Maryland Car Insurance Guide (Cost + Coverage)

Maryland car insurance averages $103 per month, which is 13 percent less than the national average. This means cheap Maryland car insurance is easy to find, especially when you comparison shop online. Read this guide to learn why Maryland car insurance rates vary by ZIP code, then enter your ZIP below to get a free Maryland car insurance quote that you can use to buy an affordable Maryland car insurance policy online.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Feb 12, 2025

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 12, 2025

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Maryland Statistics Summary | Details |

|---|---|

| Miles of Roadway | 32,037 |

| Vehicles Registered in the State | 4,008,847 |

| State Population | 6,042,718 |

| Most Popular Vehicle in the State | CR-V |

| Uninsured %/Underinsured % | 12.40% |

| Total Driving Related Deaths | 550 |

| Speeding Fatalities | 160 |

| DUI Fatalities | 186 |

| Average Annual Premiums | $1,116.45 |

| Liability Avg Premium | $609.74 |

| Collision Avg Premium | $388.28 |

| Comprehensive Avg Premium | $152.72 |

| Cheapest Providers | NAICOA and USAA |

Maryland is home to the Antietam Battlefield, the Baltimore Ravens, Chesapeake Bay, and John Hopkins School of Medicine. It is also home to mandatory vehicle insurance laws, which means you are required to have the minimum liability coverage to register your vehicle in the state.

Though it is a necessity, searching for car insurance can be difficult. Spending hours calling different companies to get a quote is nobody’s idea of a good time.

Even more frustrating is that the average insurance costs in Maryland are $1,590 per year, much higher than the national average of $1,311 annually.

Luckily, it is still possible to find a good deal on insurance in Maryland. You can enter your ZIP code now to compare quotes on car insurance today.

What kind of car insurance coverage do you need in Maryland?

Finding the right coverage can be difficult but we’ve made comparing easy. Keeping reading to learn about the minimum requirements for auto insurance in Maryland.

Maryland Minimum Coverage

Like most states in the country, Maryland is what’s known as a fault state. This means the driver who is at fault for an accident is responsible for the financial cost associated with the accident.

| Coverage Type | Required State Minimum |

|---|---|

| Bodily Injury Liability | $30,000/$60,000 |

| Property Damage Liability | $15,000 |

| Uninsured/Underinsured Motorist | $30,000/$60,000/$15,000 |

Maryland requires drivers to carry bodily injury and property damage liability coverage to register their cars in the state. To meet the minimum coverage requirements, drivers must maintain the following insurance limits:

- Individuals – $30,000/$60,000 for bodily injury and $15,000 for property damage, including uninsured motorist coverage at the same levels

- Transportation Network Company Affiliates – $50,000/$100,000 for bodily injury and $25,000 for property damage, including uninsured motorist coverage at the same levels

- Uninsured/Underinsured Motorist Coverage is also required on all auto policies at the same levels as your liability coverage.

The minimum required coverage isn’t a coverage limit, however, and considering that the majority of cars now cost more than $15,000 to replace, most drivers would benefit from having additional coverage on their vehicles.

The cost of minimum coverage varies from state to state.

Forms of Financial Responsibility

Whether you get ID cards mailed to you from your insurance company, print them at home or have access to them electronically by phone, as you will need some sort of proof of insurance to drive in the state of Maryland.

Maryland is serious about requiring proof of coverage when it comes to your car insurance, so it is important to make sure you always have active coverage in place along with up-to-date ID cards or other documentation to prove it.

If your insurance policy is canceled or you otherwise find yourself in a situation without active insurance, you may receive a letter from the state. If this happens and you have active insurance, you can reach out to your insurance agent and ask them to send an E-FR 19 form to the MDOT MVA.

Premiums as a Percentage of Income

| State | Full Coverage 2014 | Disposable Income 2014 | Insurance as % of Income 2014 | Full Coverage 2013 | Disposable Income 2013 | Insurance as % of Income 2013 | Full Coverage 2012 | Disposable Income 2012 | Insurance as % of Income 2012 |

|---|---|---|---|---|---|---|---|---|---|

| Maryland | $1,096.37 | $46,875.00 | 2.34% | $1,071.35 | $45,664.00 | 2.35% | $1,056.82 | $46,815.00 | 2.26% |

| West Virginia | $1,032.45 | $32,277.00 | 3.20% | $1,021.37 | $31,312.00 | 3.26% | $1,005.68 | $31,665.00 | 3.18% |

| District of Columbia | $1,324.39 | $59,936.00 | 2.21% | $1,316.48 | $56,573.00 | 2.33% | $1,289.49 | $57,155.00 | 2.26% |

| Virginia | $836.14 | $43,904.00 | 1.90% | $809.40 | $42,474.00 | 1.91% | $781.38 | $43,685.00 | 1.79% |

The average income in Maryland varies, but according to the ACS survey, the average per capita income in the state was $39,960 in 2017.

Many different factors impact your insurance premiums. Everything from your age and gender to your ZIP code can have a big impact on your rates. This makes figuring your premium as a percentage of your income difficult.

Teens and adults with poor driving records could be spending 30 percent or more of their income on their coverage, whereas someone in their late 30s might be spending less than 5 percent of their income on car insurance premiums.

To determine the percentage of your income spent on your car insurance, take the amount of your premium divided by your income (either gross or net) then multiply by 100.

For example, if a single, 25-year-old woman is earning $39,960 and paying $6,671.15 for insurance each year, she spends 16.69 percent of her gross income on her car insurance each year.

As she gets older her insurance rates will change, but other factors such as her ZIP code and credit history will also impact her rates, which means she may not be able to predict whether her rates will increase or decrease over time.

Average Monthly Car Insurance Rates in MD (Liability, Collision, Comprehensive)

| Coverage Type | 2015 | 2014 | 2013 | 2012 | 2011 | Annual Average |

|---|---|---|---|---|---|---|

| Liability | $609.74 | $607.19 | $596.17 | $594.28 | $590.02 | $599.48 |

| Collision | $353.99 | $339.48 | $327.89 | $319.30 | $317.96 | $331.72 |

| Comprehensive | $152.72 | $149.70 | $147.29 | $143.24 | $140.88 | $146.77 |

| Full Coverage | $1,116.45 | $1,096.37 | $1,071.35 | $1,056.82 | $1,048.86 | $1,077.97 |

While liability coverage is required in the state of Maryland, there is a lot more to insurance than just liability. Insurance is about protecting your financial interests, so you may want to consider any or all of these coverages:

- Liability – Liability insurance protects your financial welfare by paying for damages to another person’s vehicle if you are at fault in an accident. It also covers medical bills in the event of bodily injury someone else sustained in an accident where you were at fault.

- Uninsured Motorist Coverage – Uninsured motorist coverage, often referred to as UM, is mandatory in Maryland. It covers you at the same levels as your liability coverage if you are in an accident where an uninsured driver was at fault.

- Collision – Collision insurance protects your financial welfare by paying for damages to your vehicle if you are at fault in an accident, whether you hit another vehicle or a stationary object. If you are paying off a loan on a car you might be required by the lender to have active collision insurance on your policy.

- Comprehensive – Comprehensive insurance covers damage to your car that isn’t caused during an accident. Some examples of what might be covered under a comprehensive policy are hail damage, vandalism, and theft.

Each insurance company will have their own guidelines as to what is and is not covered under your comprehensive policy, so make sure you do your research when choosing an insurance provider.

Additional Liability

| Personal Injury Protection | 2015 | 2014 | 2013 |

|---|---|---|---|

| Earned Premiums | $295,125,693.00 | $289,244,367.00 | $283,175,864.00 |

| Earned Exposures | $4,081,000.00 | $4,030,583.00 | $3,980,324.00 |

| Medical Payments | 2015 | 2014 | 2013 |

| Earned Premiums | $11,375,229.00 | $11,859,213.00 | $12,056,381.00 |

| Earned Exposures | $428,728.00 | $445,281.00 | $452,564.00 |

When it comes to additional coverage you will want to consider Personal Injury Protection (PIP). While some states require PIP coverage as part of a basic liability plan, Maryland is not one of those states.

Where uninsured motorist/underinsured motorist coverage (UM) takes the place of the liability insurance the other person should have (or should have more of, depending on the situation), PIP applies no matter who was at fault in the accident.

PIP is typically a smaller amount of coverage, sometimes as low as $2,000, designed to cover your most basic needs if you have to go to the doctor or hospital due to an injury during the accident.

But PIP is about your medical needs. What about the needs of other people if you are at fault in an accident?

While the state minimum might be $30,000/$60,000 for bodily injury and $15,000 for property damage, that doesn’t mean it must be the limit for your liability coverage. You can always increase your liability levels, and most people should seriously consider carrying more than the state minimum.

You can choose to purchase more than the legal minimum of insurance. Most companies offer higher coverage levels, typically $50,000 in property damage and $250,000 per person/$500,000 per accident bodily injury, for which you will pay a higher monthly premium.

If you are lucky, in an at-fault accident you will cause minimal property damage and nobody will get hurt. But what if you aren’t so lucky?

You could hit someone in an expensive, newer model vehicle. They might have three people in the car, all of whom need medical attention. A mom of three could easily have all of her children in the car, so keep that in mind when looking at that $60,000 bodily injury cap.

If your insurance only covers $15,000 for property damage and $30,000/$60,000 for bodily injury, you could still be required to pay out of pocket for any damages beyond what your insurance policy covers, so choose your coverage levels carefully.

When you are choosing coverage, you should consider the loss ratio of the company, as well. The loss ratio is the amount paid out in claims by a company versus the amount of premium taken in by the company.

