Wyoming Car Insurance (Coverage, Companies, & More)

Is insurance cheap? insurance rates are only 5 percent higher than the national average at $114/mo, but you can save money on your insurance coverage with a good driving record. Start comparing insurance quotes below in order to find the cheapest coverage in your neighborhood.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Mar 24, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 24, 2024

It’s all about you. We want to help you make the right car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our car insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different car insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Wyoming Statistics Summary | Details |

|---|---|

| Road Miles | Total in State: 28,942 Vehicle Miles Driven: 959.7 Billion |

| Vehicles | Registered: 783,979 Stolen: 592 |

| State Population | 577,737 |

| Most Popular Vehicle | F150 |

| Uninsured Motorists | 7.8% State Rank: 41 |

| Total Driving Fatalities | 2008-2017 Speeding: 461 Drunk Driving: 451 |

| Annual Average Premiums | Collision: $270.48 Comprehensive: $222.86 Liability: $323.38 |

| Cheapest Providers | Safeco Ins Co of IL & State Farm |

Wyoming is a land of dramatic vistas and wide-open spaces. Both Yellowstone National Park and Grand Teton National Park call Wyoming home.

There are also a number of museums and historic sites scattered across the state that celebrate “the Equality State’s” suffragist heritage. In December of 1869, Wyoming made it legal for women to vote, 50 years before anywhere else in the United States. Many political firsts for women took place in Wyoming.

Yellowstone National Park is more than 2.2 million acres, most of which is located in Wyoming, and Grand Teton National Park is over 310,000 acres. Road trip, anyone?

Want to see some buffalo? What about Old Faithful? How about the Cowgirls of the West Museum & Emporium? The best way is to get in the car and drive.

While you’re on the road, it’s important to know what car insurance coverage you need to meet the legal requirements in the state, as well as the laws that keep you safe as you drive across Wyoming. We know this can be frustrating, especially when you’d rather be on your way.

We’ve collected all the information you need to make informed decisions about your coverage. Keep reading to learn more. Ready to get started? Why not use your zip code to get a free quote on car insurance!

Wyoming Car Insurance Coverage & Rates

What does Wyoming car insurance look like compared to the rest of the United States?

| Wyoming | National Average | Percent Difference |

|---|---|---|

| $1,371 | $1,311 | 4.58% |

As you can see, if you live in Wyoming, you can expect to pay, on average, 4.58 percent more than drivers across the country.

Need more information on coverage, rates, financial responsibility, and more? Keep reading, because we cover these and other important topics in the following sections.

Wyoming’s Car Culture

As we indicated in the stats summary table at the top of this page, the most popular vehicle in Wyoming is an F150 truck. This is no surprise when you consider the weather and open space in Wyoming. If you drive in the state, you need to be prepared for unexpected road and weather conditions.

Wyoming is also the least-populated state in the country, and as such, has few public transportation options. This means residents are regularly on the road — both as commuters and as adventurers ready to take on the state’s many sites and experiences.

Wyoming Minimum Coverage

The Insurance Information Institute reports that only 7.8 percent of Wyoming drivers are uninsured (ranking them 41st in the country). This is good news for you because it means you are less likely to end up in an accident with someone who is uninsured than drivers in 40 of the country’s 50 states.

But what coverage are drivers in Wyoming required to maintain?

| Insurance Required | Minimum Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person, $50,000 per accident |

| Property Damage Liability | $20,000 |

This is important to know for a few reasons. One, as we already mentioned, the state requires the insurance outlined in the above table as a minimum, so to avoid fees and potential suspension of your license, you want to make sure you have this coverage.

Two, this is important because Wyoming is an “at-fault” state, which means whoever is at-fault for an accident is financially responsible for the damages. Knowing this can help you decide what coverage you need, beyond the minimum required amount.

Three, in Wyoming, liability coverage only covers the cost of injuries and damage to others involved in the accident, not you. If you want or need coverage for your injuries and vehicle damage in an accident, you will need to obtain additional coverage.

Forms of Financial Responsibility

In Wyoming, proof of insurance is required as proof of financial responsibility. Driving uninsured is considered a misdemeanor. If you are found to be driving uninsured, you may face:

- Jail time of six months or less

- Fines between $500 – $1,500

- Suspension of your license until you can provide proof of insurance

Wyoming maintains a Financial Responsibility Verification Program (FRVP). Through this process, the state confirms you are insured. Paper insurance cards are accepted as proof. However, if you are stopped by a law enforcement officer, it is likely that in addition to accepting your insurance card, the officer will use your license plate number to confirm your proof of insurance is valid through the FRVP process.

Premiums as a Percentage of Income

How much of your income can you expect to spend on insurance in Wyoming?

| Averages | 2012 | 2013 | 2014 |

|---|---|---|---|

| Wyoming Average | 1.70% | 1.72% | 1.69% |

| National Average | 2.34% | 2.43% | 2.40% |

| Percent Difference | -27% | -29% | -30% |

On average, from 2012 – 2014, Wyoming residents spent 1.7 percent of their disposable income on car insurance, while the national average for the same time frame is 2.39 percent. This is good news if you live in Wyoming, particularly because while the national average increased over the three years, Wyoming’s average decreased slightly.

Now that we’ve compared Wyoming to the average, what about other nearby states? Do Wyoming residents spend more or less of their income on insurance than their neighbors?

| State | 2012 | 2013 | 2014 |

|---|---|---|---|

| South Dakota | 1.67% | 1.76% | 1.78% |

| Wyoming | 1.70% | 1.72% | 1.69% |

| Idaho | 2.02% | 2.01% | 2.00% |

| Colorado | 2.13% | 2.16% | 2.15% |

| Montana | 2.29% | 2.39% | 2.10% |

| Utah | 2.52% | 2.55% | 2.54% |

Read more: Utah Car Insurance (Coverage, Companies, & More)

In 2012, Wyoming residents spent more of their disposable income on insurance than South Dakota. However, for the other two years, and all three years for the remaining states, Wyoming spent less of their income on insurance than any of their neighbors.

Read more: Top 10 Wyoming Car Insurance Companies

Average Monthly Car Insurance Rates in WY (Liability, Collision, Comprehensive)

To start figuring out the right coverage mix for your lifestyle and needs, you need to know how the cost of different kinds of insurance coverage.

This table outlines the average rates for various kinds of coverage in Wyoming.

| Coverage Type | Average Cost in Wyoming |

|---|---|

| Liability | $323.38 |

| Collision | $270.48 |

| Comprehensive | $222.86 |

| Combined | $816.71 |

Please note these are average rates that can be used as a baseline to help you start determining what a reasonable rate is, but are not necessarily reflective of exactly what you will pay. There are several reasons for this.

- These average rates are from 2015, so 2019 rates may be higher

- These average rates, obtained from the National Association of Insurance Commissioners (NAIC), are based on minimum insurance coverage requirements in Wyoming

- Several factors go into how an insurance provider adjusts your rate (we will go over these factors in later sections)

Additional Liability

If you are concerned about getting in a car accident with an uninsured driver or you feel you need more coverage for medical expenses that result from an accident, there are additional liability insurance coverage options available for you to consider.

- Uninsured/Underinsured Motorist Coverage – provides additional coverage if you are in an accident with an uninsured or underinsured driver

- Personal Injury Protection (also referred to as “no-fault” insurance) — provides additional coverage for medical costs (this provides coverage for anyone in your vehicle)

- Medical Payments (MedPay) — provides additional coverage for medical costs (this is only for you and anyone else listed on your policy)

To find out if you’ll benefit from this additional coverage, should you ever need to file a claim, you also need to take a look at loss ratio. The loss ratio is the ratio of dollars spent paying claims to premium dollars collected.

You don’t want a loss ratio to be too low or too high. Too high (above 100 percent), and the insurance company is paying out too much in claims for the amount of premium collected. Too low, and you might be overpaying on premiums.

NAIC provides average loss ratio percentages for both MedPay and uninsured/underinsured motorist coverage (they do not currently offer loss ratio information for personal injury protection).

| Loss Ratio | 2013 | 2014 | 2015 |

|---|---|---|---|

| MedPay | 66% | 72% | 76% |

| Uninsured/Underinsured Motorist | 49% | 56% | 49% |

Based on the above table, the MedPay loss ratio indicates insurance providers in Wyoming have MedPay premiums dialed in. However, the uninsured/underinsured motorist loss ratio is on the low side, indicating insurance providers may not be paying many claims for that coverage.

Add-Ons, Endorsements, & Riders

Think you may need more than the average coverage options? You can talk with your insurance provider about the following add-ons, endorsements, and riders, which you can add to your policy if they fit your needs.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

Average Monthly Car Insurance Rates by Age & Gender in WY

In Wyoming, it is still legal for insurance companies to consider gender when adjusting insurance rates, unlike states like California and North Carolina, where this has been outlawed.

Do men pay more for car insurance than women in Wyoming? The below table outlines the average rates from the big insurance providers in Wyoming based on age, gender, and marital status.

| Company | Single 17-year old female annual rate | Single 17-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Safeco Ins Co of IL | $3,605.13 | $4,046.51 | $1,478.54 | $1,651.78 | $1,363.71 | $1,371.22 | $1,114.24 | $1,283.71 |

| State Farm Mutual Auto | $4,032.03 | $5,368.95 | $1,568.23 | $1,861.11 | $1,504.53 | $1,504.53 | $1,294.51 | $1,294.51 |

| Mid-Century Ins Co | $4,109.04 | $6,979.72 | $2,345.57 | $2,345.57 | $2,261.19 | $2,261.19 | $2,126.25 | $2,126.25 |

| Geico General | $4,875.40 | $6,318.07 | $2,988.60 | $3,153.08 | $2,689.63 | $2,743.19 | $2,602.22 | $2,602.22 |

| USAA | $5,059.24 | $6,245.07 | $2,191.51 | $2,482.95 | $1,655.42 | $1,661.22 | $1,435.20 | $1,505.63 |

| Allstate F&C | $8,513.43 | $10,794.53 | $2,849.40 | $3,129.16 | $2,548.54 | $2,687.45 | $2,135.78 | $2,333.15 |

In Wyoming, unlike some states, men do pay more in car insurance than women. However, the gap in rates shrinks as you get older, and for some companies, like State Farm and Mid-Century Insurance Company, by the time you are 35 (and married) rates are the same for men and women. (For more information, read our “Mid-Century Insurance Company Car Insurance Review“).

