Texas Car Insurance (Coverage, Companies, & More)

Texas car insurance is among the most expensive in the country. With average Texas car insurance rates at $135/mo, you can lower your Texas car insurance costs by maintaining a good driving record and comparison shopping online. Start now with this guide and enter your ZIP code below to compare Texas car insurance quotes for free.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Mar 20, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 20, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Texas Statistics Summary | Details |

|---|---|

| Road Miles | Total In State: 313,596 Vehicle Miles Driven: 258,122 Million |

| Vehicles | Registered in State: 21,477,692 Total Stolen: 67,485 |

| State Population (Current Estimate) | 28,701,845 |

| Most Popular Vehicle | Ford F150 |

| Percent of Uninsured Motorists | 14.10% State Rank: 16th |

| Total Driving Related Deaths | 2008-2017 Speeding Fatalities: 1,029 Drunk Driving Fatalities: 1,468 |

| Average Annual Premiums | Liability: $528.75 Collision: $374.49 Comprehensive: $206.42 |

| Cheapest Provider | USAA |

The stars at night, are big and bright, deep in the heart of Texas! Welcome to the Lone Star State (and the home of Dr. Pepper) — we’ve created this comprehensive guide to help you and your family find the best car insurance in the vast spaces of Texas.

Texas is BIG. The King Ranch between Corpus Christi and Brownsville is bigger than the state of Rhode Island. With over 28 million residents, only California has more people than Texas (that means one in every 12 Americans calls Texas home). Texas is bigger than any European nation, and two Germany’s could fit inside its borders.

And in a way, Texas is only getting bigger. The U.S. Cenus Bureau reports that four of the 10 fastest-growing major cities are in Texas: San Antonio, Fort Worth, Austin, and Frisco. As Texas grows, that means more cars and more congestion, making car insurance all the more important.

How do you choose the right car insurance? What kind of car insurance do I need in Texas? Use our tool above to find insurance that best fits your needs and budget.

Texas Car Insurance Coverage and Rates

A lot of factors affect the rate of your car insurance premium. From your age to your gender, from where you live to your credit score to the make and model of your vehicle, it’s important to know what goes into the formula companies use in calculating how much you’ll owe them for insurance.

We’re here to help.

So, how much does auto insurance cost? Trusted Choice reports that the average cost of car insurance in the U.S. is $1,311 per year.

Texans have the 14th most expensive car insurance premiums, averaging $1,620 per year.

But don’t worry: we are experts in the field of auto insurance and have compiled the list in this guide of things to know before buying car insurance in Texas.

Read more:

- Texas Insurance Company Car Insurance Review

- Fastest Growing Cities in America [+Age, Race, & Growth Data]

Texas’s Car Culture

Texas has a lot of a lot of things: a lot of livestock and cotton, a lot of rattlesnakes and small-town festivals, like the Rattlesnake Roundup in Sweetwater.

Texas also has a lot of cars, not surprisingly. With an average of 2-3 cars per household, there are a whopping 22 million registered vehicles in the state according to the Texas Department of Motor Vehicles.

Texas Minimum Coverage

So exactly how much car insurance do you need in Texas? What car insurance is required?

Texas’s minimum requirements for insurance are fairly average compared to other states across the nation. You are required to have the following car insurance minimums:

- $30,000 for bodily injury, per person per accident.

- $60,000 for bodily injury, total per accident.

- $25,000 for property damage per accident.

Remember though, this is minimum coverage. Minimum coverage will cover the damage you cause to someone else’s car (property damage liability) and the medical bills of the person/people involved in the accident if you caused the accident (bodily injury liability).

Below we’ll cover some great add-on coverages that can be easily added to your insurance policy to ensure you, your family, and your vehicles are well-protected financially in the case of an accident or other incidents.

But how do you prove you have insurance in the Lone Star State?

Forms of Financial Responsibility

You need to be able to prove you have at least the minimum insurance Texas requires. You do this through a legally-recognized form of financial responsibility.

There are various ways to show this proof of insurance, usually by carrying a valid insurance ID card or a copy of your insurance policy.

But what if you forget to do that? Texas offers the following options for proving your vehicular financial responsibility:

- A deposit of at least $55,000 as cashier’s check or cash to be held with a country judge

- A self-insurance certificate from the Texas Department of Public Safety

- A surety bond

But if you’ve forgotten your car insurance ID at home, all hope is not lost. Proving you have insurance to a police officer might be as simple as pulling out your cellphone. Recent legislation amends Transportation Code Section 601.053 to allow Standard Proof of Motor Vehicle Liability Insurance Form to be an image displayed on a wireless communication device.

Premiums as a Percentage of Income

In 2014, Texans had an average disposable household income of $41,090, of which they spent they spent $1,066.20, or 2.59 percent, on car insurance premiums for the year.

This means the state’s residents paid slightly more of their income to car insurers than the national average (2.29 percent), but also that their incomes were slightly higher than the national average of $40,726.23.

And as Texas gets biggers, incomes are also quickly growing in the state: 7.71 percent from 2014 – 2017 alone.

Texans are paying slightly more of their income each year for car insurance, but the trend is noticeably minimal. Here’s the average of Texas’s car insurance premiums as a percentage of income between 2012 – 2014:

- 2012: 2.48 percent

- 2013: 2.61 percent

- 2014: 2.59 percent

Use the handy tool below to calculate what percentage of income your insurance premium might be.

Average Monthly Car Insurance Rates in TX (Liability, Collision, Comprehensive)

As Texas grows, so grows the cost of car insurance across the Lone Star State.

But remember, experts agree: the better insured you are, the better prepared you will be to deal with an accident, whether or not you are at fault.

Following are the approximate costs for car insurance coverage in Texas:

- Liability: $500

- Collision: $325

- Comprehensive: $185

- Full: $1,100

These rates are provided by the National Association of Insurance Commissioners (NAIC). This NAIC data is based on state minimum requirements by law.

Additional Liability

Did you know that Texas, like many states, only requires liability insurance? Though anything above liability insurance is optional, more coverage can help you avoid financial hardship should bills stack up after an accident like traffic during Dallas’s rush hour.

Looking at a company’s loss ratio can help you determine if they can provide you the car insurance you need.

But what is a loss ratio? A loss ratio is simply how much the insurer spends on claims compared to how much money they receive in premiums.

But even that can sound confusing, right? Check out this example: if a company spends $650 in claims for every $1,000 they receive in premiums, they have a loss ratio of 65 percent. Thus remember: loss ratios over 100 percent mean an insurer is losing money. Conversely, abnormally low loss ratios mean a company isn’t paying out much in claims or charged too much premium.

The National Association of Insurance Commissioners (NAIC) reports that in 2017, the national average for loss ratios was 73 percent. Our research shows that the “sweet spot” for loss ratios is a bit lower than the 2017 average, between 60 and 70 percent.

The table below provides the average loss ratios for Texas insurers in 2017 by category.

| Loss Ratio | 2015 | 2014 | 2013 |

|---|---|---|---|

| Personal Injury Protection | 63.51% | 63.10% | 64.43% |

| Medical Payments | 64.37% | 72.93% | 64.31% |

| Uninsured/Underinsured Motorist | 70.62% | 67.04% | 64.26% |

Great coverage at a low premium is likely your top priority in shopping for car insurance for you and your family. And we understand that! But check out the next section for some extra protections you might want to add on to your existing coverage.

Add-ons, Endorsements, and Riders

Affordability, as we’ve said, is key. But luckily, there are a lot of cheap but powerful extras you can add to your Texas car insurance policy.

These extras ensure you are better-covered in case of an accident or other events involving you or your vehicle.

The following is a list of add-on coverage that you can add to the required car insurance you need in the Lone Star State:

• Guaranteed Asset Protection (GAP)

• Personal Umbrella Policy (PUP)

• Rental Reimbursement

• Emergency Roadside Assistance

• Mechanical Breakdown Insurance

• Non-Owner Car Insurance

• Modified Car Insurance Coverage

• Classic Car Insurance

• Pay-As-You-Drive (Usage-Based Insurance)

You might also want to consider personal injury protection (PIP). PIP, sometimes called “no-fault insurance,” covers medical bills incurred from an accident, regardless of who is at fault, who is driving, or who owns the vehicle.

Average Monthly Car Insurance Rates by Age & Gender in TX

In Texas, young men can expect to pay more in car insurance premiums than young women. Once you reach 35 years of age, however, the gender gap is minimal.

What is more significant to car insurance providers in determining your premium? Age and marital status.

The following table provides the average annual car insurance premiums for Texans of different demographics.

| Company | Single 17-year old female annual rate | Single 17-year old male annual rate | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate | $9,359.61 | $11,309.20 | $3,564.65 | $3,599.14 | $3,520.01 | $3,520.01 | $4,410.14 | $4,599.76 |

| The General | $7,713.17 | $10,116.84 | $2,918.37 | $3,249.14 | $2,712.68 | $3,109.48 | $4,191.50 | $4,782.23 |

| Geico | $5,298.09 | $5,502.21 | $2,433.73 | $2,622.73 | $2,340.42 | $2,649.67 | $2,632.39 | $2,627.86 |

| Nationwide | $6,856.66 | $8,817.88 | $2,430.55 | $2,473.88 | $2,146.15 | $2,275.09 | $2,851.87 | $3,088.49 |

| Progressive | $10,406.29 | $11,607.15 | $2,496.28 | $2,372.24 | $2,219.05 | $2,262.84 | $2,956.93 | $2,997.99 |

| State Farm | $4,814.71 | $6,130.76 | $2,020.71 | $2,020.71 | $1,797.39 | $1,797.39 | $2,195.23 | $2,262.71 |

| USAA | $4,423.33 | $4,827.05 | $1,594.84 | $1,608.07 | $1,522.66 | $1,516.79 | $2,125.64 | $2,286.61 |

Cheapest Rates by ZIP Code

Of course, the price of car insurance varies from state to state. But did you know that it varies by where you live in your state as well?