According to the NAIC, a loss ratio in the 60s or 70s is good — it means they aren’t charging too much premium and they are regularly paying out claims to their customers. Below you can see the average loss ratios for companies in Maryland.

| PIP Voluntary Business | 2015 | 2014 | 2013 |

|---|---|---|---|

| Pure Premium | 56.73 | 53.86 | 54.48 |

| Loss Ratios | 79.47 | 75.93 | 77.52 |

While loss ratios might not seem very important now, these numbers could become very important to you in the event of a claim, so consider them carefully when choosing a policy.

Add-Ons, Endorsements, & Riders

Just because you have all of the core coverages and higher-than-average levels of liability coverage doesn’t mean you are completely protected. There are other coverages available that you may need to be on solid financial ground.

- Umbrella Policy – If you don’t think that $250,000/$500,000 in bodily injury and $50,0000 in property damage would be enough to protect your assets in a serious accident, you may want to consider an umbrella policy. Umbrella policies provide a minimum of $1,000,000 in liability coverage.

- Rental Reimbursement – Rental reimbursement would cover the cost of a rental car while yours is being repaired because of a covered loss. For example, if a hail storm damaged the roof of your car, comprehensive insurance would cover that cost, but rental reimbursement coverage would cover the cost of a rental car covered during repairs.

- Roadside Assistance – If you find yourself in need of a tow truck or basic repair on the side of the road, roadside assistance coverage would help cover the cost of those services.

- GAP Insurance – GAP insurance covers the gap between what your insurance policy pays and the amount still owed for the car. GAP insurance can help prevent you from being forced to make payments on a totaled vehicle, but the type of GAP coverage available varies widely from company to company and state to state, so research carefully before buying.

- Non-Owner Insurance – If you don’t own a car but you still drive semi-regularly, you might need a non-owner insurance plan to provide you with third party liability coverage to protect you financially.

- Classic Car Insurance – The value of a classic or vintage car is worth more than standard depreciation. If you have a classic car you will need classic car insurance to make sure your vehicle is protected at its full value.

- Usage-Based/Pay-As-You-Drive Insurance – A device installed in your car or an app installed on your phone records your driving information (speed, mileage, etc.) and report it to your insurance company who offer you discounts on your coverage for being a better driver.

Average Car Insurance Rates by Age & Gender in MD

While some states are now making it illegal to rate people by gender, Maryland still allows insurance companies to use your gender when determining your premium. Take a look at the chart below to see the average rate for different demographics based on data from Quadrant Information Services.

| Company | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate | Single 17-year old female annual rate | Single 17-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate Indemnity | $3,479.22 | $3,341.48 | $3,315.46 | $3,402.86 | $10,126.25 | $11,877.20 | $3,142.00 | $3,180.86 |

| Geico Cas | $2,409.20 | $2,633.97 | $2,737.58 | $3,154.25 | $7,238.09 | $8,259.04 | $2,057.84 | $2,171.06 |

| Liberty Mutual Fire Ins Co | $6,671.15 | $6,671.15 | $6,594.83 | $6,594.83 | $12,964.69 | $19,221.87 | $6,671.15 | $8,990.68 |

| NAICOA | $2,001.73 | $2,008.48 | $1,810.88 | $1,863.99 | $4,680.47 | $6,150.29 | $2,316.18 | $2,493.50 |

| Progressive Select | $2,445.57 | $2,204.58 | $2,128.62 | $2,174.55 | $8,688.04 | $9,494.13 | $2,844.59 | $2,778.79 |

| State Farm Mutual Auto | $2,384.38 | $2,384.38 | $2,189.99 | $2,189.99 | $7,402.28 | $9,470.28 | $2,661.50 | $3,004.10 |

| USAA | $1,974.24 | $1,939.21 | $1,843.88 | $1,839.49 | $4,378.75 | $5,166.68 | $2,274.19 | $2,536.67 |

Your age and gender do impact your rates significantly, but insurance companies still have huge differences in their premiums, so shopping around for a quote can save you thousands of dollars per year.

| Company | Demographic | Average Annual Rate | Rank |

|---|---|---|---|

| Liberty Mutual Fire Ins Co | Single 17-year old male | $19,221.87 | 1 |

| Liberty Mutual Fire Ins Co | Single 17-year old female | $12,964.69 | 2 |

| Allstate Indemnity | Single 17-year old male | $11,877.20 | 3 |

| Allstate Indemnity | Single 17-year old female | $10,126.25 | 4 |

| Progressive Select | Single 17-year old male | $9,494.13 | 5 |

| State Farm Mutual Auto | Single 17-year old male | $9,470.28 | 6 |

| Liberty Mutual Fire Ins Co | Single 25-year old male | $8,990.68 | 7 |

| Progressive Select | Single 17-year old female | $8,688.04 | 8 |

| Geico Cas | Single 17-year old male | $8,259.04 | 9 |

| State Farm Mutual Auto | Single 17-year old female | $7,402.28 | 10 |

| Geico Cas | Single 17-year old female | $7,238.09 | 11 |

| Liberty Mutual Fire Ins Co | Married 35-year old female | $6,671.15 | 12 |

| Liberty Mutual Fire Ins Co | Married 35-year old male | $6,671.15 | 12 |

| Liberty Mutual Fire Ins Co | Single 25-year old female | $6,671.15 | 12 |

| Liberty Mutual Fire Ins Co | Married 60-year old female | $6,594.83 | 15 |

| Liberty Mutual Fire Ins Co | Married 60-year old male | $6,594.83 | 15 |

| NAICOA | Single 17-year old male | $6,150.29 | 17 |

| USAA | Single 17-year old male | $5,166.68 | 18 |

| NAICOA | Single 17-year old female | $4,680.47 | 19 |

| USAA | Single 17-year old female | $4,378.75 | 20 |

| Allstate Indemnity | Married 35-year old female | $3,479.22 | 21 |

| Allstate Indemnity | Married 60-year old male | $3,402.86 | 22 |

| Allstate Indemnity | Married 35-year old male | $3,341.48 | 23 |

| Allstate Indemnity | Married 60-year old female | $3,315.46 | 24 |

| Allstate Indemnity | Single 25-year old male | $3,180.86 | 25 |

| Geico Cas | Married 60-year old male | $3,154.25 | 26 |

| Allstate Indemnity | Single 25-year old female | $3,142.00 | 27 |

| State Farm Mutual Auto | Single 25-year old male | $3,004.10 | 28 |

| Progressive Select | Single 25-year old female | $2,844.59 | 29 |

| Progressive Select | Single 25-year old male | $2,778.79 | 30 |

| Geico Cas | Married 60-year old female | $2,737.58 | 31 |

| State Farm Mutual Auto | Single 25-year old female | $2,661.50 | 32 |

| Geico Cas | Married 35-year old male | $2,633.97 | 33 |

| USAA | Single 25-year old male | $2,536.67 | 34 |

| NAICOA | Single 25-year old male | $2,493.50 | 35 |

| Progressive Select | Married 35-year old female | $2,445.57 | 36 |

| Geico Cas | Married 35-year old female | $2,409.20 | 37 |

| State Farm Mutual Auto | Married 35-year old female | $2,384.38 | 38 |

| State Farm Mutual Auto | Married 35-year old male | $2,384.38 | 38 |

| NAICOA | Single 25-year old female | $2,316.18 | 40 |

| USAA | Single 25-year old female | $2,274.19 | 41 |

| Progressive Select | Married 35-year old male | $2,204.58 | 42 |

| State Farm Mutual Auto | Married 60-year old female | $2,189.99 | 43 |

| State Farm Mutual Auto | Married 60-year old male | $2,189.99 | 43 |

| Progressive Select | Married 60-year old male | $2,174.55 | 45 |

| Geico Cas | Single 25-year old male | $2,171.06 | 46 |

| Progressive Select | Married 60-year old female | $2,128.62 | 47 |

| Geico Cas | Single 25-year old female | $2,057.84 | 48 |

| NAICOA | Married 35-year old male | $2,008.48 | 49 |

| NAICOA | Married 35-year old female | $2,001.73 | 50 |

| USAA | Married 35-year old female | $1,974.24 | 51 |

| USAA | Married 35-year old male | $1,939.21 | 52 |

| NAICOA | Married 60-year old male | $1,863.99 | 53 |

| USAA | Married 60-year old female | $1,843.88 | 54 |

| USAA | Married 60-year old male | $1,839.49 | 55 |

| NAICOA | Married 60-year old female | $1,810.88 | 56 |

In the data above, the rates are determined by actual purchased coverage by drivers in Maryland. It also includes rates for high-risk drivers and drivers who choose to carry higher-than-minimum levels of coverage, so these numbers may be higher than normal in your situation.

