Idaho Car Insurance (Coverage, Companies, & More)

Idaho car insurance costs nearly 50 percent less than the national average, with Idaho car insurance rates averaging at a little over $56 per month. Start comparing Idaho car insurance companies now with this guide to find the absolute best coverage for you. Enter your ZIP code below to get free Idaho car insurance quotes.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Nov 3, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 3, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Idaho Statistics Summary | Details |

|---|---|

| Road Miles | 48,902 |

| Registered Vehicles | 1,696,496 |

| State Population | 1,754,208 |

| Most Popular Vehicle | Ford F150 |

| Uninsured Motorists | 8.20% |

| Driving Fatalities (Total) | 244 |

| Speeding Fatalities | 48 |

| DUI Fatalities | 60 |

| Average Annual Premiums | Liability: $344.29 Collision: $219.05 Comprehensive: $116.55 Combined: $679.89 |

| Cheapest Provider | State Farm |

When most people think of Idaho, the second word they think of is potatoes. Idaho produces one-third of America’s potatoes. There is a lot more to Idaho than just their potatoes.

There are two places in the world that garnet, the red stone gem, is largely abundant. Those two places are India and the great state of Idaho. Idaho is known as “The Gem State” due to 72 different gems that can be found in the state.

Read more: Gem State Insurance Company Car Insurance Review

Idaho has about 4,522,506 acres of wildlands, meaning no roads in those areas. But with 82,747 square miles of land, there is still a lot of area for cars to travel.

That is where we come in. Researching and trying to figure out insurance needs can be a difficult task. It is hard to know what effects your rate and who has the best coverage for your needs.

Imagine a world that you didn’t have to spend hours googling the best rates. Well, you’ve got it here. We are going to break down all the insurance information you need if you are driving in Idaho and need help figuring out where to state for your insurance. We make it so easy you can enter your zip code here and use our free comparison tool for quotes.

If you’re ready to start comparing now, enter your zip code above to get started.

Idaho Car Insurance Coverage and Rates

Cost is usually the first thing most consumers will question when searching for insurance. That is a normal question when buying something that you hope you never have to use. If you do have to use it, you want the best company for your needs.

How much is it going to cost? We are also going to cover what type of coverages are needed to drive in Idaho along with some that aren’t required but might be good to take a look and see if you need them.

After we go over coverages, keep reading and we will cover the best companies in Idaho.

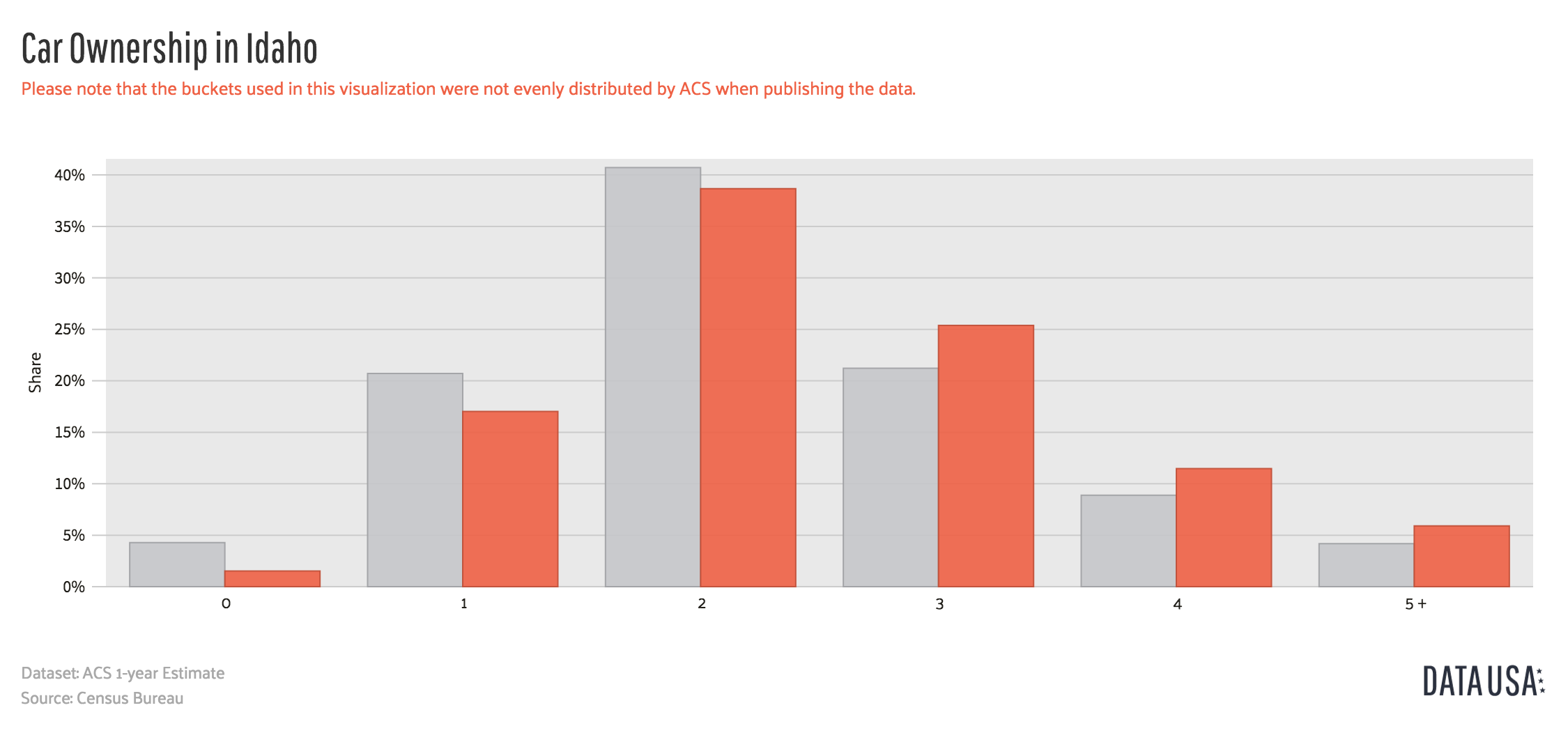

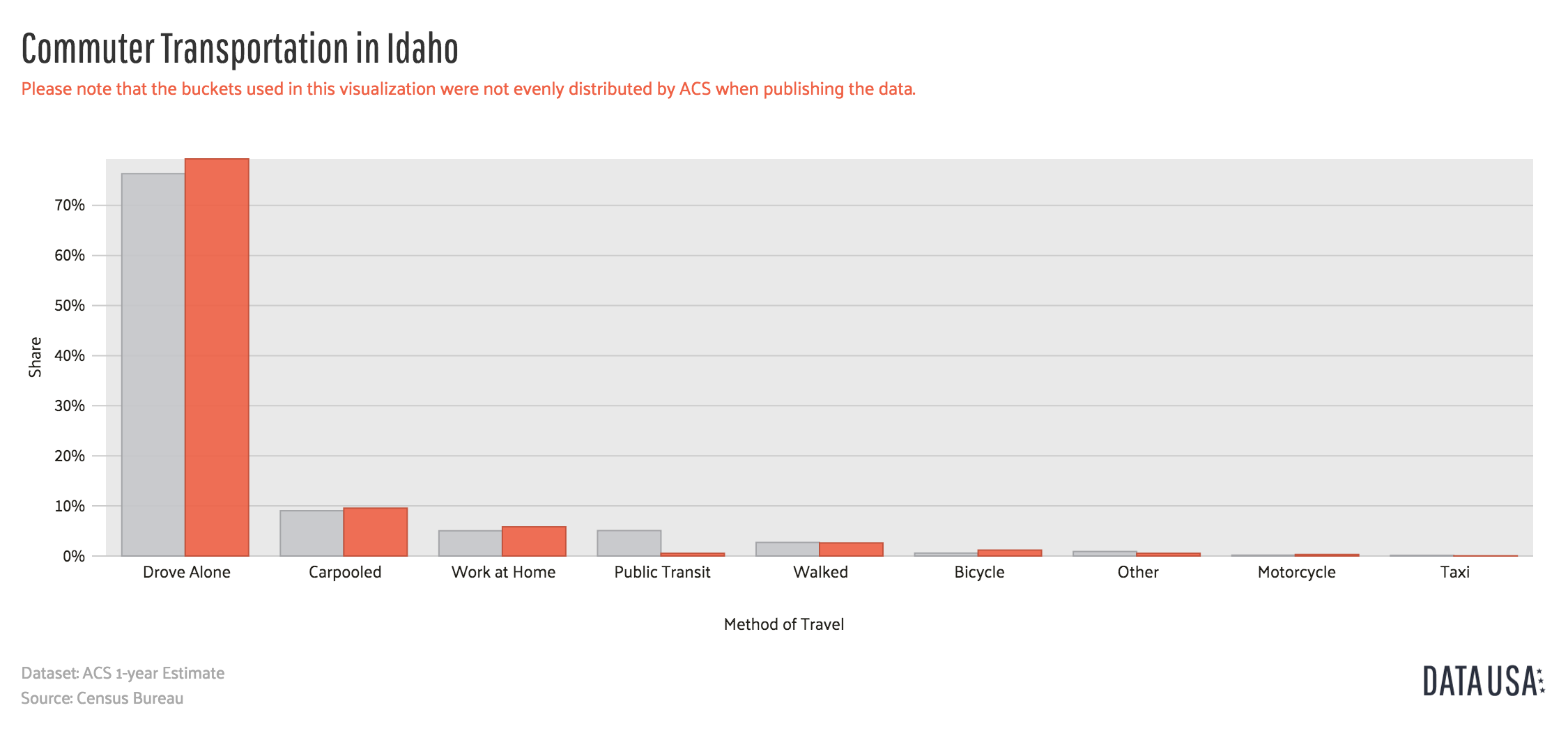

Idaho’s Car Culture

Idaho has some of the most gorgeous sites and views for drivers. Most driving occurs in rural areas taking boats and hauling trailers with mountain bikes. So it is no surprise most vehicles driven in Idaho are all-wheel-drive vehicles. The Subaru Outback sells at 275 percent of the national average.

Not only do you see a lot of crossovers and trucks on the road, but you also see a lot of bumper stickers on those vehicles. Idahoans travel a lot in their vehicles. And by a lot, we mean almost 2,000 miles more than the average American.

“According to the U.S. Department of Transportation Federal Highway Administration (FHWA), the average American drove 15,318 miles per year on their vehicles.”

So, there is a lot of driving happening in Idaho, so how much insurance is needed to keep you legal on the roads of Idaho? Let’s take a look.

Idaho Minimum Coverage

Most states, if not all, require a minimum amount of insurance on a registered vehicle being driven in their states.

Take a look at how state minimum car insurance rates vary from state to state.

| Insurance Required | Coverage |

|---|---|

| Bodily Injury Liability Coverage | $25,000 per person $50,000 per accident |

| Property Damage Liability Coverage | $15,000 per accident |

| Uninsured Motorist Coverage (unless rejected in writing) | Amount must equal selected bodily injury liability coverage amount |

While these are the minimum amount needed to be a legal driver, that doesn’t mean that this is the best amount of coverage drivers should have.

Remember, your insurance company can only pay up to the limits you have on your policy. So if you collide with a more expensive car or have serious medical bills, you could be held liable for those and be stuck with bills for yourself or others.

It is always smart to get quotes for higher coverages and see if it may be better for you to carry more and additional coverages. We will take a more detailed look at endorsements and additional coverages you can add as you continue to read.

Forms of Financial Responsibility

If you prefer to not have a traditional insurance policy, a driver can post an indemnity bond.

“The bond must guarantee payment of no less than $50,000 for any one accident, of which $15,000 is for property damage, for each vehicle registered, up to a maximum of $120,000 for five or more registered vehicles.”

Whichever option you chose, you must have some kind of financial responsibility when driving on the roads of Idaho.

Premiums as a Percentage of Income

Interested in seeing how much of your income should be devoted to your insurance premium? Check out the table below.

| Idaho Insurance and Disposable Income | 2012 | 2013 | 2014 |

|---|---|---|---|

| Disposable Income Amount (Average) | $31,589.00 | $32,312.00 | $33,600.00 |

| Full Coverage Policy Cost (Average) | $639.19 | $650.57 | $673.13 |

| Percent of Income Spent on Car Insurance | 2.02% | 2.01% | 2.00% |

Average Monthly Car Insurance Rates in ID (Liability, Collision, Comprehensive)

Let’s take a look at the average monthly car insurance rates.

