10 Cheapest Car Insurance Companies in 2025 (Save Money With These Providers)

The cheapest car insurance companies are Geico, Progressive, and Nationwide, with monthly rates starting at $32. Geico offers affordable premiums and discounts, Progressive provides flexible options and rewards safe driving, while Nationwide excels in reliable service and specialized coverage.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Mar 25, 2025

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 25, 2025

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Minimum Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Minimum Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 3,071 reviews

3,071 reviewsCompany Facts

Minimum Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviewsGeico, Progressive, and Nationwide are the cheapest car insurance companies, with rates beginning at $32 monthly. Geico is the best overall choice because of its lowest premiums and discounts.

Progressive offers flexible pricing and rewards for safe driving, while Nationwide offers good service and specialized coverage. This guide will help you learn the basics of car insurance and show you why these companies offer affordable and comprehensive coverage.

Our Top 10 Picks: Cheapest Car Insurance Companies

| Insurance Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $32 | A++ | Affordable Rates | Geico | |

| #2 | $35 | A+ | Flexible Coverage | Progressive | |

| #3 | $37 | A+ | Strong Reputation | Nationwide |

| #4 | $38 | A | Customizable Policies | American Family |

| #5 | $40 | A+ | Reliable Service | The Hartford |

| #6 | $41 | A++ | Wide Options | Travelers | |

| #7 | $43 | B | Trusted Brand | State Farm | |

| #8 | $48 | A+ | Comprehensive Coverage | Allstate | |

| #9 | $50 | A | Great Discounts | Farmers | |

| #10 | $55 | A | Customer Satisfaction | Liberty Mutual |

If you’re ready to compare the cheapest auto insurance in your area, enter your ZIP code in the free online quote tool.

- Geico is the top cheapest car insurance company, with rates of $32/mo

- Geico, Progressive, and Nationwide offer budget-friendly car insurance

- Factors like age, credit, and driving record impact rates from the cheapest insurers

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

#1 — Geico: Top Overall Pick

Pros

- Affordable Premiums: Geico has some of the lowest premiums, which makes it an excellent choice for budget-friendly drivers. Get the full details in our Geico car insurance review.

- Discounts for Safe Drivers: People with a clean driving record, those who complete a defensive driving course, or have vehicles with safety features are eligible for significant car insurance discounts.

- Nationwide Availability: Geico operates in all 50 states, so drivers can take advantage of its affordable coverage plans everywhere.

Cons

- Higher Rates for High-Risk Drivers: Drivers with an accident, DUI, or another violation on their record can expect to pay much more for car insurance.

- Limited Customization of Coverage: Geico policies are less flexible, and drivers find it more difficult to tailor their coverage to meet their needs.

#2 — Progressive: Best for Flexible Car Insurance Pricing

Pros

- Competitive Pricing: The Name Your Price program offers an opportunity for reasonably priced coverage.

- Strong Coverage for High-Risk Drivers: Progressive, unlike some insurers, provides reasonable rates for drivers with accidents or traffic violations. They also offer roadside assistance for cars that break down or are totaled in road accidents.

- Snapshot Program Rewards: Policyholders can earn car insurance discounts based on real-time driving data collected through telematics.

Cons

- Higher Premiums for Low-Mileage Drivers: Those who drive fewer miles may not see as much savings as other insurers specializing in low-usage policies.

- Customer Service Variability: Experiences vary by region, with some policyholders reporting longer-than-average wait times for claims processing.

#3 — Nationwide: Best for Reliable Car Insurance Service

Pros

- Reliable Customer Service for Insurance Claims: Nationwide provides 24/7 assistance and a strong reputation for processing claims effectively.

- Vanishing Deductible Perk: Safe motorists can reduce out-of-pocket costs by keeping their records clean of accidents. Check out our Nationwide car insurance review and learn about these perks.

- Good Coverage for Classic and Specialty Cars: Nationwide provides specialized insurance policies for classic, exotic, and high-value vehicles.