Cheapest Rates by ZIP Code

Your ZIP code plays a huge part in your insurance rates. Everything from the number of accidents to the number of cars stolen in a ZIP code goes into determining what the rate for that area should be, which means that moving a block or two could dramatically change your annual premiums if it puts you in a new ZIP code.

| Most Expensive Zip Codes in Maryland | City | Annual Average by Zip Code | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 21216 | BALTIMORE | $8,830.19 | Liberty Mutual | $18,053.57 | Progressive | $9,230.34 | USAA | $4,945.10 | Nationwide | $5,400.63 |

| 21215 | BALTIMORE | $8,651.27 | Liberty Mutual | $18,053.57 | Progressive | $9,004.76 | USAA | $4,632.39 | Nationwide | $5,400.63 |

| 21213 | BALTIMORE | $8,455.92 | Liberty Mutual | $16,417.60 | State Farm | $8,891.65 | USAA | $4,390.01 | Nationwide | $5,201.68 |

| 21217 | BALTIMORE | $8,407.60 | Liberty Mutual | $18,053.57 | Progressive | $8,410.13 | USAA | $4,625.95 | Nationwide | $5,400.63 |

| 21223 | BALTIMORE | $8,230.60 | Liberty Mutual | $15,383.48 | Progressive | $8,481.40 | USAA | $4,945.10 | Nationwide | $5,201.68 |

| 21205 | BALTIMORE | $7,886.36 | Liberty Mutual | $16,417.60 | State Farm | $8,088.92 | USAA | $3,761.94 | Nationwide | $5,201.68 |

| 21207 | GWYNN OAK | $7,721.94 | Liberty Mutual | $15,383.48 | Progressive | $7,844.78 | USAA | $4,882.32 | Nationwide | $5,400.63 |

| 21251 | BALTIMORE | $7,596.61 | Liberty Mutual | $15,383.48 | Progressive | $7,616.45 | USAA | $4,158.69 | Nationwide | $5,201.68 |

| 21218 | BALTIMORE | $7,591.34 | Liberty Mutual | $15,383.48 | Allstate | $7,693.18 | USAA | $3,928.12 | Nationwide | $5,201.68 |

| 21239 | BALTIMORE | $7,485.36 | Liberty Mutual | $15,481.52 | Allstate | $7,585.22 | USAA | $4,158.69 | Nationwide | $4,504.09 |

| 21202 | BALTIMORE | $7,310.39 | Liberty Mutual | $15,383.48 | Allstate | $7,693.18 | USAA | $3,761.94 | Nationwide | $5,201.68 |

| 21206 | BALTIMORE | $7,306.98 | Liberty Mutual | $12,595.13 | Progressive | $8,639.76 | USAA | $4,219.07 | Nationwide | $4,504.09 |

| 21133 | RANDALLSTOWN | $7,288.96 | Liberty Mutual | $15,383.48 | Allstate | $7,585.22 | USAA | $3,682.84 | Nationwide | $4,860.80 |

| 21244 | WINDSOR MILL | $7,164.27 | Liberty Mutual | $15,383.48 | Allstate | $7,585.22 | USAA | $3,906.13 | Nationwide | $4,509.81 |

| 21233 | BALTIMORE | $7,044.14 | Liberty Mutual | $15,383.48 | Progressive | $7,721.98 | USAA | $3,831.40 | Nationwide | $4,504.09 |

| 21201 | BALTIMORE | $7,013.37 | Liberty Mutual | $15,383.48 | Allstate | $7,693.18 | USAA | $3,734.89 | Geico | $4,760.90 |

| 21231 | BALTIMORE | $6,850.34 | Liberty Mutual | $15,383.48 | Allstate | $7,693.18 | USAA | $3,831.40 | Progressive | $4,824.71 |

| 21208 | PIKESVILLE | $6,777.46 | Liberty Mutual | $14,015.81 | Allstate | $7,585.22 | USAA | $3,662.08 | Nationwide | $3,990.65 |

| 21214 | BALTIMORE | $6,699.88 | Liberty Mutual | $10,811.14 | Allstate | $7,693.18 | USAA | $3,954.72 | Nationwide | $4,504.09 |

| 21209 | BALTIMORE | $6,520.50 | Liberty Mutual | $14,015.81 | Allstate | $7,585.22 | USAA | $3,358.11 | Nationwide | $4,504.09 |

| 20743 | CAPITOL HEIGHTS | $6,517.08 | Liberty Mutual | $14,583.12 | Allstate | $6,180.00 | Nationwide | $4,077.69 | USAA | $4,095.03 |

| 20747 | DISTRICT HEIGHTS | $6,402.12 | Liberty Mutual | $14,583.12 | Allstate | $6,180.00 | USAA | $4,040.83 | Nationwide | $4,077.69 |

| 20785 | HYATTSVILLE | $6,358.32 | Liberty Mutual | $14,583.12 | Allstate | $6,180.00 | USAA | $4,032.68 | Nationwide | $4,077.69 |

| 21212 | BALTIMORE | $6,321.77 | Liberty Mutual | $11,974.20 | Allstate | $7,585.22 | USAA | $3,832.56 | Nationwide | $4,504.09 |

| 20710 | BLADENSBURG | $6,313.14 | Liberty Mutual | $14,583.12 | Allstate | $6,205.95 | Nationwide | $3,588.66 | USAA | $3,865.45 |

Baltimore has the majority of the most expensive zip codes in Maryland.

| Least Expensive Zip Codes in Maryland | City | Annual Average by Zip Codes | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 21783 | SMITHSBURG | $3,658.86 | Liberty Mutual | $7,798.10 | Allstate | $4,058.11 | Nationwide | $2,288.47 | USAA | $2,292.55 |

| 21629 | DENTON | $3,679.84 | Liberty Mutual | $7,741.31 | Allstate | $4,095.48 | USAA | $2,154.13 | Nationwide | $2,199.10 |

| 21767 | MAUGANSVILLE | $3,680.30 | Liberty Mutual | $7,798.10 | Allstate | $4,058.11 | Nationwide | $2,288.47 | USAA | $2,451.41 |

| 21721 | CHEWSVILLE | $3,682.15 | Liberty Mutual | $7,798.10 | Allstate | $4,058.11 | Nationwide | $2,288.47 | USAA | $2,292.55 |

| 21660 | RIDGELY | $3,683.98 | Liberty Mutual | $7,741.31 | Allstate | $4,095.48 | USAA | $2,154.13 | Nationwide | $2,199.10 |

| 21641 | HILLSBORO | $3,688.53 | Liberty Mutual | $8,068.52 | Allstate | $4,095.48 | USAA | $2,154.13 | Nationwide | $2,199.10 |

| 21670 | TEMPLEVILLE | $3,688.53 | Liberty Mutual | $8,068.52 | Allstate | $4,095.48 | USAA | $2,154.13 | Nationwide | $2,199.10 |

| 21655 | PRESTON | $3,689.34 | Liberty Mutual | $8,068.52 | Allstate | $4,095.48 | USAA | $2,154.13 | Nationwide | $2,199.10 |

| 21601 | EASTON | $3,689.45 | Liberty Mutual | $8,068.52 | Allstate | $4,095.48 | Nationwide | $2,199.10 | USAA | $2,283.88 |

| 21719 | CASCADE | $3,696.13 | Liberty Mutual | $7,798.10 | Allstate | $4,058.11 | Nationwide | $2,288.47 | USAA | $2,292.55 |

| 21811 | BERLIN | $3,696.78 | Liberty Mutual | $7,741.31 | Allstate | $4,095.48 | Nationwide | $2,213.21 | USAA | $2,322.55 |

| 21632 | FEDERALSBURG | $3,697.12 | Liberty Mutual | $7,741.31 | Allstate | $4,095.48 | Nationwide | $2,255.85 | USAA | $2,377.24 |

| 21742 | HAGERSTOWN | $3,697.62 | Liberty Mutual | $7,798.10 | Allstate | $4,058.11 | Nationwide | $2,288.47 | USAA | $2,292.55 |

| 21842 | OCEAN CITY | $3,698.26 | Liberty Mutual | $7,741.31 | Allstate | $4,095.48 | Nationwide | $2,213.21 | USAA | $2,322.55 |

| 21862 | SHOWELL | $3,699.60 | Liberty Mutual | $7,741.31 | Allstate | $4,095.48 | Nationwide | $2,213.21 | USAA | $2,407.74 |

| 21810 | ALLEN | $3,699.92 | Liberty Mutual | $7,741.31 | Allstate | $4,095.48 | Nationwide | $2,247.24 | USAA | $2,424.67 |

| 21627 | CROCHERON | $3,701.33 | Liberty Mutual | $7,741.31 | Allstate | $4,095.48 | Nationwide | $2,255.85 | USAA | $2,377.24 |

| 21663 | SAINT MICHAELS | $3,702.10 | Liberty Mutual | $8,068.52 | Allstate | $4,095.48 | Nationwide | $2,199.10 | USAA | $2,278.74 |

| 21652 | NEAVITT | $3,702.66 | Liberty Mutual | $8,068.52 | Allstate | $4,095.48 | Nationwide | $2,199.10 | USAA | $2,253.04 |

| 21653 | NEWCOMB | $3,702.66 | Liberty Mutual | $8,068.52 | Allstate | $4,095.48 | Nationwide | $2,199.10 | USAA | $2,253.04 |

| 21795 | WILLIAMSPORT | $3,706.29 | Liberty Mutual | $7,798.10 | Allstate | $4,058.11 | Nationwide | $2,288.47 | USAA | $2,451.41 |

| 21852 | POWELLVILLE | $3,706.88 | Liberty Mutual | $7,741.31 | Allstate | $4,095.48 | Nationwide | $2,247.24 | USAA | $2,424.67 |

| 21654 | OXFORD | $3,708.41 | Liberty Mutual | $8,068.52 | Allstate | $4,095.48 | Nationwide | $2,199.10 | USAA | $2,253.04 |

| 21659 | RHODESDALE | $3,711.42 | Liberty Mutual | $7,741.31 | Allstate | $4,095.48 | Nationwide | $2,255.85 | USAA | $2,377.24 |

| 21734 | FUNKSTOWN | $3,711.93 | Liberty Mutual | $7,798.10 | Allstate | $4,058.11 | Nationwide | $2,288.47 | USAA | $2,292.55 |

Cheapest Rates by City

Just like your ZIP code, your city can impact your insurance rates significantly. Crime rates, street parking, and all sorts of other variables can impact the insurance rates for your city.

