SR-22 Insurance – How to File an SR-22 Form

How to file SR-22 car insurance starts by contacting your insurance provider. SR-22 car insurance isn't actually insurance but a form your car insurance company must file with the local DMV after a DUI in order to prove that you have insurance coverage. If you’ve been charged with a DUI, call your insurance company and ask them to file an SR-22 form on your behalf.

Read more

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Nov 14, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 14, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

SR-22 car insurance is not a type of car insurance policy but rather a form required by state law to be filed with the Department of Motor Vehicles Division of Drivers Licenses to show proof of financial responsibility.

Courts define who must file an SR 22, which also make an SR 22 filing mandatory for people convicted of certain traffic violations or involved in car accidents with no car insurance.

The SR-22 form is actually filed by the car insurance company and not the policyholder. The information completed is a short list of general question specific to the car insurance policy and confirms that auto liability insurance is in good standing for the particular party.

Compare insurance quotes now! Enter your zip code above to get started for FREE!

- SR-22 insurance is usually mandated for drivers who have been convicted of DUI or other major traffic violations

- Department of Motor Vehicles Division of Drivers Licenses to show proof of financial responsibility

- If you are required to have an SR-22, you must register this in every state you live in

What states have an SR-22 form requirement?

Some of the common reasons for a driver to be required to file an SR-22 are DUI or DWI convictions, involvement in a traffic accident and unable to take financial responsibility for the damages. (For more information, read our “Do car insurance companies cover DUI accidents?“).

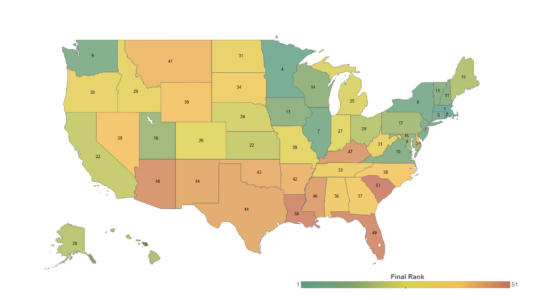

The reasons for a driver to be required to file an SR-22 will vary from state to state, however, there are some states who do not use the SR 22 including:

- Delaware

- Kentucky

- Minnesota

- New Mexico

- New York

- North Carolina

- Oklahoma

- Pennsylvania

Read more: SR-22 Car Insurance Quotes

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

It’s important to note that if you are required to file an SR-22 and suddenly move to one of the states listed above, you still must follow the law of your previous state and continue with the SR-22 filing until you are told otherwise.

Otherwise, your drivers’ license may be suspended.

Be advised that very often States change requirements so wherever you live always inquire about SR-22 requirements should you be involved in a car accident or a DUI/DWI case.

This information is only based on internal data which may or may not be completely accurate.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Where to get an SR-22 Form?

The only place to get an SR-22 form is from a licensed car insurance company who is approved to do business in your state and authorized to issue/file SR-22 forms.

You can not file an SR-22 form yourself – an insurance company must do so on your behalf.

At this time, we have no knowledge of any state requiring drivers to keep a copy of the SR-22 form in the vehicle.

SR-22’s are commonly recorded on your driving record so if you do get stopped this information is clearly visible to any law enforcement official viewing your profile.

When an individual is required to file an SR-22 form car insurance comparison is needed more than ever to find the most affordable and reliable auto insurance coverage. (For more information, read our “Best Cheap SR-22 Coverage Car Insurance Company“).

There is no answer to who has the best rates so shop around and compare car insurance companies today. Enter your zip code below and start comparing quotes for FREE!

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.