Core coverages on an auto policy are basic coverages that most consumers opt to include in their policy. As you can see from the previous section, liability is a necessity to drive legally on the road. Liability coverage covers the other party if you are in an accident and are found at fault. If there is damage to your vehicle, it will not cover your car regardless of who is at fault.

Collision and Comprehensive will cover your vehicle if you are in an accident. They are deductible based coverages, meaning your insurance company will deduct the amout of your deductible from any payout you might be entitled to. The higher your deductible, the lower the premium will be.

Full coverage simply means you have all three coverages on your policy.

| Coverage Type | Idaho Average (2015) | National Average (2015) |

|---|---|---|

| Liability | $344.29 | $538.73 |

| Collision | $219.05 | $322.61 |

| Comprehensive | $116.55 | $148.04 |

| Full Coverage | $679.89 | $1,009.38 |

Idaho falls well below the national average for insurance costs.

Additional Liability

Other liability coverages include medical payments and uninsured/underinsured motorist coverage. Both of these coverages can be added to your required liability policy.

Medical Payments can be used for any medical needs for you or any passengers in your vehicle. Med pay coverage will pay out regardless of fault.

Uninsured and underinsured motorist coverage is just that, coverage if you are hit by someone either not insured or does not carry enough insurance.

Loss ratio is a commonly used term in the insurance world, but it may not be so common to the consumer. Loss ratio is the ratio of losses to earned premiums. For instance, if an insurance company writes $100,000 of premium and pays out $50,000 in claims, their loss ratio is 50 percent.

The higher the loss ratio the more a company is paying out for claims. That seems like it would be a good thing, but if it gets too high that means the company is no longer making money and may in financial distress. If the ratio is too low, that means the company may not be very good about paying out claims.

| Loss Ratio | Idaho (2015) | National (2015) |

|---|---|---|

| Medical Payments (MedPay) | 79.94 | 75.72 |

| Uninsured/ Underinsured Motorist Coverage | 59.20 | 75.11 |

Add-ons, Endorsements, and Riders

When it comes to your insurance policy, there are a lot of different add-ons and endorsements you can add to your policy. It is best to review all coverages and even talk to your agent to verify you are fully covered.

Below are some additional coverages you can add to your policy.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

Average Monthly Car Insurance Rates by Age & Gender in ID

Most parents cringe when their kids get their driver’s license. Some of that fear may come knowing their kids are spreading their wings and branching out into independence, but some fear comes from opening the mail with their new insurance premium.

Age and gender will affect your car insurance. Younger drivers are often in a high risk class. See if the gender stereotype (males pay more) holds true in ID.

It is a pretty well-known fact younger, inexperienced drivers have higher rates.

| Company | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $2,345.01 | $2,332.52 | $2,040.06 | $2,114.91 | $8,575.44 | $9,910.14 | $2,620.54 | $2,771.46 |

| American Family Mutual | $2,098.66 | $2,098.66 | $1,865.53 | $1,865.53 | $7,458.86 | $9,709.85 | $2,098.66 | $2,634.55 |

| Farmers Ins Co Of ID | $1,579.86 | $1,568.87 | $1,394.21 | $1,475.19 | $7,662.21 | $7,928.27 | $1,819.86 | $1,917.77 |

| Geico | $2,003.54 | $1,977.85 | $1,905.97 | $1,851.21 | $4,285.41 | $5,332.81 | $2,715.75 | $2,092.87 |

| Safeco Ins Co of IL | $1,441.66 | $1,555.14 | $1,167.08 | $1,303.18 | $4,638.27 | $5,157.45 | $1,530.65 | $1,618.67 |

| Depositors Insurance | $1,856.77 | $1,901.41 | $1,674.47 | $1,778.32 | $4,550.02 | $5,610.65 | $2,171.95 | $2,339.94 |

| State Farm Mutual Auto | $1,150.90 | $1,150.90 | $1,037.46 | $1,037.46 | $3,436.89 | $4,333.19 | $1,298.56 | $1,498.32 |

| Travelers Home & Marine Ins Co | $1,355.74 | $1,376.87 | $1,363.72 | $1,357.36 | $6,688.71 | $10,577.29 | $1,440.61 | $1,650.04 |

| USAA | $1,099.98 | $1,098.36 | $1,073.73 | $1,059.32 | $3,611.65 | $4,046.57 | $1,458.58 | $1,572.68 |

Read more:

- Farmers Insurance Company of Idaho Car Insurance Review

- The Travelers Home and Marine Insurance Company Car Insurance Review

- Depositors Insurance Company Car Insurance Review

Cheapest Rates in Idaho by Zip Code

Zipcode can also affect your rate. We have compiled rates for all Idaho zip codes. See where you zip code lands on the list.

Let’s take a closer look at how ZIP codes affect car insurance in Idaho.

| Zipcode | Average | Allstate F&C | American Family Mutual | Farmers Ins Co Of ID | Geico General | Safeco Ins Co of IL | Depositors Insurance | State Farm Mutual Auto | Travelers Home & Marine Ins Co | USAA |

|---|---|---|---|---|---|---|---|---|---|---|

| 83536 | $3,008.28 | $4,691.81 | $3,695.28 | $3,306.96 | $2,777.53 | $2,466.87 | $2,804.12 | $1,989.82 | $3,344.06 | $1,998.09 |

| 83546 | $2,999.62 | $4,631.61 | $3,695.28 | $3,306.96 | $2,777.53 | $2,432.86 | $2,872.16 | $2,000.81 | $3,281.24 | $1,998.09 |

| 83531 | $2,994.12 | $4,600.50 | $3,695.28 | $3,306.96 | $2,777.53 | $2,338.96 | $2,872.16 | $1,921.71 | $3,435.94 | $1,998.09 |

| 83544 | $2,991.37 | $4,540.30 | $3,695.28 | $3,306.96 | $2,777.53 | $2,432.86 | $2,872.16 | $2,017.88 | $3,281.24 | $1,998.09 |

| 83520 | $2,988.00 | $4,691.81 | $3,695.28 | $3,306.96 | $2,777.53 | $2,466.87 | $2,872.16 | $1,921.71 | $3,161.57 | $1,998.09 |

| 83553 | $2,987.99 | $4,540.30 | $3,695.28 | $3,306.96 | $2,777.53 | $2,432.86 | $2,872.16 | $2,003.38 | $3,265.37 | $1,998.09 |

| 83523 | $2,980.70 | $4,691.81 | $3,695.28 | $3,306.96 | $2,777.53 | $2,466.87 | $2,804.12 | $1,924.06 | $3,161.57 | $1,998.09 |

| 83543 | $2,975.21 | $4,600.50 | $3,695.28 | $3,306.96 | $2,777.53 | $2,466.87 | $2,804.12 | $1,965.99 | $3,161.57 | $1,998.09 |

| 83860 | $2,974.33 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,776.38 | $1,949.95 | $3,566.74 | $2,028.83 |

| 83530 | $2,973.80 | $4,600.50 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,825.55 | $3,435.94 | $1,998.09 |

| 83526 | $2,973.54 | $4,691.81 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,921.71 | $3,246.18 | $1,998.09 |

| 83449 | $2,968.69 | $4,339.03 | $3,935.85 | $3,231.61 | $2,777.53 | $2,404.62 | $2,712.31 | $2,023.09 | $3,349.33 | $1,944.86 |

| 83434 | $2,968.23 | $4,265.28 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,916.45 | $3,457.46 | $1,944.86 |

| 83826 | $2,967.64 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,480.69 | $2,802.25 | $1,921.71 | $3,455.88 | $2,028.83 |

| 83853 | $2,967.64 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,480.69 | $2,802.25 | $1,921.71 | $3,455.88 | $2,028.83 |

| 83404 | $2,967.30 | $4,279.29 | $3,935.85 | $3,319.49 | $2,841.52 | $2,404.62 | $2,803.64 | $1,939.56 | $3,236.84 | $1,944.86 |

| 83524 | $2,965.83 | $4,691.81 | $3,552.57 | $3,306.96 | $2,777.53 | $2,466.87 | $2,804.12 | $1,863.47 | $3,374.98 | $1,854.19 |

| 83809 | $2,964.55 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,776.38 | $1,974.64 | $3,453.94 | $2,028.83 |

| 83548 | $2,964.45 | $4,691.81 | $3,695.28 | $3,306.96 | $2,777.53 | $2,466.87 | $2,804.12 | $1,921.71 | $3,161.57 | $1,854.19 |

| 83865 | $2,964.42 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,802.25 | $1,921.71 | $3,479.87 | $2,028.83 |

| 83805 | $2,964.11 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,480.69 | $2,802.25 | $1,889.90 | $3,455.88 | $2,028.83 |

| 83455 | $2,963.74 | $4,339.03 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,876.70 | $2,102.03 | $3,262.32 | $1,890.34 |

| 83428 | $2,963.46 | $4,339.03 | $3,935.85 | $3,231.61 | $2,777.53 | $2,404.62 | $2,712.31 | $2,016.77 | $3,382.90 | $1,870.51 |

| 83539 | $2,963.26 | $4,631.61 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,892.81 | $3,242.75 | $1,998.09 |

| 83856 | $2,961.57 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,802.25 | $1,953.39 | $3,422.54 | $2,028.83 |

| 83422 | $2,960.74 | $4,339.03 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,876.70 | $2,075.08 | $3,262.32 | $1,890.34 |

| 83836 | $2,960.60 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,480.69 | $2,802.25 | $1,948.96 | $3,365.22 | $2,028.83 |

| 83822 | $2,959.92 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,802.25 | $1,953.39 | $3,407.67 | $2,028.83 |

| 83549 | $2,959.83 | $4,540.30 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,959.63 | $3,236.40 | $1,998.09 |

| 83401 | $2,959.48 | $4,181.57 | $3,935.85 | $3,319.49 | $2,841.52 | $2,404.62 | $2,712.31 | $2,023.03 | $3,272.09 | $1,944.86 |

| 83452 | $2,959.41 | $4,339.03 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,876.70 | $2,063.11 | $3,262.32 | $1,890.34 |

| 83533 | $2,959.06 | $4,691.81 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,921.71 | $3,115.83 | $1,998.09 |

| 83221 | $2,958.18 | $4,201.19 | $3,935.85 | $3,231.61 | $2,841.52 | $2,452.43 | $2,762.33 | $2,105.49 | $3,148.31 | $1,944.86 |

| 83845 | $2,957.53 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,480.69 | $2,802.25 | $1,895.95 | $3,390.67 | $2,028.83 |

| 83554 | $2,956.33 | $4,540.30 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,921.71 | $3,242.78 | $1,998.09 |

| 83821 | $2,956.28 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,480.69 | $2,802.25 | $1,898.85 | $3,376.45 | $2,028.83 |

| 83444 | $2,955.14 | $4,153.76 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,962.74 | $3,404.85 | $1,944.86 |

| 83848 | $2,953.98 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,480.69 | $2,802.25 | $1,921.71 | $3,332.93 | $2,028.83 |

| 83811 | $2,953.78 | $4,076.47 | $3,668.25 | $3,306.96 | $2,985.98 | $2,480.69 | $2,776.38 | $1,959.78 | $3,300.64 | $2,028.83 |

| 83864 | $2,953.66 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,323.02 | $2,802.25 | $1,929.51 | $3,479.87 | $2,028.83 |

| 83218 | $2,953.40 | $4,224.74 | $3,935.85 | $3,231.61 | $2,841.52 | $2,452.43 | $2,762.33 | $2,016.77 | $3,248.63 | $1,866.71 |

| 83402 | $2,952.67 | $4,213.93 | $3,935.85 | $3,319.49 | $2,841.52 | $2,395.81 | $2,803.64 | $1,937.78 | $3,181.16 | $1,944.86 |

| 83450 | $2,951.80 | $4,185.79 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,937.02 | $3,368.48 | $1,944.86 |