The Quadrant data included in the above table is based on actual, purchased coverage by Wyoming residents and includes rates for high-risk drivers, drivers who purchase more than the state minimum coverage, and drivers who purchase liability coverage.

Cheapest Rates by Zip Code

Insurance companies look at more than age, gender, and marital status when generating your insurance rates. They also look at where you live.

This table includes a list of average premium rates for all zip codes in Wyoming. You can search the table to see the average rate for your zip code and how it compares to other zip codes in the state.

| Zipcode | Average Annual Rate | Allstate F&C | Mid-Century Ins Co | Geico General | Safeco Ins Co of IL | State Farm Mutual Auto | USAA |

|---|---|---|---|---|---|---|---|

| 83414 | $3,156.84 | $4,258.41 | $3,306.61 | $3,576.30 | $2,148.31 | $2,688.77 | $2,962.67 |

| 83001 | $3,136.29 | $4,330.91 | $3,306.61 | $3,576.30 | $1,952.50 | $2,688.77 | $2,962.67 |

| 83014 | $3,136.29 | $4,330.91 | $3,306.61 | $3,576.30 | $1,952.50 | $2,688.77 | $2,962.67 |

| 83025 | $3,136.29 | $4,330.91 | $3,306.61 | $3,576.30 | $1,952.50 | $2,688.77 | $2,962.67 |

| 83012 | $3,124.21 | $4,258.41 | $3,306.61 | $3,576.30 | $1,952.50 | $2,688.77 | $2,962.67 |

| 83011 | $3,121.12 | $4,239.90 | $3,306.61 | $3,576.30 | $1,952.50 | $2,688.77 | $2,962.67 |

| 83013 | $3,117.92 | $4,220.65 | $3,306.61 | $3,576.30 | $1,952.50 | $2,688.77 | $2,962.67 |

| 82945 | $3,087.10 | $4,425.07 | $3,355.80 | $3,591.27 | $2,066.89 | $2,295.47 | $2,788.13 |

| 82725 | $3,081.33 | $4,624.49 | $3,355.80 | $3,387.40 | $2,016.76 | $2,295.47 | $2,808.05 |

| 82731 | $3,081.33 | $4,624.49 | $3,355.80 | $3,387.40 | $2,016.76 | $2,295.47 | $2,808.05 |

| 82716 | $3,076.27 | $4,624.49 | $3,355.80 | $3,387.40 | $1,986.42 | $2,295.47 | $2,808.05 |

| 82727 | $3,076.27 | $4,624.49 | $3,355.80 | $3,387.40 | $1,986.42 | $2,295.47 | $2,808.05 |

| 82336 | $3,053.13 | $4,425.07 | $3,355.80 | $3,387.40 | $2,066.89 | $2,295.47 | $2,788.13 |

| 82901 | $3,053.13 | $4,425.07 | $3,355.80 | $3,387.40 | $2,066.89 | $2,295.47 | $2,788.13 |

| 82942 | $3,053.13 | $4,425.07 | $3,355.80 | $3,387.40 | $2,066.89 | $2,295.47 | $2,788.13 |

| 82943 | $3,053.13 | $4,425.07 | $3,355.80 | $3,387.40 | $2,066.89 | $2,295.47 | $2,788.13 |

| 82932 | $3,052.11 | $4,418.96 | $3,355.80 | $3,387.40 | $2,066.89 | $2,295.47 | $2,788.13 |

| 82938 | $3,052.11 | $4,418.96 | $3,355.80 | $3,387.40 | $2,066.89 | $2,295.47 | $2,788.13 |

| 82322 | $3,045.81 | $4,381.19 | $3,355.80 | $3,387.40 | $2,066.89 | $2,295.47 | $2,788.13 |

| 82222 | $3,043.46 | $4,624.49 | $3,020.36 | $3,591.27 | $2,016.76 | $2,296.14 | $2,711.75 |

| 82701 | $3,043.46 | $4,624.49 | $3,020.36 | $3,591.27 | $2,016.76 | $2,296.14 | $2,711.75 |

| 82710 | $3,043.46 | $4,624.49 | $3,020.36 | $3,591.27 | $2,016.76 | $2,296.14 | $2,711.75 |

| 82711 | $3,043.46 | $4,624.49 | $3,020.36 | $3,591.27 | $2,016.76 | $2,296.14 | $2,711.75 |

| 82712 | $3,043.46 | $4,624.49 | $3,020.36 | $3,591.27 | $2,016.76 | $2,296.14 | $2,711.75 |

| 82714 | $3,043.46 | $4,624.49 | $3,020.36 | $3,591.27 | $2,016.76 | $2,296.14 | $2,711.75 |

| 82715 | $3,043.46 | $4,624.49 | $3,020.36 | $3,591.27 | $2,016.76 | $2,296.14 | $2,711.75 |

| 82720 | $3,043.46 | $4,624.49 | $3,020.36 | $3,591.27 | $2,016.76 | $2,296.14 | $2,711.75 |

| 82721 | $3,043.46 | $4,624.49 | $3,020.36 | $3,591.27 | $2,016.76 | $2,296.14 | $2,711.75 |

| 82723 | $3,043.46 | $4,624.49 | $3,020.36 | $3,591.27 | $2,016.76 | $2,296.14 | $2,711.75 |

| 82729 | $3,043.46 | $4,624.49 | $3,020.36 | $3,591.27 | $2,016.76 | $2,296.14 | $2,711.75 |

| 82730 | $3,043.46 | $4,624.49 | $3,020.36 | $3,591.27 | $2,016.76 | $2,296.14 | $2,711.75 |

| 82718 | $3,041.69 | $4,417.02 | $3,355.80 | $3,387.40 | $1,986.42 | $2,295.47 | $2,808.05 |

| 82732 | $3,041.69 | $4,417.02 | $3,355.80 | $3,387.40 | $1,986.42 | $2,295.47 | $2,808.05 |

| 82929 | $3,038.16 | $4,335.30 | $3,355.80 | $3,387.40 | $2,066.89 | $2,295.47 | $2,788.13 |

| 82934 | $3,038.16 | $4,335.30 | $3,355.80 | $3,387.40 | $2,066.89 | $2,295.47 | $2,788.13 |

| 82935 | $3,038.16 | $4,335.30 | $3,355.80 | $3,387.40 | $2,066.89 | $2,295.47 | $2,788.13 |

| 82639 | $3,033.37 | $4,532.65 | $3,017.90 | $3,591.27 | $1,967.37 | $2,296.14 | $2,794.87 |

| 83110 | $3,031.04 | $4,335.30 | $3,020.36 | $3,591.27 | $2,148.31 | $2,296.14 | $2,794.87 |

| 83111 | $3,031.04 | $4,335.30 | $3,020.36 | $3,591.27 | $2,148.31 | $2,296.14 | $2,794.87 |

| 83112 | $3,031.04 | $4,335.30 | $3,020.36 | $3,591.27 | $2,148.31 | $2,296.14 | $2,794.87 |

| 83114 | $3,031.04 | $4,335.30 | $3,020.36 | $3,591.27 | $2,148.31 | $2,296.14 | $2,794.87 |

| 83119 | $3,031.04 | $4,335.30 | $3,020.36 | $3,591.27 | $2,148.31 | $2,296.14 | $2,794.87 |

| 83120 | $3,031.04 | $4,335.30 | $3,020.36 | $3,591.27 | $2,148.31 | $2,296.14 | $2,794.87 |

| 83122 | $3,031.04 | $4,335.30 | $3,020.36 | $3,591.27 | $2,148.31 | $2,296.14 | $2,794.87 |

| 83126 | $3,031.04 | $4,335.30 | $3,020.36 | $3,591.27 | $2,148.31 | $2,296.14 | $2,794.87 |

| 83127 | $3,031.04 | $4,335.30 | $3,020.36 | $3,591.27 | $2,148.31 | $2,296.14 | $2,794.87 |

| 83101 | $3,030.31 | $4,330.91 | $3,020.36 | $3,591.27 | $2,148.31 | $2,296.14 | $2,794.87 |

| 83116 | $3,030.31 | $4,330.91 | $3,020.36 | $3,591.27 | $2,148.31 | $2,296.14 | $2,794.87 |

| 83118 | $3,030.31 | $4,330.91 | $3,020.36 | $3,591.27 | $2,148.31 | $2,296.14 | $2,794.87 |

| 83121 | $3,030.31 | $4,330.91 | $3,020.36 | $3,591.27 | $2,148.31 | $2,296.14 | $2,794.87 |

| 83123 | $3,030.31 | $4,330.91 | $3,020.36 | $3,591.27 | $2,148.31 | $2,296.14 | $2,794.87 |

| 83124 | $3,030.31 | $4,330.91 | $3,020.36 | $3,591.27 | $2,148.31 | $2,296.14 | $2,794.87 |

| 83128 | $3,030.31 | $4,330.91 | $3,020.36 | $3,591.27 | $2,148.31 | $2,296.14 | $2,794.87 |

| 82638 | $3,029.84 | $4,425.21 | $3,342.63 | $3,272.44 | $2,007.75 | $2,327.26 | $2,803.76 |

| 82923 | $3,027.10 | $4,311.65 | $3,020.36 | $3,591.27 | $2,148.31 | $2,296.14 | $2,794.87 |

| 83113 | $3,027.10 | $4,311.65 | $3,020.36 | $3,591.27 | $2,148.31 | $2,296.14 | $2,794.87 |

| 82941 | $3,024.02 | $4,293.14 | $3,020.36 | $3,591.27 | $2,148.31 | $2,296.14 | $2,794.87 |

| 82642 | $3,022.19 | $4,425.21 | $3,017.90 | $3,591.27 | $2,007.75 | $2,296.14 | $2,794.87 |

| 82514 | $3,021.44 | $4,420.68 | $3,017.90 | $3,591.27 | $2,007.75 | $2,296.14 | $2,794.87 |

| 82515 | $3,021.44 | $4,420.68 | $3,017.90 | $3,591.27 | $2,007.75 | $2,296.14 | $2,794.87 |

| 82520 | $3,021.44 | $4,420.68 | $3,017.90 | $3,591.27 | $2,007.75 | $2,296.14 | $2,794.87 |