In Texas, the most expensive average car insurance rates can be found in 78049, a neighborhood in the border city of Laredo. The tables below provide a breakdown of the average car insurance premiums by ZIP code, and by insurer within that ZIP code.

| Most Expensive Zip Codes in Texas | City | Average Annual Rate by Zip Code | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 78049 | LAREDO | $5,538.80 | American Family | $11,340.83 | Progressive | $7,300.88 | USAA | $2,748.03 | State Farm | $3,078.58 |

| 78599 | WESLACO | $5,452.78 | American Family | $11,340.83 | Allstate | $6,223.28 | State Farm | $2,972.86 | USAA | $3,185.94 |

| 77036 | HOUSTON | $5,430.22 | American Family | $9,058.31 | Allstate | $7,237.52 | USAA | $3,028.85 | State Farm | $3,600.90 |

| 77033 | HOUSTON | $5,271.84 | American Family | $8,080.72 | Allstate | $7,297.35 | USAA | $3,021.85 | State Farm | $3,649.74 |

| 77072 | HOUSTON | $5,247.11 | American Family | $9,024.11 | Allstate | $6,217.03 | USAA | $3,028.85 | State Farm | $3,485.64 |

| 75207 | DALLAS | $5,225.75 | Allstate | $7,664.33 | Progressive | $7,367.34 | USAA | $2,935.83 | State Farm | $3,620.92 |

| 77053 | HOUSTON | $5,188.07 | American Family | $8,091.63 | Allstate | $7,155.33 | USAA | $3,035.35 | State Farm | $3,538.37 |

| 77060 | HOUSTON | $5,173.49 | American Family | $7,251.55 | Allstate | $6,756.97 | USAA | $3,031.86 | State Farm | $3,941.98 |

| 77067 | HOUSTON | $5,166.35 | American Family | $7,397.64 | Allstate | $7,135.70 | USAA | $3,031.86 | State Farm | $3,965.58 |

| 77076 | HOUSTON | $5,164.01 | Allstate | $7,297.35 | American Family | $6,965.79 | USAA | $3,007.16 | State Farm | $3,863.19 |

| 77091 | HOUSTON | $5,162.46 | Allstate | $7,297.35 | American Family | $6,976.94 | USAA | $3,155.30 | State Farm | $3,768.48 |

| 77078 | HOUSTON | $5,154.98 | Allstate | $7,352.64 | American Family | $7,217.59 | USAA | $3,158.70 | State Farm | $3,763.05 |

| 75242 | DALLAS | $5,150.98 | Allstate | $7,822.46 | Progressive | $7,730.91 | USAA | $3,035.63 | Geico | $3,508.43 |

| 79430 | LUBBOCK | $5,143.23 | American Family | $11,340.83 | Progressive | $7,300.88 | USAA | $2,679.39 | State Farm | $2,898.28 |

| 77037 | HOUSTON | $5,141.92 | Allstate | $7,292.85 | American Family | $6,534.37 | USAA | $3,031.86 | State Farm | $3,803.26 |

| 77022 | HOUSTON | $5,115.43 | Allstate | $7,297.35 | American Family | $6,978.54 | USAA | $3,007.16 | State Farm | $3,906.52 |

| 77039 | HOUSTON | $5,115.40 | American Family | $7,325.25 | Allstate | $6,770.35 | USAA | $3,007.16 | State Farm | $3,857.41 |

| 77081 | HOUSTON | $5,113.05 | American Family | $7,787.38 | Allstate | $7,121.41 | USAA | $3,179.07 | State Farm | $3,384.26 |

| 77088 | HOUSTON | $5,111.68 | American Family | $8,232.62 | Allstate | $6,585.55 | USAA | $3,155.30 | State Farm | $3,823.85 |

| 77016 | HOUSTON | $5,108.01 | Allstate | $7,352.64 | American Family | $6,981.03 | USAA | $3,007.16 | State Farm | $3,777.08 |

| 77028 | HOUSTON | $5,107.10 | Allstate | $7,664.33 | American Family | $6,909.53 | USAA | $3,158.70 | State Farm | $3,494.20 |

| 77093 | HOUSTON | $5,104.27 | Allstate | $7,286.61 | American Family | $6,716.86 | USAA | $3,158.70 | State Farm | $3,838.99 |

| 77026 | HOUSTON | $5,098.02 | Allstate | $7,352.64 | American Family | $7,017.25 | USAA | $3,158.70 | State Farm | $4,012.27 |

| 77050 | HOUSTON | $5,097.68 | Allstate | $7,306.24 | American Family | $6,677.08 | USAA | $3,007.16 | State Farm | $3,762.08 |

| 75210 | DALLAS | $5,095.76 | Allstate | $7,664.33 | American Family | $7,286.10 | USAA | $3,025.08 | State Farm | $3,565.59 |

The cheapest rates? Those can be found in 76901, a ZIP code including parts of the West Texas city of San Angelo and some of its suburbs.

| Least Expensive Zip Codes in Texas | City | Average Annual Rate by Zip Codes | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 76901 | SAN ANGELO | $3,157.68 | Allstate | $4,542.85 | American Family | $3,786.57 | USAA | $2,191.07 | State Farm | $2,428.78 |

| 76904 | SAN ANGELO | $3,158.56 | Allstate | $4,542.85 | Progressive | $3,809.41 | USAA | $2,074.47 | State Farm | $2,401.91 |

| 76939 | KNICKERBOCKER | $3,209.72 | Allstate | $4,542.85 | American Family | $3,866.31 | USAA | $2,086.49 | State Farm | $2,422.19 |

| 76306 | WICHITA FALLS | $3,210.65 | Allstate | $4,736.95 | American Family | $3,838.60 | USAA | $1,891.48 | State Farm | $2,518.20 |

| 76909 | SAN ANGELO | $3,224.21 | Allstate | $4,542.85 | Progressive | $3,954.71 | USAA | $2,074.47 | State Farm | $2,422.19 |

| 76502 | TEMPLE | $3,260.31 | Allstate | $4,841.18 | American Family | $3,890.07 | USAA | $2,228.61 | Geico | $2,679.10 |

| 76886 | VERIBEST | $3,267.18 | Allstate | $4,926.00 | American Family | $3,815.43 | USAA | $2,191.07 | State Farm | $2,422.19 |

| 76798 | WACO | $3,267.20 | Allstate | $5,137.52 | Progressive | $3,902.02 | Nationwide | $2,326.70 | USAA | $2,345.00 |

| 76712 | WOODWAY | $3,268.96 | Allstate | $5,153.61 | Progressive | $4,103.39 | Nationwide | $2,245.76 | USAA | $2,276.47 |

| 76908 | GOODFELLOW AFB | $3,281.51 | Allstate | $4,542.85 | American Family | $3,972.20 | USAA | $2,074.47 | State Farm | $2,437.99 |

| 75110 | CORSICANA | $3,285.30 | Allstate | $4,920.59 | Progressive | $3,748.30 | USAA | $2,189.79 | Geico | $2,551.76 |

| 76354 | BURKBURNETT | $3,293.59 | Allstate | $4,898.60 | American Family | $3,869.85 | USAA | $2,065.82 | State Farm | $2,533.62 |

| 76543 | KILLEEN | $3,306.33 | Allstate | $4,929.48 | American Family | $4,125.00 | USAA | $2,227.94 | State Farm | $2,673.85 |

| 76309 | WICHITA FALLS | $3,315.43 | Allstate | $4,816.42 | American Family | $4,292.15 | USAA | $2,065.82 | Geico | $2,530.78 |

| 76706 | WACO | $3,320.96 | Allstate | $5,137.52 | American Family | $4,044.42 | Nationwide | $2,326.70 | USAA | $2,345.00 |

| 76905 | SAN ANGELO | $3,322.35 | Allstate | $4,926.00 | Progressive | $4,180.44 | USAA | $2,091.54 | State Farm | $2,389.41 |

| 76903 | SAN ANGELO | $3,331.83 | Allstate | $4,799.16 | American Family | $4,047.69 | USAA | $2,187.37 | State Farm | $2,424.89 |

| 76957 | WALL | $3,332.11 | Allstate | $4,542.85 | Progressive | $3,999.84 | USAA | $2,191.07 | State Farm | $2,422.19 |

| 76513 | BELTON | $3,334.52 | Allstate | $5,137.52 | American Family | $3,792.42 | USAA | $2,184.73 | State Farm | $2,632.49 |

| 76564 | PENDLETON | $3,336.13 | Allstate | $5,114.28 | American Family | $3,910.53 | USAA | $2,199.69 | State Farm | $2,658.77 |

| 76710 | WACO | $3,337.22 | Allstate | $5,128.65 | American Family | $3,865.74 | USAA | $2,276.47 | Geico | $2,681.32 |

| 76711 | WACO | $3,347.58 | Allstate | $5,153.61 | Progressive | $3,857.42 | USAA | $2,276.47 | Geico | $2,690.25 |

| 77881 | WELLBORN | $3,347.60 | Allstate | $4,860.77 | Progressive | $3,942.06 | USAA | $2,198.68 | State Farm | $2,671.94 |

| 76311 | SHEPPARD AFB | $3,351.07 | Allstate | $4,975.86 | American Family | $4,243.10 | USAA | $1,891.48 | Geico | $2,530.78 |

| 76310 | WICHITA FALLS | $3,351.57 | Allstate | $4,952.60 | American Family | $4,289.31 | USAA | $2,065.82 | State Farm | $2,480.04 |

It’s easy to find the cheapest car insurance rates for you. Just enter your ZIP code to get started.

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

Cheapest Rates by City

Texas cities are very diverse. Diverse by size and climate, by density and culture.

The tables below show you the cheapest (and most expensive) car insurance rates by Texas city.