Cons

- Higher Rates for Minimum Coverage: Drivers seeking only basic liability insurance may find cheaper alternatives elsewhere.

- Fewer Discount Opportunities: Compared to Geico and Progressive, Nationwide offers fewer discount programs for policyholders.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

#4 — American Family: Best for Customizable Car Insurance Policies

Pros

- Extensive Customization: Policyholders can tailor their coverage with numerous add-ons and endorsements. For further information, read our American Family car insurance review.

- Low Prices for Bundled Policies: Customers bundling home or renters insurance with car coverage can enjoy significant savings.

- Great Discount Plans: These provide discounts on loyalty, student drivers, and multi-car policies and help drivers save on car insurance premiums.

Cons

- Limited Nationwide Availability: American Family is unavailable in every state, restricting some motorists.

- Slower Quote Process Compared to Online-First Providers: Getting an insurance quote may take longer as it often requires interaction with an agent.

#5 — The Hartford: Best for Senior Car Insurance Benefits

Pros

- Tailored Insurance for Senior Drivers: The Hartford specializes in policies for older drivers and offers unique benefits like RecoverCare. Learn more by reading our The Harford car insurance review.

- High Customer Satisfaction for Insurance Claims: Specific drivers are qualified to be granted life renewal benefits to avoid age and record lapses.

- Lifetime Renewability for Eligible Drivers: Certain drivers qualify for guaranteed renewal, ensuring they won’t lose coverage due to age or record changes.

Cons

- Higher Premiums for Younger Drivers: Rates are higher for younger or inexperienced drivers than other insurers.

- Limited Availability for Non-AARP Members: Many of The Hartford’s best insurance perks are only available to AARP members.

#6 — Travelers: Best for Diverse Car Insurance Options

Pros

- Comprehensive Insurance Coverage Range: The range of options is flexible coverage throughout, extensive, and broad, with options like rideshare insurance coverage.

- Strong Financial Stability for Car Insurance Claims: Travelers boast a muscular financial strength that can support claims with an A++ rating.

- Multiple Discount Opportunities: It discounts safe drivers, multi-policy owners, and green car owners.

- Preferred by Most Drivers: As the Liberty Mutual vs. Travelers review mentioned, Travelers are also preferred by drivers with excellent credit scores, low mileage, and clean driving because it offers consistently reasonable prices.

Cons

- Higher Average Rates: Minimum coverage policies are more expensive than competitors.

- Slower Claims Processing Times: Some policyholders report delays in receiving claim payouts, which may be frustrating.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

#7 — State Farm: Best for Young Driver Car Insurance

Pros

- Trusted Brand: State Farm is a trusted and customer-centric company. Read our State Farm car insurance review for more information.

- Large Network of Local Agents: Offers in-person support through a large network of agents nationwide.

- Competitive Rates for Young Drivers: Young and student drivers can find affordable insurance options with State Farm.

Cons

- Higher Rates for High-Risk Drivers: Drivers with accidents or violations may pay higher premiums than other insurers.

- Fewer Digital Tools: Online features and mobile tools are less advanced than digital-first insurance companies.

#8 — Allstate: Best for Comprehensive Car Insurance Coverage

Pros

- Comprehensive Coverage Options: Offers accident forgiveness, new car replacement, and other extra features for maximum protection.

- Strong Local Agent Network: Policyholders can obtain face-to-face assistance from a large network of agents.

- Multiple Discount Opportunities: Using their app, Drivewise, can also help you earn significant savings, especially for safe drivers. Other than that, they also offer savings for bundling and anti-theft devices to lower insurance costs.

Cons

- Higher Premiums for Certain Drivers: Some drivers, especially those without discounts, may find Allstate’s rates less competitive.

- Mixed Customer Service Reviews: Some customers report slow claims processing and inconsistent service experiences.

