverage plan for me/my family/my situation?” “What are the minimum coverage requirements in my state and what form of coverage do you recommend?” “Do you guys offer any bundle discounts if I take out both my auto insurance and home insurance with you?” and “What is the average rate of insurance quotes you guys offer?”

Before making any big insurance decisions, use our free tool to compare insurance quotes near you. It’s simple, just plug in your zip code and we’ll do the rest!

Curious what other options are available? Use the tool below to find the best rates near you.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.