| Most Expensive Cities in Texas | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Weslaco | $5,452.78 | American Family | $11,340.83 | Allstate | $6,223.28 | State Farm | $2,972.86 | USAA | $3,185.94 |

| Texhoma | $5,290.29 | American Family | $11,340.83 | Progressive | $7,937.62 | USAA | $2,417.11 | State Farm | $2,464.41 |

| Aldine | $5,143.60 | American Family | $7,037.06 | Allstate | $6,940.06 | USAA | $3,023.62 | State Farm | $3,867.55 |

| Cockrell Hill | $4,805.29 | Allstate | $6,750.75 | American Family | $6,361.56 | USAA | $2,898.46 | State Farm | $3,728.37 |

| North Houston | $4,799.60 | Progressive | $7,300.88 | Allstate | $6,438.51 | USAA | $2,760.28 | State Farm | $3,348.79 |

| Houston | $4,770.73 | American Family | $6,846.57 | Allstate | $6,514.79 | USAA | $2,931.67 | State Farm | $3,466.09 |

| Garciasville | $4,762.95 | Progressive | $7,172.16 | Allstate | $6,903.43 | State Farm | $2,719.54 | USAA | $2,891.85 |

| South Houston | $4,748.61 | Allstate | $6,493.81 | American Family | $6,132.67 | USAA | $3,023.90 | State Farm | $3,338.51 |

| Galena Park | $4,739.02 | Allstate | $6,493.81 | American Family | $6,255.89 | USAA | $3,163.52 | State Farm | $3,389.03 |

| Linn | $4,726.10 | Progressive | $6,965.34 | Allstate | $6,148.71 | State Farm | $3,080.73 | USAA | $3,185.94 |

| Four Corners | $4,725.43 | American Family | $7,099.38 | Allstate | $5,778.86 | USAA | $3,026.34 | State Farm | $3,321.83 |

| Santa Elena | $4,706.00 | Progressive | $6,792.94 | Allstate | $6,588.22 | State Farm | $2,719.54 | USAA | $2,891.85 |

| Dallas | $4,682.06 | Allstate | $6,793.69 | American Family | $6,354.16 | USAA | $2,842.16 | State Farm | $3,514.46 |

| McAllen | $4,673.94 | Allstate | $6,096.88 | American Family | $6,072.08 | USAA | $2,893.08 | State Farm | $3,068.13 |

| Hidalgo | $4,664.22 | Allstate | $6,588.22 | Nationwide | $6,084.75 | USAA | $2,893.08 | State Farm | $3,095.91 |

| Fresno | $4,655.49 | American Family | $6,911.13 | Allstate | $5,956.87 | USAA | $3,045.00 | State Farm | $3,076.76 |

| Devers | $4,645.50 | Progressive | $6,929.03 | American Family | $5,960.18 | USAA | $2,789.77 | State Farm | $3,150.69 |

| Edcouch | $4,631.97 | Allstate | $6,320.76 | American Family | $5,478.44 | State Farm | $3,047.18 | USAA | $3,185.94 |

| Doolittle | $4,631.85 | Allstate | $6,167.63 | Nationwide | $5,705.17 | USAA | $3,013.60 | State Farm | $3,101.27 |

| Grulla | $4,624.28 | Progressive | $6,837.33 | Allstate | $6,143.37 | State Farm | $2,719.54 | USAA | $2,891.85 |

| Sullivan City | $4,608.29 | Allstate | $6,710.46 | Nationwide | $5,455.81 | State Farm | $3,098.35 | USAA | $3,185.94 |

| Alief | $4,606.74 | Allstate | $6,217.03 | Progressive | $5,819.67 | USAA | $2,686.48 | State Farm | $3,356.67 |

| Channelview | $4,605.85 | Allstate | $6,681.17 | American Family | $6,115.98 | USAA | $2,869.94 | State Farm | $3,419.77 |

| Hilshire Village | $4,604.38 | Allstate | $6,378.68 | American Family | $6,105.10 | USAA | $2,986.57 | State Farm | $3,447.69 |

| Alton | $4,599.58 | Allstate | $6,355.48 | American Family | $5,498.36 | USAA | $2,863.94 | State Farm | $3,121.38 |

Major cities like Houston and Dallas make the list of the most expensive car insurance rates.

| Least Expensive Cities in Texas | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Grape Creek | $3,157.68 | Allstate | $4,542.85 | American Family | $3,786.57 | USAA | $2,191.07 | State Farm | $2,428.78 |

| Knickerbocker | $3,209.72 | Allstate | $4,542.85 | American Family | $3,866.31 | USAA | $2,086.49 | State Farm | $2,422.19 |

| San Angelo | $3,259.24 | Allstate | $4,702.71 | Progressive | $3,992.96 | USAA | $2,106.96 | State Farm | $2,409.60 |

| Veribest | $3,267.18 | Allstate | $4,926.00 | American Family | $3,815.43 | USAA | $2,191.07 | State Farm | $2,422.19 |

| Goodfellow AFB | $3,281.51 | Allstate | $4,542.85 | American Family | $3,972.20 | USAA | $2,074.47 | State Farm | $2,437.99 |

| Burkburnett | $3,293.59 | Allstate | $4,898.60 | American Family | $3,869.85 | USAA | $2,065.82 | State Farm | $2,533.62 |

| Robinson | $3,320.96 | Allstate | $5,137.52 | American Family | $4,044.42 | Nationwide | $2,326.70 | USAA | $2,345.00 |

| Wall | $3,332.11 | Allstate | $4,542.85 | Progressive | $3,999.84 | USAA | $2,191.07 | State Farm | $2,422.19 |

| Belton | $3,334.52 | Allstate | $5,137.52 | American Family | $3,792.42 | USAA | $2,184.73 | State Farm | $2,632.49 |

| Pendleton | $3,336.13 | Allstate | $5,114.28 | American Family | $3,910.53 | USAA | $2,199.69 | State Farm | $2,658.77 |

| Beverly Hills | $3,347.58 | Allstate | $5,153.61 | Progressive | $3,857.42 | USAA | $2,276.47 | Geico | $2,690.25 |

| Wellborn | $3,347.60 | Allstate | $4,860.77 | Progressive | $3,942.06 | USAA | $2,198.68 | State Farm | $2,671.94 |

| Sheppard AFB | $3,351.07 | Allstate | $4,975.86 | American Family | $4,243.10 | USAA | $1,891.48 | Geico | $2,530.78 |

| Wichita Falls | $3,357.55 | Allstate | $4,892.91 | American Family | $4,292.31 | USAA | $2,017.62 | Geico | $2,530.78 |

| Christoval | $3,359.14 | Allstate | $4,542.85 | Progressive | $4,363.18 | USAA | $2,086.49 | State Farm | $2,384.33 |

| Temple | $3,360.15 | Allstate | $5,049.46 | American Family | $4,170.69 | USAA | $2,202.93 | Geico | $2,679.10 |

| Mexia | $3,361.10 | Allstate | $5,091.11 | American Family | $3,727.04 | USAA | $2,189.79 | State Farm | $2,618.65 |

| Heidenheimer | $3,364.77 | Allstate | $5,153.61 | Progressive | $4,006.20 | USAA | $2,243.44 | State Farm | $2,658.77 |

| Iowa Park | $3,367.05 | Allstate | $5,109.77 | American Family | $3,848.86 | USAA | $2,065.82 | State Farm | $2,496.96 |

| Tennyson | $3,367.34 | Allstate | $4,799.16 | Progressive | $4,001.70 | USAA | $2,223.72 | State Farm | $2,464.41 |

| Copperas Cove | $3,368.96 | Allstate | $5,075.02 | Progressive | $3,714.41 | USAA | $2,250.13 | State Farm | $2,640.95 |

| West | $3,373.02 | Allstate | $5,223.83 | American Family | $3,709.63 | USAA | $2,409.44 | Geico | $2,608.93 |

| Killeen | $3,375.97 | Allstate | $4,975.95 | American Family | $4,281.63 | USAA | $2,202.42 | State Farm | $2,678.96 |

| Presidio | $3,379.33 | Allstate | $4,542.85 | American Family | $4,486.47 | USAA | $2,341.36 | State Farm | $2,485.11 |

| Hewitt | $3,382.22 | Allstate | $4,841.18 | Progressive | $3,805.97 | USAA | $2,337.64 | Geico | $2,679.10 |

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Best Texas Car Insurance Companies

A number of factors are important to consider in finding the best car insurance company for you and your family’s needs.

From company financial ratings to rates for drivers of various histories, you’ll want to consider the pros and cons of each insurer.

The Texas Department of Insurance is another great resource; they exist to protect and serve the state’s insurance consumers.

Read more: Top 10 Texas Car Insurance Companies

For our compilation of the best car insurance companies in Texas, check out the sections below.

The Largest Companies Financial Rating

You want any company you do business with to have a good financial rating. This is especially true if that company has the responsibility of protecting you and your family, like a car insurance provider.

A company’s ability to financially cover its customers is important, and that’s where financial ratings come into play.

AM Best ranks America’s insurance companies by financial solvency. What does it mean for a company to receive a high grade? That company is highly likely to stay solvent and have the ability to pay customer claims. A bad grade might be a warning sign for potential customers.

The table below provides the financial ratings for Texas’s 10 largest car insurance providers.

| Insurance Company | A.M. Best Rating |

|---|---|

| State Farm Group | A++ |

| Geico | A++ |

| Allstate Insurance Group | A+ |

| Progressive Group | A+ |

| Farmers Insurance Group | A |

| USAA Group | A++ |

| Liberty Mutual Group | A |

| Texas Farm Bureau Mutual Group | A |

| Consumers County Mutual Insurance Co | NR |

| Nationwide Corp Group | A+ |

Read more: Consumers County Mutual Insurance Company Car Insurance Review

Companies with Best Ratings

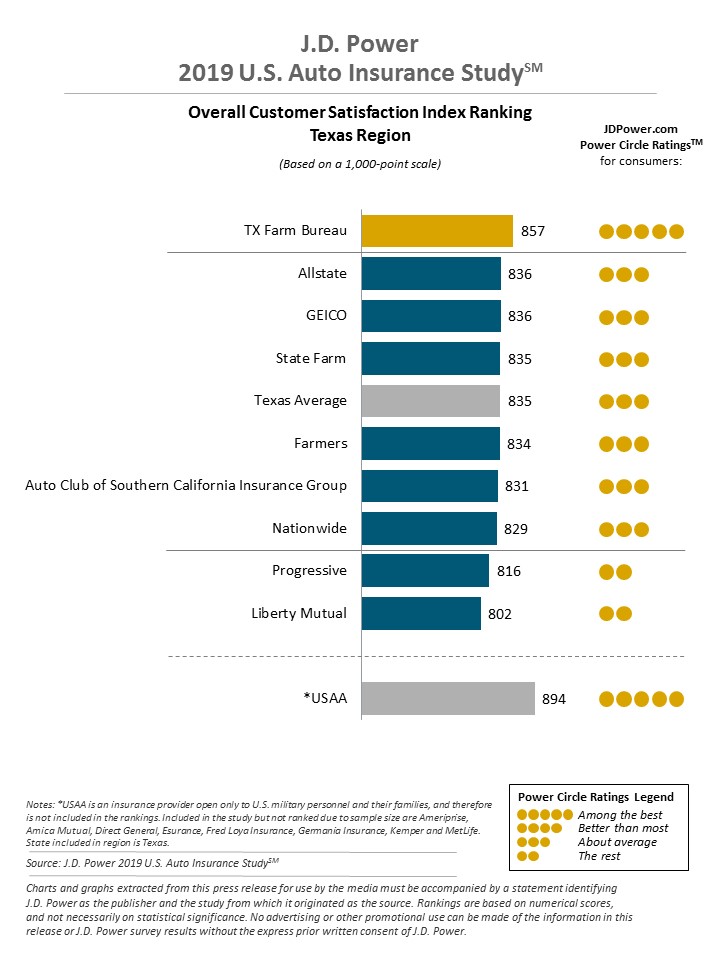

According to J.D. Power and Associates’ U.S. Auto Insurance Study, the best-rated insurance company in Texas is Texas Farm Bureau Insurance.