#9 — Farmers: Best for Car Insurance Discount Programs

Pros

- Substantial Discounts: Offers multiple savings options, including good student and safe driver discounts. Learn more about the discounts in our Farmers car insurance review.

- Customizable Coverage Options: Policyholders can personalize coverage with add-ons like accident forgiveness and new car replacements.

- Robust Customer Support: Provides 24/7 claims assistance and in-person consultations through a network of agents.

Cons

- Higher Premiums: Rates are more expensive than other budget-friendly car insurance providers.

- Limited Availability in Some States: Farmers do not operate in all states, restricting access for some drivers.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

#10 — Liberty Mutual: Best for Digital Car Insurance Experience

Pros

- Wide Range of Coverage Options: For customized protection, gap insurance, accident forgiveness, and custom parts replacement are added.

- Strong Online and Mobile Experience: An intuitive app lets policyholders manage their policies, file claims, and make payments. Read our comprehensive guide and review of the Liberty Mutual app to learn how to navigate its online platform.

- Discounts for Safe and Low-Mileage Drivers: This program offers savings for safe driving, bundling policies, and driving fewer miles annually.

Cons

- Higher Rates for High-Risk Drivers: Drivers with past accidents or violations may find lower premiums elsewhere.

- Mixed Customer Service Reviews: Some customers report delays in claims processing and billing issues.

Cheapest Car Insurance Monthly Rates From Top Providers & Coverage Level

Searching for what insurance company is the cheapest for your needs can be slightly overwhelming and confusing. Still, we are here to help you find the best cheap car insurance that fits your needs, lifestyle, and especially your budget.

Car Insurance Monthly Rates by Provider & Coverage Level

Insurance Company Minimum Coverage Full Coverage

$48 $155

$38 $132

$50 $165

$32 $112

$55 $178

$37 $125

$35 $120

$43 $145

$40 $135

$41 $138

The table above shows the cheapest car insurance companies’ minimum vs. full coverage rates. Knowing this information might help you gauge how much money you will save to avail yourself of car insurance and what type of car insurance coverage you might need. However, we suggest that getting full coverage is better for your protection and peace of mind.

With this information, you are better equipped when selecting and knowing how to get the cheapest car insurance quotes in your area.

Car Insurance Discounts From the Top Providers

| Insurance Company | Available Discounts |

|---|---|

| Multi-Car, Multi-Policy, Safe Driver, Good Student, Defensive Driving Course, Vehicle Safety Features, Anti-Theft Devices, Early Signing, New Car | |

| Multi-Car, Multi-Policy, Safe Driver, Good Student, Defensive Driving Course, Vehicle Safety Features, Pay-In-Full, Teen Driver |

| Multi-Car, Multi-Policy, Safe Driver, Good Student, Defensive Driving Course, Vehicle Safety Features, Pay-In-Full, Electronic Payments | |

| Multi-Car, Multi-Policy, Military, Good Student, Defensive Driving Course, Vehicle Safety Features, Low Mileage, Federal Employee, Anti-Theft Devices | |

| Multi-Car, Multi-Policy, Safe Driver, Good Student, Defensive Driving Course, Vehicle Safety Features, Low Mileage, Pay-In-Full, Hybrid Vehicle |

| Multi-Car, Multi-Policy, Safe Driver, Defensive Driving Course, Vehicle Safety Features, Good Student, Anti-Theft Devices, Low Mileage |

| Multi-Car, Multi-Policy, Snapshot Program (Usage-Based), Safe Driver, Vehicle Safety Features, Good Student, Homeowner, Pay-In-Full, Teen Driver | |

| Multi-Car, Multi-Policy, Safe Driver, Good Student, Defensive Driving Course, Vehicle Safety Features, Low Mileage, Steer Clear (For Young Drivers) | |

| Multi-Car, Multi-Policy, Safe Driver, Good Student, Defensive Driving Course, Vehicle Safety Features, Anti-Theft Devices, Homeowner |

| Multi-Car, Multi-Policy, Safe Driver, Good Student, Defensive Driving Course, Vehicle Safety Features, Homeowner, Pay-In-Full |

Other information you should be aware of is what discounts are offered by the cheapest car insurance companies. For example, most of the top car insurance providers offer big discounts for new drivers who complete a full defensive driving course and for drivers who practice safe driving habits on the road. This knowledge can help you earn substantial savings when applying for car insurance.