| 83840 | $2,951.68 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,802.25 | $1,921.71 | $3,365.22 | $2,028.83 |

| 83841 | $2,951.68 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,802.25 | $1,921.71 | $3,365.22 | $2,028.83 |

| 83541 | $2,950.11 | $4,691.81 | $3,552.57 | $3,306.96 | $2,777.53 | $2,466.87 | $2,804.12 | $1,935.36 | $3,161.57 | $1,854.19 |

| 83555 | $2,949.99 | $4,691.81 | $3,695.28 | $3,306.96 | $2,777.53 | $2,225.41 | $2,804.12 | $1,900.98 | $3,149.76 | $1,998.09 |

| 83850 | $2,949.04 | $3,941.82 | $3,668.25 | $3,306.96 | $2,985.98 | $2,478.28 | $2,776.38 | $2,012.25 | $3,342.64 | $2,028.83 |

| 83813 | $2,948.73 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,776.38 | $1,983.50 | $3,302.74 | $2,028.83 |

| 83406 | $2,948.71 | $4,234.50 | $3,935.85 | $3,319.49 | $2,841.52 | $2,404.62 | $2,712.31 | $2,004.26 | $3,141.01 | $1,944.86 |

| 83852 | $2,947.82 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,802.25 | $1,919.29 | $3,332.93 | $2,028.83 |

| 83236 | $2,946.32 | $4,192.99 | $3,935.85 | $3,231.61 | $2,777.53 | $2,452.43 | $2,762.33 | $2,008.19 | $3,211.14 | $1,944.86 |

| 83839 | $2,946.09 | $3,941.82 | $3,668.25 | $3,306.96 | $2,985.98 | $2,478.28 | $2,776.38 | $1,985.71 | $3,342.64 | $2,028.83 |

| 83522 | $2,945.39 | $4,600.50 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,889.98 | $3,115.83 | $1,998.09 |

| 83427 | $2,945.31 | $4,279.29 | $3,935.85 | $3,231.61 | $2,841.52 | $2,404.62 | $2,712.31 | $2,016.77 | $3,141.01 | $1,944.86 |

| 83847 | $2,945.23 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,802.25 | $1,895.95 | $3,332.93 | $2,028.83 |

| 83425 | $2,944.13 | $4,305.88 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,900.69 | $3,215.70 | $1,944.86 |

| 83274 | $2,942.05 | $4,192.99 | $3,935.85 | $3,231.61 | $2,841.52 | $2,452.43 | $2,762.33 | $1,937.52 | $3,179.32 | $1,944.86 |

| 83424 | $2,941.37 | $4,339.03 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,876.70 | $1,900.69 | $3,262.32 | $1,890.34 |

| 83540 | $2,940.84 | $4,691.81 | $3,552.57 | $3,306.96 | $2,777.53 | $2,225.41 | $2,804.12 | $1,859.37 | $3,395.55 | $1,854.19 |

| 83861 | $2,940.69 | $3,941.82 | $3,668.25 | $3,306.96 | $2,985.98 | $2,432.86 | $2,776.38 | $1,965.80 | $3,359.32 | $2,028.83 |

| 83545 | $2,938.99 | $4,691.81 | $3,552.57 | $3,306.96 | $2,777.53 | $2,466.87 | $2,804.12 | $1,832.79 | $3,164.06 | $1,854.19 |

| 83431 | $2,938.11 | $4,270.46 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,947.35 | $3,150.27 | $1,944.86 |

| 83420 | $2,937.21 | $4,265.28 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,915.05 | $3,234.18 | $1,890.34 |

| 83866 | $2,937.09 | $3,941.82 | $3,668.25 | $3,306.96 | $2,985.98 | $2,432.86 | $2,776.38 | $1,933.37 | $3,359.32 | $2,028.83 |

| 83810 | $2,936.68 | $3,941.82 | $3,668.25 | $3,306.96 | $2,985.98 | $2,478.28 | $2,776.38 | $1,964.36 | $3,279.25 | $2,028.83 |

| 83429 | $2,936.38 | $4,265.28 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,932.41 | $3,209.35 | $1,890.34 |

| 83451 | $2,936.22 | $4,265.28 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,838.44 | $3,301.86 | $1,890.34 |

| 83442 | $2,935.59 | $4,270.46 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,956.08 | $3,118.91 | $1,944.86 |

| 83436 | $2,934.77 | $4,265.28 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,900.69 | $3,226.58 | $1,890.34 |

| 83542 | $2,933.61 | $4,540.30 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,921.71 | $3,038.34 | $1,998.09 |

| 83833 | $2,932.09 | $3,941.82 | $3,668.25 | $3,306.96 | $2,985.98 | $2,478.28 | $2,776.38 | $1,931.25 | $3,271.08 | $2,028.83 |

| 83842 | $2,931.94 | $3,941.82 | $3,668.25 | $3,306.96 | $2,985.98 | $2,478.28 | $2,776.38 | $1,921.71 | $3,279.25 | $2,028.83 |

| 83824 | $2,931.84 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,432.86 | $2,776.38 | $1,921.71 | $3,368.17 | $2,028.83 |

| 83262 | $2,931.35 | $4,050.30 | $3,935.85 | $3,231.61 | $2,777.53 | $2,452.43 | $2,762.33 | $2,098.97 | $3,128.26 | $1,944.86 |

| 83537 | $2,929.55 | $4,691.81 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,804.12 | $1,896.98 | $3,267.47 | $1,854.19 |

| 83445 | $2,929.41 | $4,265.28 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,832.34 | $3,246.69 | $1,890.34 |

| 83421 | $2,928.50 | $4,265.28 | $3,695.28 | $3,231.61 | $2,777.53 | $2,434.83 | $2,926.80 | $1,900.69 | $3,234.18 | $1,890.34 |

| 83215 | $2,928.21 | $4,201.19 | $3,935.85 | $3,028.45 | $2,841.52 | $2,452.43 | $2,762.33 | $2,016.77 | $3,248.63 | $1,866.71 |

| 83446 | $2,927.88 | $4,305.88 | $3,695.28 | $3,231.61 | $2,777.53 | $2,434.83 | $2,926.80 | $1,900.69 | $3,211.60 | $1,866.71 |

| 83851 | $2,927.88 | $3,941.82 | $3,668.25 | $3,306.96 | $2,985.98 | $2,432.86 | $2,776.38 | $1,938.71 | $3,271.08 | $2,028.83 |

| 83440 | $2,926.93 | $4,265.28 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,830.10 | $3,226.58 | $1,890.34 |

| 83671 | $2,926.88 | $4,540.30 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,872.16 | $1,921.71 | $3,242.78 | $1,998.09 |

| 83870 | $2,926.80 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,432.86 | $2,776.38 | $1,885.23 | $3,359.32 | $2,028.83 |

| 83433 | $2,925.74 | $4,265.28 | $3,695.28 | $3,231.61 | $2,777.53 | $2,434.83 | $2,926.80 | $1,900.69 | $3,209.35 | $1,890.34 |

| 83872 | $2,925.52 | $4,600.50 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,849.83 | $3,406.89 | $1,947.30 |

| 83876 | $2,923.27 | $3,941.82 | $3,668.25 | $3,306.96 | $2,892.45 | $2,478.28 | $2,776.38 | $1,945.43 | $3,271.08 | $2,028.83 |

| 83535 | $2,922.35 | $4,691.81 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,884.61 | $3,345.44 | $1,854.19 |

| 83443 | $2,922.33 | $4,270.46 | $3,695.28 | $3,231.61 | $2,777.53 | $2,434.83 | $2,926.80 | $1,900.69 | $3,118.91 | $1,944.86 |

| 83832 | $2,921.33 | $4,691.81 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,860.24 | $3,267.47 | $1,947.30 |

| 83812 | $2,919.68 | $3,988.75 | $3,668.25 | $3,306.96 | $2,985.98 | $2,432.86 | $2,776.38 | $1,921.71 | $3,167.40 | $2,028.83 |

| 83803 | $2,919.27 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,224.27 | $2,705.06 | $1,966.22 | $3,329.59 | $2,028.83 |

| 83871 | $2,918.98 | $4,600.50 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,842.99 | $3,354.93 | $1,947.30 |

| 83460 | $2,918.87 | $4,265.28 | $3,695.28 | $3,231.61 | $2,777.53 | $2,434.83 | $2,876.70 | $1,817.18 | $3,226.58 | $1,944.86 |

| 83448 | $2,918.32 | $4,265.28 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,876.70 | $1,802.78 | $3,226.58 | $1,890.34 |

| 83868 | $2,918.02 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,263.18 | $2,776.38 | $1,992.56 | $3,342.64 | $2,028.83 |

| 83806 | $2,917.85 | $4,600.50 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,832.79 | $3,354.93 | $1,947.30 |

| 83827 | $2,917.63 | $3,988.75 | $3,695.28 | $3,306.96 | $2,777.53 | $2,432.86 | $2,872.16 | $1,921.71 | $3,265.37 | $1,998.09 |

| 83830 | $2,917.14 | $4,033.13 | $3,668.25 | $3,306.96 | $2,985.98 | $2,263.18 | $2,776.38 | $1,921.71 | $3,269.84 | $2,028.83 |

| 83438 | $2,917.01 | $4,265.28 | $3,695.28 | $3,231.61 | $2,777.53 | $2,338.96 | $2,926.80 | $1,900.69 | $3,226.58 | $1,890.34 |

| 83837 | $2,916.87 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,263.18 | $2,776.38 | $1,973.04 | $3,351.76 | $2,028.83 |

| 83204 | $2,916.73 | $3,950.56 | $3,935.85 | $3,220.36 | $2,827.17 | $2,452.43 | $2,783.09 | $2,094.87 | $3,115.76 | $1,870.51 |

| 83547 | $2,916.57 | $4,540.30 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,872.16 | $1,921.71 | $3,150.00 | $1,998.09 |

| 83808 | $2,914.35 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,263.18 | $2,776.38 | $1,950.38 | $3,351.76 | $2,028.83 |

| 83801 | $2,911.64 | $4,058.23 | $3,668.25 | $3,306.96 | $2,985.98 | $2,224.27 | $2,776.38 | $1,971.85 | $3,184.02 | $2,028.83 |

| 83823 | $2,911.17 | $4,600.50 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,865.74 | $3,354.93 | $1,854.19 |

| 83804 | $2,911.12 | $3,923.58 | $3,668.25 | $3,306.96 | $2,985.98 | $2,427.69 | $2,802.25 | $1,954.48 | $3,102.03 | $2,028.83 |

| 83867 | $2,910.15 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,263.18 | $2,776.38 | $1,921.71 | $3,342.64 | $2,028.83 |

| 83435 | $2,910.08 | $3,999.42 | $3,695.28 | $3,231.61 | $2,841.52 | $2,434.83 | $2,926.80 | $1,900.69 | $3,215.70 | $1,944.86 |

| 83849 | $2,909.77 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,263.18 | $2,776.38 | $1,918.28 | $3,342.64 | $2,028.83 |

| 83844 | $2,909.41 | $4,600.50 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,832.79 | $3,278.99 | $1,947.30 |

| 83201 | $2,908.65 | $3,950.56 | $3,935.85 | $3,220.36 | $2,827.17 | $2,404.62 | $2,783.09 | $2,072.13 | $3,113.54 | $1,870.51 |

| 83802 | $2,907.88 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,263.18 | $2,776.38 | $1,921.71 | $3,322.24 | $2,028.83 |

| 83202 | $2,902.87 | $4,008.90 | $3,935.85 | $3,220.36 | $2,827.17 | $2,404.62 | $2,783.09 | $2,034.83 | $3,040.47 | $1,870.51 |

| 83873 | $2,902.47 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,263.18 | $2,776.38 | $1,854.26 | $3,340.98 | $2,028.83 |

| 83210 | $2,902.40 | $4,037.34 | $3,935.85 | $3,028.45 | $2,777.53 | $2,452.43 | $2,762.33 | $1,995.38 | $3,187.48 | $1,944.86 |

| 83846 | $2,901.21 | $3,897.43 | $3,668.25 | $3,306.96 | $2,985.98 | $2,263.18 | $2,776.38 | $1,861.68 | $3,322.24 | $2,028.83 |