Read more: Farm Bureau County Mutual Insurance Company of Texas Car Insurance Review

The graph below depicts Texas’ insurance providers and their J.D. Power ratings.

Companies with Most Complaints in Texas

Part of knowing who is best is knowing who gets the most complaints. In Texas, State Farm receives more complaints than any other car insurance provider. But keep that in perspective: they also hold a bigger market share than any other Texas car insurance company.

The table below provides the number of complaints filed against Texas’s 10 largest car insurance providers in 2017.

| Insurance Company | Number of Complaints (2017) |

|---|---|

| State Farm | 1482 |

| Geico | 333 |

| USAA | 296 |

| Liberty Mutual | 222 |

| Allstate | 163 |

| Progressive | 120 |

| Nationwide | 25 |

| Consumers County | 5 |

| Texas Farm Bureau | 3 |

| Farmers | 0 |

Read more: State Farm County Mutual Insurance Company of Texas Car Insurance Review

Commute Rates by Companies

How much you drive certainly affects how much you pay for car insurance. Whether you drive a little or a lot, however, State Farm is likely your cheapest insurance provider in the Lone Star State.

The following table lists car insurance providers and their corresponding average rates for both a 10- and 25-mile average commute distance.

| Insurance Company | Commute And Annual Mileage | Annual Average Premiums |

|---|---|---|

| Allstate | 10 miles commute. 6000 annual mileage. | $5,354.10 |

| Allstate | 25 miles commute. 12000 annual mileage. | $5,616.53 |

| American Family | 10 miles commute. 6000 annual mileage. | $4,849.18 |

| American Family | 25 miles commute. 12000 annual mileage. | $4,849.18 |

| Geico | 10 miles commute. 6000 annual mileage. | $3,201.27 |

| Geico | 25 miles commute. 12000 annual mileage. | $3,325.50 |

| Nationwide | 10 miles commute. 6000 annual mileage. | $3,867.57 |

| Nationwide | 25 miles commute. 12000 annual mileage. | $3,867.57 |

| Progressive | 10 miles commute. 6000 annual mileage. | $4,664.85 |

| Progressive | 25 miles commute. 12000 annual mileage. | $4,664.85 |

| State Farm | 10 miles commute. 6000 annual mileage. | $2,879.95 |

| State Farm | 25 miles commute. 12000 annual mileage. | $2,879.95 |

| USAA | 10 miles commute. 6000 annual mileage. | $2,456.42 |

| USAA | 25 miles commute. 12000 annual mileage. | $2,519.83 |

Coverage Level Rates by Companies

Not surprisingly, your car insurance coverage level affects how much money you pay in premiums. The more coverage and the more add-ons, the more expensive car insurance gets. The less coverage, the cheaper your insurance will likely be.

Though remember, cheaper is not always better, especially when it comes to something like car insurance.

Here is a table that shows the different types of insurance coverage levels and their average yearly rates for Texas’s biggest insurance providers.

| Insurance Company | Coverage Type | Annual Average Premiums |

|---|---|---|

| Allstate | High | $5,655.81 |

| Allstate | Medium | $5,438.89 |

| Allstate | Low | $5,361.24 |

| American Family | High | $5,357.52 |

| American Family | Medium | $4,672.73 |

| American Family | Low | $4,517.27 |

| Geico | High | $3,477.68 |

| Geico | Medium | $3,221.75 |

| Geico | Low | $3,090.73 |

| Nationwide | Low | $4,165.19 |

| Nationwide | High | $3,736.52 |

| Nationwide | Medium | $3,701.00 |

| Progressive | High | $4,920.90 |

| Progressive | Medium | $4,642.33 |

| Progressive | Low | $4,431.31 |

| State Farm | High | $3,039.86 |

| State Farm | Medium | $2,870.49 |

| State Farm | Low | $2,729.50 |

| USAA | High | $2,582.94 |

| USAA | Medium | $2,477.96 |

| USAA | Low | $2,403.46 |

Credit History Rates by Companies

Does it surprise you to find out your credit history can affect your car insurance premium?

It certainly can, especially if you’re an Allstate customer in Texas.

With an average Experian score of 656, Texans have one of the lowest average credit scores across the United States. (The national average? 675.)

Who are the best car insurers in Texas for those with a poor credit rating? Likely Progressive or State Farm will be the most affordable option.

The table below shows average rates for those with a good, fair, or poor credit rating for Texas’s top car insurance providers.

| Insurance Company | Credit History | Annual Average Premiums |

|---|---|---|

| Allstate | Poor | $6,977.11 |

| Allstate | Fair | $5,107.95 |

| Allstate | Good | $4,370.89 |

| Geico | Poor | $5,036.40 |

| Geico | Fair | $2,851.60 |

| Geico | Good | $1,902.16 |

| Nationwide | Poor | $4,644.64 |

| Nationwide | Fair | $3,722.88 |

| Nationwide | Good | $3,235.20 |

| Progressive | Poor | $5,256.57 |

| Progressive | Fair | $4,536.59 |

| Progressive | Good | $4,201.38 |

| American Family | Poor | $6,669.84 |

| American Family | Fair | $4,205.41 |

| American Family | Good | $3,672.27 |

| State Farm | Poor | $4,077.51 |

| State Farm | Fair | $2,538.85 |

| State Farm | Good | $2,023.50 |

| USAA | Poor | $3,658.82 |

| USAA | Fair | $2,109.52 |

| USAA | Good | $1,696.02 |

Driving Record Rates by Companies

Okay, so most of us don’t have a spotless driving record. And though we all make mistakes, you have to be prepared for your car insurance premium to be affected by your driving history, perhaps more than anything else.

The following table shows different insurance companies and their annual averages for people with varying driving records in Texas.

| Insurance Company | Driving Record | Annual Average Premiums |

|---|---|---|

| Allstate | With 1 DUI | $6,837.95 |

| Allstate | With 1 accident | $6,562.28 |

| Allstate | With 1 speeding violation | $4,270.52 |

| Allstate | Clean record | $4,270.52 |

| Nationwide | With 1 DUI | $4,977.19 |

| Nationwide | With 1 accident | $3,351.99 |

| Nationwide | With 1 speeding violation | $3,789.11 |

| Nationwide | Clean record | $3,351.99 |

| American Family | With 1 DUI | $4,931.37 |

| American Family | With 1 accident | $5,627.66 |

| American Family | With 1 speeding violation | $4,418.84 |

| American Family | Clean record | $4,418.84 |

| Progressive | With 1 DUI | $4,753.00 |

| Progressive | With 1 accident | $5,258.36 |

| Progressive | With 1 speeding violation | $4,581.27 |

| Progressive | Clean record | $4,066.74 |

| Geico | With 1 DUI | $3,061.96 |

| Geico | With 1 accident | $3,651.43 |

| Geico | With 1 speeding violation | $3,570.55 |

| Geico | Clean record | $2,769.60 |

| State Farm | With 1 DUI | $3,462.47 |

| State Farm | With 1 accident | $2,934.63 |

| State Farm | With 1 speeding violation | $2,561.35 |

| State Farm | Clean record | $2,561.35 |

| USAA | With 1 DUI | $3,224.03 |

| USAA | With 1 accident | $2,737.39 |

| USAA | With 1 speeding violation | $2,132.96 |

| USAA | Clean record | $1,858.11 |

Across the board, State Farm is likely the cheapest car insurance provider for Texans with a DUI, previous accident, or speeding violation.

Number of Foreign vs. Domestic Insurers in Texas

What do you think a foreign or domestic car insurance company is? When it comes to auto insurers, domestic simply means an in-state provider, and foreign, an out-of-state provider.

According to the NAIC, Texas has 199 domestic insurance companies and 937 foreign insurance providers.

Texas Laws

You’ve probably heard it before — Don’t Mess with Texas.

And we’d like to add: don’t mess with Texas laws. Even if you’re just passing through the Lone Star State, it’s important to know the laws where you’re driving.

In the sections below, we’ll cover a variety of legal topics related to driving or insuring your car in Texas. You might also want to check out the National Motorists Association guide to driving in Texas.

Car Insurance Laws

Remember, Texas requires liability insurance with the following minimums:

- $30,000 for bodily injury, per person per accident.

- $60,000 for bodily injury, total per accident.

- $25,000 for property damage per accident.

Also remember, these are minimums. What is best for you and your family might be coverage above liability.

How State Laws for Insurance are Determined

The National Association of Insurance Commissioners (NAIC) takes some of the mystery out of how car insurance laws get made.

They are the U.S. standard-setting and regulatory support organization created and governed by the chief insurance regulators from all 50 states, the District of Columbia and five U.S. territories. They offer this great white paper to help you understand how insurance laws get made.

The Texas State Legislature is known for its, well, Texas-sized personalities and quirks.

Windshield Coverage

In Texas, there are no specific laws speaking to windshields and glass coverage.

If you regularly drive on one of the Lone Star’s State’s thousands of unpaved roads, or pass through terrains where there’s a high probability of getting hit by cobbles and pebbles on the windshield — like Big Bend National Park in Southwest Texas — you will want to check with your car insurance provider to see if windshield coverage is something you can add to your policy.

High-Risk Insurance

As we talked about above, you might have had some bad luck on the road. And this may have led you to a less-than-stellar driving record.

Because of their driving behavior, high-risk drivers are at times ineligible to obtain car insurance from the traditional market. To offer coverage to these drivers, the state has established a program for them, known as the Texas Automobile Insurance Plan Association (TAIPA).

Automobile Insurance Fraud in Texas

To the point: auto insurance fraud is a crime.

And though most people only contact their auto insurer in case of an accident or other types of claim, some folks try to scam the system by filing false claims to make a quick buck.

In 2017 alone, the Texas fraud unit received 7,756 reports of motor vehicle insurance fraud.

Since insurance fraud in Texas carries big fines and possible jail time, it’s best to avoid the situation altogether. But find yourself on the wrong side of the Lone Star State’s insurance fraud laws, and here’s what you can expect:

- When the claim amount is less than $50: Anything lower than $50 is considered a “Class C” misdemeanor, carrying a fine of $500.

- When the claim amount is more than $200,000: As the value is high, the penalty is also severe with fines up to $10,000 and/or jail time of five to 99 years.

According to the Insurance Information Institute (III), common types of fraud include “padding,” or inflating actual claims; misrepresenting facts on an insurance application; submitting claims for injuries or damage that never occurred, services never rendered or equipment never delivered; and “staging” accidents.

But consumers don’t only scam insurance companies. Some companies also scam their customers. The Texas Department of Insurance has produced the video below to help you avoid being scammed after an accident.