If you’re unsure where to get cheap insurance, start with the top 10 insurance companies in the United States. Here’s a quick look at the average monthly rates from America’s leading car insurance companies.

Geico stands out as the best choice for cheap car insurance rates and discounts, and reliable customer service.Schimri Yoyo Licensed Insurance Agent

USAA offers the most affordable insurance, but it’s only exclusive for active military members. Geico is the cheapest for all other drivers in the United States, followed by American Family and Nationwide.

However, your rates could vary. The most affordable auto insurance companies determine your rates using several factors, including your age and driving record. Check out the subsections below to see how various factors affect car insurance rates.

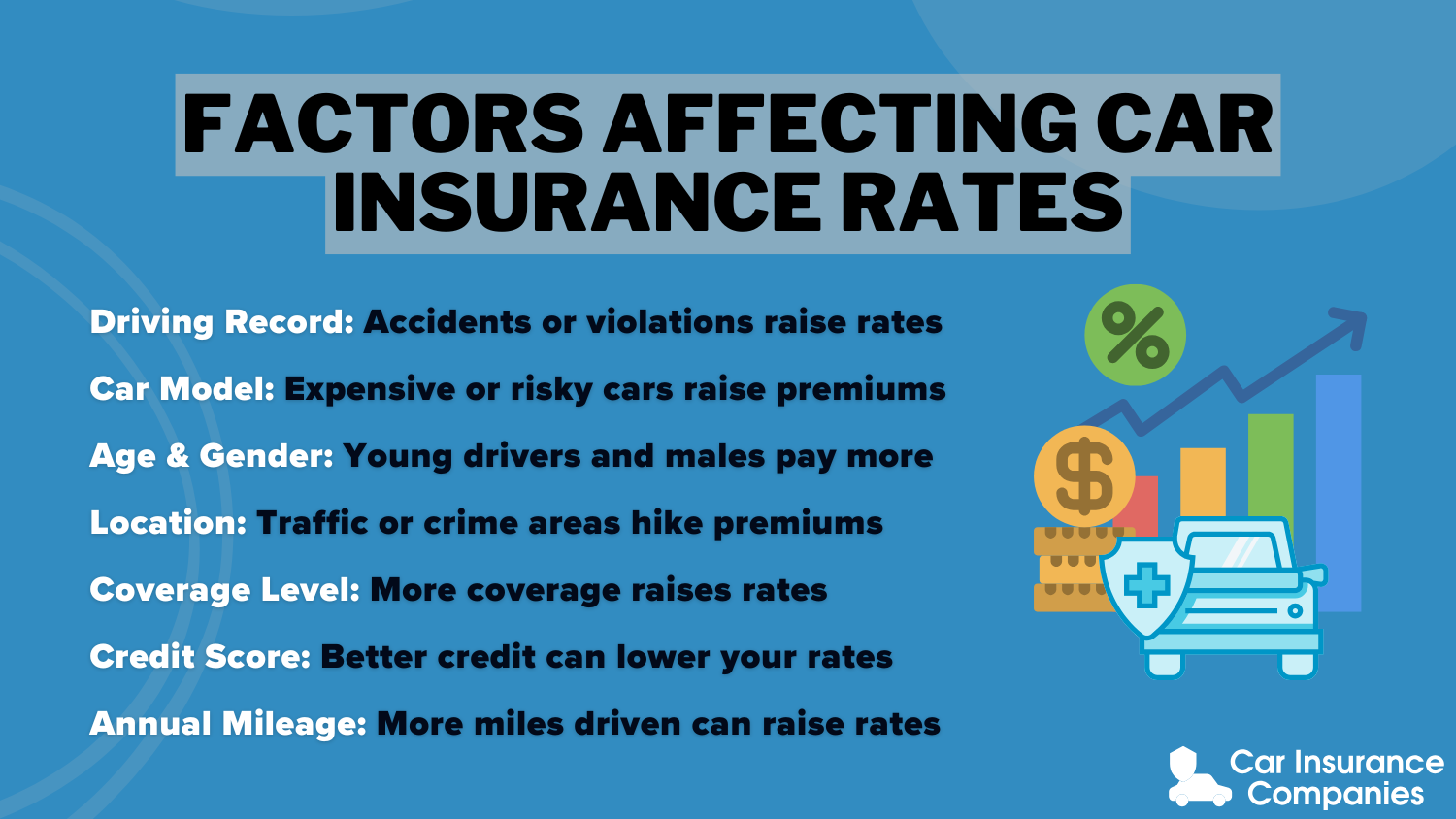

Factors Influencing the Rates of Cheapest Car Insurance Companies

Car insurance rates often change depending on several elements, including age, credit history, driving record, etc., which is also why car insurance quotes change daily. These factors greatly influence how the cheapest car insurance companies quote you.

In this section, we will provide you with various information on how these elements affect your car insurance prices and help guide you in securing the best cheap car insurance tailored to your lifestyle.

Cheapest Car Insurance Rates by State & Provider

Location and region are also factors top car insurance providers consider when writing policies. As you can see in the table below, Geico is considered the cheapest insurance company. However, you can also use the data in this table to see which car insurer offers the cheapest rates in your area that suit your budget.