| 83245 | $2,900.20 | $3,992.53 | $3,935.85 | $3,231.61 | $2,827.17 | $2,452.43 | $2,631.16 | $2,033.19 | $3,127.33 | $1,870.51 |

| 83209 | $2,897.71 | $3,950.56 | $3,935.85 | $3,220.36 | $2,827.17 | $2,452.43 | $2,631.16 | $2,075.63 | $3,115.76 | $1,870.51 |

| 83423 | $2,897.09 | $3,999.42 | $3,695.28 | $3,231.61 | $2,777.53 | $2,434.83 | $2,926.80 | $1,941.79 | $3,199.88 | $1,866.71 |

| 83277 | $2,895.19 | $4,037.34 | $3,935.85 | $3,028.45 | $2,777.53 | $2,452.43 | $2,762.33 | $2,016.77 | $3,179.32 | $1,866.71 |

| 83843 | $2,891.59 | $4,600.50 | $3,552.57 | $3,306.96 | $2,596.54 | $2,214.33 | $2,673.74 | $1,853.42 | $3,278.99 | $1,947.30 |

| 83501 | $2,890.80 | $4,691.81 | $3,552.57 | $3,208.69 | $2,596.54 | $2,225.41 | $2,804.12 | $1,846.78 | $3,237.05 | $1,854.19 |

| 83552 | $2,888.02 | $3,954.45 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,892.81 | $3,242.78 | $1,998.09 |

| 83869 | $2,875.40 | $3,923.58 | $3,668.25 | $3,306.96 | $2,985.98 | $2,224.27 | $2,705.06 | $1,933.66 | $3,102.03 | $2,028.83 |

| 83687 | $2,871.66 | $3,973.77 | $4,166.07 | $3,203.06 | $2,499.48 | $2,267.71 | $2,801.06 | $1,909.39 | $3,297.43 | $1,726.98 |

| 83626 | $2,871.31 | $4,004.21 | $4,166.07 | $3,041.94 | $2,515.57 | $2,338.96 | $2,805.89 | $1,859.31 | $3,382.91 | $1,726.98 |

| 83686 | $2,871.09 | $3,973.77 | $4,166.07 | $3,203.06 | $2,499.48 | $2,381.57 | $2,717.98 | $1,908.45 | $3,262.45 | $1,726.98 |

| 83858 | $2,869.16 | $3,819.53 | $3,668.25 | $3,306.96 | $2,985.98 | $2,224.27 | $2,705.06 | $1,926.26 | $3,157.25 | $2,028.83 |

| 83612 | $2,868.51 | $4,540.30 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,808.07 | $3,088.31 | $1,866.71 |

| 83525 | $2,867.22 | $3,863.12 | $3,695.28 | $3,306.96 | $2,777.53 | $2,252.15 | $2,872.16 | $1,894.73 | $3,144.95 | $1,998.09 |

| 83250 | $2,865.42 | $3,992.53 | $3,695.28 | $3,231.61 | $2,827.17 | $2,452.43 | $2,631.16 | $1,964.55 | $3,127.33 | $1,866.71 |

| 83651 | $2,864.29 | $3,973.77 | $4,166.07 | $3,185.49 | $2,499.48 | $2,269.58 | $2,801.06 | $1,991.41 | $3,164.82 | $1,726.98 |

| 83672 | $2,864.12 | $4,637.51 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,705.50 | $3,054.16 | $1,866.71 |

| 83464 | $2,863.70 | $4,202.95 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,814.70 | $1,961.37 | $3,160.69 | $1,866.71 |

| 83605 | $2,863.42 | $3,937.96 | $4,166.07 | $3,014.28 | $2,499.48 | $2,345.70 | $2,838.90 | $1,965.27 | $3,276.10 | $1,726.98 |

| 83467 | $2,862.84 | $4,202.95 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,814.70 | $1,940.19 | $3,174.07 | $1,866.71 |

| 83286 | $2,859.35 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,788.99 | $3,364.85 | $1,866.71 |

| 83610 | $2,859.27 | $4,540.30 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,814.28 | $2,998.91 | $1,866.71 |

| 83462 | $2,859.10 | $4,202.95 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,814.70 | $1,919.91 | $3,160.69 | $1,866.71 |

| 83468 | $2,858.98 | $4,202.95 | $3,695.28 | $3,041.94 | $2,777.53 | $2,338.96 | $2,814.70 | $1,900.69 | $3,092.11 | $1,866.71 |

| 83654 | $2,858.61 | $4,540.30 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,828.16 | $2,979.06 | $1,866.71 |

| 83233 | $2,858.15 | $4,071.41 | $3,695.28 | $3,231.61 | $2,777.53 | $2,338.96 | $2,631.16 | $1,745.81 | $3,364.85 | $1,866.71 |

| 83213 | $2,857.29 | $4,201.19 | $3,695.28 | $3,028.45 | $2,777.53 | $2,252.15 | $2,771.34 | $1,916.84 | $3,206.17 | $1,866.71 |

| 83465 | $2,856.96 | $4,202.95 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,814.70 | $1,900.69 | $3,160.69 | $1,866.71 |

| 83466 | $2,856.96 | $4,202.95 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,814.70 | $1,900.69 | $3,160.69 | $1,866.71 |

| 83607 | $2,856.56 | $4,054.78 | $4,166.07 | $3,041.94 | $2,515.57 | $2,375.37 | $2,805.89 | $1,921.26 | $3,101.23 | $1,726.98 |

| 83676 | $2,855.64 | $4,004.21 | $4,166.07 | $3,041.94 | $2,515.57 | $2,338.96 | $2,805.89 | $1,826.41 | $3,274.70 | $1,726.98 |

| 83263 | $2,854.56 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.87 | $3,364.85 | $1,866.71 |

| 83272 | $2,854.56 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.87 | $3,364.85 | $1,866.71 |

| 83223 | $2,854.55 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.81 | $3,364.85 | $1,866.71 |

| 83283 | $2,854.55 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.81 | $3,364.85 | $1,866.71 |

| 83252 | $2,854.44 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,452.43 | $2,631.16 | $1,780.84 | $3,138.23 | $1,866.71 |

| 83285 | $2,854.44 | $4,192.99 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.81 | $3,283.25 | $1,870.51 |

| 83234 | $2,853.72 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,452.43 | $2,631.16 | $1,776.88 | $3,135.65 | $1,866.71 |

| 83217 | $2,852.05 | $4,073.85 | $3,695.28 | $3,231.61 | $2,777.53 | $2,452.43 | $2,631.16 | $1,769.34 | $3,166.74 | $1,870.51 |

| 83214 | $2,851.19 | $4,034.89 | $3,695.28 | $3,231.61 | $2,777.53 | $2,452.43 | $2,631.16 | $1,803.19 | $3,167.89 | $1,866.71 |

| 83220 | $2,849.58 | $4,071.41 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.81 | $3,364.85 | $1,866.71 |

| 83238 | $2,849.58 | $4,071.41 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.81 | $3,364.85 | $1,866.71 |

| 83281 | $2,849.34 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,452.43 | $2,631.16 | $1,745.81 | $3,127.33 | $1,866.71 |

| 83463 | $2,849.34 | $4,202.95 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,814.70 | $1,900.69 | $3,092.11 | $1,866.71 |

| 83855 | $2,848.45 | $3,897.43 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,852.90 | $3,413.29 | $1,947.30 |

| 83243 | $2,847.29 | $4,116.21 | $3,695.28 | $3,231.61 | $2,827.17 | $2,452.43 | $2,631.16 | $1,745.81 | $3,059.27 | $1,866.71 |

| 83251 | $2,846.67 | $3,999.42 | $3,695.28 | $3,028.45 | $2,777.53 | $2,252.15 | $2,771.34 | $1,973.22 | $3,255.95 | $1,866.71 |

| 83340 | $2,846.21 | $4,037.34 | $3,695.28 | $3,028.45 | $2,777.53 | $2,222.00 | $2,706.72 | $1,932.28 | $3,392.53 | $1,823.77 |

| 83230 | $2,845.61 | $4,190.56 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.81 | $3,206.20 | $1,870.51 |

| 83228 | $2,845.31 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,776.88 | $3,250.62 | $1,866.71 |

| 83237 | $2,844.28 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,767.61 | $3,250.62 | $1,866.71 |

| 83254 | $2,844.20 | $4,071.41 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,697.43 | $3,364.85 | $1,866.71 |

| 83211 | $2,843.72 | $4,037.34 | $3,695.28 | $3,028.45 | $2,827.17 | $2,452.43 | $2,631.16 | $1,806.31 | $3,248.63 | $1,866.71 |

| 83239 | $2,843.53 | $4,071.41 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,691.38 | $3,364.85 | $1,866.71 |

| 83276 | $2,843.08 | $4,190.56 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,723.03 | $3,206.20 | $1,870.51 |

| 83255 | $2,842.92 | $4,034.33 | $3,695.28 | $3,028.45 | $2,777.53 | $2,252.15 | $2,771.34 | $1,921.71 | $3,238.75 | $1,866.71 |

| 83631 | $2,841.87 | $3,916.80 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,863.50 | $3,391.58 | $1,866.71 |

| 83232 | $2,841.86 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.81 | $3,250.62 | $1,866.71 |

| 83287 | $2,841.86 | $4,116.21 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,745.81 | $3,250.62 | $1,866.71 |

| 83644 | $2,839.20 | $3,892.56 | $4,166.07 | $3,041.94 | $2,543.13 | $2,230.07 | $2,805.89 | $1,928.74 | $3,217.41 | $1,726.98 |

| 83857 | $2,838.56 | $3,897.43 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,831.70 | $3,345.44 | $1,947.30 |

| 83244 | $2,834.89 | $4,034.33 | $3,695.28 | $3,028.45 | $2,777.53 | $2,252.15 | $2,771.34 | $1,900.69 | $3,187.51 | $1,866.71 |

| 83241 | $2,833.28 | $4,073.85 | $3,695.28 | $3,231.61 | $2,777.53 | $2,261.83 | $2,631.16 | $1,739.83 | $3,217.91 | $1,870.51 |

| 83246 | $2,831.92 | $3,992.53 | $3,695.28 | $3,231.61 | $2,777.53 | $2,452.43 | $2,631.16 | $1,751.93 | $3,088.06 | $1,866.71 |

| 83253 | $2,831.54 | $3,974.13 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,814.70 | $1,900.69 | $3,160.69 | $1,866.71 |

| 83212 | $2,829.43 | $3,992.53 | $3,695.28 | $3,231.61 | $2,777.53 | $2,452.43 | $2,631.16 | $1,745.81 | $3,071.82 | $1,866.71 |

| 83834 | $2,828.33 | $3,897.43 | $3,552.57 | $3,306.96 | $2,777.53 | $2,214.33 | $2,673.74 | $1,832.79 | $3,345.44 | $1,854.19 |

| 83278 | $2,826.86 | $4,012.05 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,971.75 | $3,053.03 | $1,866.71 |

| 83235 | $2,826.72 | $3,974.13 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,900.69 | $3,160.69 | $1,866.71 |

| 83226 | $2,826.16 | $3,974.13 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,895.71 | $3,160.69 | $1,866.71 |

| 83641 | $2,824.89 | $3,878.18 | $4,166.07 | $3,041.94 | $2,515.57 | $2,252.15 | $2,717.98 | $1,824.03 | $3,161.37 | $1,866.71 |

| 83271 | $2,824.30 | $4,037.34 | $3,695.28 | $3,028.45 | $2,827.17 | $2,452.43 | $2,631.16 | $1,820.94 | $3,059.27 | $1,866.71 |

| 83327 | $2,824.05 | $4,037.34 | $3,695.28 | $3,028.45 | $2,777.53 | $2,252.15 | $2,706.72 | $1,896.19 | $3,277.85 | $1,744.94 |

| 83229 | $2,823.92 | $3,974.13 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,814.70 | $1,900.69 | $3,092.11 | $1,866.71 |

| 83469 | $2,823.92 | $3,974.13 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,814.70 | $1,900.69 | $3,092.11 | $1,866.71 |

| 83347 | $2,823.71 | $4,034.80 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,722.48 | $1,719.58 | $3,317.43 | $1,744.94 |