| Most Expensive Cities in Maryland | Annual Average by City | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|

| Randallstown | $7,288.96 | Liberty Mutual | $15,383.48 | Allstate | $7,585.22 | USAA | $3,682.84 | Nationwide | $4,860.80 |

| Windsor Mill | $7,164.27 | Liberty Mutual | $15,383.48 | Allstate | $7,585.22 | USAA | $3,906.13 | Nationwide | $4,509.81 |

| Baltimore | $6,862.78 | Liberty Mutual | $13,543.49 | Allstate | $7,512.52 | USAA | $3,899.06 | Nationwide | $4,576.97 |

| Capitol Heights | $6,517.08 | Liberty Mutual | $14,583.12 | Allstate | $6,180.00 | Nationwide | $4,077.69 | USAA | $4,095.03 |

| District Heights | $6,402.12 | Liberty Mutual | $14,583.12 | Allstate | $6,180.00 | USAA | $4,040.83 | Nationwide | $4,077.69 |

| Cheverly | $6,358.32 | Liberty Mutual | $14,583.12 | Allstate | $6,180.00 | USAA | $4,032.68 | Nationwide | $4,077.69 |

| Bladensburg | $6,313.13 | Liberty Mutual | $14,583.12 | Allstate | $6,205.95 | Nationwide | $3,588.66 | USAA | $3,865.45 |

| Forest Heights | $6,203.36 | Liberty Mutual | $13,517.97 | Allstate | $5,762.95 | USAA | $4,029.40 | Nationwide | $4,077.69 |

| East Riverdale | $6,143.03 | Liberty Mutual | $14,583.12 | Allstate | $6,205.95 | Nationwide | $3,588.66 | USAA | $4,003.22 |

| Garrison | $6,113.39 | Liberty Mutual | $11,974.20 | Allstate | $7,529.77 | USAA | $3,552.82 | Nationwide | $4,160.22 |

It is important to note that your rate can vary significantly from ZIP code to ZIP code even within a city, so keep that in mind when you are comparing rates based on your city of residence.

| Least Expensive Cities in Maryland | Annual Average by City | Most Expensive Company | Most Expensive Rate | 2nd Most Expensive Company | 2nd Most Expensive Rate | Cheapest Company | Cheapest Rate | 2nd Cheapest Company | 2nd Cheapest Rate |

|---|---|---|---|---|---|---|---|---|---|

| Cavetown | $3,658.86 | Liberty Mutual | $7,798.10 | Allstate | $4,058.11 | Nationwide | $2,288.47 | USAA | $2,292.55 |

| Denton | $3,679.84 | Liberty Mutual | $7,741.31 | Allstate | $4,095.48 | USAA | $2,154.13 | Nationwide | $2,199.10 |

| Maugansville | $3,680.30 | Liberty Mutual | $7,798.10 | Allstate | $4,058.11 | Nationwide | $2,288.47 | USAA | $2,451.41 |

| Chewsville | $3,682.15 | Liberty Mutual | $7,798.10 | Allstate | $4,058.11 | Nationwide | $2,288.47 | USAA | $2,292.55 |

| Ridgely | $3,683.98 | Liberty Mutual | $7,741.31 | Allstate | $4,095.48 | USAA | $2,154.13 | Nationwide | $2,199.10 |

| Hillsboro | $3,688.53 | Liberty Mutual | $8,068.52 | Allstate | $4,095.48 | USAA | $2,154.13 | Nationwide | $2,199.10 |

| Templeville | $3,688.53 | Liberty Mutual | $8,068.52 | Allstate | $4,095.48 | USAA | $2,154.13 | Nationwide | $2,199.10 |

| Preston | $3,689.34 | Liberty Mutual | $8,068.52 | Allstate | $4,095.48 | USAA | $2,154.13 | Nationwide | $2,199.10 |

| Easton | $3,689.44 | Liberty Mutual | $8,068.52 | Allstate | $4,095.48 | Nationwide | $2,199.10 | USAA | $2,283.88 |

| Cascade | $3,696.13 | Liberty Mutual | $7,798.10 | Allstate | $4,058.11 | Nationwide | $2,288.47 | USAA | $2,292.55 |

Rates in Maryland’s Ten Largest Cities

While these are all large cities, the difference in premium from place to place can still be significant. Also, don’t assume rates are all based on population — there is a lot more that goes into determining a city’s rate than just how many people live there.

| City | Annual Rate |

|---|---|

| Baltimore | $8,830.19 |

| Columbia | $4,832.81 |

| Germantown | $4,588.40 |

| Silver Spring | $5,762.99 |

| Waldorf | $5,112.33 |

| Ellicott City | $4,756.43 |

| Frederick | $3,911.66 |

| Glen Burnie | $4,801.79 |

| Gaithersburg | $4,768.57 |

| Rockville | $4,785.35 |

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

What are the best Maryland car insurance companies?

It can be hard to determine which Maryland car insurance company is best for you. Some insurance companies offer more options, others provide more robust coverage, while others are the most affordable option. How do you choose which one is right for you?

It can be helpful to have a wide variety of data when determining which insurance company you should choose to protect you and your vehicle. These are just a few points you might want to reference when making a decision. Read on to learn more.

The Largest Companies’ Financial Ratings

You can review the ratings of some of the largest insurance companies in Maryland in the chart below:

| Company | AM Best Rating |

|---|---|

| Allstate Indemnity | A+ (Superior) |

| Geico Cas | A++ (Superior) |

| Liberty Mutual Fire Ins Co | A (Excellent) |

| NAICOA | B++ (Good) |

| Progressive Select | A+ (Superior) |

| State Farm Mutual Auto | A++ (Superior) |

| USAA | A++ (Superior) |

You can also compare the company’s A.M. Best rating with their direct premiums written and their loss ratio to determine which companies are the best match for your needs.

| Company Name | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| Geico | $1,173,739 | 71.93% | 23.98% |

| State Farm Group | $940,404 | 76.11% | 19.21% |

| Allstate Insurance Group | $582,872 | 56.19% | 11.91% |

| USAA Group | $422,116 | 78.75% | 8.62% |

| Erie Insurance Group | $376,241 | 78.20% | 7.69% |

| Nationwide Corp Group | $373,032 | 63.41% | 7.62% |

| Progressive Group | $310,170 | 59.90% | 6.34% |

| Liberty Mutual Group | $185,153 | 61.25% | 3.78% |

| Travelers Group | $81,122 | 63.94% | 1.66% |

| Hartford Fire & Casualty Group | $50,075 | 61.65% | 1.02% |

Companies with Best Ratings

One of the ways you can determine the stability of an insurance company is by its financial rating. Companies like A.M. Best rate each company based on their financial stability — whether they have the financial assets necessary to pay out claims over the year.

Keep in mind, however, that just because a company has excellent financial ratings doesn’t mean their customers are happy with their service.

It also doesn’t mean their rates are lower (or higher) than any other company, so this is just one of many points to consider when choosing an insurance company.

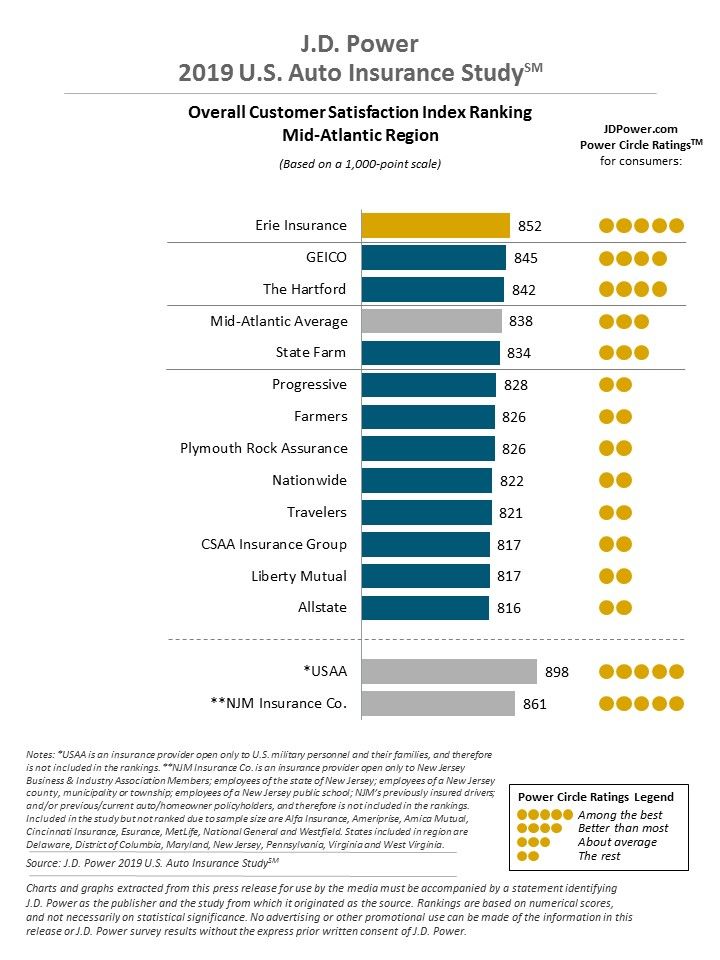

JD Power also released an annual best companies rating which is helpful to see what other consumers are actually saying about major providers. See the rankings below:

Companies with Complaints in Maryland

Consumers are encouraged to report complaints regarding their insurance companies to the Attorney General’s office, but how do you know if your problem warrants filing an official claim?

The NAIC can help guide you through the process. They have phone apps for both iPhone and Android that can walk you through the steps to take after an accident, including reporting an issue to the state if necessary.