Cheapest Car Insurance Monthly Rates by State & Provider

| State | Company | Rates |

|---|---|---|

| Alabama | $111 | |

| Alaska | $109 | |

| Arizona | $150 | |

| Arkansas | $150 | |

| California | $120 | |

| Colorado | $155 | |

| Connecticut | $171 | |

| Delaware | $175 | |

| Florida | $168 | |

| Georgia | $140 | |

| Hawaii | $105 | |

| Idaho | $95 | |

| Illinois | $134 | |

| Indiana | $101 | |

| Iowa | $112 | |

| Kansas | $126 | |

| Kentucky | $130 | |

| Louisiana | $179 | |

| Maine | $99 | |

| Maryland | $150 | |

| Massachusetts | $129 | |

| Michigan | $150 | |

| Minnesota | $121 | |

| Mississippi | $119 | |

| Missouri | $129 | |

| Montana | $128 | |

| Nebraska | $124 | |

| Nevada | $190 | |

| New Hampshire | $99 | |

| New Jersey | $145 | |

| New Mexico | $122 | |

| New York | $160 | |

| North Carolina | $108 | |

| North Dakota | $118 | |

| Ohio | $102 | |

| Oklahoma | $139 | |

| Oregon | $134 | |

| Pennsylvania | $126 | |

| Rhode Island | $184 | |

| South Carolina | $127 | |

| South Dakota | $125 | |

| Tennessee | $130 | |

| Texas | $135 | |

| Utah | $131 | |

| Vermont | $95 | |

| Virginia | $128 | |

| Washington | $135 | |

| Washington, D.C. | $142 | |

| West Virginia | $122 | |

| Wisconsin | $128 | |

| Wyoming | $135 |

This highlights the importance of knowing these factors to get the cheapest coverage rates and potentially earn substantial savings as well as full coverage.

Cheap Car Insurance Rates by Age

One of the most significant factors when comparing rates from cheapest car insurance companies is age. The average teen car insurance rates are usually more expensive than almost dirt-cheap car insurance for senior drivers. The table below showcases how age affects insurance rates.