| 83353 | $2,823.59 | $4,037.34 | $3,695.28 | $3,028.45 | $2,777.53 | $2,222.00 | $2,706.72 | $1,932.28 | $3,188.93 | $1,823.77 |

| 83341 | $2,823.22 | $3,981.55 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,517.12 | $1,814.30 | $3,312.51 | $1,744.94 |

| 83342 | $2,821.81 | $4,034.89 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,722.48 | $1,787.86 | $3,231.96 | $1,744.94 |

| 83655 | $2,820.93 | $4,004.21 | $3,695.28 | $3,041.94 | $2,543.13 | $2,338.96 | $2,746.31 | $1,765.46 | $3,386.32 | $1,866.71 |

| 83311 | $2,820.70 | $4,034.89 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,722.48 | $1,777.86 | $3,231.96 | $1,744.94 |

| 83312 | $2,820.50 | $4,034.89 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,722.48 | $1,776.05 | $3,231.96 | $1,744.94 |

| 83666 | $2,820.16 | $3,990.50 | $3,695.28 | $3,028.45 | $2,777.53 | $2,252.15 | $2,771.34 | $1,740.19 | $3,259.27 | $1,866.71 |

| 83333 | $2,819.20 | $4,037.34 | $3,695.28 | $3,028.45 | $2,777.53 | $2,157.63 | $2,706.72 | $1,903.09 | $3,243.00 | $1,823.77 |

| 83635 | $2,816.93 | $3,863.12 | $3,695.28 | $3,041.94 | $2,777.53 | $2,338.96 | $2,746.31 | $1,740.19 | $3,282.34 | $1,866.71 |

| 83323 | $2,816.45 | $4,004.47 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,722.48 | $1,770.01 | $3,231.96 | $1,744.94 |

| 83316 | $2,816.20 | $3,981.55 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,517.12 | $1,703.17 | $3,360.47 | $1,744.94 |

| 83321 | $2,816.17 | $3,981.55 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,517.12 | $1,702.88 | $3,360.47 | $1,744.94 |

| 83835 | $2,814.62 | $3,378.15 | $3,668.25 | $3,306.96 | $2,892.45 | $2,224.25 | $2,705.06 | $1,913.57 | $3,214.11 | $2,028.83 |

| 83350 | $2,812.32 | $3,923.80 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,722.48 | $1,733.43 | $3,312.05 | $1,744.94 |

| 83325 | $2,811.29 | $3,893.47 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,501.20 | $1,810.88 | $3,312.51 | $1,744.94 |

| 83336 | $2,810.54 | $3,923.80 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,722.48 | $1,712.02 | $3,317.43 | $1,744.94 |

| 83318 | $2,809.93 | $3,923.80 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,722.48 | $1,712.02 | $3,311.97 | $1,744.94 |

| 83328 | $2,809.58 | $3,981.55 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,517.12 | $1,761.33 | $3,242.70 | $1,744.94 |

| 83344 | $2,809.18 | $3,893.47 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,517.12 | $1,812.35 | $3,276.17 | $1,744.94 |

| 83335 | $2,807.89 | $3,893.47 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,501.20 | $1,816.63 | $3,276.17 | $1,744.94 |

| 83324 | $2,807.80 | $4,122.97 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,501.20 | $1,837.80 | $3,189.15 | $1,744.94 |

| 83320 | $2,807.71 | $4,037.34 | $3,695.28 | $3,028.45 | $2,777.53 | $2,078.91 | $2,706.72 | $1,932.41 | $3,188.93 | $1,823.77 |

| 83677 | $2,807.29 | $3,863.12 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,740.19 | $3,282.34 | $1,866.71 |

| 83338 | $2,807.01 | $3,981.55 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,501.20 | $1,807.70 | $3,189.15 | $1,744.94 |

| 83638 | $2,806.24 | $3,812.10 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,781.75 | $3,282.34 | $1,866.71 |

| 83227 | $2,806.14 | $3,974.13 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,900.69 | $2,975.52 | $1,866.71 |

| 83334 | $2,805.37 | $3,951.78 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,517.12 | $1,806.74 | $3,189.15 | $1,744.94 |

| 83346 | $2,805.21 | $3,923.89 | $3,989.27 | $3,028.45 | $2,640.14 | $2,078.91 | $2,722.48 | $1,806.80 | $3,312.05 | $1,744.94 |

| 83352 | $2,804.68 | $4,122.97 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,501.20 | $1,809.70 | $3,189.15 | $1,744.94 |

| 83313 | $2,804.18 | $4,037.34 | $3,695.28 | $3,028.45 | $2,777.53 | $2,078.91 | $2,706.72 | $1,900.71 | $3,188.93 | $1,823.77 |

| 83348 | $2,804.18 | $4,037.34 | $3,695.28 | $3,028.45 | $2,777.53 | $2,078.91 | $2,706.72 | $1,900.69 | $3,188.93 | $1,823.77 |

| 83604 | $2,803.70 | $3,957.83 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,716.71 | $3,153.84 | $1,866.71 |

| 83660 | $2,803.64 | $4,004.21 | $3,695.28 | $3,041.94 | $2,515.57 | $2,338.96 | $2,746.31 | $1,784.72 | $3,378.79 | $1,726.98 |

| 83332 | $2,803.35 | $3,895.92 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,501.20 | $1,745.80 | $3,303.66 | $1,744.94 |

| 83349 | $2,802.61 | $4,065.22 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,501.20 | $1,848.81 | $3,189.15 | $1,744.94 |

| 83637 | $2,802.41 | $4,035.84 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,740.19 | $3,040.72 | $1,866.71 |

| 83302 | $2,801.88 | $3,957.83 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,517.12 | $1,776.05 | $3,182.42 | $1,744.94 |

| 83622 | $2,801.87 | $3,851.12 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,961.84 | $2,998.91 | $1,866.71 |

| 83650 | $2,801.63 | $3,920.66 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,740.19 | $3,148.92 | $1,866.71 |

| 83615 | $2,801.62 | $3,812.10 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,740.19 | $3,282.34 | $1,866.71 |

| 83355 | $2,801.00 | $3,981.55 | $3,989.27 | $3,028.45 | $2,777.53 | $2,243.36 | $2,501.20 | $1,737.29 | $3,205.41 | $1,744.94 |

| 83629 | $2,800.10 | $3,893.01 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,850.06 | $3,052.86 | $1,866.71 |

| 83314 | $2,793.41 | $3,895.92 | $3,989.27 | $3,028.45 | $2,777.53 | $2,252.15 | $2,501.20 | $1,745.80 | $3,205.41 | $1,744.94 |

| 83337 | $2,791.00 | $3,895.92 | $3,695.28 | $3,028.45 | $2,777.53 | $2,252.15 | $2,706.72 | $1,740.19 | $3,277.85 | $1,744.94 |

| 83624 | $2,790.70 | $3,920.66 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,695.73 | $3,094.98 | $1,866.71 |

| 83330 | $2,789.58 | $3,895.92 | $3,989.27 | $3,028.45 | $2,777.53 | $2,078.91 | $2,501.20 | $1,786.32 | $3,303.66 | $1,744.94 |

| 83645 | $2,786.61 | $3,928.48 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,767.19 | $3,003.84 | $1,866.71 |

| 83639 | $2,785.64 | $3,920.66 | $3,695.28 | $3,041.94 | $2,515.57 | $2,252.15 | $2,771.34 | $1,828.33 | $3,178.81 | $1,866.71 |

| 83619 | $2,784.05 | $4,004.21 | $3,695.28 | $3,041.94 | $2,543.13 | $2,338.96 | $2,746.31 | $1,721.94 | $3,097.92 | $1,866.71 |

| 83301 | $2,782.56 | $3,767.16 | $3,989.27 | $3,136.73 | $2,640.14 | $2,243.36 | $2,517.12 | $1,821.89 | $3,182.42 | $1,744.94 |

| 83628 | $2,780.47 | $3,920.66 | $3,695.28 | $3,041.94 | $2,515.57 | $2,252.15 | $2,771.34 | $1,781.81 | $3,178.81 | $1,866.71 |

| 83611 | $2,777.71 | $3,850.00 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,770.53 | $2,998.91 | $1,866.71 |

| 83643 | $2,776.34 | $3,863.12 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,740.19 | $3,003.84 | $1,866.71 |

| 83602 | $2,775.91 | $3,776.31 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,771.34 | $1,740.19 | $3,061.71 | $1,866.71 |

| 83632 | $2,771.35 | $3,818.17 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,746.31 | $1,740.19 | $3,003.84 | $1,866.71 |

| 83322 | $2,770.68 | $3,895.92 | $3,695.28 | $3,028.45 | $2,777.53 | $2,252.15 | $2,706.72 | $1,740.19 | $3,094.98 | $1,744.94 |

| 83815 | $2,769.93 | $3,287.39 | $3,668.25 | $3,069.45 | $2,892.45 | $2,188.37 | $2,616.57 | $1,925.45 | $3,252.68 | $2,028.83 |

| 83661 | $2,763.83 | $3,917.84 | $3,695.28 | $3,041.94 | $2,543.13 | $2,252.15 | $2,746.31 | $1,721.94 | $3,089.14 | $1,866.71 |

| 83814 | $2,761.06 | $3,287.39 | $3,668.25 | $3,106.56 | $2,892.45 | $2,137.80 | $2,616.57 | $1,925.45 | $3,186.27 | $2,028.83 |

| 83670 | $2,756.15 | $3,893.01 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,550.15 | $1,836.16 | $3,051.43 | $1,707.67 |

| 83657 | $2,747.13 | $3,960.33 | $3,695.28 | $3,041.94 | $2,777.53 | $2,252.15 | $2,550.15 | $1,740.19 | $2,998.91 | $1,707.67 |

| 83616 | $2,743.03 | $3,798.47 | $3,533.88 | $3,203.06 | $2,515.57 | $2,156.72 | $2,622.63 | $2,000.78 | $3,167.23 | $1,688.94 |

| 83854 | $2,732.36 | $3,359.90 | $3,668.25 | $2,736.09 | $2,892.45 | $2,152.23 | $2,681.54 | $1,908.48 | $3,163.44 | $2,028.83 |

| 83633 | $2,728.15 | $3,895.92 | $3,695.28 | $3,028.45 | $2,097.93 | $2,252.15 | $2,771.34 | $1,740.19 | $3,205.41 | $1,866.71 |

| 83623 | $2,725.76 | $3,895.92 | $3,695.28 | $3,028.45 | $2,097.93 | $2,252.15 | $2,771.34 | $1,718.69 | $3,205.41 | $1,866.71 |

| 83669 | $2,725.33 | $3,970.99 | $3,438.58 | $3,203.06 | $2,499.48 | $2,158.46 | $2,550.15 | $1,790.11 | $3,228.23 | $1,688.94 |

| 83713 | $2,719.52 | $3,912.68 | $3,533.88 | $3,107.12 | $2,451.67 | $2,258.52 | $2,626.54 | $1,871.30 | $3,077.54 | $1,636.40 |

| 83627 | $2,717.41 | $4,004.78 | $3,695.28 | $3,028.45 | $2,097.93 | $2,252.15 | $2,771.34 | $1,740.19 | $2,999.83 | $1,866.71 |

| 83634 | $2,711.21 | $3,786.71 | $3,438.58 | $3,203.06 | $2,470.64 | $2,146.48 | $2,580.24 | $1,846.56 | $3,239.70 | $1,688.94 |

| 83617 | $2,706.75 | $3,882.38 | $3,695.28 | $3,041.94 | $2,543.13 | $2,080.69 | $2,550.15 | $1,806.66 | $3,052.86 | $1,707.67 |

| 83648 | $2,692.24 | $3,920.66 | $3,695.28 | $3,041.94 | $2,470.64 | $2,252.15 | $2,771.34 | $1,599.08 | $3,072.20 | $1,406.90 |

| 83636 | $2,691.56 | $3,951.90 | $3,695.28 | $3,041.94 | $2,403.40 | $2,080.69 | $2,550.15 | $1,740.19 | $3,052.86 | $1,707.67 |

| 83714 | $2,691.46 | $3,892.84 | $3,533.88 | $3,041.94 | $2,403.40 | $2,140.68 | $2,622.63 | $1,874.85 | $3,076.52 | $1,636.40 |