When in doubt, you can always contact the Attorney General’s office at 410-528-8662 and ask for clarification.

| Consumer Complaints by Coverage Type | 2019 |

|---|---|

| Collision | 1,414 |

| Commercial | 590 |

| Comprehensive | 727 |

| Liability | 5,344 |

| Medical Payments | 98 |

| Motorcycle | 58 |

| No fault/PIP | 231 |

| Physical Damage | 541 |

| Private Passenger | 9,834 |

Cheapest Companies in Maryland

These are the largest insurance companies in Maryland and their annual rates:

Maryland Average Rates By Carrier

| Insurance Company | Annual Average | Compared to State Average | Percentage |

|---|---|---|---|

| $5,233.17 | $650.47 | 12.43% | |

| $3,832.63 | -$750.07 | -19.57% | |

| $9,297.55 | $4,714.85 | 50.71% |

| $2,915.69 | -$1,667.01 | -57.17% |

| $4,094.86 | -$487.84 | -11.91% | |

| $3,960.86 | -$621.83 | -15.70% | |

| $2,744.14 | -$1,838.56 | -67.00% |

Here’s how their rates compare to the state average.

While the price is important, it is one of many things you should consider when choosing an insurance plan. If you are in a situation where the price of the policy must determine your insurance plan, consider some of the following information:

Commute Rates by Companies

Your commute is an important factor when determining your insurance rates. Often your commute is broken down into categories, such as 10-mile commute/6,000 annual mileage or 25-mile commute/12,000 annual mileage.

The more time you spend on the road each day, the more likely you are to file a claim.

Whether the claim is as serious as a car accident or something smaller, such as a windshield replacement, increased drive time will expose you to more situations that might damage your vehicle.

| Group | Commute_And_Annual_Mileage | Annual Average |

|---|---|---|

| Liberty Mutual | 25 miles commute. 12000 annual mileage. | $9,546.53 |

| Liberty Mutual | 10 miles commute. 6000 annual mileage. | $9,048.56 |

| Allstate | 25 miles commute. 12000 annual mileage. | $5,307.15 |

| Allstate | 10 miles commute. 6000 annual mileage. | $5,159.18 |

| Progressive | 10 miles commute. 6000 annual mileage. | $4,094.86 |

| Progressive | 25 miles commute. 12000 annual mileage. | $4,094.86 |

| State Farm | 25 miles commute. 12000 annual mileage. | $4,062.86 |

| Geico | 25 miles commute. 12000 annual mileage. | $3,896.96 |

| State Farm | 10 miles commute. 6000 annual mileage. | $3,858.87 |

| Geico | 10 miles commute. 6000 annual mileage. | $3,768.30 |

| Nationwide | 10 miles commute. 6000 annual mileage. | $2,915.69 |

| Nationwide | 25 miles commute. 12000 annual mileage. | $2,915.69 |

| USAA | 25 miles commute. 12000 annual mileage. | $2,829.44 |

| USAA | 10 miles commute. 6000 annual mileage. | $2,658.84 |

Commute distance are not the only factor that affect your rates.

Coverage Level Rates by Companies

Because you have so many options when choosing an insurance plan, the price of your insurance can vary wildly depending on which coverages you choose.

Your individual situation has a big impact on your insurance prices. Driving a five-year-old Toyota? Your comprehensive and collision coverage will probably be much cheaper than if you were driving a brand new BMW.

Credit History Rates by Companies

One of the things that can impact your rates is your credit history. Statistics have shown that people with lower credit scores tend to file more claims, which means a low credit score can increase your rates, or possibly even cause you to be denied coverage, depending on the circumstances.

Take a look at the chart below to see how your credit history can impact your insurance rates.

| Group | Credit History | Annual Average |

|---|---|---|

| Liberty Mutual | Poor | $13,288.03 |

| Liberty Mutual | Fair | $8,563.61 |

| Allstate | Poor | $6,779.90 |

| Liberty Mutual | Good | $6,040.99 |

| State Farm | Poor | $5,794.48 |

| Progressive | Poor | $5,161.32 |

| Allstate | Fair | $4,730.97 |

| Geico | Poor | $4,344.33 |

| Allstate | Good | $4,188.63 |

| Progressive | Fair | $3,875.85 |

| Nationwide | Poor | $3,726.47 |

| USAA | Poor | $3,659.27 |

| Geico | Fair | $3,598.70 |

| Geico | Good | $3,554.85 |

| State Farm | Fair | $3,437.51 |

| Progressive | Good | $3,247.40 |

| State Farm | Good | $2,650.60 |

| Nationwide | Fair | $2,636.53 |

| USAA | Fair | $2,509.68 |

| Nationwide | Good | $2,384.07 |

| USAA | Good | $2,063.46 |

If you need to bring down the cost of your car insurance, cleaning up your credit rating is a great place to start.

Driving Record Rates by Companies

It may seem obvious, but don’t forget that your driving record can have a dramatic impact on your insurance premiums.

While a speeding ticket may only cost you a hundred dollars or so initially, the infraction will be reported to your insurance company and your rates will probably increase, so keep that in mind when you are zooming through that residential neighborhood.

Speeding tickets and other minor offenses may seem forgettable in the moment, but they will absolutely show up on your insurance premiums in the future. Obeying traffic laws and avoiding citations is a good way to keep your insurance costs low.

Take a look at the chart below to see how your driving record can impact your insurance rates.

| Group | Driving Record | Annual Average |

|---|---|---|

| Liberty Mutual | With 1 DUI | $13,177.49 |

| Liberty Mutual | With 1 accident | $8,825.47 |

| Liberty Mutual | With 1 speeding violation | $8,465.21 |

| Liberty Mutual | Clean record | $6,722.01 |

| Allstate | With 1 accident | $6,158.29 |

| Allstate | With 1 speeding violation | $5,510.30 |

| Geico | With 1 DUI | $5,144.48 |

| Progressive | With 1 accident | $4,633.82 |

| Allstate | Clean record | $4,632.04 |

| Allstate | With 1 DUI | $4,632.04 |

| State Farm | With 1 accident | $4,461.30 |

| Geico | With 1 accident | $4,234.15 |

| Progressive | With 1 DUI | $4,229.05 |

| Progressive | With 1 speeding violation | $4,020.51 |

| State Farm | With 1 DUI | $3,915.37 |

| State Farm | With 1 speeding violation | $3,915.37 |

| USAA | With 1 DUI | $3,849.72 |

| State Farm | Clean record | $3,551.42 |

| Progressive | Clean record | $3,496.06 |

| Nationwide | With 1 accident | $3,443.50 |

| Geico | With 1 speeding violation | $3,232.71 |

| Nationwide | With 1 speeding violation | $2,908.52 |

| Nationwide | With 1 DUI | $2,744.79 |

| Geico | Clean record | $2,719.17 |

| USAA | With 1 accident | $2,645.44 |

| Nationwide | Clean record | $2,565.95 |

| USAA | With 1 speeding violation | $2,323.31 |

| USAA | Clean record | $2,158.09 |

Largest Car Insurance Companies in Maryland

While size isn’t everything, choosing a well-known company with offices all over your state can be a good way to guarantee you’ll be able to find someone to help you if you have to file a claim.

You may also have an easier time finding recommendations from customers for larger companies. After all, the larger their customer base, the more people they have who can recommend their company.

Take a look at the chart below to see some of the largest insurance companies in Maryland and their rates.

Maryland Average Rates By Carrier

| Insurance Company | Annual Average | Compared to State Average | Percentage |

|---|---|---|---|

| $5,233.17 | $650.47 | 12.43% | |

| $3,832.63 | -$750.07 | -19.57% | |

| $9,297.55 | $4,714.85 | 50.71% |

| $2,915.69 | -$1,667.01 | -57.17% |

| $4,094.86 | -$487.84 | -11.91% | |

| $3,960.86 | -$621.83 | -15.70% | |

| $2,744.14 | -$1,838.56 | -67.00% |

Number of Insurers in Maryland

Maryland may only have 29 property/casualty insurance companies domiciled in the state, but that doesn’t mean there are only 29 options for car insurance. Insurance companies in other states can be licensed to sell insurance in Maryland as well, and that doesn’t even include charter groups or other self-insured options.

Below is a chart of the number of insurance companies doing business in Maryland in 2017. Please note that this includes all regulated insurance entities, not just auto insurance companies.

| Domestic Insurers | Licensed Out Of State Insurers | Chartered Self Insured Groups/Pools | Chartered Purchasing Groups | All Companies Doing Business in Maryland |

|---|---|---|---|---|

| 61 | 1,507 | 5 | 14 | 1,587 |

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

Maryland Laws

Every state has its own laws, rules, and regulations when it comes to cars, driving, and insurance. What is perfectly legal in one state might be illegal in another, so don’t assume that just because you know the law in Texas you won’t run afoul of the law in Maryland.

Car Insurance Laws

Like all other laws, car insurance laws are changed or updated all the time. It is important to keep yourself up to date on the laws as they pertain to your car insurance to make sure you know what is required of you as a consumer and a driver.

For example, in 2018 a law was passed that created a program designed to reduce the number of uninsured drivers in the state of Maryland. If you qualify for the program you’ll want to know about it, because drivers who participate could see a waiver of their penalties for driving uninsured.

Using Maryland’s insurance website can help you stay on top of the laws, possibly saving you money in the process.

How State Laws for Insurance are Determined

In Maryland, insurance laws are passed the same way any other laws are passed — through the legislative process. Once the laws are passed, they are upheld and interpreted by a couple of different groups.

- Maryland Insurance Administration – The Maryland Insurance Administration (MIA) regulates the insurance industry according to the laws and rules set forth by the state.