Car Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $774 | $887 | $258 | $271 | $263 | $260 | $214 | $220 | |

| $500 | $678 | $178 | $210 | $184 | $185 | $148 | $150 | |

| $710 | $762 | $246 | $256 | $213 | $213 | $171 | $183 | |

| $471 | $523 | $138 | $133 | $192 | $193 | $104 | $106 | |

| $968 | $1,143 | $267 | $306 | $317 | $321 | $211 | $227 |

| $480 | $598 | $194 | $213 | $197 | $199 | $141 | $149 |

| $724 | $802 | $201 | $209 | $191 | $181 | $131 | $136 | |

| $496 | $610 | $144 | $158 | $173 | $173 | $108 | $108 | |

| $776 | $1,071 | $152 | $165 | $182 | $183 | $127 | $129 | |

| $401 | $449 | $114 | $122 | $129 | $128 | $75 | $75 |

Younger drivers pay at least three times more for car insurance, but drivers 25 and older pay significantly less than teens. Female drivers have cheaper car insurance rates, but male drivers have more expensive rates.

Drivers between 16 and 24 correlate to higher risks of filing car insurance claims, but drivers over 25 have cheaper insurance rates.

Most Affordable Car Insurance Rates by Credit History

Credit history is also a big factor in determining insurance rates. This element plays a big role when comparing the cheapest car insurance companies. The chart below describes how credit history affects the top insurance companies in the nation.

Car Insurance Monthly Rates by Provider & Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $322 | $382 | $541 | |

| $224 | $264 | $372 | |

| $306 | $325 | $405 | |

| $203 | $249 | $355 | |

| $366 | $467 | $734 |

| $244 | $271 | $340 |

| $302 | $330 | $395 | |

| $181 | $238 | $413 | |

| $338 | $362 | $430 | |

| $152 | $185 | $308 |

Car insurance companies offer more affordable rates for people with good credit, but it’s impossible to get the cheapest car insurance with bad credit, as it produces more expensive rates.

USAA is the most affordable insurance company for drivers with poor credit, but only for military affiliates. Nationwide though, offers affordable rates for drivers with bad credit, and State Farm offers the cheapest car insurance for people with good and fair credit.

How Coverage Limits Impact Cheapest Car Insurance Rates

Higher coverage limits—or the maximum amount of money insured by a policy—result in higher car insurance rates. This is also a relevant factor when car insurers make a quotation, and coverage limits impact insurance rates from the cheapest car insurance companies.

Car Insurance Monthly Rates by Provider & Coverage Level

| Companies | Low | Medium | High |

|---|---|---|---|

| $386 | $408 | $428 | |

| $281 | $295 | $285 | |

| $327 | $347 | $375 | |

| $250 | $268 | $286 | |

| $484 | $505 | $530 |

| $283 | $287 | $292 |

| $311 | $335 | $363 | |

| $255 | $272 | $288 | |

| $352 | $372 | $385 | |

| $200 | $212 | $222 |

Geico is one of the cheapest companies for low—and medium-coverage limits. Meanwhile, American Family is the most affordable company for high coverage limits. How car comparison works should be common knowledge to customers who want to get car insurance because this will help them make a smart, informed decision.

Cheapest Insurance Rates by Driving Record

The most effective way to get affordable car insurance is to keep a clean driving record. Speeding tickets, DUIs, and accidents can raise your rates.

This chart reviews how traffic violations impact insurance rates from top car companies.

Car Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $318 | $374 | $416 | $522 | |

| $224 | $252 | $310 | $361 | |

| $288 | $340 | $377 | $393 | |

| $179 | $220 | $266 | $406 | |

| $398 | $475 | $517 | $634 |

| $229 | $259 | $283 | $379 |

| $283 | $334 | $398 | $331 | |

| $235 | $266 | $283 | $303 | |

| $287 | $355 | $357 | $478 | |

| $161 | $183 | $210 | $292 |

This is how DUI affects your car insurance rates. You may wonder, how long will a DUI affect my car insurance? A severe DUI charge can impact your car insurance price for years. Getting the cheapest car insurance rates with recent DUIs and accidents is impossible because they generate the most expensive increases in car insurance. Speeding tickets don’t affect car insurance rates as much, but multiple speeding infractions and DUIs can significantly raise rates.