| 82242 | $3,017.98 | $4,471.59 | $3,020.36 | $3,591.27 | $2,016.76 | $2,296.14 | $2,711.75 |

| 82225 | $3,017.40 | $4,468.10 | $3,020.36 | $3,591.27 | $2,016.76 | $2,296.14 | $2,711.75 |

| 82310 | $3,017.21 | $4,395.32 | $3,017.90 | $3,591.27 | $2,007.75 | $2,296.14 | $2,794.87 |

| 82005 | $3,015.99 | $4,449.45 | $3,215.76 | $3,286.65 | $2,042.51 | $2,310.05 | $2,791.52 |

| 82060 | $3,015.99 | $4,449.45 | $3,215.76 | $3,286.65 | $2,042.51 | $2,310.05 | $2,791.52 |

| 82061 | $3,015.99 | $4,449.45 | $3,215.76 | $3,286.65 | $2,042.51 | $2,310.05 | $2,791.52 |

| 82922 | $3,015.02 | $4,239.15 | $3,020.36 | $3,591.27 | $2,148.31 | $2,296.14 | $2,794.87 |

| 83115 | $3,015.02 | $4,239.15 | $3,020.36 | $3,591.27 | $2,148.31 | $2,296.14 | $2,794.87 |

| 82601 | $3,014.09 | $4,515.48 | $3,342.63 | $3,272.44 | $1,946.72 | $2,327.26 | $2,680.02 |

| 82635 | $3,014.09 | $4,515.48 | $3,342.63 | $3,272.44 | $1,946.72 | $2,327.26 | $2,680.02 |

| 82636 | $3,014.09 | $4,515.48 | $3,342.63 | $3,272.44 | $1,946.72 | $2,327.26 | $2,680.02 |

| 82643 | $3,014.09 | $4,515.48 | $3,342.63 | $3,272.44 | $1,946.72 | $2,327.26 | $2,680.02 |

| 82640 | $3,014.09 | $4,417.02 | $3,017.90 | $3,591.27 | $1,967.37 | $2,296.14 | $2,794.87 |

| 82840 | $3,014.09 | $4,417.02 | $3,017.90 | $3,591.27 | $1,967.37 | $2,296.14 | $2,794.87 |

| 82646 | $3,012.33 | $4,381.19 | $3,342.63 | $3,272.44 | $1,946.72 | $2,327.26 | $2,803.76 |

| 82648 | $3,012.33 | $4,381.19 | $3,342.63 | $3,272.44 | $1,946.72 | $2,327.26 | $2,803.76 |

| 82925 | $3,011.93 | $4,220.65 | $3,020.36 | $3,591.27 | $2,148.31 | $2,296.14 | $2,794.87 |

| 82227 | $3,008.88 | $4,417.02 | $3,020.36 | $3,591.27 | $2,016.76 | $2,296.14 | $2,711.75 |

| 82213 | $3,008.45 | $4,583.74 | $3,020.36 | $3,591.27 | $1,847.42 | $2,296.14 | $2,711.75 |

| 82224 | $3,007.77 | $4,740.14 | $2,798.83 | $3,387.40 | $2,016.76 | $2,295.47 | $2,808.05 |

| 82944 | $3,007.74 | $4,417.02 | $2,798.83 | $3,591.27 | $2,148.31 | $2,296.14 | $2,794.87 |

| 82059 | $3,007.48 | $4,398.39 | $3,215.76 | $3,286.65 | $2,042.51 | $2,310.05 | $2,791.52 |

| 82052 | $3,006.61 | $4,398.39 | $3,020.36 | $3,591.27 | $2,021.74 | $2,296.14 | $2,711.75 |

| 82084 | $3,006.61 | $4,398.39 | $3,020.36 | $3,591.27 | $2,021.74 | $2,296.14 | $2,711.75 |

| 82063 | $3,005.49 | $4,391.67 | $3,020.36 | $3,591.27 | $2,021.74 | $2,296.14 | $2,711.75 |

| 82070 | $3,005.49 | $4,391.67 | $3,020.36 | $3,591.27 | $2,021.74 | $2,296.14 | $2,711.75 |

| 82072 | $3,005.49 | $4,391.67 | $3,020.36 | $3,591.27 | $2,021.74 | $2,296.14 | $2,711.75 |

| 82401 | $3,001.52 | $4,341.55 | $3,017.90 | $3,591.27 | $1,967.37 | $2,296.14 | $2,794.87 |

| 82442 | $3,001.52 | $4,341.55 | $3,017.90 | $3,591.27 | $1,967.37 | $2,296.14 | $2,794.87 |

| 82433 | $3,001.27 | $4,354.93 | $3,017.90 | $3,591.27 | $1,952.50 | $2,296.14 | $2,794.87 |

| 82501 | $3,000.18 | $4,293.14 | $3,017.90 | $3,591.27 | $2,007.75 | $2,296.14 | $2,794.87 |

| 82510 | $3,000.18 | $4,293.14 | $3,017.90 | $3,591.27 | $2,007.75 | $2,296.14 | $2,794.87 |

| 82516 | $3,000.18 | $4,293.14 | $3,017.90 | $3,591.27 | $2,007.75 | $2,296.14 | $2,794.87 |

| 82524 | $3,000.18 | $4,293.14 | $3,017.90 | $3,591.27 | $2,007.75 | $2,296.14 | $2,794.87 |

| 82620 | $2,995.78 | $4,381.19 | $3,342.63 | $3,272.44 | $1,847.42 | $2,327.26 | $2,803.76 |

| 82630 | $2,995.78 | $4,381.19 | $3,342.63 | $3,272.44 | $1,847.42 | $2,327.26 | $2,803.76 |

| 82930 | $2,994.12 | $4,335.30 | $2,798.83 | $3,591.27 | $2,148.31 | $2,296.14 | $2,794.87 |

| 82933 | $2,994.12 | $4,335.30 | $2,798.83 | $3,591.27 | $2,148.31 | $2,296.14 | $2,794.87 |

| 82936 | $2,994.12 | $4,335.30 | $2,798.83 | $3,591.27 | $2,148.31 | $2,296.14 | $2,794.87 |

| 82937 | $2,994.12 | $4,335.30 | $2,798.83 | $3,591.27 | $2,148.31 | $2,296.14 | $2,794.87 |

| 82443 | $2,993.45 | $4,293.14 | $3,017.90 | $3,591.27 | $1,967.37 | $2,296.14 | $2,794.87 |

| 82604 | $2,991.71 | $4,381.19 | $3,342.63 | $3,272.44 | $1,946.72 | $2,327.26 | $2,680.02 |

| 82609 | $2,991.71 | $4,381.19 | $3,342.63 | $3,272.44 | $1,946.72 | $2,327.26 | $2,680.02 |

| 82644 | $2,991.71 | $4,381.19 | $3,342.63 | $3,272.44 | $1,946.72 | $2,327.26 | $2,680.02 |

| 82834 | $2,989.43 | $4,269.04 | $3,017.90 | $3,591.27 | $1,967.37 | $2,296.14 | $2,794.87 |

| 82201 | $2,989.17 | $4,468.10 | $3,020.36 | $3,591.27 | $1,847.42 | $2,296.14 | $2,711.75 |

| 82212 | $2,989.17 | $4,468.10 | $3,020.36 | $3,591.27 | $1,847.42 | $2,296.14 | $2,711.75 |

| 82219 | $2,989.17 | $4,468.10 | $3,020.36 | $3,591.27 | $1,847.42 | $2,296.14 | $2,711.75 |

| 82223 | $2,989.17 | $4,468.10 | $3,020.36 | $3,591.27 | $1,847.42 | $2,296.14 | $2,711.75 |

| 82240 | $2,989.17 | $4,468.10 | $3,020.36 | $3,591.27 | $1,847.42 | $2,296.14 | $2,711.75 |

| 82512 | $2,988.10 | $4,220.65 | $3,017.90 | $3,591.27 | $2,007.75 | $2,296.14 | $2,794.87 |

| 82513 | $2,988.10 | $4,220.65 | $3,017.90 | $3,591.27 | $2,007.75 | $2,296.14 | $2,794.87 |

| 82523 | $2,988.10 | $4,220.65 | $3,017.90 | $3,591.27 | $2,007.75 | $2,296.14 | $2,794.87 |

| 82221 | $2,986.06 | $4,449.45 | $3,020.36 | $3,591.27 | $1,847.42 | $2,296.14 | $2,711.75 |

| 82649 | $2,985.13 | $4,202.87 | $3,017.90 | $3,591.27 | $2,007.75 | $2,296.14 | $2,794.87 |

| 82050 | $2,983.48 | $4,449.45 | $3,215.76 | $3,286.65 | $1,847.42 | $2,310.05 | $2,791.52 |

| 82053 | $2,983.48 | $4,449.45 | $3,215.76 | $3,286.65 | $1,847.42 | $2,310.05 | $2,791.52 |

| 82054 | $2,983.48 | $4,449.45 | $3,215.76 | $3,286.65 | $1,847.42 | $2,310.05 | $2,791.52 |

| 82081 | $2,983.48 | $4,449.45 | $3,215.76 | $3,286.65 | $1,847.42 | $2,310.05 | $2,791.52 |

| 82082 | $2,983.48 | $4,449.45 | $3,215.76 | $3,286.65 | $1,847.42 | $2,310.05 | $2,791.52 |

| 82428 | $2,982.10 | $4,225.04 | $3,017.90 | $3,591.27 | $1,967.37 | $2,296.14 | $2,794.87 |

| 82430 | $2,982.10 | $4,225.04 | $3,017.90 | $3,591.27 | $1,967.37 | $2,296.14 | $2,794.87 |

| 82432 | $2,982.10 | $4,225.04 | $3,017.90 | $3,591.27 | $1,967.37 | $2,296.14 | $2,794.87 |

| 82441 | $2,982.10 | $4,225.04 | $3,017.90 | $3,591.27 | $1,967.37 | $2,296.14 | $2,794.87 |

| 82410 | $2,981.37 | $4,220.65 | $3,017.90 | $3,591.27 | $1,967.37 | $2,296.14 | $2,794.87 |