- Maryland Attorney General – The Attorney General’s office helps protect consumers and the citizens of Maryland from dangerous or abusive companies and industries. Believe your insurance company is breaking the law? The Attorney General is the person to tell.

Windshield Coverage

When it comes to windshield coverage, there isn’t anything specific to the state that you need to know. Each insurance company is different, so some may have glass and windshields covered under your comprehensive benefit while others may write separate riders for windshield damage.

The state does allow insurance companies to use aftermarket glass in repairs, so if used glass bothers you, be mindful of that when filing a claim.

High-Risk Insurance

Sometimes a driver with a significant number of tickets, accidents, or moving violations can be considered uninsurable. But auto insurance is required by law in Maryland, so what are your options if the industry doesn’t want to cover you?

If you can’t get an auto insurance policy through traditional means, you can reach out to the Maryland Auto Insurance Fund for assistance. They will guarantee you a policy, though that guarantee doesn’t mean the policy will be affordable.

If affordability is a concern, they do have some programs available to help, such as their FineFix program which is designed to help reduce your uninsured driving fines by up to 80 percent.

Low-Cost Insurance

At this time there are no discounts available for people on Medicare or Medicaid so, unfortunately, people in those programs will have to pay the full price for their auto insurance. However, there are lots of potential discounts available through almost every insurance company.

There are standard discounts, such as good driving record discounts or discounts for people who have multiple lines of insurance through the company, but that isn’t all that is available.

Many insurers give discounts to teachers, members of the military, and other occupational discounts. Some insurers give discounts to students with a high GPA. Some offer discounts through certain large employer groups, so check with your HR department to see if they offer car insurance discounts as an employee benefit.

Automobile Insurance Fraud in Maryland

Insurance fraud isn’t just filing an illegitimate claim. Filing false documents, agents pocketing your premium, or exaggerating the damage in a claim are all forms of insurance fraud.

Purposely damaging your property to file a claim is also insurance fraud, which means if you’re caught knowingly setting your car on fire or arranging to have it stolen so you can file a claim, you will face severe penalties.

Insurance fraud for more than $300 is considered a felony, which can mean up to 15 years in prison and $10,000 or more in fines. You may also be held accountable in civil court and forced to pay back any money to the insurance company.

It is estimated that the average consumer pays an extra $1,000 per year in premiums to account for insurance fraud. If you need to report an issue of insurance fraud you can call 1-800-846-4069 and file an anonymous report.

Statute of Limitations

The law in Maryland states that you must file and resolve a claim for compensation within three years of a car accident, otherwise you are beyond the statute of limitations. Filing a lawsuit before the statute of limitations expires will preserve your ability to collect on a claim once the statute runs.

Pretty much any issue that can be taken to court will run into a statute of limitations, so if you believe you’ve been in an accident or filed a claim that needs to go through the court system, make sure you file as soon as you possibly can to avoid having your case denied.

State-Specific Laws

Every state has unique laws that you won’t find in other places, and Maryland is no exception. Make sure you know the law of the land — Maryland, that is — before getting behind the wheel.

DUI charges can only be made with a BAC of .08, but a BAC of .07 can earn you a DWI charge if the police have other signs of impairment, such as swerving, to justify the charge.

For example, Maryland has the same DUI standards as most other states, but they have DWI standards, as well. DWI stands for driving while impaired and can be applied to drivers with a blood alcohol content (BAC) of .07.

Vehicle Licensing Laws

Each state has slightly different requirements for getting licensed to drive. Those requirements are often different even for people within the state, with different standards for new drivers, experienced drivers who are new state residents, and senior citizens.

If you need to get your license for the first time, or even just update or renew your license, you’ll need to make sure you follow all of Maryland’s laws and regulations.

REAL ID

The REAL ID Act is a federal law designed as a strategy to help combat terrorism. REAL IDs are much more secure, increasing the likelihood that someone’s ID matches their identity.

Maryland is compliant with the REAL ID Act, which means that your Maryland ID will allow you to board commercial airplanes and enter federal facilities. If you want to make sure your ID is a REAL ID, you can check the ID lookup tool on the Maryland MVA website.

Penalties for Driving Without Insurance

Driving without insurance comes with serious penalties in Maryland, starting with $150 charge for the first 30 days of driving uninsured and an additional $7 per day beyond that.

You’ll also lose your license plates and vehicle registration, incurring up to $25 in charges to reinstate your registration.

Maryland law states that the only acceptable proof of financial responsibility is documentation provided by your insurance company. That could be simple ID cards or more complex documents, but you must have physical documentation of coverage from your provider.

Teen Driver Laws

Like other states, Maryland has restrictions on teen drivers. Teens must be 15 years and 9 months old before applying for their learner’s permit and begin their minimum of 60 hours of driving time, of which 10 hours must be at night.

Once they have held their learner’s permit for at least nine months, teen drivers are able to earn their intermediate driver’s license. This allows for driving without supervision, but comes with restrictions like no passengers under 18 allowed and no driving from midnight to 5 a.m.

Older Driver License Renewal Procedures

In Maryland, everyone has to renew their license every eight years, but after you turn 40, a vision test is required at every renewal. If you are renewing by mail and require a vision test, your doctor can fill out that portion of the renewal form, otherwise, you must renew in person.

Other than the mandatory vision testing, Maryland has no other age-related requirements for license renewals.

Just because they have no other requirements doesn’t mean there isn’t more to know about driving as you approach your senior years, however.

The Maryland MVA has a resource guide for aging drivers available online. Drivers who are over 40 would benefit from reviewing the information for themselves as we as their aging family members.

New Residents

When moving to Maryland from out of state, you have 60 days to obtain a Maryland driver’s license. To obtain a license, new Maryland residents must have the following:

- A valid out-of-state license or a license expired for less than one year. The license cannot be suspended.

- If you have an out-of-state license that has been expired for more than a year, you are required to take the written driving tests in addition to the vision test.

- You will be asked to surrender your out-of-state driver’s license before you can obtain a Maryland one.

- If you’ve been licensed for less than 18 months, you will be issued a Maryland provisional license.

License Renewal Procedures

In Maryland, drivers over the age of 21 will have their license expire eight years after it was issued and the expiration date will always fall on their birthday. Don’t worry, they have lots of ways to renew your license, so you won’t have to spend your birthday at the DMV.

Maryland residents can renew their license online or by mail. Even if your renewal requires a vision test, it can be done separately at a doctor’s office, so you can avoid a trip to the DMV by taking advantage of these renewal options.

Negligent Operator Treatment System (NOTS)

Traffic convictions and collisions stay on your record for up to two years in Maryland. During that time you accumulate points on your license. The more points you accumulate, the harsher the penalties.

The point system in Maryland is as follows:

- 3 – 4 points – The MVA will send you a warning letter.

- 5 – 7 points – The MVA will require you to enroll in a Driver Improvement Program (DIP).

- 8 – 11 points – The MVA will send you a notice of suspension.

- 12 or more points – The MVA will send you a notice of revocation.

Rules of the Road

Every state has its own laws and rules when it comes to driving. Everything from seat belts and car seats to highway speed limits is determined by the state.

This means you can’t assume that just because you know the rules of the road in one state that they will be the same in Maryland.

To keep yourself safe and prevent traffic citations it is important to be aware of the specific rules and regulations in your state.

Fault vs. No-Fault

Maryland is an at-fault state, which means the driver who is at fault for an accident is responsible for paying for the costs of any injuries and damages.

If you are in an accident, you can file a claim with the at-fault driver’s insurance company, contact your insurance company and have them pursue the issue, or file suit directly against the other driver.

At the same time, this also means that if you are at fault in an accident the other driver has the same rights, so it is important to make sure you have sufficient liability insurance in place.

Seat Belt & Car Seat Laws

As of October 1, 2013, seat belt laws changed in Maryland to apply to passengers in both the front and rear seats. This means that anyone over the age of 16 can be ticketed for not wearing their seat belt.

If passengers under the age of 16 are unbelted, the driver can be ticketed for each offense.

Maryland takes their seat belt laws seriously for a reason – seat belts save lives. From 2007 – 2011 there were 127 back seat passenger fatalities in the state, and of those 127 fatalities, 75 percent of the passengers were not wearing their seat belts.

When it comes to car seats for infants and children, Maryland requires children 7 and younger who are 57 inches or shorter to ride in a car seat. Unlike other states, however, Maryland does not require children to ride in the back seat unless they are in a rear-facing car seat.

Maryland’s car seat laws apply to both in-state and out-of-state vehicles, so even people just driving through the state are subject to the car seat laws for their children.

Keep Right & Move Over Laws

The law in Maryland says that vehicles traveling under the speed limit should keep right.

Passing should typically be done on the left, but the law permits passing on the right as long as it is safe to do so.

When you are approaching or being approached by an emergency vehicle, the law requires you to pull over and stop in a lane that is not adjacent to the emergency vehicle if at all possible.

If you don’t have the space to pull over, the law requires you to slow down and be prepared to stop if necessary. You should also watch for a place where you can pull over if the opportunity presents itself.

Speed Limits

The speed limit on interstates throughout the state of Maryland is 70 mph. Other roads typically have a speed limit of 50 mph.

The law allows motorists to travel under the speed limit when the situation warrants (icy roads, sharp turns, etc.), but at no point does the law allow drivers to go faster than the posted speed limit.

Keep in mind that there are several situations where the speed limit may be lowered to 25 mph or less, such as traveling through school zones or work zones. Speeding in a reduced speed zone could come with higher or additional penalties than a standard speeding ticket.