Statute of Limitations

A statute of limitations is the amount of time you have to file and resolve your claim or to file a lawsuit following an accident or another vehicular incident.

In Texas, you have two years from the time of the accident to file a lawsuit for both personal injury and property damage.

Texas Specific Laws

Again, we urge you to check out The National Motorists Association’s summary of Texas-specific driving laws. Here is some interesting (and important) information for driving in Texas they provide:

- On many rural highways in Texas, there is a full-width paved shoulder. Though this is mainly provided as a breakdown lane, it is legal to travel on that shoulder for specific purposes; for instance, it should be used by a slow car to allow faster cars behind it to pass safely.

- Texas repealed its motorcycle helmet law in 1997 for cyclists 21 years of age or older. However, in order for residents or nonresidents to go helmetless, they must have proof of $10,000 in medical insurance or proof that they have taken a motorcycle safety course that meets the standards of the Motorcycle Safety Foundation.

- No matter if you’re ticketed for a parking violation or a DUI, you always have the right to a trial by jury in Texas.

Vehicle Licensing Laws

Like almost every state, Texas requires a valid driver’s license to operate a vehicle. And be honest: who doesn’t love getting their picture taken at the DMV? Okay, maybe not, but, licensing yourself and your vehicle in Texas may be easier than you think.

The Texas Department of Public Safety has made this great video on obtaining a driver’s license in the Lone Star State.

The Department of Public Safety’s comprehensive website provides a lot of great information on legally driving in Texas, in fact. One thing you’ll want to remember, the list of documents you need to bring to the DMV with you:

- Proof of U.S. Citizenship or, if you are not a U.S. Citizen, evidence of lawful presence

- Proof of Texas Residency

- Proof of Identity

- Social Security Number

- Evidence of Texas Vehicle Registration* for each vehicle you own. Registration must be current. Visit Texas DMV vehicle registration for more information. (New Residents who are surrendering an out-of-state drivers license only)

- Proof of Insurance* for each vehicle you own

*If you do not own a vehicle, you will sign a statement affirming this.

Real ID

A REAL ID can save you the hassle of bringing other forms of identification with you to conduct official state or federal government business. Like when you’re entering the Comanche Peak Nuclear Power Plant near Glen Rose.

Texas IDs issued after October 10, 2016, automatically comply with the Federal Real ID Act.

Penalties for Driving Without Insurance

In Texas, around 20 percent of the motorists are driving without any insurance coverage. To reduce the number of uninsured motorists on roads, the State of Texas levies heavy penalties. These include:

- First Offense: When you’re caught without insurance for the first time, you would be fined in the range of $175 to $350. In addition, you would have to pay an additional surcharge of $250 annually towards your driver’s license fee for the next three years.

- Subsequent Offenses: For repeat offenders, the fines can range from $350 to $1,000 along with the chance of license revocation and vehicle impoundment.

Sure, auto insurance is expensive, but if you happen to be involved in an accident, the financial costs of personal injury, property damage and state fines can burn a deep hole in your pocket, a hole that might lead you all the way to bankruptcy.

Having insurance is also part of being a good neighbor.

Driving without an insurance policy poses an extremely serious threat to others on the road, and the state of Texas has established the TexasSure program to initiate automatic verification of insurance.

This program allows law officers to easily verify whether you have car insurance coverage through a central database that connects a vehicle license plate, VIN number, and your liability insurance policy.

Teen Driver Laws

Did you know most states have some form of graduated licensing laws for teens?

In Texas, these laws mean a two-step process: learners permit then provisional or intermediate license. The table below provides restrictions for the learners permit, available to those who are at least 15 years of age.

| Restriction | Details |

|---|---|

| Mandatory Holding Period | 6 months |

| Supervised Driving Time | 30 hours, with at least 10 hours of nighttime driving |

| Required Tests | Driver's knowledge test, vision test and a sign recognition test |

Teens can apply for a provisional license if they have satisfied the requirements under the learner’s permit in the State of Texas. The table below provides restrictions for this provisional license.

| Restriction | Details |

|---|---|

| Nighttime Restrictions | Midnight to 5 a.m, unless accompanied with a parent/guardian |

| Passenger Restrictions | One person at a time under 21 who isn't a family member |

| Required Tests | Road test and certified driver's education course |

Older Driver License Renewal Procedures

If you’re below 79 in Texas, you can renew your license by phone, mail, or online. Drivers under 18 and older than 79, however, are required to renew their licenses in person at a Texas DPS office.

Beyond this, the only real difference in renewal for older drivers: if you’re older than 84, you’re required to renew your license every two years, as opposed to every six for those 18-84.

New Residents

Texas is a little more lenient with its new residents when it comes to obtaining a drivers license. According to the Department of Public Safety, “new Texas residents can legally drive with a valid, unexpired drivers license from another U.S. state, U.S. territory, Canadian province, or qualifying country for up to 90 days after moving to Texas.”

When you move to Texas, you’ll have to surrender your out-of-state license and show up to the DMV with:

- Proof of U.S. Citizenship or, if you are not a U.S. Citizen, evidence of lawful presence

- Proof of Texas Residency

- Proof of Identity

- Social Security Number

- Evidence of Texas Vehicle Registration* for each vehicle you own. Registration must be current. Visit Texas DMV vehicle registration for more information. (New Residents who are surrendering an out-of-state drivers license only)

- Proof of Insurance for each vehicle you own. (If you do not own a vehicle, you will sign a statement affirming this.)

License Renewal Procedures

Renewing your license in Texas is fairly straight-forward. We recommend you check out the Department of Public Safety’s renewal site for the best information on making the process as quick and painless as possible. But we also wanted to point out, Texas allows you to renew:

- Online

- By Telephone

- By Mail, or

- In-person at your local drivers license office.

Rules of the Road

Whether you’re a Texan through-and-through or just a passing scurring on through the Lone Star State, you’ll need to know rules for driving in Texas.

Below we’ve compiled some helpful advice to make sure you avoid any run-ins with the Texas Rangers.

Fault vs. No-Fault

Texas is an at-fault state, meaning you’ll be held financially and legally liable if you are found at-fault in an auto accident.

But if you haven’t gathered by now, the more comprehensive your insurance, the better prepared you are to face accidents and other auto incidents head-on, whether or not you are at fault.

Make sure you have the best insurance you can to protect you and your family.

Seat belt and car seat laws

Texas law requires drivers and all passengers to wear seat belts. Fail to do so? You can be fined in the range of $25-$250.

The Texas Department of Public Safety is invested in caring for the state’s children and ensuring they are properly and securely seated when riding in a motor vehicle. The table below illustrates the guidelines for car seat laws in Texas.

| Phase | Guideline |

|---|---|

| Birth-2 years | All children below the age of two are required to ride inside a rear-facing seat |

| 2-4 years | Once the child turns two, he/she can ride in a forward facing seat as long as recommended by the seat manufacturer (check for weight & height labels on the seat) |

| 4-10 years | Children can ride in a booster seat once they are 4 years old and weigh 40+ pounds |

| Beyond 10 years | Once children outgrow their booster seat (around 10-12 years old), they are allowed to use the adult safety belt, provided it fits them perfectly |

Keep Right and Move Over Laws

Texas clearly marks where the left lane of a multi-lane highway is for passing. You’ll see a sign that says “Left Lane For Passing Only.”

And it’s good to know: impeding the flow of traffic by continuing to drive in the left lane is punishable by a fine of up to $200 in the Lone Star State.

According to the Texas Department of Transportation, when approaching a stopped emergency vehicle with lights flashing, state law requires that you:

- move a lane away from the emergency vehicle, or

- slow down 20 miles per hour below the posted speed limit.

Fail to comply? You could be issued a fine of up to $200.

Speed Limits

Texas has a lot of wide-open highways in sparsely populated areas. Thus, it’s maximum speed limits are higher than most states, and variable.

Here are the maximum speeds on Texas’ roadways for both cars and trucks:

- Rural Interstates: 75 mph, though 80 or 85 on specified segments

- Urban Interstates: 75 mph

- Other Limited Access Roads: 75 mph

Ridesharing

After clashes over variable statutes from city to city, House Bill 100 established statewide standards for ridesharing companies — like Uber or Lyft — across the state of Texas.

To operate a rideshare car in Texas, drivers must:

- Be at least 18 years of age;

- Maintain a valid driver’s license issued by Texas, another state, or Washington D.C.;

- Maintain proof of registration and auto insurance for every vehicle to be used; and

- Pass a background check that covers local, state, and national searches.

And don’t forget: most major rideshare companies require their drivers to have insurance that covers not only the driver, but also all passengers.

Automation on the Road

Automobile technology is advancing at a rapid rate, meaning you’ll likely see more and more automation on the road.

The Insurance Institute for Highway Safety (IIHS) explains that automation is simply the use of a machine or technology to perform a task previously carried out by a human.

When it comes to automation, think radars, cameras, and other sensors used to gather information about a vehicle’s surroundings.

Texas is pro-active in figuring out how (and if) fully-automated vehicles will be able to legally drive on its roadways. In early 2019, the state formed a Self-Driving Car Task Force.

Safety Laws

Wherever you are, driving safely is important. And a big part of driving safely is knowing a state’s safety laws and regulations.

Since you now know the proper way to insure and register your vehicle in Texas, let’s now cover some important safety information to keep you, your family, and your vehicles safe in the Lone Star State.

DWI Laws

Whether you’re drunk or just buzzed, driving under the influence of alcohol is not a good idea.

It’s especially not a good idea in Texas, where DUIs are known as DWIs (“driving while intoxicate”). You can be issued a DWI in Texas if you are caught:

- with a blood alcohol content (BAC) of .08% or more (often called a “per se” DWI), or,

- while lacking “the normal use of mental or physical faculties” because of the ingestion of alcohol, drug or any other substance.

Texas heavily penalizes for DWIs. The fines and jail time increase with the number of offenses:

- First Offense: First-time offenders can be fined up to $2,000 and face the possibility of jail time from three days to six months as well. In addition, their license can also be suspended for a period of up to 12 months.

- Second Offense: If you’re caught the second time, you may be fined up to $4,000 and face jail time from a month to a year. You can also lose your driver’s license for up to two years.

- Third Offense: For a third time, the fines increase substantially to $10,000 and you would have to spend time in prison for a period of two to 10 years. Also, you might lose driving rights for up to two years.

Marijuana-Impaired Driving Laws

As we’ve seen above, anyone can be charged with a DWI if found lacking “the normal use of mental or physical faculties” because of the ingestion of alcohol, drug or any other substance.

This includes marijuana, which has yet to be legalized at all in the state of Texas with very few exceptions.