| 82411 | $2,981.37 | $4,220.65 | $3,017.90 | $3,591.27 | $1,967.37 | $2,296.14 | $2,794.87 |

| 82412 | $2,981.37 | $4,220.65 | $3,017.90 | $3,591.27 | $1,967.37 | $2,296.14 | $2,794.87 |

| 82420 | $2,981.37 | $4,220.65 | $3,017.90 | $3,591.27 | $1,967.37 | $2,296.14 | $2,794.87 |

| 82421 | $2,981.37 | $4,220.65 | $3,017.90 | $3,591.27 | $1,967.37 | $2,296.14 | $2,794.87 |

| 82422 | $2,981.37 | $4,220.65 | $3,017.90 | $3,591.27 | $1,967.37 | $2,296.14 | $2,794.87 |

| 82426 | $2,981.37 | $4,220.65 | $3,017.90 | $3,591.27 | $1,967.37 | $2,296.14 | $2,794.87 |

| 82431 | $2,981.37 | $4,220.65 | $3,017.90 | $3,591.27 | $1,967.37 | $2,296.14 | $2,794.87 |

| 82434 | $2,981.37 | $4,220.65 | $3,017.90 | $3,591.27 | $1,967.37 | $2,296.14 | $2,794.87 |

| 82831 | $2,979.71 | $4,510.51 | $3,017.90 | $3,347.54 | $1,967.37 | $2,136.33 | $2,898.60 |

| 82190 | $2,978.89 | $4,220.65 | $3,017.90 | $3,591.27 | $1,952.50 | $2,296.14 | $2,794.87 |

| 82414 | $2,978.89 | $4,220.65 | $3,017.90 | $3,591.27 | $1,952.50 | $2,296.14 | $2,794.87 |

| 82423 | $2,978.89 | $4,220.65 | $3,017.90 | $3,591.27 | $1,952.50 | $2,296.14 | $2,794.87 |

| 82435 | $2,978.89 | $4,220.65 | $3,017.90 | $3,591.27 | $1,952.50 | $2,296.14 | $2,794.87 |

| 82440 | $2,978.89 | $4,220.65 | $3,017.90 | $3,591.27 | $1,952.50 | $2,296.14 | $2,794.87 |

| 82450 | $2,978.89 | $4,220.65 | $3,017.90 | $3,591.27 | $1,952.50 | $2,296.14 | $2,794.87 |

| 82051 | $2,977.55 | $4,398.39 | $3,020.36 | $3,591.27 | $1,847.42 | $2,296.14 | $2,711.75 |

| 82058 | $2,977.55 | $4,398.39 | $3,020.36 | $3,591.27 | $1,847.42 | $2,296.14 | $2,711.75 |

| 82083 | $2,977.55 | $4,398.39 | $3,020.36 | $3,591.27 | $1,847.42 | $2,296.14 | $2,711.75 |

| 82055 | $2,976.43 | $4,391.67 | $3,020.36 | $3,591.27 | $1,847.42 | $2,296.14 | $2,711.75 |

| 82229 | $2,973.19 | $4,532.65 | $2,798.83 | $3,387.40 | $2,016.76 | $2,295.47 | $2,808.05 |

| 82637 | $2,973.19 | $4,532.65 | $2,798.83 | $3,387.40 | $2,016.76 | $2,295.47 | $2,808.05 |

| 82210 | $2,966.79 | $4,333.82 | $3,020.36 | $3,591.27 | $1,847.42 | $2,296.14 | $2,711.75 |

| 82214 | $2,966.79 | $4,333.82 | $3,020.36 | $3,591.27 | $1,847.42 | $2,296.14 | $2,711.75 |

| 82215 | $2,966.79 | $4,333.82 | $3,020.36 | $3,591.27 | $1,847.42 | $2,296.14 | $2,711.75 |

| 82217 | $2,966.79 | $4,333.82 | $3,020.36 | $3,591.27 | $1,847.42 | $2,296.14 | $2,711.75 |

| 82218 | $2,966.79 | $4,333.82 | $3,020.36 | $3,591.27 | $1,847.42 | $2,296.14 | $2,711.75 |

| 82243 | $2,966.79 | $4,333.82 | $3,020.36 | $3,591.27 | $1,847.42 | $2,296.14 | $2,711.75 |

| 82244 | $2,966.79 | $4,333.82 | $3,020.36 | $3,591.27 | $1,847.42 | $2,296.14 | $2,711.75 |

| 82837 | $2,964.13 | $4,417.02 | $3,017.90 | $3,347.54 | $1,967.37 | $2,136.33 | $2,898.60 |

| 82844 | $2,964.13 | $4,417.02 | $3,017.90 | $3,347.54 | $1,967.37 | $2,136.33 | $2,898.60 |

| 82939 | $2,960.14 | $4,335.30 | $2,798.83 | $3,387.40 | $2,148.31 | $2,296.14 | $2,794.87 |

| 82835 | $2,955.90 | $4,367.66 | $3,017.90 | $3,347.54 | $1,967.37 | $2,136.33 | $2,898.60 |

| 82633 | $2,953.92 | $4,417.02 | $2,798.83 | $3,387.40 | $2,016.76 | $2,295.47 | $2,808.05 |

| 82836 | $2,931.40 | $4,220.65 | $3,017.90 | $3,347.54 | $1,967.37 | $2,136.33 | $2,898.60 |

| 82838 | $2,931.40 | $4,220.65 | $3,017.90 | $3,347.54 | $1,967.37 | $2,136.33 | $2,898.60 |

| 82001 | $2,931.29 | $4,449.45 | $3,215.76 | $3,286.65 | $2,042.51 | $2,310.05 | $2,283.32 |

| 82009 | $2,931.29 | $4,449.45 | $3,215.76 | $3,286.65 | $2,042.51 | $2,310.05 | $2,283.32 |

| 82301 | $2,924.73 | $4,406.56 | $2,798.83 | $3,387.40 | $1,847.42 | $2,295.47 | $2,812.71 |

| 82321 | $2,924.73 | $4,406.56 | $2,798.83 | $3,387.40 | $1,847.42 | $2,295.47 | $2,812.71 |

| 82323 | $2,924.73 | $4,406.56 | $2,798.83 | $3,387.40 | $1,847.42 | $2,295.47 | $2,812.71 |

| 82325 | $2,924.73 | $4,406.56 | $2,798.83 | $3,387.40 | $1,847.42 | $2,295.47 | $2,812.71 |

| 82329 | $2,924.73 | $4,406.56 | $2,798.83 | $3,387.40 | $1,847.42 | $2,295.47 | $2,812.71 |

| 82331 | $2,924.73 | $4,406.56 | $2,798.83 | $3,387.40 | $1,847.42 | $2,295.47 | $2,812.71 |

| 82332 | $2,924.73 | $4,406.56 | $2,798.83 | $3,387.40 | $1,847.42 | $2,295.47 | $2,812.71 |

| 82007 | $2,922.78 | $4,398.39 | $3,215.76 | $3,286.65 | $2,042.51 | $2,310.05 | $2,283.32 |

| 82832 | $2,921.32 | $4,160.17 | $3,017.90 | $3,347.54 | $1,967.37 | $2,136.33 | $2,898.60 |

| 82842 | $2,921.32 | $4,160.17 | $3,017.90 | $3,347.54 | $1,967.37 | $2,136.33 | $2,898.60 |

| 82324 | $2,920.50 | $4,381.19 | $2,798.83 | $3,387.40 | $1,847.42 | $2,295.47 | $2,812.71 |

| 82327 | $2,920.50 | $4,381.19 | $2,798.83 | $3,387.40 | $1,847.42 | $2,295.47 | $2,812.71 |

| 82334 | $2,920.50 | $4,381.19 | $2,798.83 | $3,387.40 | $1,847.42 | $2,295.47 | $2,812.71 |

| 82335 | $2,920.50 | $4,381.19 | $2,798.83 | $3,387.40 | $1,847.42 | $2,295.47 | $2,812.71 |

| 82615 | $2,920.50 | $4,381.19 | $2,798.83 | $3,387.40 | $1,847.42 | $2,295.47 | $2,812.71 |

| 82801 | $2,896.66 | $4,012.21 | $3,017.90 | $3,347.54 | $1,967.37 | $2,136.33 | $2,898.60 |

| 82833 | $2,896.66 | $4,012.21 | $3,017.90 | $3,347.54 | $1,967.37 | $2,136.33 | $2,898.60 |

| 82839 | $2,896.66 | $4,012.21 | $3,017.90 | $3,347.54 | $1,967.37 | $2,136.33 | $2,898.60 |

| 82845 | $2,896.66 | $4,012.21 | $3,017.90 | $3,347.54 | $1,967.37 | $2,136.33 | $2,898.60 |

On average, the cheapest zip code in Wyoming for car insurance premiums is 82801, while the most expensive zip code is 83414. However, it is interesting to note there is only about a $287 difference between the lowest and highest average rates in the state.

As you might expect, insurance rates can also be broken down by city.