Ridesharing

In 2015, Maryland Governor Larry Hogan signed the Uber Bill into law as part of a package of laws designed to spur job creation. The law officially moved rideshare apps out of the category of taxis so they would not be subject to the same regulations.

In Maryland, the insurance companies covering rideshare drivers are Allstate, Erie, Farmers, Geico, Liberty Mutual, and USAA. These companies offer a special, commercial policy for rideshare providers.

If you are driving for a rideshare company, be certain you are up-to-date on all the laws and regulations regarding your work.

You can reach out to your insurance company for details and to make sure you have all the necessary coverage in place to protect yourself and your passengers.

Automation on the Road

Maryland is very excited about the safety benefits that could come along with autonomous vehicles. Because of this, the state has been active in allowing for the testing of automated vehicles on Maryland roads.

There is a permitting process and the areas where self-driving cars can be used are limited, but Maryland is eager to see this life-saving technology on the roads.

Safety Laws

Like all states, Maryland has laws in place to keep people safe while they are on the road. Whether someone is texting on the road or drinking and driving, they are putting the lives of other people in danger, so the state has laws in place to prevent and punish these dangerous behaviors.

Keep in mind that laws change over time, so just because something was legal five years ago doesn’t mean it is legal now.

Conversely, things that were illegal just a few years ago might be completely legal today, so make sure to do your research when it comes to traffic safety laws.

DUI Laws

| State | BAC Limit | High BAC Limit | Criminal Status by Offense | Formal Name for Offense | Look Back Period/Washout Period | 1st Offense - ALS or Revocation | 1st Offense - Imprisonment | 1st Offense - Fine | 1st Offense - Other | 2nd Offense - DL Revocation | 2nd Offense - Imprisonment | 2nd Offense - Fine | 2nd Offense - Other | 3rd Offense - DL Revocation | 3rd Offense - Imprisonment | 3rd Offense - Fine | 3rd Offense - Other |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Maryland | 0.08 | 0.15 | all misdemeanors | Driving Under the Influence (DUI) | 5 years | 6 months | no minimum, but up to 1 year | no minimum, but up to $1000 | 12 points on license | 1 year; if 2 convictions w/in 5 years, IID program mandatory | 5 days - 2 years | no minimum, but up to $2,000 | 12 points on license | 18 months up to lifetime | no minimum, but up to 3 years | no minimum, but up to $3,000 | 12 points on license |

In 2017, there were 186 total alcohol-impaired driving fatalities in Maryland, so the state is serious about keeping drunk drivers off the road. Not only do they have serious penalties for driving under the influence (as illustrated in the table above) but they have also instituted a mandated ignition interlock device for drivers convicted of DUI.

In 2015, police officer Noah Leotta was struck and killed by a drunk driver. This horrible incident inspired what became known as Noah’s Law in 2016, which requires drivers convicted of DUI to have a device installed in their vehicle that prevents the ignition from starting if the driver has an elevated blood alcohol level.

You may be required to install an ignition interlock device if you are found guilty of any of the following crimes:

- Driving Under the Influence (DUI)

- Driving While Impaired (DWI) with a minor under the age of 16 in the car

- Homicide/Life-Threatening Injury with a motor vehicle while DUI/DWI

Maryland also has DWI laws, which are different than the laws for a DUI. If you are pulled over for dangerous or erratic driving (swerving, running a red light, etc.) and an officer gives you a field sobriety test, you might be in trouble even if your blood alcohol level (BAC) isn’t .08.

A blood alcohol level of .07 combined with other evidence of impairment is enough to charge a driver with DWI, so keep that in mind before you get behind the wheel.

Marijuana-Impaired Driving Laws

While Maryland doesn’t have any laws specifically related to marijuana use while driving, that doesn’t mean you won’t face consequences if you are caught driving while high.

Recreational use of marijuana is still illegal in Maryland and, although medical marijuana use is permitted in the state, there are still federal laws that apply to the use and possession of the drug.

Distracted Driving Laws

Texting, eating, and talking on the phone are just a few of the ways drivers allow themselves to be distracted behind the wheel.

According to the CDC, there are three types of distracted driving:

- Visual, causing you to take your eyes off the road

- Manual, causing you to take your hands off the wheel

- Cognitive, causing you to take your mind off of driving

Texting is the worst form of distracted driving because it combines all three forms of distraction. Because of this, Maryland is just one of many states with strict laws about phone use while driving.

According to Maryland law, texting and handheld phone use are banned for all drivers, no matter their age. While adults are allowed to use hands-free devices to make phone calls, drivers under 18 are not allowed any phone use at all while the car is moving.

Driving Safely in Maryland

Driving is one of the most dangerous things most people do in their day-to-day lives. Nationally there are more than 30,000 car accidents a year, causing almost 25,000 fatalities and more than two million injuries.

Protecting your vehicle, yourself, and your loved ones is important, and one of the best ways to help keep yourself safe is to be aware of the dangers that go along with driving — knowing the most dangerous roads, commuting times, and weather conditions can help you prepare for and possibly even prevent an accident from occurring.

Vehicle Theft in Maryland

While a stolen vehicle would be covered under your comprehensive insurance, the possibility of replacing the car doesn’t stop the victim from feeling scared and violated.

Vehicle theft isn’t just a worry for people with new, expensive cars — the most commonly stolen vehicles are often older family sedans or minivans.

While comprehensive coverage is easy to go without in an attempt to keep your insurance costs low, keep in mind that a liability-only policy won’t protect you in case of car theft.

| Rank | Make/Model | Year of Vehicle | Thefts |

|---|---|---|---|

| 1 | Dodge Caravan | 2003 | 727 |

| 2 | Honda Accord | 2008 | 675 |

| 3 | Toyota Camry | 2014 | 347 |

| 4 | Honda Civic | 2012 | 313 |

| 5 | Ford Pickup (Full Size) | 2004 | 287 |

| 6 | Nissan Altima | 2013 | 230 |

| 7 | Toyota Corolla | 2014 | 204 |

| 8 | Jeep Cherokee/Grand Cherokee | 2015 | 194 |

| 9 | Chevrolet Pickup (Full Size) | 1999 | 192 |

| 10 | Hyundai Sonata | 2013 | 169 |

The Maryland State Police have a few important tips to help prevent your vehicle from being stolen:

- Lock your car and take your keys with you every time you leave the vehicle.

- Never leave your car running when you aren’t in it, even if you are just grabbing a cup of coffee or warming up the car before you leave for work.

- Don’t leave valuables, such as your phone, wallet, or laptop, in your car — this just tempts thieves who may then decide to steal your car along with your other valuables.

Also, don’t underestimate the importance of where you live and work when it comes to stolen vehicles. For example, in 2017 there were 40 vehicles stolen in Annapolis and 5,171 vehicles stolen in Baltimore.

If you live, work, or otherwise spend a lot of time in areas where car theft is rampant, make sure to take the necessary steps to protect your vehicle and think about adding comprehensive coverage to your auto policy.

Road Fatalities in Maryland

In 2017, there were 550 traffic fatalities in Maryland. Of those, 186 were alcohol-related fatalities and 160 were speeding-related fatalities.

It isn’t just alcohol and speeding that can cause traffic fatalities, however. Whether your vehicle rolls over or you hit a deer on the highway, you always need to be cautious behind the wheel.

Most Fatal Highway in Maryland

The highway in Maryland that sees the most fatalities is US Route 1. This is the highway that connects Pennsylvania to Washington D.C., which means there is a significant amount of traffic on the road, especially during traditional commute times. (For more information, read our “Top 10 Washington DC Car Insurance Companies“).

US Route 1 in Maryland has about 12 fatal accidents every year, which could potentially represent dozens of fatalities, depending on the number of passengers in a vehicle.

Fatal Crashes by Weather Condition & Light Condition

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 184 | 117 | 104 | 18 | 0 | 423 |

| Rain | 14 | 9 | 9 | 4 | 0 | 36 |

| Snow/Sleet | 2 | 0 | 1 | 0 | 0 | 3 |

| Other | 1 | 5 | 0 | 0 | 0 | 6 |

| Unknown | 16 | 8 | 15 | 2 | 2 | 43 |

| TOTAL | 217 | 139 | 129 | 24 | 2 | 511 |

Weather conditions and light conditions can have a dramatic impact on the likelihood of an accident, with wet, slippery weather or dark, unlit roads increasing the odds that you’ll be in an accident.

Weather can even increase the severity of an accident, taking what otherwise would have been a minor incident and turning it into a situation where injuries or even fatalities occur.

Take precautions when driving in the dark or in inclement weather. Use your headlights, slow down, and leave yourself plenty of space to make sure you aren’t stuck in an unnecessarily dangerous situation.

Fatalities (All Crashes) by County

| Fatalities by County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Allegany | 1 | 1 | 9 | 13 | 3 |

| Anne Arundel | 34 | 37 | 37 | 44 | 44 |

| Baltimore | 31 | 30 | 42 | 53 | 38 |

| Baltimore | 58 | 64 | 69 | 54 | 72 |

| Calvert | 11 | 8 | 13 | 11 | 10 |

| Caroline | 8 | 12 | 6 | 9 | 8 |

| Carroll | 20 | 11 | 16 | 21 | 25 |

| Cecil | 17 | 14 | 16 | 21 | 31 |

| Charles | 16 | 8 | 15 | 29 | 35 |

| Dorchester | 5 | 5 | 6 | 5 | 6 |

| Frederick | 20 | 18 | 20 | 16 | 27 |

| Garrett | 6 | 3 | 7 | 9 | 6 |

| Harford | 25 | 17 | 22 | 25 | 21 |

| Howard | 16 | 16 | 18 | 23 | 17 |

| Kent | 3 | 2 | 1 | 2 | 1 |

| Montgomery | 40 | 39 | 47 | 42 | 33 |

| Prince Georges | 87 | 98 | 96 | 78 | 99 |

| Queen Anne | 12 | 3 | 11 | 8 | 13 |

| Somerset | 3 | 0 | 2 | 1 | 5 |

| St.Mary | 6 | 9 | 12 | 12 | 19 |

| Talbot | 4 | 2 | 11 | 4 | 5 |

| Washington | 21 | 25 | 17 | 18 | 14 |

| Wicomico | 18 | 9 | 17 | 9 | 10 |

| Worcester | 3 | 11 | 10 | 15 | 8 |

It is interesting to note that Montgomery County is the largest county in the state but doesn’t even make the top five counties for traffic fatalities, so don’t assume that just because an area has more people that it will be more dangerous for drivers.