Smaller Insurance Companies With More Affordable Rates

Sometimes the best companies aren’t the cheapest. You can secure low prices at some of the small car insurance companies. Look at three insurance companies below that provide cheap monthly rates.

Full Coverage vs. Liability-Only Car Insurance Monthly Rates by Small Company

| Insurance Company | Liability-Only | Full Coverage |

|---|---|---|

| $42 | $115 |

| $39 | $131 | |

| $40 | $132 |

Erie Insurance rates are the cheapest and most affordable than the USAA average. However, Erie Insurance isn’t available all over the United States. The Farm Bureau also provides the cheapest liability car insurance rates.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Pay-Per-Mile Car Insurance Affordability

It depends on how much you drive. This type of insurance is known as pay-as-you-drive insurance. Metromile and Root insurance could be cheaper for drivers, but they’ll have to limit their miles.

Progressive is a top pick for budget-conscious drivers, thanks to its competitive pricing, customizable coverage, and Name Your Price® tool.Chris Abrams Licensed Insurance Agent

If you’ve searched for the “cheapest car insurance near me” online, you may have seen companies like Metromile or Root Insurance. These two companies provide coverage based on the number of miles you drive. You can check our Metromile car insurance review or our Root insurance car insurance review to understand which of these known providers offers you the cheapest pay-per-mile car insurance.

There’s no reason you should still be confused and overwhelmed with getting your car insurance rates. You’ll see discounts added to your car insurance policy when you finish up your quote. If you have good credit and a clean driving record, you can save up to 30% on car insurance. Bundling your car insurance with other insurance products can save you an additional 10%, and safety features on a car can provide at least 5%.

Knowing yourself as a customer and reading this guide should help you determine what policy, coverage, and riders best fit your needs.

Choosing the Cheapest Car Insurance Companies With Ease

Choosing the cheapest car insurance depends on factors like where you live, your driving history, age, credit score, and coverage needs. Insurance companies use these details to determine your rates when creating your policy.

Geico, Progressive, and Nationwide are among the most economical auto insurance options available. To find which insurance company is the cheapest for you, shop around, consider discounts, and choose the coverage that offers the best value.

Now that you know more about the cheapest car insurance companies, use our free online quote tool to compare quotes from multiple companies near you.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Frequently Asked Questions

What is the cheapest car insurance in the USA?

USAA is the cheapest overall, but it’s only available to military members and families. Geico is the most affordable for most drivers. Also, know if Geico can insure a car that is not under your name.

Which insurance is best for a car in the USA?

Geico is a top pick due to its low rates, nationwide availability, and discounts. By entering your ZIP code, see how much you can save for car insurance today.

Which car insurance group is the cheapest?

Groups like Geico, Progressive, and Nationwide offer budget-friendly insurance.

What can you do to decrease the cost of insurance policies?

Maintain a clean driving record, bundle policies, improve credit, and look for discounts.

What are the cheapest auto insurance companies?

Geico, Progressive, Nationwide, Erie, and USAA offer some of the lowest rates. Learn more about the best car insurance you can buy today.

How much is car insurance per month in the USA?

The average cost is around $125/month, but minimum coverage can be as low as $32 per month.

What age is insurance cheapest?

Insurance is the cheapest for drivers aged 25-65. Learn more about insurance for first-time drivers over the age of 25.

What is the cheapest type of car insurance policy?

Minimum liability coverage is typically the cheapest.

Are there risks to cheap car insurance?

Yes, it may have limited coverage, higher deductibles, or slower claim processing. Enter your ZIP code into our free comparison tool to learn more about discounts from the top 10 cheapest car insurance companies in your region.

What is the most common type of car insurance?

Liability insurance is the most common and legally required in most states.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.