Cheapest Rates by City

Let’s take a look at the average rate for premiums in cities and towns across the state of Wyoming compared to the state average of $3,082.81 (ranked in order of most to least expensive).

| Rank | City | Zipcode | Average Rate ($) | Compared to Average ($) |

|---|---|---|---|---|

| 1 | ALTA | 83414 | 3241.54 | 158.73 |

| 2 | JACKSON | 83001 | 3221.37 | 138.56 |

| 2 | WILSON | 83014 | 3221.37 | 138.56 |

| 2 | TETON VILLAGE | 83025 | 3221.37 | 138.56 |

| 5 | MOOSE | 83012 | 3209.29 | 126.48 |

| 6 | KELLY | 83011 | 3206.21 | 123.4 |

| 7 | MORAN | 83013 | 3203 | 120.19 |

| 8 | SUPERIOR | 82945 | 3172.49 | 89.68 |

| 9 | RECLUSE | 82725 | 3164.81 | 82 |

| 9 | WESTON | 82731 | 3164.81 | 82 |

| 11 | GILLETTE | 82716 | 3161.85 | 79.04 |

| 11 | ROZET | 82727 | 3161.85 | 79.04 |

| 13 | WAMSUTTER | 82336 | 3138.23 | 55.42 |

| 13 | ROCK SPRINGS | 82901 | 3138.23 | 55.42 |

| 13 | POINT OF ROCKS | 82942 | 3138.23 | 55.42 |

| 13 | RELIANCE | 82943 | 3138.23 | 55.42 |

| 17 | FARSON | 82932 | 3137.21 | 54.4 |

| 17 | MC KINNON | 82938 | 3137.21 | 54.4 |

| 19 | BAIROIL | 82322 | 3130.92 | 48.11 |

| 20 | GILLETTE | 82718 | 3127.28 | 44.47 |

| 20 | WRIGHT | 82732 | 3127.28 | 44.47 |

| 22 | LITTLE AMERICA | 82929 | 3123.27 | 40.46 |

| 22 | GRANGER | 82934 | 3123.27 | 40.46 |

| 22 | GREEN RIVER | 82935 | 3123.27 | 40.46 |

| 25 | LANCE CREEK | 82222 | 3122.1 | 39.29 |

| 25 | NEWCASTLE | 82701 | 3122.1 | 39.29 |

| 25 | ALADDIN | 82710 | 3122.1 | 39.29 |

| 25 | ALVA | 82711 | 3122.1 | 39.29 |

| 25 | BEULAH | 82712 | 3122.1 | 39.29 |

| 25 | DEVILS TOWER | 82714 | 3122.1 | 39.29 |

| 25 | FOUR CORNERS | 82715 | 3122.1 | 39.29 |

| 25 | HULETT | 82720 | 3122.1 | 39.29 |

| 25 | MOORCROFT | 82721 | 3122.1 | 39.29 |

| 25 | OSAGE | 82723 | 3122.1 | 39.29 |

| 25 | SUNDANCE | 82729 | 3122.1 | 39.29 |

| 25 | UPTON | 82730 | 3122.1 | 39.29 |

| 37 | HILAND | 82638 | 3121.13 | 38.32 |

| 38 | CASPER | 82601 | 3111.08 | 28.27 |

| 38 | EDGERTON | 82635 | 3111.08 | 28.27 |

| 38 | EVANSVILLE | 82636 | 3111.08 | 28.27 |

| 38 | MIDWEST | 82643 | 3111.08 | 28.27 |

| 42 | FT WARREN AFB | 82005 | 3110.37 | 27.56 |

| 42 | HILLSDALE | 82060 | 3110.37 | 27.56 |

| 42 | HORSE CREEK | 82061 | 3110.37 | 27.56 |

| 45 | AFTON | 83110 | 3110.15 | 27.34 |

| 45 | AUBURN | 83111 | 3110.15 | 27.34 |

| 45 | BEDFORD | 83112 | 3110.15 | 27.34 |

| 45 | COKEVILLE | 83114 | 3110.15 | 27.34 |

| 45 | FAIRVIEW | 83119 | 3110.15 | 27.34 |

| 45 | FREEDOM | 83120 | 3110.15 | 27.34 |

| 45 | GROVER | 83122 | 3110.15 | 27.34 |

| 45 | SMOOT | 83126 | 3110.15 | 27.34 |

| 45 | THAYNE | 83127 | 3110.15 | 27.34 |

| 54 | NATRONA | 82646 | 3109.43 | 26.62 |

| 54 | POWDER RIVER | 82648 | 3109.43 | 26.62 |

| 56 | KEMMERER | 83101 | 3109.24 | 26.43 |

| 56 | DIAMONDVILLE | 83116 | 3109.24 | 26.43 |

| 56 | ETNA | 83118 | 3109.24 | 26.43 |

| 56 | FRONTIER | 83121 | 3109.24 | 26.43 |

| 56 | LA BARGE | 83123 | 3109.24 | 26.43 |

| 56 | OPAL | 83124 | 3109.24 | 26.43 |

| 56 | ALPINE | 83128 | 3109.24 | 26.43 |

| 63 | KAYCEE | 82639 | 3108.99 | 26.18 |

| 64 | BOULDER | 82923 | 3106.03 | 23.22 |

| 64 | BIG PINEY | 83113 | 3106.03 | 23.22 |

| 66 | PINEDALE | 82941 | 3102.94 | 20.13 |

| 67 | LYSITE | 82642 | 3100.27 | 17.46 |

| 68 | GRANITE CANON | 82059 | 3099.98 | 17.17 |

| 69 | FORT WASHAKIE | 82514 | 3099.34 | 16.53 |

| 69 | HUDSON | 82515 | 3099.34 | 16.53 |

| 69 | LANDER | 82520 | 3099.34 | 16.53 |

| 72 | VAN TASSELL | 82242 | 3098.83 | 16.02 |

| 73 | LUSK | 82225 | 3097.92 | 15.11 |

| 74 | JEFFREY CITY | 82310 | 3095.11 | 12.3 |

| 75 | BONDURANT | 82922 | 3093.94 | 11.13 |

| 75 | DANIEL | 83115 | 3093.94 | 11.13 |

| 77 | CORA | 82925 | 3090.86 | 8.05 |

| 78 | LINCH | 82640 | 3089.71 | 6.9 |

| 78 | SADDLESTRING | 82840 | 3089.71 | 6.9 |

| 80 | BUFORD | 82052 | 3088.77 | 5.96 |

| 80 | TIE SIDING | 82084 | 3088.77 | 5.96 |

| 82 | CASPER | 82604 | 3088.7 | 5.89 |

| 82 | CASPER | 82609 | 3088.7 | 5.89 |

| 82 | MILLS | 82644 | 3088.7 | 5.89 |

| 85 | GLENDO | 82213 | 3088.27 | 5.46 |

| 86 | JELM | 82063 | 3087.65 | 4.84 |

| 86 | LARAMIE | 82070 | 3087.65 | 4.84 |

| 86 | LARAMIE | 82072 | 3087.65 | 4.84 |

| 89 | MANVILLE | 82227 | 3087.52 | 4.71 |

| 90 | ALCOVA | 82620 | 3086.51 | 3.7 |

| 90 | ARMINTO | 82630 | 3086.51 | 3.7 |

| 92 | LOST SPRINGS | 82224 | 3085.78 | 2.97 |

| 93 | ROBERTSON | 82944 | 3084.8 | 1.99 |

| 95 | MEETEETSE | 82433 | 3079.79 | -3.02 |

| 96 | RIVERTON | 82501 | 3078.08 | -4.73 |

| 96 | ARAPAHOE | 82510 | 3078.08 | -4.73 |

| 96 | KINNEAR | 82516 | 3078.08 | -4.73 |

| 96 | SAINT STEPHENS | 82524 | 3078.08 | -4.73 |

| 100 | WORLAND | 82401 | 3077.13 | -5.68 |

| 100 | TEN SLEEP | 82442 | 3077.13 | -5.68 |

| 102 | ALBIN | 82050 | 3072.11 | -10.7 |

| 102 | BURNS | 82053 | 3072.11 | -10.7 |

| 102 | CARPENTER | 82054 | 3072.11 | -10.7 |

| 102 | MERIDEN | 82081 | 3072.11 | -10.7 |

| 102 | PINE BLUFFS | 82082 | 3072.11 | -10.7 |

| 107 | EVANSTON | 82930 | 3071.18 | -11.63 |

| 107 | FORT BRIDGER | 82933 | 3071.18 | -11.63 |

| 107 | LONETREE | 82936 | 3071.18 | -11.63 |

| 107 | LYMAN | 82937 | 3071.18 | -11.63 |

| 111 | WHEATLAND | 82201 | 3069 | -13.81 |

| 111 | FORT LARAMIE | 82212 | 3069 | -13.81 |

| 111 | JAY EM | 82219 | 3069 | -13.81 |

| 111 | LINGLE | 82223 | 3069 | -13.81 |

| 111 | TORRINGTON | 82240 | 3069 | -13.81 |

| 116 | THERMOPOLIS | 82443 | 3068.89 | -13.92 |

| 117 | CROWHEART | 82512 | 3066 | -16.81 |

| 117 | DUBOIS | 82513 | 3066 | -16.81 |

| 117 | PAVILLION | 82523 | 3066 | -16.81 |

| 120 | LAGRANGE | 82221 | 3065.89 | -16.92 |

| 121 | BUFFALO | 82834 | 3065.05 | -17.76 |

| 122 | SHOSHONI | 82649 | 3063.03 | -19.78 |

| 123 | HYATTVILLE | 82428 | 3057.72 | -25.09 |

| 123 | KIRBY | 82430 | 3057.72 | -25.09 |

| 123 | MANDERSON | 82432 | 3057.72 | -25.09 |

| 123 | SHELL | 82441 | 3057.72 | -25.09 |

| 127 | YELLOWSTONE NATIONAL PARK | 82190 | 3057.41 | -25.4 |

| 127 | CODY | 82414 | 3057.41 | -25.4 |

| 127 | FRANNIE | 82423 | 3057.41 | -25.4 |

| 127 | POWELL | 82435 | 3057.41 | -25.4 |

| 127 | RALSTON | 82440 | 3057.41 | -25.4 |

| 127 | WAPITI | 82450 | 3057.41 | -25.4 |

| 133 | BASIN | 82410 | 3056.81 | -26 |

| 133 | BURLINGTON | 82411 | 3056.81 | -26 |

| 133 | BYRON | 82412 | 3056.81 | -26 |

| 133 | COWLEY | 82420 | 3056.81 | -26 |

| 133 | DEAVER | 82421 | 3056.81 | -26 |

| 133 | EMBLEM | 82422 | 3056.81 | -26 |

| 133 | GREYBULL | 82426 | 3056.81 | -26 |

| 133 | LOVELL | 82431 | 3056.81 | -26 |

| 133 | OTTO | 82434 | 3056.81 | -26 |

| 142 | BOSLER | 82051 | 3055.49 | -27.32 |

| 142 | GARRETT | 82058 | 3055.49 | -27.32 |

| 142 | ROCK RIVER | 82083 | 3055.49 | -27.32 |

| 145 | CENTENNIAL | 82055 | 3054.37 | -28.44 |

| 146 | ARVADA | 82831 | 3051.23 | -31.58 |

| 147 | SHAWNEE | 82229 | 3051.2 | -31.61 |

| 147 | GLENROCK | 82637 | 3051.2 | -31.61 |

| 149 | CHUGWATER | 82210 | 3046.62 | -36.19 |

| 149 | GUERNSEY | 82214 | 3046.62 | -36.19 |

| 149 | HARTVILLE | 82215 | 3046.62 | -36.19 |