| 83704 | $2,671.21 | $3,645.33 | $3,533.88 | $3,107.12 | $2,451.67 | $2,177.55 | $2,590.59 | $1,805.21 | $3,093.17 | $1,636.40 |

| 83708 | $2,652.60 | $3,892.48 | $3,438.58 | $3,012.15 | $2,403.40 | $2,030.14 | $2,473.21 | $1,827.67 | $3,068.76 | $1,726.98 |

| 83647 | $2,647.03 | $3,810.09 | $3,695.28 | $3,041.94 | $2,097.93 | $2,252.15 | $2,771.34 | $1,836.28 | $2,911.33 | $1,406.90 |

| 83705 | $2,646.43 | $3,652.78 | $3,533.88 | $3,012.15 | $2,451.67 | $2,158.80 | $2,586.68 | $1,732.81 | $3,052.70 | $1,636.40 |

| 83712 | $2,644.60 | $3,724.95 | $3,438.58 | $3,039.47 | $2,470.64 | $2,153.26 | $2,473.21 | $1,741.39 | $3,123.46 | $1,636.40 |

| 83702 | $2,643.34 | $3,724.95 | $3,438.58 | $3,039.47 | $2,470.64 | $2,011.10 | $2,473.21 | $1,850.82 | $3,144.94 | $1,636.40 |

| 83642 | $2,642.29 | $3,677.17 | $3,438.58 | $2,785.84 | $2,408.93 | $2,216.06 | $2,580.24 | $1,841.47 | $3,143.40 | $1,688.94 |

| 83709 | $2,641.37 | $3,547.57 | $3,438.58 | $3,270.65 | $2,451.67 | $2,030.14 | $2,581.95 | $1,821.11 | $2,994.27 | $1,636.40 |

| 83646 | $2,636.84 | $3,708.80 | $3,438.58 | $2,763.07 | $2,408.93 | $2,146.48 | $2,622.63 | $1,772.67 | $3,143.40 | $1,726.98 |

| 83703 | $2,630.15 | $3,724.95 | $3,438.58 | $3,012.15 | $2,403.40 | $2,094.92 | $2,630.93 | $1,809.91 | $2,920.16 | $1,636.40 |

| 83725 | $2,625.99 | $3,680.86 | $3,438.58 | $2,945.06 | $2,403.40 | $2,116.06 | $2,511.51 | $1,827.67 | $3,074.37 | $1,636.40 |

| 83706 | $2,615.06 | $3,602.20 | $3,438.58 | $3,012.15 | $2,403.40 | $2,008.23 | $2,511.51 | $1,711.24 | $3,211.80 | $1,636.40 |

| 83716 | $2,612.88 | $3,669.45 | $3,438.58 | $2,975.76 | $2,470.64 | $2,036.00 | $2,473.21 | $1,741.54 | $3,074.37 | $1,636.40 |

Cheapest Rates in Idaho by City

We have compiled the same information for each city in Idaho.

| City | Average Grand Total |

|---|---|

| MERIDIAN | $2,639.57 |

| BOISE | $2,645.74 |

| MOUNTAIN HOME | $2,647.03 |

| GARDEN CITY | $2,691.46 |

| LETHA | $2,691.57 |

| MOUNTAIN HOME A F B | $2,692.24 |

| EMMETT | $2,706.75 |

| KUNA | $2,711.21 |

| HAMMETT | $2,717.41 |

| STAR | $2,725.33 |

| GLENNS FERRY | $2,725.77 |

| KING HILL | $2,728.15 |

| POST FALLS | $2,732.36 |

| EAGLE | $2,743.03 |

| OLA | $2,747.13 |

| SWEET | $2,756.15 |

| PAYETTE | $2,763.83 |

| COEUR D ALENE | $2,765.50 |

| CORRAL | $2,770.68 |

| INDIAN VALLEY | $2,771.35 |

| BANKS | $2,775.91 |

| MESA | $2,776.34 |

| CASCADE | $2,777.71 |

| HOMEDALE | $2,780.47 |

| TWIN FALLS | $2,782.56 |

| FRUITLAND | $2,784.04 |

| MARSING | $2,785.64 |

| MIDVALE | $2,786.60 |

| GOODING | $2,789.58 |

| GRAND VIEW | $2,790.70 |

| HILL CITY | $2,791.00 |

| BLISS | $2,793.41 |

| HORSESHOE BEND | $2,800.10 |

| WENDELL | $2,801.00 |

| DONNELLY | $2,801.62 |

| MURPHY | $2,801.63 |

| GARDEN VALLEY | $2,801.87 |

| ROGERSON | $2,801.88 |

| LOWMAN | $2,802.41 |

| RICHFIELD | $2,802.61 |

| HAGERMAN | $2,803.35 |

| PARMA | $2,803.64 |

| BRUNEAU | $2,803.70 |

| BELLEVUE | $2,804.18 |

| PICABO | $2,804.18 |

| SHOSHONE | $2,804.68 |

| OAKLEY | $2,805.21 |

| HANSEN | $2,805.37 |

| CLAYTON | $2,806.14 |

| MCCALL | $2,806.23 |

| JEROME | $2,807.02 |

| YELLOW PINE | $2,807.29 |

| CAREY | $2,807.71 |

| DIETRICH | $2,807.80 |

| HAZELTON | $2,807.89 |

| MURTAUGH | $2,809.18 |

| FILER | $2,809.58 |

| BURLEY | $2,809.93 |

| HEYBURN | $2,810.54 |

| EDEN | $2,811.29 |

| RUPERT | $2,812.32 |

| HAYDEN | $2,814.63 |

| CASTLEFORD | $2,816.17 |

| BUHL | $2,816.20 |

| DECLO | $2,816.44 |

| LAKE FORK | $2,816.93 |

| HAILEY | $2,819.20 |

| PLACERVILLE | $2,820.16 |

| ALMO | $2,820.50 |

| ALBION | $2,820.70 |

| NEW PLYMOUTH | $2,820.93 |

| MALTA | $2,821.81 |

| KIMBERLY | $2,823.22 |

| SUN VALLEY | $2,823.59 |

| PAUL | $2,823.71 |

| COBALT | $2,823.92 |

| SHOUP | $2,823.92 |

| FAIRFIELD | $2,824.05 |

| ROCKLAND | $2,824.31 |

| MELBA | $2,824.89 |

| CHALLIS | $2,826.16 |

| ELLIS | $2,826.72 |

| STANLEY | $2,826.86 |

| HARVARD | $2,828.33 |

| ARBON | $2,829.43 |

| MAY | $2,831.54 |

| LAVA HOT SPRINGS | $2,831.92 |

| GRACE | $2,833.28 |

| HOWE | $2,834.89 |

| PRINCETON | $2,838.55 |

| MIDDLETON | $2,839.20 |

| DAYTON | $2,841.86 |

| FISH HAVEN | $2,841.86 |

| IDAHO CITY | $2,841.87 |

| MOORE | $2,842.92 |

| SODA SPRINGS | $2,843.08 |

| GEORGETOWN | $2,843.53 |

| AMERICAN FALLS | $2,843.72 |

| MONTPELIER | $2,844.20 |

| FRANKLIN | $2,844.28 |

| CLIFTON | $2,845.31 |

| CONDA | $2,845.61 |

| KETCHUM | $2,846.21 |

| MACKAY | $2,846.67 |

| HOLBROOK | $2,847.29 |

| POTLATCH | $2,848.45 |

| GIBBONSVILLE | $2,849.34 |

| SWANLAKE | $2,849.34 |

| BERN | $2,849.58 |

| GENEVA | $2,849.58 |

| ARIMO | $2,851.19 |

| BANCROFT | $2,852.05 |

| DOWNEY | $2,853.72 |

| MALAD CITY | $2,854.44 |

| WAYAN | $2,854.44 |

| BLOOMINGTON | $2,854.55 |

| THATCHER | $2,854.55 |

| PRESTON | $2,854.56 |

| SAINT CHARLES | $2,854.56 |

| WILDER | $2,855.64 |

| LEMHI | $2,856.96 |

| NORTH FORK | $2,856.96 |

| ARCO | $2,857.30 |

| DINGLE | $2,858.15 |

| NEW MEADOWS | $2,858.60 |

| TENDOY | $2,858.99 |

| CARMEN | $2,859.10 |

| CAMBRIDGE | $2,859.27 |

| WESTON | $2,859.35 |

| CALDWELL | $2,859.99 |

| SALMON | $2,862.84 |

| LEADORE | $2,863.70 |

| WEISER | $2,864.12 |

| MCCAMMON | $2,865.42 |

| ELK CITY | $2,867.22 |

| COUNCIL | $2,868.51 |

| NAMPA | $2,869.02 |

| RATHDRUM | $2,869.15 |

| GREENLEAF | $2,871.31 |

| SPIRIT LAKE | $2,875.40 |

| STITES | $2,888.02 |

| LEWISTON | $2,890.80 |

| SPRINGFIELD | $2,895.19 |

| DUBOIS | $2,897.10 |

| INKOM | $2,900.20 |

| MOSCOW | $2,900.50 |

| MULLAN | $2,901.21 |

| ABERDEEN | $2,902.40 |

| WALLACE | $2,902.47 |

| POCATELLO | $2,906.49 |

| AVERY | $2,907.88 |

| OSBURN | $2,909.77 |

| MONTEVIEW | $2,910.08 |

| SILVERTON | $2,910.15 |

| BLANCHARD | $2,911.12 |

| DEARY | $2,911.17 |

| ATHOL | $2,911.64 |

| CALDER | $2,914.35 |

| POLLOCK | $2,916.57 |

| KELLOGG | $2,916.87 |

| PARKER | $2,917.01 |

| FERNWOOD | $2,917.14 |

| ELK RIVER | $2,917.63 |

| BOVILL | $2,917.85 |

| SMELTERVILLE | $2,918.02 |

| SUGAR CITY | $2,918.32 |

| TROY | $2,918.98 |

| BAYVIEW | $2,919.27 |

| CLARKIA | $2,919.68 |

| GENESEE | $2,921.33 |

| RIRIE | $2,922.33 |

| JULIAETTA | $2,922.35 |

| REXBURG | $2,922.90 |

| WORLEY | $2,923.28 |

| VIOLA | $2,925.52 |

| MACKS INN | $2,925.75 |

| TENSED | $2,926.80 |

| WARREN | $2,926.88 |

| PLUMMER | $2,927.88 |

| SPENCER | $2,927.88 |

| ATOMIC CITY | $2,928.21 |

| CHESTER | $2,928.51 |

| SAINT ANTHONY | $2,929.41 |

| KENDRICK | $2,929.55 |

| PINGREE | $2,931.35 |

| DESMET | $2,931.84 |

| MEDIMONT | $2,931.94 |

| HARRISON | $2,932.09 |

| LUCILE | $2,933.61 |

| NEWDALE | $2,934.77 |

| RIGBY | $2,935.59 |

| TETON | $2,936.22 |

| ISLAND PARK | $2,936.38 |

| CATALDO | $2,936.68 |

| SANTA | $2,937.09 |

| ASHTON | $2,937.21 |

| LEWISVILLE | $2,938.11 |

| PECK | $2,938.99 |

| SAINT MARIES | $2,940.69 |

| LAPWAI | $2,940.83 |

| FELT | $2,941.37 |

| SHELLEY | $2,942.05 |

| HAMER | $2,944.13 |

| NAPLES | $2,945.23 |

| IONA | $2,945.31 |

| COTTONWOOD | $2,945.39 |

| KINGSTON | $2,946.09 |

| FIRTH | $2,946.32 |

| PONDERAY | $2,947.82 |

| COCOLALLA | $2,948.73 |

| PINEHURST | $2,949.04 |

| WINCHESTER | $2,949.99 |

| LENORE | $2,950.11 |

| KOOTENAI | $2,951.68 |

| LACLEDE | $2,951.68 |

| TERRETON | $2,951.80 |

| BASALT | $2,953.40 |

| SANDPOINT | $2,953.66 |

| CLARK FORK | $2,953.78 |

| NORDMAN | $2,953.98 |

| ROBERTS | $2,955.14 |

| COOLIN | $2,956.28 |

| WHITE BIRD | $2,956.33 |

| IDAHO FALLS | $2,957.04 |

| MOYIE SPRINGS | $2,957.53 |

| BLACKFOOT | $2,958.18 |

| GREENCREEK | $2,959.06 |

| TETONIA | $2,959.41 |

| RIGGINS | $2,959.83 |

| OLDTOWN | $2,959.92 |

| HOPE | $2,960.60 |

| DRIGGS | $2,960.74 |

| PRIEST RIVER | $2,961.57 |

| KOOSKIA | $2,963.26 |

| IRWIN | $2,963.46 |

| VICTOR | $2,963.74 |

| BONNERS FERRY | $2,964.11 |

| COLBURN | $2,964.42 |

| REUBENS | $2,964.45 |

| CAREYWOOD | $2,964.55 |

| CULDESAC | $2,965.83 |

| EASTPORT | $2,967.64 |

| PORTHILL | $2,967.64 |

| MENAN | $2,968.23 |

| SWAN VALLEY | $2,968.69 |

| FERDINAND | $2,973.54 |

| GRANGEVILLE | $2,973.79 |

| SAGLE | $2,974.33 |

| NEZPERCE | $2,975.21 |

| CRAIGMONT | $2,980.70 |

| WEIPPE | $2,987.99 |

| AHSAHKA | $2,988.00 |

| OROFINO | $2,991.37 |

| FENN | $2,994.12 |

| PIERCE | $2,999.61 |

| KAMIAH | $3,008.28 |

Take a look at these 6 major factors affecting auto insurance rates in Idaho.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Best Idaho Car Insurance Companies

So if you know you need insurance, where do you get it? There are so many insurance companies out there; just do one search on the internet for car insurance and see how many options come up.