Distracted Driving Laws

NO ONE in Texas is allowed to drive and text, no matter how old they are. A first offense can get you a fine up to $99, and subsequent offenses can cost you as much as $200.

Those under the age of 18 are not allowed to use hand-held devices at all, and no one is allowed to use a hand-held device, such as a cellphone, in a school zone.

Driving Safely in Texas

Driving safely is important wherever you are, but read on for some important information about keeping you, your family, and your vehicles safe in the Lone Star State.

Vehicle Theft in Texas

Every year, the FBI tracks vehicle thefts and other crimes in all cities across Texas, from Abernathy to Yorktown. In 2016, Houston, the state’s largest city, led in vehicle thefts with 12,738.

What vehicles are stolen the most in the Lone Star State? The table below shows the top-10 most-stolen cars in Texas for 2018 by make, model, and model year.

| Rank | Make and Model | Year of Vehicle | Thefts |

|---|---|---|---|

| 1 | Ford Pickup (Full Size) | 2006 | 7,897 |

| 2 | Chevrolet Pickup (Full Size) | 2004 | 6,158 |

| 3 | Dodge Pickup (Full Size) | 2004 | 2,898 |

| 4 | Honda Accord | 1997 | 1,626 |

| 5 | GMC Pickup (Full Size) | 2015 | 1,450 |

| 6 | Honda Civic | 2000 | 1,371 |

| 7 | Chevrolet Tahoe | 2004 | 1,148 |

| 8 | Toyota Camry | 2014 | 1,030 |

| 9 | Nissan Altima | 2012 | 957 |

| 10 | Chevrolet Impala | 2007 | 898 |

Road Fatalities in Texas

In the sections below, we’ll explore different variables of road fatalities, which totaled 3,567 across Texas in 2018.

Most fatal highway in Texas

GeoTab reports that US-83, which runs from Brownsville at the southern-most tip of Texas on the Mexico border to the border of Oklahoma at the north end of the Texas panhandle, is the most deadly highway in Texas, with an average of 26 fatal crashes a year over the last decade.

Fatal Crashes by Weather Condition and Light Condition

Perhaps not surprisingly, crashes are highly affected by weather and light conditions.

The table below provides a breakdown of fatal crashes by weather and light conditions across Texas in 2017.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 1,316 | 664 | 930 | 94 | 8 | 3,012 |

| Rain | 91 | 53 | 85 | 9 | 0 | 238 |

| Snow/Sleet | 9 | 0 | 1 | 0 | 0 | 10 |

| Other | 17 | 18 | 32 | 4 | 0 | 71 |

| Unknown | 3 | 0 | 3 | 0 | 6 | 12 |

| TOTAL | 1,436 | 735 | 1,051 | 107 | 14 | 3,343 |

Fatalities (All Crashes) by Road Type in Texas

Like in a lot of large states, especially, the urban-rural divide is striking when considering traffic fatalities. The table below illustrates the number of crashes on both urban and rural Texas roadways between 2008 and 2017.

| Road Type | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 1,761 | 1,652 | 1,462 | 1,464 | 1,696 | 1,663 | 1,780 | 1,622 | 1,590 | 1,504 |

| Urban | 1,629 | 1,437 | 1,546 | 1,582 | 1,711 | 1,726 | 1,750 | 1,948 | 2,205 | 2,205 |

| Unknown | 86 | 15 | 15 | 8 | 1 | 0 | 6 | 12 | 2 | 13 |

| Total | 3,476 | 3,104 | 3,023 | 3,054 | 3,408 | 3,389 | 3,536 | 3,582 | 3,797 | 3,722 |

Fatalities by Person Type

We don’t often think in these terms, but it’s not only motorists who die on Texas roads. Pedestrians, cyclists, and others are part of the state’s transportation system, too.

The table below shows 2017 fatalities by person type.

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car | 1,067 | 1,137 | 1,171 | 1,219 | 1,252 |

| Light Truck - Pickup | 606 | 693 | 626 | 636 | 588 |

| Light Truck - Utility | 441 | 480 | 483 | 441 | 457 |

| Light Truck - Van | 95 | 87 | 88 | 87 | 64 |

| Light Truck - Other | 1 | 1 | 1 | 11 | 8 |

| Large Truck | 111 | 114 | 100 | 109 | 129 |

| Bus | 7 | 2 | 17 | 10 | 16 |

| Other/Unknown Occupants | 23 | 21 | 23 | 27 | 31 |

| Total Occupants | 2,351 | 2,535 | 2,509 | 2,540 | 2,545 |

| Total Motorcyclists | 493 | 451 | 452 | 495 | 490 |

| Pedestrian | 480 | 479 | 549 | 675 | 607 |

| Bicyclist and Other Cyclist | 48 | 50 | 52 | 65 | 59 |

| Other/Unknown Nonoccupants | 17 | 21 | 20 | 22 | 21 |

| Total Nonoccupants | 545 | 550 | 621 | 762 | 687 |

| Total | 3,389 | 3,536 | 3,582 | 3,797 | 3,722 |

Read more: Bus Driver Car Insurance

Fatalities by Crash Type

The table below shows the number of Texas fatalities by crash type from 2013 to 2017.

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes) | 3,389 | 3,536 | 3,582 | 3,797 | 3,722 |

| Single Vehicle | 1,815 | 1,913 | 1,848 | 1,982 | 1,914 |

| Involving a Large Truck | 535 | 553 | 567 | 558 | 649 |

| Involving Speeding | 1,181 | 1,277 | 1,125 | 1,076 | 1,029 |

| Involving a Rollover | 1,011 | 1,091 | 983 | 1,020 | 942 |

| Involving a Roadway Departure | 1,836 | 1,912 | 1,800 | 1,860 | 1,832 |

| Involving an Intersection (or Intersection Related) | 668 | 667 | 709 | 719 | 724 |

It’s striking that the highest number of fatalities in Texas result from crashes involving a single vehicle.

Five-Year Trend For The Top 10 Counties

Texas is one of the fastest-growing states in the United States.

The table below provides the five-year road fatality trends for the Lone Star State’s 10 biggest counties.

| Rank | Texas Counties by 2017 Ranking | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|

| 1 | Harris County | 369 | 417 | 391 | 447 | 456 |

| 2 | Dallas County | 225 | 238 | 259 | 315 | 282 |

| 3 | Tarrant County | 144 | 145 | 157 | 167 | 180 |

| 4 | Bexar County | 189 | 184 | 189 | 226 | 164 |

| 5 | Travis County | 112 | 95 | 145 | 120 | 120 |

| 6 | Collin County | 41 | 47 | 37 | 50 | 68 |

| 7 | Hidalgo County | 65 | 65 | 67 | 75 | 60 |

| 8 | El Paso County | 60 | 66 | 62 | 81 | 58 |

| 9 | Bell County | 36 | 34 | 40 | 42 | 57 |

| 10 | Montgomery County | 51 | 53 | 60 | 76 | 54 |

| Total | 1,326 | 1,358 | 1,445 | 1,614 | 1,499 |

Fatalities Involving Speeding by County

As you’ve already seen above, speeding can be deadly.

The following table illustrates the 2013-2017 statistics on fatalities caused by speeding in Texas by county according to the National Highway Transportation Safety Administration.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Anderson County | 4 | 4 | 3 | 5 | 3 |