| 149 | HAWK SPRINGS | 82217 | 3046.62 | -36.19 |

| 149 | HUNTLEY | 82218 | 3046.62 | -36.19 |

| 149 | VETERAN | 82243 | 3046.62 | -36.19 |

| 149 | YODER | 82244 | 3046.62 | -36.19 |

| 156 | LEITER | 82837 | 3040.36 | -42.45 |

| 156 | WOLF | 82844 | 3040.36 | -42.45 |

| 158 | MOUNTAIN VIEW | 82939 | 3036.92 | -45.89 |

| 159 | DOUGLAS | 82633 | 3031.93 | -50.88 |

| 160 | CLEARMONT | 82835 | 3027.42 | -55.39 |

| 161 | CHEYENNE | 82001 | 3025.3 | -57.51 |

| 161 | CHEYENNE | 82009 | 3025.3 | -57.51 |

| 163 | CHEYENNE | 82007 | 3014.9 | -67.91 |

| 164 | DAYTON | 82836 | 3007.45 | -75.36 |

| 164 | PARKMAN | 82838 | 3007.45 | -75.36 |

| 166 | RAWLINS | 82301 | 3002.07 | -80.74 |

| 166 | BAGGS | 82321 | 3002.07 | -80.74 |

| 166 | DIXON | 82323 | 3002.07 | -80.74 |

| 166 | ENCAMPMENT | 82325 | 3002.07 | -80.74 |

| 166 | MEDICINE BOW | 82329 | 3002.07 | -80.74 |

| 166 | SARATOGA | 82331 | 3002.07 | -80.74 |

| 166 | SAVERY | 82332 | 3002.07 | -80.74 |

| 173 | ELK MOUNTAIN | 82324 | 2997.84 | -84.97 |

| 173 | HANNA | 82327 | 2997.84 | -84.97 |

| 173 | SINCLAIR | 82334 | 2997.84 | -84.97 |

| 173 | WALCOTT | 82335 | 2997.84 | -84.97 |

| 173 | SHIRLEY BASIN | 82615 | 2997.84 | -84.97 |

| 178 | BANNER | 82832 | 2992.84 | -89.97 |

| 178 | STORY | 82842 | 2992.84 | -89.97 |

| 180 | SHERIDAN | 82801 | 2968.18 | -114.63 |

| 180 | BIG HORN | 82833 | 2968.18 | -114.63 |

| 180 | RANCHESTER | 82839 | 2968.18 | -114.63 |

| 180 | WYARNO | 82845 | 2968.18 | -114.63 |

It is interesting to note that Alta, Wyoming, (population 511) has the highest average rates for insurance, while Cheyenne, Wyoming, (population 63,957) — the state’s capital — ranks 161st (out of 183) for average rates. For car insurance, it is cheaper to live in Cheyenne than Alta.

Rates in Wyoming’s 10 Largest Cities

Wyoming’s 10 largest cities and towns, along with their average premiums (calculated by averaging the rates for each zip code in each city) are listed in this table.

| Rank | City/Town | Average Premium |

|---|---|---|

| 1 | Cheyenne | $3,021.83 |

| 2 | Casper | $3,096.16 |

| 3 | Laramie | $3,087.65 |

| 4 | Gillette | $3,144.57 |

| 5 | Rock Springs | $3,138.23 |

| 6 | Sheridan | $2,968.18 |

| 7 | Green River | $3,123.27 |

| 8 | Evanston | $3,071.18 |

| 9 | Riverton | $3,078.08 |

| 10 | Jackson | $3,221.37 |

Based on the above table, there is a $253.19 difference between the cheapest and most expensive average rates in the top-10 largest cities/towns in Wyoming.

However, these are not correlated to the largest and smallest of the 10, as the highest average rate is found in Jackson, which is ranked number 10, while the lowest average rate (in this list) is found in Sheridan, which is ranked number six.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Best Wyoming Car Insurance Companies

You know you have options when it comes to choosing the right car insurance provider and coverage mix for your needs. But how do you choose the right company? What factors should you consider besides the rates they offer you?

We know figuring this out can be difficult, so we’ve pulled together data on financial stability, customer service ratings, and complaint percentages for the biggest and best insurance providers in Wyoming.

We’ve also compiled details on how different providers in the state determine your rates (i.e. what other factors they may consider) so you can move forward with all the knowledge you need to make an informed decision.

Keep reading to learn more.

The Largest Companies’ Financial Rating

Knowing the financial stability of the insurance providers you are considering is important. Why? Because you need to know whether the company you are considering has the financial stability to both stay in business and payout on claims, should you ever need to file one.

AM Best, a global credit firm that looks at the insurance market, has rated the major insurance providers based on their financial stability and outlook. Check out this table to see how they rank.

| Insurance Company | Rating | Outlook |

|---|---|---|

| Allstate F&C | A+ | Stable |

| Mid-Century Ins Co | A | Stable |

| Geico General | A++ | Stable |

| Safeco Ins Co of IL | A | Stable |

| State Farm Mutual Auto | A++ | Stable |

| USAA | A++ | Stable |

Any company with a rating of A-minus or better is both financially stable and maintains a consistent loss ratio, per AM Best.

Based on the information in the above table, drivers in Wyoming can be confident in the financial stability and outlook of the main companies providing insurance coverage in the state.

Companies with Best Ratings

What about customer service? For many consumers, customer service is key in determining both what services to purchase and whether they become long-term consumers of a particular service provider. This holds for insurance providers, as well.

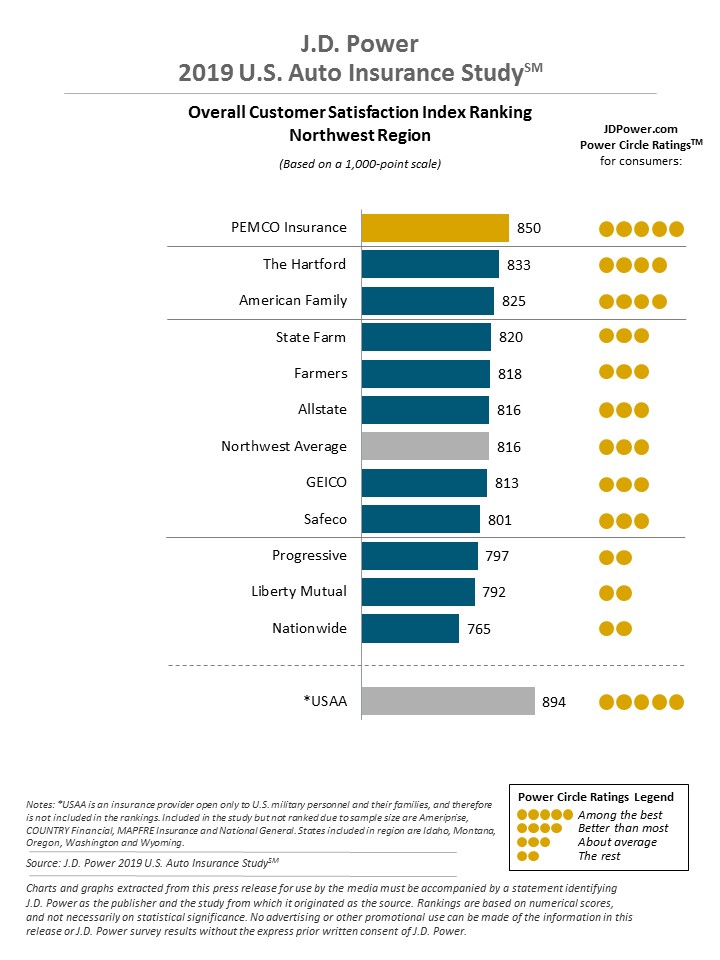

According to a recent J.D. Power study, car insurance companies have been listening to you, the consumer, and have made the necessary adjustments, because customer service satisfaction ratings are higher than ever.

The customer satisfaction ratings for the main insurance companies in the Northwest region of the United States are below.

Companies with Most Complaints in Wyoming

Now that you’ve seen the customer satisfaction ratings for insurance providers in Wyoming, let’s look at it another way. What kind and how many complaints do insurance providers receive in Wyoming?

| Insurance Company | Complaints | Premiums ($) | Direct Premiums Written ($1.0 million) | 2018 Complaint Ratio |

|---|---|---|---|---|

| Allstate Property and Casualty Insurance Company | 4 | 8,420,287 | 8.42 | 0.48 |

| USAA | 4 | 11,196,457 | 11.197 | 0.36 |

| Geico | 5 | 14,667,553 | 14.668 | 0.34 |

| Allstate Fire & Casualty Insurance Company | 5 | 16,003,594 | 16.004 | 0.31 |

| Progressive Universal Ins Co | 7 | 29,068,699 | 29.069 | 0.24 |

| Farmers Insurance Exchange | 6 | 26,163,166 | 26.1632 | 0.23 |

| State Farm Fire and Causalty | 11 | 64,777,467 | 64.778 | 0.17 |

| Safeco Insurance Co of America | 3 | 21,043,821 | 21.044 | 0.14 |

| Progressive Northern Ins Co | 4 | 30,837,684 | 30.838 | 0.13 |

| Mountain West Farm Bureau Mutual Insurance Company | 12 | 106,616,202 | 106.616 | 0.11 |

| State Farm Mutual Auto | 8 | 95,825,878 | 95.826 | 0.08 |

The complaint ratio looks at how many complaints a company receives compared to average. In the above table, the average is one. Companies with a ratio above one receive more than the average number of complaints, while companies with a ratio below one receive less.

Based on the data in the above table, most companies in Wyoming receive well below the average complaints. For more detailed information on complaint ratio data in Wyoming, you can visit the Wyoming Department of Insurance website.

The Wyoming Department of Insurance investigates claims submitted to them through their Customer Request for Assistance form.