Each insurance company has its niche. Some do better with older drivers, while some have better rates for drivers with records. That is a lot of research to have to do.

Well, you are in luck. We have done the research for you. Sit back and keep reading to find out which carrier has the best ratings and could have the best rates for you and your needs.

Read more: Farm Bureau Mutual Insurance Company of Idaho Car Insurance Review

The Largest Companies Financial Rating

AM Best is a nationally known rating company. The ratings provided by AM Best are globally recognized as a standard of financial strength for thousands of insurance companies.

Who are the largest car insurance companies in Idaho?

We have taken the top ten largest companies writing in Idaho and listed their ratings.

| Providers (Listed by Size, Largest to Smallest) | A.M. Best Rating |

|---|---|

| State Farm Group | A++ |

| Geico | A++ |

| Farm Bureau Group | A |

| Liberty Mutual Group | A |

| Progressive Group | A+ |

| Farmers Insurance Group | A |

| Allstate Insurance Group | A+ |

| USAA Group | A++ |

| American Family Insurance Group | A |

| Sentry Insurance Group | A+ |

Read more: Sentry Insurance Company Car Insurance Review

The 10 largest companies all have A ratings or higher. So there are a lot of companies to chose from with excellent financial standing.

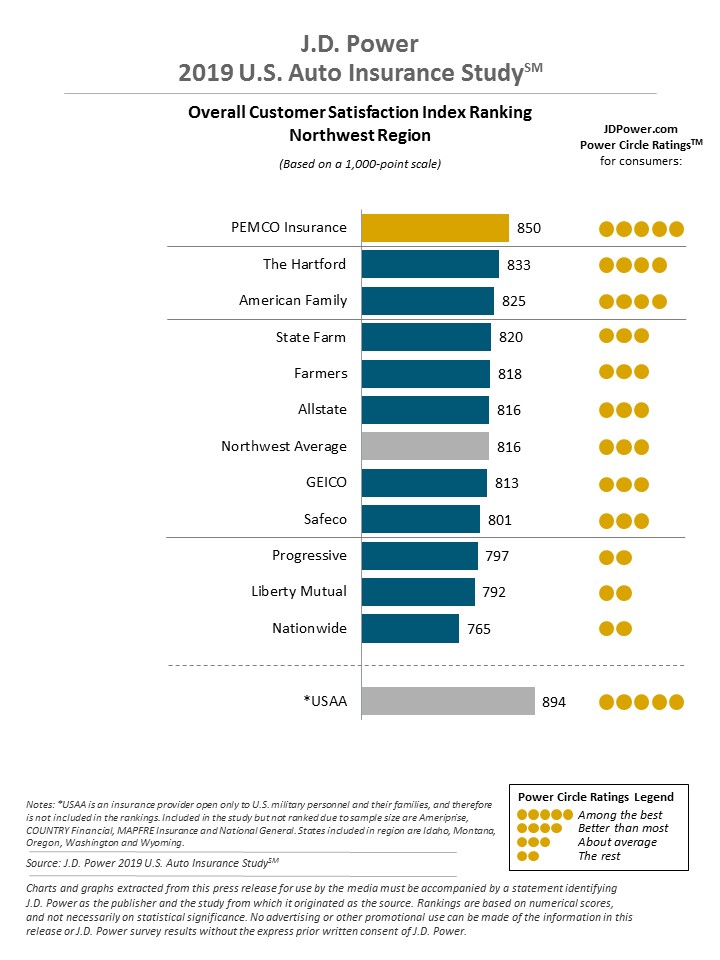

– Companies with Best Ratings

Great customer service is a huge asset to an insurance company. Most of the time, if you are dealing with customer service, you are frustrated. You may have a claim you are dealing with or you have questions regarding bills or coverages.

Now let’s see who is the cheapest car insurance company in Idaho.

You want to pick a company that not only has great rates for your needs but also has good customer service. J.D. Power uses the actual consumer’s ratings on tested products and services.

– Companies with Most Complaints in Idaho

While companies get A or higher ratings and have great customer ratings, they can still have complaints filed against them. Check out the table below listing the biggest companies and their complaint ratio.

| Company Name | # of Complaints | Index | Market Share | Premium |

|---|---|---|---|---|

| State Farm | 3 | 2.24 | 13.38 % | $126,962,470 |

| Liberty Mutual | 2 | 9.99 | 2.00 % | $19,000,251 |

| Safeco | 1 | 1.32 | 7.58 % | $71,952,626 |

| Geico | 1 | 4.06 | 2.46 % | $23,355,526 |

– Cheapest Insurance Companies in Idaho

We took the 10 largest companies in Idaho and compared their rates to the national average. State Farm won the award for the cheapest company in Idaho.

| Company | Average | Compared to State Average ($) | Compared to State Average (%) |

|---|---|---|---|

| Allstate F&C | $4,088.76 | $1,225.95 | 29.98% |

| American Family Mutual | $3,728.79 | $865.97 | 23.22% |

| Farmers Ins Co Of ID | $3,168.28 | $305.47 | 9.64% |

| Geico General | $2,770.68 | -$92.14 | -3.33% |

| Safeco Ins Co of IL | $2,301.51 | -$561.30 | -24.39% |

| Depositors Insurance | $2,735.44 | -$127.37 | -4.66% |

| State Farm Mutual Auto | $1,867.96 | -$994.85 | -53.26% |

| Travelers Home & Marine Ins Co | $3,226.29 | $363.48 | 11.27% |

| USAA | $1,877.61 | -$985.20 | -52.47% |

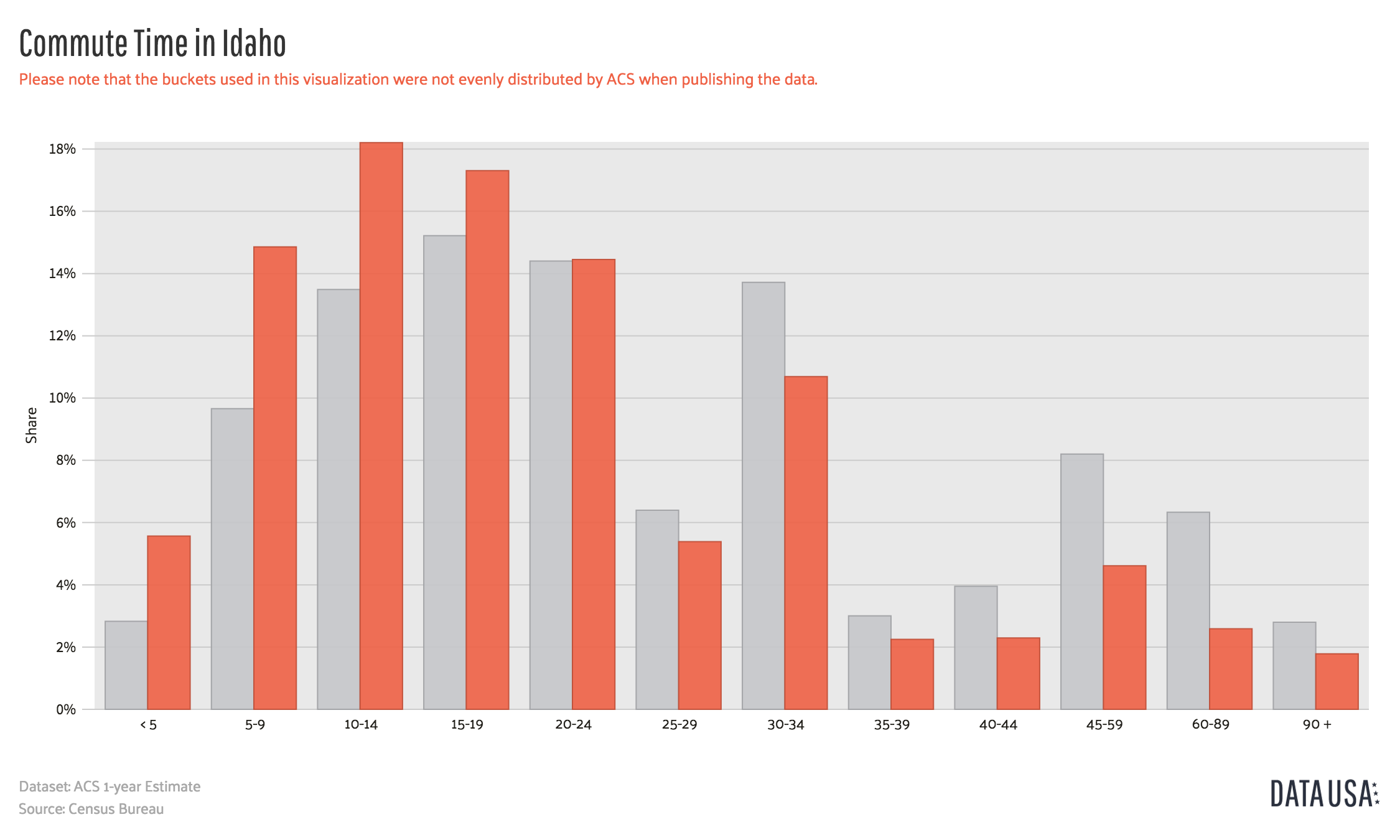

– Commute Rates by Companies

While the Idahoans commute less than the average American, almost two percent have a commute of over 90 minutes. Your car insurance rate could be affected by longer commutes.

| Group | 10-mile commute, 6,000 mile annual average | 25-mile commute, 12,000 mile annual average |

|---|---|---|

| Allstate | $4,088.76 | $4,088.76 |

| American Family | $3,651.77 | $3,805.81 |

| Travelers | $3,226.29 | $3,226.29 |

| Farmers | $3,168.28 | $3,168.28 |

| Geico | $2,723.05 | $2,818.30 |

| Nationwide | $2,735.44 | $2,735.44 |

| Liberty Mutual | $2,301.51 | $2,301.51 |

| State Farm | $1,823.01 | $1,912.91 |

| USAA | $1,855.16 | $1,900.06 |

Luckily, for those with long commutes, premiums are not heavily rated on commuting. If you do have a longer commute, you can see which companies may suit your needs better with no rate increase for commuting miles and time.

Coverage Level Rates by Companies

Coverage level is another factor for rating. Most states have a required minimum limit, but you can buy coverage levels much higher than what is required.