| Andrews County | 2 | 1 | 2 | 0 | 2 |

| Angelina County | 3 | 10 | 4 | 1 | 7 |

| Aransas County | 2 | 1 | 0 | 1 | 0 |

| Archer County | 1 | 1 | 0 | 1 | 0 |

| Armstrong County | 3 | 0 | 0 | 0 | 0 |

| Atascosa County | 0 | 3 | 7 | 1 | 3 |

| Austin County | 2 | 6 | 4 | 0 | 1 |

| Bailey County | 2 | 0 | 0 | 0 | 0 |

| Bandera County | 6 | 5 | 3 | 1 | 2 |

| Bastrop County | 8 | 5 | 4 | 4 | 5 |

| Baylor County | 1 | 1 | 1 | 0 | 0 |

| Bee County | 2 | 1 | 1 | 2 | 1 |

| Bell County | 15 | 20 | 15 | 11 | 20 |

| Bexar County | 70 | 69 | 73 | 60 | 57 |

| Blanco County | 4 | 5 | 0 | 1 | 0 |

| Borden County | 1 | 1 | 1 | 1 | 0 |

| Bosque County | 1 | 3 | 0 | 1 | 0 |

| Bowie County | 12 | 7 | 2 | 8 | 2 |

| Brazoria County | 13 | 12 | 14 | 13 | 18 |

| Brazos County | 3 | 6 | 10 | 6 | 9 |

| Brewster County | 2 | 0 | 0 | 0 | 0 |

| Briscoe County | 0 | 0 | 0 | 1 | 0 |

| Brooks County | 6 | 1 | 1 | 0 | 0 |

| Brown County | 0 | 1 | 1 | 1 | 0 |

| Burleson County | 1 | 2 | 1 | 2 | 1 |

| Burnet County | 5 | 6 | 5 | 3 | 10 |

| Caldwell County | 1 | 4 | 4 | 5 | 6 |

| Calhoun County | 1 | 1 | 0 | 0 | 0 |

| Callahan County | 5 | 2 | 1 | 1 | 6 |

| Cameron County | 10 | 10 | 8 | 9 | 10 |

| Camp County | 2 | 1 | 0 | 0 | 0 |

| Carson County | 0 | 0 | 1 | 0 | 1 |

| Cass County | 2 | 0 | 6 | 3 | 2 |

| Castro County | 1 | 0 | 0 | 0 | 0 |

| Chambers County | 3 | 8 | 5 | 3 | 0 |

| Cherokee County | 3 | 3 | 1 | 5 | 5 |

| Childress County | 1 | 0 | 0 | 0 | 1 |

| Clay County | 2 | 1 | 0 | 0 | 0 |

| Cochran County | 0 | 0 | 0 | 0 | 0 |

| Coke County | 0 | 0 | 0 | 0 | 0 |

| Coleman County | 0 | 1 | 0 | 2 | 0 |

| Collin County | 12 | 21 | 19 | 16 | 37 |

| Collingsworth County | 0 | 0 | 0 | 0 | 0 |

| Colorado County | 7 | 1 | 8 | 1 | 1 |

| Comal County | 9 | 5 | 6 | 14 | 4 |

| Comanche County | 2 | 1 | 0 | 4 | 1 |

| Concho County | 0 | 0 | 0 | 0 | 0 |

| Cooke County | 2 | 7 | 5 | 2 | 2 |

| Coryell County | 3 | 1 | 3 | 4 | 1 |

| Cottle County | 0 | 0 | 0 | 0 | 0 |

| Crane County | 1 | 1 | 0 | 0 | 0 |

| Crockett County | 2 | 0 | 2 | 3 | 2 |

| Crosby County | 0 | 0 | 2 | 4 | 1 |

| Culberson County | 1 | 1 | 5 | 0 | 2 |

| Dallam County | 0 | 1 | 0 | 0 | 0 |

| Dallas County | 92 | 118 | 93 | 114 | 102 |

| Dawson County | 0 | 0 | 2 | 0 | 0 |

| Deaf Smith County | 1 | 1 | 0 | 1 | 3 |

| Delta County | 0 | 0 | 0 | 1 | 0 |

| Denton County | 17 | 21 | 12 | 13 | 16 |

| Dewitt County | 2 | 3 | 1 | 1 | 0 |

| Dickens County | 0 | 0 | 0 | 1 | 0 |

| Dimmit County | 2 | 7 | 2 | 0 | 1 |

| Donley County | 0 | 3 | 0 | 1 | 0 |

| Duval County | 1 | 0 | 0 | 0 | 0 |

| Eastland County | 7 | 4 | 4 | 0 | 2 |

| Ector County | 13 | 10 | 14 | 7 | 14 |

| Edwards County | 0 | 0 | 3 | 1 | 0 |

| El Paso County | 20 | 28 | 21 | 10 | 13 |

| Ellis County | 8 | 11 | 7 | 12 | 7 |

| Erath County | 1 | 8 | 3 | 4 | 3 |

| Falls County | 1 | 1 | 0 | 1 | 0 |

| Fannin County | 1 | 1 | 1 | 4 | 7 |

| Fayette County | 5 | 2 | 3 | 0 | 7 |

| Fisher County | 0 | 3 | 2 | 1 | 0 |

| Floyd County | 0 | 2 | 0 | 1 | 0 |

| Foard County | 1 | 0 | 0 | 1 | 0 |

| Fort Bend County | 20 | 11 | 9 | 6 | 6 |

| Franklin County | 0 | 2 | 2 | 3 | 0 |

| Freestone County | 2 | 2 | 1 | 5 | 0 |

| Frio County | 4 | 0 | 6 | 0 | 0 |

| Gaines County | 3 | 2 | 3 | 1 | 1 |

| Galveston County | 11 | 17 | 12 | 13 | 10 |

| Garza County | 1 | 3 | 0 | 1 | 0 |

| Gillespie County | 1 | 2 | 3 | 6 | 2 |

| Glasscock County | 0 | 0 | 3 | 1 | 0 |

| Goliad County | 0 | 2 | 1 | 0 | 0 |

| Gonzales County | 5 | 8 | 3 | 2 | 1 |

| Gray County | 0 | 2 | 2 | 0 | 0 |

| Grayson County | 11 | 7 | 4 | 8 | 8 |

| Gregg County | 5 | 5 | 14 | 6 | 6 |

| Grimes County | 2 | 0 | 4 | 1 | 2 |

| Guadalupe County | 5 | 3 | 8 | 10 | 1 |

| Hale County | 0 | 4 | 2 | 1 | 1 |

| Hall County | 0 | 0 | 0 | 0 | 0 |

| Hamilton County | 2 | 2 | 1 | 0 | 2 |

| Hansford County | 0 | 1 | 0 | 0 | 1 |

| Hardeman County | 0 | 3 | 0 | 2 | 1 |

| Hardin County | 7 | 4 | 3 | 2 | 2 |

| Harris County | 121 | 136 | 107 | 135 | 105 |

| Harrison County | 6 | 3 | 9 | 7 | 6 |

| Hartley County | 1 | 1 | 3 | 0 | 0 |

| Haskell County | 1 | 3 | 1 | 0 | 1 |

| Hays County | 10 | 8 | 10 | 7 | 8 |

| Hemphill County | 0 | 0 | 0 | 0 | 0 |

| Henderson County | 3 | 2 | 4 | 2 | 3 |

| Hidalgo County | 26 | 29 | 29 | 24 | 18 |

| Hill County | 6 | 5 | 5 | 4 | 3 |

| Hockley County | 2 | 5 | 1 | 2 | 1 |

| Hood County | 2 | 5 | 0 | 3 | 4 |

| Hopkins County | 2 | 2 | 5 | 4 | 7 |

| Houston County | 1 | 3 | 2 | 7 | 2 |

| Howard County | 6 | 1 | 6 | 0 | 3 |

| Hudspeth County | 3 | 4 | 3 | 6 | 5 |

| Hunt County | 1 | 7 | 1 | 6 | 8 |

| Hutchinson County | 1 | 1 | 1 | 3 | 0 |

| Irion County | 0 | 4 | 2 | 0 | 0 |

| Jack County | 3 | 1 | 0 | 0 | 0 |

| Jackson County | 1 | 1 | 1 | 1 | 1 |

| Jasper County | 6 | 1 | 4 | 2 | 3 |

| Jeff Davis County | 1 | 2 | 0 | 0 | 1 |

| Jefferson County | 9 | 9 | 9 | 9 | 7 |

| Jim Hogg County | 1 | 0 | 0 | 0 | 0 |

| Jim Wells County | 4 | 2 | 4 | 1 | 1 |

| Johnson County | 9 | 13 | 10 | 6 | 6 |

| Jones County | 2 | 2 | 0 | 1 | 4 |

| Karnes County | 5 | 2 | 2 | 3 | 3 |

| Kaufman County | 2 | 6 | 4 | 5 | 9 |

| Kendall County | 6 | 0 | 7 | 2 | 2 |

| Kenedy County | 1 | 0 | 0 | 0 | 0 |

| Kent County | 0 | 0 | 0 | 0 | 0 |

| Kerr County | 4 | 7 | 3 | 5 | 0 |

| Kimble County | 0 | 0 | 0 | 6 | 1 |

| King County | 0 | 0 | 1 | 0 | 0 |

| Kinney County | 1 | 0 | 0 | 1 | 0 |

| Kleberg County | 1 | 2 | 1 | 1 | 1 |

| Knox County | 1 | 0 | 1 | 0 | 0 |

| La Salle County | 4 | 5 | 1 | 1 | 2 |

| Lamar County | 3 | 3 | 2 | 4 | 1 |

| Lamb County | 3 | 0 | 1 | 1 | 1 |

| Lampasas County | 0 | 1 | 1 | 1 | 4 |

| Lavaca County | 1 | 1 | 4 | 0 | 1 |

| Lee County | 2 | 3 | 6 | 5 | 0 |

| Leon County | 6 | 2 | 3 | 1 | 0 |

| Liberty County | 4 | 7 | 5 | 4 | 9 |

| Limestone County | 0 | 1 | 4 | 2 | 1 |

| Lipscomb County | 0 | 0 | 0 | 0 | 0 |

| Live Oak County | 1 | 6 | 4 | 3 | 1 |

| Llano County | 2 | 2 | 0 | 3 | 1 |

| Loving County | 0 | 0 | 0 | 1 | 0 |

| Lubbock County | 18 | 17 | 8 | 11 | 12 |

| Lynn County | 1 | 0 | 2 | 1 | 0 |

| Madison County | 0 | 1 | 2 | 4 | 0 |

| Marion County | 3 | 0 | 1 | 1 | 3 |

| Martin County | 1 | 2 | 2 | 0 | 1 |

| Mason County | 0 | 0 | 0 | 0 | 1 |

| Matagorda County | 3 | 2 | 8 | 2 | 2 |

| Maverick County | 1 | 5 | 0 | 2 | 1 |

| Mcculloch County | 0 | 1 | 3 | 1 | 0 |

| Mclennan County | 12 | 13 | 12 | 7 | 14 |

| Mcmullen County | 0 | 0 | 0 | 0 | 0 |

| Medina County | 5 | 0 | 3 | 4 | 10 |

| Menard County | 1 | 0 | 0 | 0 | 1 |

| Midland County | 14 | 20 | 12 | 10 | 14 |

| Milam County | 0 | 4 | 3 | 1 | 5 |

| Mills County | 0 | 3 | 0 | 1 | 0 |

| Mitchell County | 1 | 1 | 1 | 0 | 0 |

| Montague County | 1 | 3 | 1 | 2 | 0 |

| Montgomery County | 21 | 25 | 18 | 21 | 12 |

| Moore County | 4 | 1 | 0 | 0 | 0 |

| Morris County | 2 | 3 | 1 | 2 | 2 |

| Motley County | 1 | 0 | 0 | 0 | 0 |

| Nacogdoches County | 6 | 3 | 6 | 5 | 1 |

| Navarro County | 5 | 3 | 1 | 1 | 4 |

| Newton County | 0 | 1 | 1 | 1 | 0 |

| Nolan County | 4 | 5 | 0 | 4 | 7 |

| Nueces County | 15 | 12 | 10 | 12 | 9 |

| Ochiltree County | 1 | 0 | 1 | 1 | 0 |

| Oldham County | 2 | 0 | 4 | 0 | 4 |

| Orange County | 2 | 10 | 6 | 5 | 7 |

| Palo Pinto County | 2 | 3 | 3 | 4 | 2 |

| Panola County | 6 | 6 | 6 | 6 | 1 |