Cheapest Companies in Wyoming

One of the most important considerations when making a purchasing decision of any kind is price. What gets you the most bang for your buck. Let’s take a look at the average rates for the major car insurance providers in Wyoming.

| Company | Average Annual Rate | +/- Compared to State Average (rate) | +/- Compared to State Average (%) |

|---|---|---|---|

| Safeco Ins Co of IL | $1,989.36 | -$1,012.69 | -50.91% |

| State Farm Mutual Auto | $2,303.55 | -$698.49 | -30.32% |

| USAA | $2,779.53 | -$222.51 | -8.01% |

| Mid-Century Ins Co | $3,069.35 | $67.30 | 2.19% |

| Geico General | $3,496.55 | $494.51 | 14.14% |

| Allstate F&C | $4,373.93 | $1,371.89 | 31.37% |

The data in this table compares the annual average rates for each company against the annual average rate for the state as a whole, which is $3,002.04.

Three of the companies are below the average (some quite significantly, like Safeco), while the remaining providers offer rates above the state average cost for car insurance.

But where do these rates come from? As we mentioned earlier, there are some factors beyond location and age that insurance providers consider when adjusting your rates. These include commute, driving record, and even credit score, and sometimes education level.

Keep reading to learn more about what factors may affect your rates.

Commute Rates by Companies

Do you have a long commute? If so, you, unfortunately, may be facing higher insurance rates than someone with a shorter commute. This is largely because your chances of getting in an accident increase the longer you spend driving each day.

This table compares insurance for a daily commute of 10 miles versus a daily commute of 25 miles to see how it can affect your rates.

| Company | 10 Mile Commute (10,000 annual mileage) | 25 Mile Commute (12,000 annual mileage) | Percent Increase |

|---|---|---|---|

| Liberty Mutual | $1,989.35 | $1,989.35 | 0.00% |

| State Farm | $2,222.40 | $2,384.70 | 7.30% |

| USAA | $2,747.30 | $2,811.77 | 2.35% |

| Farmers | $3,069.35 | $3,069.35 | 0.00% |

| Geico | $3,440.58 | $3,552.52 | 3.25% |

| Allstate | $4,270.81 | $4,477.05 | 4.83% |

As you can see, different companies consider your commute more than others when adjusting your rates. If you have a long commute, Liberty Mutual and Farmers may be good options for you, because they do not increase their rates based on this factor. However, the other four companies do, to varying degrees, increase their rates based on an increase in your commute.

Coverage Level Rates by Companies

As you might expect, the amount of coverage you choose to purchase can affect your rates. Do you need high coverage? Low coverage? Somewhere in between? This table compares average rates for different levels of coverage in Wyoming.

| Insurance Company | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| Liberty Mutual | $1,899.46 | $1,982.49 | $2,086.12 |

| State Farm | $2,229.01 | $2,304.26 | $2,377.38 |

| USAA | $2,715.01 | $2,777.42 | $2,846.16 |

| Farmers | $2,991.48 | $3,064.88 | $3,151.68 |

| Geico | $3,445.96 | $3,499.83 | $3,543.86 |

| Allstate | $4,264.74 | $4,365.39 | $4,491.67 |

Some companies charge more than others for different levels of coverage. For example, Liberty Mutual’s average rates increase by 4.4 percent if you choose medium coverage instead of low. If you choose high coverage, their rates increase by almost 10 percent over their low coverage rates.

By contrast, Geico only increases their average rates by 1.6 percent and 2.9 percent for medium and high coverage, respectively.

Credit History Rates by Companies

Do you have good credit? For some insurance providers, the better your credit, the lower they will adjust your rates. Some insurance companies consider good credit as a sign of responsibility they believe will transfer to other areas beyond your track record for paying bills.

Experian indicates that the average credit score in Wyoming is 678, which is typically considered to be a good credit score. This table compares rates for good, fair, and poor credit in Wyoming.

| Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| USAA | $1,496.84 | $2,124.46 | $4,717.29 |

| Liberty Mutual | $1,752.67 | $1,956.81 | $2,258.58 |

| State Farm | $1,789.00 | $2,123.67 | $2,997.98 |

| Farmers | $2,809.91 | $3,106.41 | $3,291.73 |

| Geico | $3,166.77 | $3,364.95 | $3,957.93 |

| Allstate | $3,524.08 | $4,138.37 | $5,459.34 |

What does all this data mean for you?

- Good Credit (670+) = average annual premiums: $2,423.21

- Fair Credit (580-669) = 6 – 19 percent increase: $2,802.45

- Poor Credit (300-579) = 17 – 215 percent increase: $3,780.48

Driving Record Rates by Companies

It’s no surprise that car insurance companies consider your driving record when adjusting your rates. But how much does this affect your rates? How do different infractions affect your rates? Check out this table to see what can happen to your rates depending on the infractions on your driving record.

| Company | Clean Record | 1 Speeding Violation | 1 DUI | 1 Accident |

|---|---|---|---|---|

| Liberty Mutual | $1,427.24 | $1,980.39 | $2,365.60 | $2,184.19 |

| State Farm | $2,129.24 | $2,303.46 | $2,303.46 | $2,478.05 |

| USAA | $2,184.09 | $2,380.48 | $3,904.12 | $2,649.43 |

| Geico | $2,294.34 | $3,845.09 | $4,784.93 | $3,061.85 |

| Farmers | $2,324.65 | $2,466.47 | $4,736.07 | $2,750.20 |

| Allstate | $3,787.57 | $4,387.13 | $4,813.14 | $4,507.89 |

Do you find yourself speeding down the highway regularly? If so, you may want to consider Farmers insurance, as they have the smallest increase for a speeding violation.

To look at this data another way, we’ve calculated the percent increase for each infraction and compiled those numbers into the table below.

| Company | Percent Increase - Speeding Ticket | Percent Increase - DUI | Percent Increase - Accident |

|---|---|---|---|

| Farmers | 6.10% | 103.73% | 18.31% |

| State Farm | 8.18% | 8.18% | 16.38% |

| USAA | 8.99% | 78.75% | 21.31% |

| Allstate | 15.83% | 27.08% | 19.02% |

| Liberty Mutual | 38.76% | 65.75% | 53.04% |

| Geico | 67.59% | 108.55% | 33.45% |

It is interesting to note that while most companies increase your rates much more dramatically for a DUI than they do for speeding, State Farm does not. Their rate increases are the same for both speeding and DUI violations.

Largest Car Insurance Companies in Wyoming

Company size is also something to consider when looking for the right insurance provider for your lifestyle and needs. The size, expressed as market share, can be a sign, combined with loss ratio and complaint data, of a company’s ability to pay a claim, should you need to file one.

This table compares the main insurance providers in the state based on their market share in Wyoming, along with the premiums paid for each.

| Company | Premiums Written | Market Share |

|---|---|---|

| State Farm Group | $94,390 | 24.09% |

| Progressive Group | $54,498 | 13.91% |

| Farmers Insurance Group | $47,277 | 12.07% |

| Mountain West Farm Group | $38,093 | 9.72% |

| Geico | $32,878 | 8.39% |

| USAA Group | $25,560 | 6.52% |

| Liberty Mutual Group | $25,238 | 6.44% |

| Allstate Insurance Group | $18,926 | 4.83% |

| Nationwide Corp Group | $12,398 | 3.16% |

| Hartford Fire & Casualty Group | $6,638 | 1.69% |

Number of Insurers by State

While we’ve only looked at the top-six-to-ten insurance providers in Wyoming, you have other options. There are a total of 695 insurance providers in the state. Two of these are considered domestic insurers, which means the companies are incorporated in Wyoming. The remaining 693 are termed foreign insurers, which means they are incorporated somewhere else in the country (rather than Wyoming).

It is important to note that regardless of whether they are domestic or foreign insurers, every company is required to follow the insurance laws set by the state of Wyoming to legally operate within the borders of the state.

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

Wyoming Laws

You know there are laws that you must follow (some of these, like the minimum liability insurance requirement, we’ve already covered), but we know figuring out what these are, where to find them, and how and when they apply to you can be overwhelming.

To enable you to be able to focus on your next adventure, rather than the stress related to these laws, we’ve researched for you and compiled information for you on various laws of which you should be aware when shopping for insurance and driving on the road.

Car Insurance Laws

You know insurance is required, but what if you can’t get insurance because of your driving record? Are there laws regarding when and how you need to get your windshield repaired if it gets chipped or cracked? What constitutes insurance fraud?

We answer all these questions and more in the following sections. Keep reading to learn more.

How State Laws for Insurance are Determined

As is typical for law creation in the United States, when a law is passed in Wyoming, it first must be presented to the state legislature. The legislature then reviews it and determines its validity. If they agree it is beneficial, it will then be passed into law.

There are some safety-related insurance laws of which you should be aware so you are driving both safely and legally on the road in Wyoming. The following sections take a look at some of these safety laws.

Windshield Coverage

Wyoming does not have any specific laws regarding windshield repair requirements. However, it is prohibited to have a windshield with an obstructed view, so if your windshield has chips or cracks that appear to impair your ability to see the road, you may be stopped by law enforcement at their discretion.

High-Risk Insurance

You already know it is required for all Wyoming drivers to maintain minimum liability insurance. But what if, because you have a poor driving record, insurance companies refuse to sell you car insurance?

If you are a high-risk driver, Wyoming does have options to keep you legal while driving on the road. If you qualify, you may receive help obtaining insurance through the Wyoming Automobile Insurance Plan (WY AIP), which was started in 1948.

What is WY AIP? It is a program that matches high-risk drivers who have been unable to obtain car insurance coverage on their own with insurance companies. If you are insured under this program, you cannot choose the insurance company. Instead, you are assigned to an insurance company.

Insurance companies are required to participate in this program as a part of the laws they follow to be able to operate in the state. Their market share determines how many high-risk drivers they must insure through WY AIP. For example, we know State Farm has a market share of about 24 percent in Wyoming. This means they must provide insurance to 24 percent of the high-risk drivers applying through WY AIP.

To qualify for an application to WY AIP, you must be able to prove:

- You have attempted and been unable to obtain car insurance in Wyoming for the previous two months

- You have a valid driver’s license

You will have the option for minimum liability coverage, as well as more full coverage options including additional liability coverage.

To apply for insurance through WY AIP, you can speak to any car insurance agent. They can help you apply and find out what your rates will be.

You can also call the Wyoming Department of Insurance at 307-777-7401 to find out more information on the WY AIP.

If at any point your license is suspended because you were found to be driving while uninsured and you ended up involved in a car accident, part of your license reinstatement requirements will include obtaining an SR-22. This is both promise and proof that you will obtain insurance and will continue to have insurance coverage for three years.