It is always good to go over your specific situation with an agent or company. We have taken the top ten companies and compiled rates for three levels of coverage.

| Group | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| Allstate | $3,935.49 | $4,080.92 | $4,249.86 |

| American Family | $3,729.46 | $3,914.07 | $3,542.83 |

| Travelers | $3,172.59 | $3,273.82 | $3,232.47 |

| Farmers | $3,012.76 | $3,132.36 | $3,359.73 |

| Geico | $2,627.36 | $2,766.30 | $2,918.37 |

| Nationwide | $2,696.85 | $2,874.15 | $2,635.33 |

| Liberty Mutual | $2,177.07 | $2,297.91 | $2,429.56 |

| State Farm | $1,762.35 | $1,871.85 | $1,969.68 |

| USAA | $1,822.69 | $1,874.40 | $1,935.74 |

As you can see from the table, it is surprising how little some extra coverage will cost. In some cases, it is even cheaper to get the extra coverage.

– Credit History Rates by Companies

Most consumers think credit history is something that follows you for larger purchases, like a car or a home. Good credit may even get you a lower interest rate with credit cards and loans.

Your credit history can also drastically affect your insurance premium as well.

| Group | Poor Credit | Fair Credit | Good Credit |

|---|---|---|---|

| Allstate | $5,398.15 | $3,666.01 | $3,202.11 |

| American Family | $4,816.08 | $3,436.47 | $2,933.82 |

| Farmers | $3,573.21 | $3,033.33 | $2,898.31 |

| Geico | $3,368.23 | $2,689.62 | $2,254.17 |

| Liberty Mutual | $3,283.44 | $2,020.02 | $1,601.08 |

| Nationwide | $3,266.83 | $2,632.86 | $2,306.63 |

| State Farm | $2,624.03 | $1,658.82 | $1,321.02 |

| Travelers | $3,694.26 | $3,107.83 | $2,876.79 |

| USAA | $2,744.62 | $1,599.54 | $1,288.67 |

With some companies, like Allstate, your rate could go up over $2000 for bad credit history. It is wise to keep an eye on your credit as it could save you on bigger purchases and your annual insurance premium.

If you have a lower credit rating, you can take a look at companies that do not rate as high for lower credit, like Farmers Insurance.

– Driving Record Rates by Companies

Your driving record is probably one of the most obvious factors in your insurance rates. It happens, most of us have seen those flashing blue lights in our rear-view mirror. How much does that speeding ticket cost you outside of court fees and fines?

Well, take a look below to see the difference between a clean record and various road infractions.

| Group | Clean Record | With 1 accident | With 1 DUI | With 1 speeding violation |

|---|---|---|---|---|

| USAA | $1,347.13 | $1,921.59 | $2,609.61 | $1,632.10 |

| Travelers | $1,990.40 | $2,832.53 | $4,913.17 | $3,169.07 |

| State Farm | $1,703.63 | $2,032.29 | $1,867.96 | $1,867.96 |

| Nationwide | $2,088.90 | $2,712.70 | $3,792.39 | $2,347.77 |

| Liberty Mutual | $1,912.27 | $2,394.45 | $2,469.94 | $2,429.40 |

| Geico | $1,703.22 | $2,715.10 | $3,793.66 | $2,870.72 |

| Farmers | $2,765.42 | $3,502.85 | $3,281.82 | $3,123.03 |

| American Family | $2,939.25 | $4,158.40 | $4,488.53 | $3,328.97 |

| Allstate | $3,374.66 | $4,240.80 | $4,737.87 | $4,001.71 |

State Farm and Farmers Insurance are two companies that are not higher for a DUI conviction. In most situations, a DUI will land you the highest rates.

– Largest Car Insurance Companies in Idaho

State Farm holds the largest market in Idaho and is, by far, the largest writing company in Idaho.

| Company Name | Direct Premiums Written | Market Share |

|---|---|---|

| State Farm Group | $142,722 | 15.04% |

| Geico | $100,544 | 10.60% |

| Farm Bureau Group | $98,873 | 10.42% |

| Liberty Mutual Group | $96,435 | 10.16% |

| Progressive Group | $86,456 | 9.11% |

| Farmers Insurance Group | $81,594 | 8.60% |

| Allstate Insurance Group | $79,124 | 8.34% |

| USAA Group | $53,222 | 5.61% |

| American Family Insurance Group | $27,659 | 2.91% |

| Sentry Insurance Group | $18,243 | 1.92% |

Number of Insurers in Idaho

If you live in Idaho, you have a lot of different choices when it comes to which insurance company to use, 832 to be exact.

| Property & Casualty Insurance | Totals |

|---|---|

| Domestic | 10 |

| Foreign | 822 |

| Total | 832 |

When you hear foreign, you usually think outside of the United States. In this case, it is just outside of Idaho. So over 800 companies have been founded and hold headquarters outside of Idaho but still do business within the state.

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

Idaho State Laws

Going to any new state or even a state you have lived in for years, it is hard to know all the state laws. There are pages of laws determining seatbelt laws, vehicle licensing laws, safety laws, and driving laws.

We are really going to dig deep and take a look at some of these laws and help you figure out how to stay legal and safe on the road.

Car Insurance Laws

Fraud and certain types of insurance, like low-cost and higher risk, are state laws. We are going to take a look at those laws and more in this next section.

Windshield Coverage

We all hate when we are driving on the interstate or behind any truck and a rock flies up and hits your windshield. Suddenly, your perfect windshield has a huge crack in it.

Most insurance companies have coverage under comprehensive coverage. In Idaho, there are no unique laws pertaining to windshield coverage. Used and aftermarket parts are allowed as long as they are mentioned in the quote.

High-Risk Insurance

High-risk insurance is coverage for consumers that can not get insurance in a normal market. This is usually due to excess speeding tickets, reckless violations, and driving under the influence convictions.

Not only are the court fees and fines expensive, but your car insurance can also get really expensive when trying to find high-risk insurance. Drivers are required to file for SR-22 insurance.

Not all companies will file an SR-22 requirement for drivers. If this is the case and you can not find insurance, Idaho has the AIPSO that can help you find insurance outside of the norma residual markets available.

Low-Cost Insurance

There are no dedicated plans for low-cost insurance in the state of Idaho. If you are concerned with the amount of your premium, it is best to shop your car insurance to ensure you are getting the best rate.

Automobile Insurance Fraud in Idaho

As in most states, Idaho considers any type of fraud a criminal act. Anyone from consumers to third-parties involved in the claims process can commit fraud.

It is considered fraud to misrepresent information on an auto insurance application all the way to falsifying a claim or “padding” information to make the claim bigger.

Two insurance sectors are considered to be more susceptible to fraud, auto insurance being one and health insurance the other.

If you suspect fraud, please contact your state insurance department here.

Statute of Limitations

It is always wise to file your auto insurance claim as soon as it happens. The Statute of limitations is the time you have from when the claim occurred to your claim is no longer collectible.

In Idaho, you have two years for physical injury and three years for property damage.

Vehicle Licensing Laws

Auto insurance will keep your car legal on the road, but you also need to follow licensing laws to keep you legal when driving.

In this next section, we are going to take a look at what things you need to do to keep you up to date on licensing and renewal procedures and what happens when you don’t.

Real ID

In 2005, Congress passed an act stating that states should have certain guidelines for issuance of a driver’s license. These standards allow government issues driver’s license to be used as identification to enter government buildings and fly commercial airlines.

Effective October 1, 2020, Idaho’s Real ID, known as a Star Card, is needed to fly or enter any federal building. You can get your Star card at your local Department of Motor Vehicles.

Penalties for Driving Without Insurance

Driving without insurance is against the law. Not to mention, if you were to get into an accident, you would have no coverage and be held liable for damages whether they be physical or property. If you think insurance is expensive, driving without can cost you more, a lot more.

If you are convicted of driving without insurance, your first offense can get you a $75 fine and your license is suspended until you can prove you have an active insurance policy in place.

If you are caught a second time within five years of the first offense, you can receive up to $1000 fine and/or six months in jail. Driving without insurance can also run the risk of being considered a high-risk driver and you may need to file SR-22 insurance.

If you are pulled over and proof of insurance is requested, there are a couple of ways you can prove coverage. Idaho uses an online insurance verification system, OIVS, that can show coverage. You can also show proof with a paper insurance id card or electronic card.

Teen Driver Laws

Idaho uses a Graduated Drivers License Program. This program helps younger drivers gradually ease into driving and once all requirements are met, the driver can get a full license.

| Type of License | Age of Eligibility | Requirements | Restrictions |

|---|---|---|---|

| Driver Training Permit | 14.5 years | Enroll in Driver Education | May only drive with instructor |

| Supervised Instruction Permit | 14.5 years +instruction period (min. 30 days for public school program) | Pass course including: -30 hours classroom -6 hours behind the wheel -6 hours observation in car | May only drive with a licensed driver over 21 |

| Intermediate License | 15 years | Hold permit for at least six months Complete 50 hours of practice, 10 of which were at night Pass written and road tests | May only drive during daylight hours unless accompanied by a driver over 21 Only one passenger under 21 (other than family) for first six months or until age 17 |

| Full License | 16 years | None | Passenger restriction (only one under 21 except family) applies if license has not been held for at least six months |

Older Driver License Renewal Procedures

Drivers sixty-three and over will need to renew their driver’s license every four years. You can renew online every other renewal process until the age of seventy. Once you turn seventy, all renewals must be done in person.

Every renewal process you must show proof of adequate vision.

New Residents

If you are new to Idaho, you have 90 days to an Idaho license. In order to obtain an Idaho license, you will need to take a vision test and you will also have to take a written examination.

You will also need to surrender your out-of-state license once you have obtained your new Idaho license.

License Renewal Procedures

Renewal for all drivers over the age of 21-62 is every four or eight years. You can choose the amount of time between renewals, knowing that on the fourth year you can submit renewal online or mail.

All licenses expire on the birthday of the driver. You must have submitted an application, fees, and completed a vision test. If the tester deems necessary, you could then have to complete another skills test or medical test will be required.

Younger drivers have five days after their 18th birthday and again five days after their 21st birthday to renew their license.

Negligent Operator Treatment System

Idaho uses a point system for convicted moving violations in and outside of Idaho. An accumulation of these points can result in a license suspension.

| Number Of Points | License Suspension |

|---|---|

| 12-17 in 12 months | 30 days |

| 18-23 in 24 months | 90 days |

| 24+ in 36 months | 6 months |

Examples of convictions of moving violations are

- Overtaking and Passing a school bus

- Racing on public highways

- Pedestrians right of way on sidewalks

- Basic rule and maximum speed limits

- Limitations on turning around

- Following too close

- Operation of vehicles on approach of authorized emergency or police vehicles

A complete list of violations and points can be found on the Idaho Transportation Department website.

Driver’s will receive notice when the following points are accumulated

- 8 to 11 points in a twelve-month period of time

- 14 to 17 points in a twenty-four month period of time

- 20 to 23 points in a thirty-six month period of time

There are some offenses that if you are convicted of, no matter your points, you could still end up with a suspended license.

- DUI

- Use of car to commit a felony

- Leaving the scene of an accident

- Reckless driving

- Driving under a suspended license

- Failure to pay

- Fleeing from a police officer

- Violations of license restrictions

- Failure to carry insurance

Rules of the Road

Each state as different rules to keep you safe on the road. We are going to take a look at some Idaho rules of the road to make sure you how to stay safe.

Fault vs. No-Fault

Idaho is a traditional ‘at-fault’ state. This means that whoever is at fault of the accident will payout for the claim, but for Idahoans, it doesn’t stop there.

Idaho has modified comparative negligence law. You must prove that the other person is more at fault than you are. This also means, for example, if you are found 30 percent at fault, your claim payment will only be 70 percent of your total damages.

Seat belt and car seat laws

Seat belts are required for everyone seven and older, regardless of rear or front seat. Failure to follow this law is minimum $10 fine.

Car seats are required for any child six and younger. The Idaho Department of Transportation makes the following recommendations for car seats:

- Rear-facing seat until two or until the child reaches the maximum height and weight of the seat.

- Forward-facing seat until approximately four years and 40-65 pounds

- Booster seat from four to at least eight years old or 4’9”

- When using a booster seat, use a high back or backless belt-positioning booster

- Lap-belt only seating positions should not be used with a booster seat

Keep Right and Move Over Laws

Slower vehicles should stay to the right of faster traffic.