| Parker County | 7 | 5 | 6 | 11 | 8 |

| Parmer County | 0 | 0 | 1 | 0 | 2 |

| Pecos County | 0 | 3 | 4 | 0 | 2 |

| Polk County | 4 | 4 | 3 | 4 | 4 |

| Potter County | 8 | 11 | 8 | 7 | 13 |

| Presidio County | 0 | 1 | 0 | 1 | 0 |

| Rains County | 1 | 1 | 0 | 0 | 0 |

| Randall County | 7 | 5 | 7 | 0 | 1 |

| Reagan County | 1 | 2 | 0 | 0 | 1 |

| Real County | 2 | 0 | 2 | 1 | 0 |

| Red River County | 1 | 0 | 1 | 4 | 1 |

| Reeves County | 8 | 4 | 3 | 0 | 3 |

| Refugio County | 4 | 4 | 1 | 0 | 1 |

| Roberts County | 0 | 3 | 0 | 0 | 0 |

| Robertson County | 2 | 0 | 0 | 1 | 2 |

| Rockwall County | 3 | 0 | 1 | 2 | 1 |

| Runnels County | 0 | 1 | 0 | 2 | 0 |

| Rusk County | 7 | 0 | 8 | 6 | 4 |

| Sabine County | 2 | 1 | 1 | 0 | 1 |

| San Augustine County | 0 | 1 | 2 | 0 | 3 |

| San Jacinto County | 3 | 3 | 1 | 4 | 0 |

| San Patricio County | 4 | 6 | 3 | 0 | 2 |

| San Saba County | 1 | 1 | 0 | 1 | 0 |

| Schleicher County | 3 | 0 | 0 | 0 | 0 |

| Scurry County | 2 | 2 | 0 | 0 | 1 |

| Shackelford County | 1 | 2 | 0 | 0 | 0 |

| Shelby County | 2 | 2 | 1 | 3 | 1 |

| Sherman County | 0 | 0 | 0 | 0 | 0 |

| Smith County | 11 | 18 | 25 | 9 | 16 |

| Somervell County | 1 | 2 | 1 | 1 | 3 |

| Starr County | 4 | 2 | 1 | 0 | 1 |

| Stephens County | 2 | 1 | 0 | 0 | 1 |

| Sterling County | 0 | 1 | 1 | 0 | 0 |

| Stonewall County | 0 | 0 | 0 | 0 | 0 |

| Sutton County | 4 | 1 | 1 | 1 | 0 |

| Swisher County | 1 | 0 | 0 | 1 | 0 |

| Tarrant County | 64 | 71 | 60 | 53 | 48 |

| Taylor County | 7 | 7 | 6 | 2 | 6 |

| Terrell County | 1 | 0 | 0 | 0 | 0 |

| Terry County | 5 | 0 | 2 | 0 | 1 |

| Throckmorton County | 0 | 0 | 0 | 0 | 2 |

| Titus County | 0 | 5 | 0 | 1 | 1 |

| Tom Green County | 6 | 8 | 6 | 3 | 2 |

| Travis County | 37 | 33 | 43 | 28 | 30 |

| Trinity County | 2 | 0 | 1 | 5 | 0 |

| Tyler County | 2 | 4 | 1 | 2 | 1 |

| Upshur County | 0 | 2 | 3 | 1 | 3 |

| Upton County | 1 | 2 | 2 | 1 | 0 |

| Uvalde County | 1 | 2 | 0 | 1 | 0 |

| Val Verde County | 2 | 1 | 1 | 1 | 0 |

| Van Zandt County | 6 | 4 | 3 | 7 | 6 |

| Victoria County | 3 | 5 | 5 | 1 | 6 |

| Walker County | 8 | 10 | 4 | 10 | 9 |

| Waller County | 6 | 4 | 1 | 2 | 8 |

| Ward County | 1 | 2 | 5 | 2 | 3 |

| Washington County | 0 | 4 | 4 | 2 | 2 |

| Webb County | 6 | 3 | 6 | 19 | 10 |

| Wharton County | 2 | 5 | 4 | 4 | 2 |

| Wheeler County | 0 | 3 | 0 | 1 | 3 |

| Wichita County | 4 | 3 | 4 | 4 | 4 |

| Wilbarger County | 0 | 1 | 2 | 2 | 1 |

| Willacy County | 1 | 0 | 0 | 5 | 1 |

| Williamson County | 7 | 9 | 11 | 14 | 7 |

| Wilson County | 2 | 6 | 1 | 4 | 0 |

| Winkler County | 0 | 0 | 1 | 0 | 0 |

| Wise County | 4 | 2 | 6 | 5 | 8 |

| Wood County | 6 | 4 | 1 | 2 | 1 |

| Yoakum County | 0 | 1 | 0 | 2 | 1 |

| Young County | 0 | 1 | 1 | 2 | 2 |

| Zapata County | 2 | 0 | 0 | 0 | 0 |

| Zavala County | 2 | 2 | 0 | 1 | 0 |

Read more:

- Cameron National Insurance Company Car Insurance Review

- Cameron Mutual Insurance Company Car Insurance Review

Fatalities in Crashes Involving an Alcohol-Impaired Driver by County

For good reason, drunk driving is one of the most notorious causes of road fatalities.

This table offers the 2013-2017 statistics on crash fatalities involving an alcohol-impaired driver in Texas by county according to the National Highway Transportation Safety Administration.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Anderson County | 3 | 5 | 1 | 5 | 5 |

| Andrews County | 5 | 7 | 8 | 0 | 9 |

| Angelina County | 3 | 4 | 4 | 5 | 5 |

| Aransas County | 2 | 1 | 0 | 1 | 2 |

| Archer County | 3 | 4 | 0 | 2 | 0 |

| Armstrong County | 2 | 0 | 0 | 0 | 0 |

| Atascosa County | 2 | 9 | 5 | 2 | 0 |

| Austin County | 4 | 4 | 0 | 2 | 1 |

| Bailey County | 1 | 0 | 1 | 1 | 0 |

| Bandera County | 7 | 5 | 3 | 0 | 3 |

| Bastrop County | 7 | 6 | 8 | 14 | 12 |

| Baylor County | 1 | 2 | 2 | 0 | 0 |

| Bee County | 2 | 2 | 4 | 3 | 1 |

| Bell County | 16 | 18 | 16 | 13 | 24 |

| Bexar County | 88 | 74 | 82 | 95 | 71 |

| Blanco County | 2 | 5 | 1 | 5 | 1 |

| Borden County | 1 | 0 | 0 | 0 | 0 |

| Bosque County | 2 | 3 | 1 | 0 | 1 |

| Bowie County | 9 | 6 | 4 | 5 | 6 |

| Brazoria County | 16 | 12 | 18 | 23 | 17 |

| Brazos County | 3 | 5 | 9 | 6 | 10 |

| Brewster County | 1 | 1 | 1 | 0 | 0 |

| Briscoe County | 0 | 0 | 0 | 0 | 0 |

| Brooks County | 2 | 1 | 1 | 0 | 0 |

| Brown County | 0 | 1 | 4 | 3 | 1 |

| Burleson County | 1 | 1 | 2 | 4 | 4 |

| Burnet County | 4 | 7 | 5 | 1 | 9 |

| Caldwell County | 1 | 6 | 3 | 6 | 3 |

| Calhoun County | 2 | 3 | 0 | 1 | 1 |

| Callahan County | 3 | 0 | 0 | 4 | 1 |

| Cameron County | 20 | 12 | 9 | 17 | 18 |

| Camp County | 1 | 2 | 0 | 0 | 2 |

| Carson County | 0 | 1 | 1 | 1 | 1 |

| Cass County | 1 | 0 | 5 | 1 | 6 |

| Castro County | 1 | 2 | 0 | 0 | 0 |

| Chambers County | 5 | 7 | 3 | 7 | 2 |

| Cherokee County | 6 | 2 | 2 | 2 | 7 |

| Childress County | 1 | 0 | 0 | 1 | 1 |

| Clay County | 2 | 0 | 0 | 0 | 2 |

| Cochran County | 0 | 0 | 0 | 0 | 0 |

| Coke County | 0 | 3 | 2 | 1 | 1 |

| Coleman County | 0 | 2 | 0 | 1 | 0 |

| Collin County | 15 | 21 | 15 | 23 | 25 |

| Collingsworth County | 0 | 0 | 3 | 0 | 0 |

| Colorado County | 4 | 1 | 6 | 1 | 2 |

| Comal County | 9 | 6 | 7 | 10 | 7 |

| Comanche County | 0 | 1 | 1 | 1 | 1 |

| Concho County | 1 | 0 | 0 | 0 | 1 |

| Cooke County | 2 | 5 | 4 | 1 | 2 |

| Coryell County | 2 | 3 | 5 | 4 | 3 |

| Cottle County | 0 | 1 | 0 | 0 | 0 |

| Crane County | 0 | 2 | 1 | 0 | 1 |

| Crockett County | 3 | 2 | 1 | 0 | 2 |

| Crosby County | 0 | 1 | 1 | 0 | 1 |

| Culberson County | 1 | 3 | 2 | 1 | 0 |

| Dallam County | 0 | 2 | 1 | 0 | 0 |

| Dallas County | 98 | 98 | 103 | 131 | 114 |

| Dawson County | 2 | 2 | 1 | 1 | 1 |

| Deaf Smith County | 1 | 1 | 0 | 1 | 0 |

| Delta County | 2 | 0 | 0 | 3 | 0 |

| Denton County | 17 | 14 | 12 | 18 | 21 |

| Dewitt County | 0 | 2 | 1 | 2 | 1 |

| Dickens County | 0 | 0 | 0 | 0 | 1 |

| Dimmit County | 4 | 3 | 2 | 0 | 0 |

| Donley County | 0 | 1 | 0 | 0 | 0 |

| Duval County | 1 | 0 | 1 | 1 | 2 |

| Eastland County | 3 | 4 | 2 | 0 | 2 |

| Ector County | 26 | 16 | 22 | 14 | 25 |

| Edwards County | 0 | 0 | 2 | 0 | 0 |

| El Paso County | 30 | 31 | 33 | 39 | 22 |

| Ellis County | 7 | 11 | 11 | 7 | 10 |

| Erath County | 1 | 4 | 4 | 6 | 2 |

| Falls County | 1 | 4 | 1 | 1 | 0 |

| Fannin County | 1 | 2 | 2 | 4 | 8 |

| Fayette County | 6 | 3 | 5 | 2 | 6 |

| Fisher County | 0 | 4 | 0 | 1 | 1 |

| Floyd County | 1 | 1 | 0 | 1 | 0 |

| Foard County | 1 | 0 | 0 | 0 | 0 |

| Fort Bend County | 23 | 14 | 15 | 17 | 14 |

| Franklin County | 1 | 2 | 2 | 2 | 0 |

| Freestone County | 2 | 2 | 2 | 9 | 2 |

| Frio County | 3 | 0 | 5 | 1 | 0 |

| Gaines County | 5 | 2 | 3 | 3 | 1 |

| Galveston County | 12 | 22 | 16 | 19 | 18 |

| Garza County | 0 | 1 | 0 | 1 | 1 |

| Gillespie County | 1 | 2 | 2 | 2 | 4 |

| Glasscock County | 2 | 2 | 1 | 1 | 0 |

| Goliad County | 0 | 1 | 1 | 1 | 0 |

| Gonzales County | 3 | 4 | 6 | 3 | 2 |

| Gray County | 0 | 2 | 2 | 1 | 4 |

| Grayson County | 9 | 7 | 6 | 9 | 7 |

| Gregg County | 4 | 7 | 7 | 9 | 12 |

| Grimes County | 3 | 2 | 6 | 5 | 5 |

| Guadalupe County | 7 | 3 | 8 | 14 | 9 |

| Hale County | 1 | 3 | 2 | 1 | 2 |

| Hall County | 1 | 0 | 2 | 0 | 0 |

| Hamilton County | 0 | 1 | 1 | 0 | 2 |