Traffic Fatalities

| Fatality Type (Urban vs Rural) | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Total | 591 | 549 | 496 | 485 | 511 | 465 | 442 | 520 | 522 | 550 |

| Rural | 222 | 203 | 182 | 170 | 180 | 167 | 149 | 125 | 108 | 126 |

| Urban | 368 | 342 | 313 | 311 | 325 | 295 | 293 | 378 | 408 | 416 |

| Unknown | 1 | 4 | 1 | 4 | 6 | 3 | 0 | 17 | 6 | 8 |

Over the last 10 years, Maryland has seen a significant reduction in the number of rural traffic fatalities and a significant increase in the number of urban traffic fatalities.

Fatalities by Person Type

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car | 181 | 174 | 214 | 192 | 213 |

| Light Truck - Pickup | 39 | 24 | 42 | 33 | 42 |

| Light Truck - Utility | 40 | 48 | 50 | 47 | 51 |

| Light Truck - Van | 19 | 8 | 11 | 19 | 12 |

| Large Truck | 5 | 7 | 10 | 12 | 10 |

| Other/Unknown Occupants | 2 | 2 | 8 | 9 | 6 |

| Total Occupants | 286 | 264 | 335 | 318 | 337 |

| Light Truck - Other | 0 | 1 | 0 | 0 | 3 |

| Bus | 0 | 0 | 0 | 6 | 0 |

| Pedestrian | 108 | 101 | 97 | 108 | 114 |

| Bicyclist and Other Cyclist | 6 | 5 | 11 | 16 | 10 |

| Other/Unknown Nonoccupants | 3 | 3 | 2 | 4 | 3 |

| Total Nonoccupants | 117 | 109 | 110 | 128 | 127 |

| Total Motorcyclists | 62 | 69 | 75 | 76 | 86 |

| Total | 465 | 442 | 520 | 522 | 550 |

Passenger cars and motorcycles have seen the largest increase in traffic fatalities over the past few years, but almost every category has seen at least a small increase in fatalities.

Fatalities by Crash Type

| Fatalities by Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes)* | 465 | 442 | 520 | 522 | 550 |

| Single Vehicle | 269 | 254 | 280 | 288 | 304 |

| Involving a Large Truck | 58 | 49 | 58 | 63 | 48 |

| Involving Speeding | 148 | 134 | 124 | 132 | 160 |

| Involving a Rollover | 71 | 65 | 99 | 60 | 59 |

| Involving a Roadway Departure | 226 | 205 | 249 | 222 | 262 |

| Involving an Intersection (or Intersection Related) | 100 | 127 | 145 | 146 | 163 |

While Maryland has seen an overall increase in the number of traffic fatalities, there is good news. The number of rollovers ending in a fatality has been cut in half, not to mention the significant decrease in fatalities involving a large truck.

Five-Year Trend For the Top 10 Counties

| Fatalities by County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Prince Georges | 87 | 98 | 96 | 78 | 99 |

| Baltimore County | 58 | 64 | 69 | 54 | 72 |

| Anne Arundel County | 34 | 37 | 37 | 44 | 44 |

| Baltimore City | 31 | 30 | 42 | 53 | 38 |

| Charles County | 16 | 8 | 15 | 29 | 35 |

| Montgomery County | 40 | 39 | 47 | 42 | 33 |

| Cecil County | 17 | 14 | 16 | 21 | 31 |

| Frederick County | 20 | 18 | 20 | 16 | 27 |

| Carroll County | 20 | 11 | 16 | 21 | 25 |

| Harford County | 25 | 17 | 22 | 25 | 21 |

| Top Ten Counties | 354 | 358 | 385 | 390 | 425 |

| All Other Counties | 111 | 84 | 135 | 132 | 125 |

| All Counties | 465 | 442 | 520 | 522 | 550 |

The number of traffic fatalities per county can vary wildly from year to year, but overall the numbers have increased slowly over time.

Fatalities Involving Speeding by County

Speeding is a major contributor to most fatal accidents across the nation. Maryland is no exception — the numbers may fluctuate from year to year, but there are still a significant number of speeding-related deaths in the state.

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Speeding-Related Fatalities in Maryland | 192 | 186 | 164 | 142 | 202 | 148 | 134 | 124 | 132 | 160 |

These numbers can be broken down even further by county:

| Traffic Fatalities Due To Speeding | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Allegany | 1 | 1 | 1 | 4 | 1 |

| Anne Arundel | 15 | 12 | 13 | 15 | 14 |

| Baltimore | 13 | 13 | 12 | 15 | 15 |

| Baltimore | 13 | 17 | 10 | 16 | 18 |

| Calvert | 5 | 3 | 3 | 2 | 2 |

| Caroline | 5 | 3 | 3 | 2 | 2 |

| Carroll | 10 | 3 | 3 | 2 | 5 |

| Cecil | 4 | 3 | 7 | 8 | 9 |

| Charles | 5 | 3 | 5 | 3 | 17 |

| Dorchester | 1 | 0 | 0 | 1 | 0 |

| Frederick | 6 | 6 | 7 | 3 | 12 |

| Garrett | 1 | 1 | 1 | 3 | 1 |

| Harford | 8 | 5 | 4 | 7 | 4 |

| Howard | 4 | 6 | 7 | 8 | 8 |

| Kent | 3 | 1 | 0 | 1 | 0 |

| Montgomery | 1 | 1 | 8 | 3 | 5 |

| Prince Georges | 29 | 36 | 24 | 18 | 30 |

| Queen Anne | 7 | 1 | 0 | 4 | 2 |

| Somerset | 0 | 0 | 1 | 1 | 0 |

| St. Mary | 2 | 3 | 5 | 1 | 7 |

| Talbot | 1 | 0 | 1 | 0 | 3 |

| Washington | 7 | 13 | 6 | 6 | 3 |

| Wicomico | 7 | 2 | 0 | 3 | 1 |

| Worcester | 0 | 1 | 3 | 6 | 1 |

Fatalities in Crashes Involving an Alcohol-Impaired Driver by County

| Alcohol- Impaired Fatalities by County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Allegany | 1 | 0 | 3 | 11 | 0 |

| Anne Arundel | 12 | 9 | 15 | 10 | 19 |

| Baltimore | 5 | 4 | 16 | 9 | 10 |

| Baltimore | 12 | 12 | 13 | 18 | 29 |

| Calvert | 2 | 2 | 6 | 2 | 3 |

| Caroline | 3 | 3 | 4 | 3 | 2 |

| Carroll | 7 | 3 | 2 | 5 | 5 |

| Cecil | 5 | 4 | 2 | 6 | 12 |

| Charles | 8 | 3 | 3 | 10 | 13 |

| Dorchester | 1 | 3 | 1 | 1 | 1 |

| Frederick | 4 | 1 | 5 | 4 | 4 |

| Garrett | 3 | 1 | 1 | 3 | 3 |

| Harford | 5 | 4 | 5 | 5 | 4 |

| Howard | 5 | 2 | 5 | 5 | 6 |

| Kent | 1 | 2 | 0 | 0 | 0 |

| Montgomery | 11 | 14 | 12 | 6 | 10 |

| Prince Georges | 34 | 42 | 35 | 23 | 39 |

| Queen Anne | 2 | 1 | 4 | 0 | 7 |

| Somerset | 1 | 0 | 0 | 1 | 1 |

| St. Mary | 1 | 2 | 4 | 3 | 11 |

| Talbot | 1 | 0 | 2 | 2 | 3 |

| Washington | 7 | 8 | 10 | 3 | 3 |

| Wicomico | 6 | 3 | 5 | 4 | 1 |

| Worcester | 1 | 5 | 6 | 7 | 2 |

Some counties, like Washington and Wicomico, have seen a steady decrease in the number of alcohol-related fatalities. Others, such as Charles and Baltimore, have seen a steady increase in alcohol-related fatalities.

Teen Drinking & Driving

| State | DUI Arrest (Under 18 years old) | Rank | DUI Arrests (18 years old and older) | Rank | Total DUI Arrests | Rank | DUI Arrests as a % of Total Arrests | Rank | Rank | Total Arrests | 2016 Estimated Population (Under 18) | 2016 Estimated Population (18 years old and older) | 2016 estimated population | For every 1 minor arrested for a DUI, # of adults | Total Score | Total Rank |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Maryland | 60 | 39 | 17,809 | 29 | 17,869 | 28 | 11.23% | 16 | 26 | 159,178 | 1,348,728 | 4,667,719 | 6,016,447 | 297 | 138 | 30 |

While there were 17,869 DUI arrests in Maryland in 2016, only 60 of those were under the age of 18. This is excellent news, but it is still important to impress upon teens the dangers of drinking and driving.

EMS Response Time