Low-Cost Insurance

While Wyoming offers programs to help drivers with poor driving records obtain insurance, it does not have a commensurate program for low-income drivers.

Currently, California, Hawaii, and New Jersey are the only states in the country that offer government-funded options to help low-income families obtain and pay for car insurance.

Automobile Insurance Fraud in Wyoming

According to the Insurance Information Institute, property and casualty insurance fraud averages about $30 billion each year. The same article noted that, on average, one in 10 Americans has included false information when purchasing car insurance to try and reduce their rates.

All this adds up to a lot of money lost, which ultimately means you as the insured pay more in car insurance to make up for this. Wyoming considers insurance fraud a crime. What constitutes fraud for car insurance? It can include (but is not limited to):

- Casualty fraud: exaggerating injuries due to an accident to increase the amount of money you receive from the insurance company, or even faking an accident to file a claim

- Property fraud: exaggerating or falsifying damage to your vehicle to get money from the appropriate insurance company

If you are found guilty of car insurance fraud in the state, you may face up to a year in jail as well as fines.

If you need to report suspected fraud, you can do so by filling out the NAIC online report form. The Wyoming Department of Insurance investigates all reports of fraud through that system. You can also call the Wyoming Department of Insurance at 307-777-7401.

Statute of Limitations

The statute of limitations on insurance claims in Wyoming is four years. If you do not submit a claim during that time frame, you lose your right to do so for both personal injury and property damage.

State-Specific Laws

While most of the laws we’ve discussed so far are similar state-to-state, Wyoming does have some laws specific to the state.

One driving-related law that at first glance seems excessive is one regarding closing fences. If you open a fence, you are legally required to close it. If you do not, this may cost you up to $750 in fines and you may also be charged with a misdemeanor.

Why does this law exist and why are the consequences for such a seemingly innocuous action so steep? Wyoming is filled with ranch land. If you do not close a fence behind you, livestock like cattle and sheep can end up on the road unexpectedly, which can result in property damage both for you as a driver and the rancher whose livestock you hit with your vehicle.

Vehicle Licensing Laws

How do you register a vehicle? How do you obtain a driver’s license? What about renewing your license? These are all important questions to ask if you want to avoid fees and potential suspension of your license and driving privileges.

In Wyoming, individual counties manage vehicle registration. The County Treasurer’s office in each county is responsible for providing both license plates and vehicle registrations.

For vehicle titles and liens, residents also file through their county clerk office.

If you’re not sure which county clerk’s office you should be working with for vehicle title and registration, the Wyoming Department of Transportation provides a list of cities and counties you can use to figure this out.

REAL ID

By now you’ve heard of the REAL ID act. It is an effort by the Department of Homeland Security in coordination with states to ensure anyone with a REAL ID-compliant form of identification is who they say they are (it was originally instituted in the wake of 9/11).

REAL IDs are required if you plan to fly commercially or visit military installations or nuclear power plants. For the latter two, you also have to need to access those locations. Having a REAL ID will not automatically grant you access to either military installations or nuclear power plants.

REAL ID–compliance is more important than ever because starting in October of 2020, REAL ID–compliant driver’s licenses will be the only driver’s license accepted to get on a commercial airplane (though valid passports and other forms of identification will also still be accepted).

Wyoming has been compliant with REAL ID for several years. However, the state is developing new identification cards (including driver’s licenses) to reduce fraudulent identification documentation. These new credentials started being issued in the summer of 2019. You will not be required to make a specific change. When your license needs to be renewed, you will automatically be issued a new license.

REAL ID driver’s licenses in Wyoming are indicated by a star on the top right corner of your license.

To obtain a REAL ID in Wyoming, you will be required to apply in person with the following documentation:

- Passport or birth certificate

- Social security number

- Two proofs of state residency

- Name change (if applicable)

Penalties for Driving Without Insurance

What happens if you’re found driving without insurance?

In Wyoming, driving without insurance can result in you being charged with a misdemeanor. You may face fines of between $250 – $750, jail time of up to six months, and suspension of your license until you can prove you have insurance. To reinstate your license, you will also have to pay a $50 reinstatement fee and maintain an SR-22 form for three years.

Initially, if you are stopped by law enforcement and found to be driving without insurance, you will be fined and will have seven days to prove you have insurance coverage in court. If you do not do so, your license will be suspended 30 days after you are notified of your suspension.

Teen Driver Laws

If you are a teenager just learning to drive, Wyoming has specific requirements you must meet.

According to the Wyoming Department of Transportation, when applying for a license, in addition to the required documentation, you must also bring your driver education course completion (this is obtained by applying for and taking a driver education course through your local school district).

At 15, you can apply for a learner’s permit in the state. You are required to maintain this permit for a minimum of 10 days. You must also complete 50 hours of driving (10 must be at night).

Once you have applied for and obtained an intermediate license, you may not drive without supervision between 11:00 p.m. – 5:00 a.m. Additionally, you can only have one passenger who is under the age of 18 at any given time. Once you have held the intermediate license for six months or you turn 17 (whichever is first), you can apply for an unrestricted license.

Older Driver License Renewal Procedures

In Wyoming, drivers in the older population and those in the general population have the same license renewal requirements. Renewals must be completed every five years, a vision test is required every 10 years, and you only have to renew in-person every other time. On the opposite renewal, you can mail in your license renewal application.

New Residents

Have you recently moved to Wyoming? If so, you need to be aware of the licensing requirements in the state.

Within one year of establishing residency in the state, you are required to obtain a Wyoming driver’s license. To do this, you will need to apply in person at a driver exam office. You will be required to trade in your out-of-state license and provide the following documentation:

- Proof of identity

- Two proofs of current state residence

- Social security number

- Name change (if applicable)

You will also need to pass a vision exam and have a photo taken.

If you live in Wyoming because you are an active-duty military, you do not need to apply for a Wyoming driver’s license.

License Renewal Procedures

License renewals are required every five years in Wyoming, and as we mentioned earlier, you may mail in your renewal every other time (once each eight years) a renewal is required.

The state will mail you a renewal application form about four months before the expiration date listed on your license. You will need to fill out the form and submit it either through the mail or in-person (if you are required to do so).

The vision portion of the form must be signed by either a vision specialist or a driver services examiner. Any vision screening must be within the preceding 12 months.

If you are active-duty military, you are exempt from the limitation on renewals by mail, but you are required to visit a driver exam office whenever you are next in Wyoming, to obtain an updated license and license photo

Negligent Operator Treatment System (NOTS)

Unlike many states, Wyoming does not use a points system like the Negligent Operator Treatment System (NOTS). However, any moving violation (i.e. a speeding ticket) you receive is recorded with the state and attached to your driving record.

If you receive two moving violations within one year, you may be required to attend a driver improvement course. However, if you receive four violations in a year, your license will be suspended for 90 days.

Rules of the Road

How do you stay safe on the road? Keep your driving record clean? You must know the rules of the road to stay safe and legal when you’re driving in Wyoming.

Keep reading to learn more about who is financially responsible if you are in an accident, seat belt requirements, speed limits, and even what you can expect concerning driverless cars in the state.

Fault vs. No-Fault

Wyoming is an “at-fault” state, meaning whoever is at-fault for an accident is financially responsible for any resulting damages (both property and injury-related).

In the event you are in an accident for which you are not at fault, you have three options for how to ensure your damages are covered financially. You can:

- File a claim with your insurance provider (they will pursue obtaining payment from the insurance provider of the driver who was at fault)

- File a claim with the insurance provider of the driver who was at fault

- File a personal injury lawsuit against the driver who was at fault

Seat Belt & Car Seat Laws

Seat belt laws were initially instituted at a federal level in 1968. The law specifically stated vehicles must include seat belts. However, both drivers and passengers had the option to choose whether or not to use the seat belts.

Individual states have gradually instituted the requirement for all individuals in a vehicle (driver and passengers) to be properly belted at all times. Wyoming made this state law in 1989. Because this is a state-governed law, every state has slightly different requirements.

Anyone riding in a vehicle who is nine years or older is required to be wearing the proper, standard seat belt. If the passenger is eight years or younger, they are required to be in a child safety seat; an adult seat belt is not acceptable. Additionally, if there is a back seat in your vehicle, anyone eight or younger must ride there.

In Wyoming, being caught without wearing a seat belt is considered a secondary offense. This means you cannot be pulled over specifically and ticketed for not wearing a seat belt. However, if you are pulled over for a different offense (for example, speeding), and you are not wearing your seat belt, you can be ticketed for both the speeding offense and the fact that you are not wearing a seat belt.

There is no state law specifically calling out whether or not riding in the bed of a pickup truck is legal in Wyoming.

Keep Right & Move Over Laws

In Wyoming, you are only required to move to the right if you are driving slower than the speed of the traffic around you. You can drive in the left lane as long you are not slowing down traffic to below the speed limit by doing so.

Speed Limits

For most interstates in Wyoming, the maximum speed limit is 75 mph. However, on specific portions of the road, which are marked accordingly, the speed limit increases to 80 mph.

As we noted earlier, Wyoming takes speeding seriously. If you are convicted of four moving offenses within a year, your license will be suspended. It is also illegal to drive below the speed limit if doing so slows down surrounding traffic to below the posted speed limit.

Ridesharing

Unlike many states, Wyoming has very few laws governing how ridesharing services are required to operate in the state. There are no explicit insurance, business license, or license to operate requirements.

Transportation network companies (TNC) are relatively new to Wyoming. Uber and Lyft, which were the first TNCs to operate in the state, started providing rides to Wyoming residents in 2017.

USAA is the only insurance company that currently offers coverage to TNC drivers in Wyoming. Insurance providers are also permitted to not extend coverage to policyholders if and when that policyholder is performing services as part of a TNC.

Automation on the Road

Wyoming does not currently have any laws related to autonomous vehicles. While they are not explicitly permitted, they are also not explicitly banned.

However, the state is paying attention to the changes happening in the driving world with regard to driverless cars.

The state does have a grant (they are one of only three states to have received one) to be part of a trial of “connected” vehicles. Connected vehicles are vehicles that can communicate with other connected vehicles. This allows the vehicle to notify other connected vehicles if there is bad weather, a car accident, and more so those other vehicles can slow down, be prepared, etc.

Safety Laws

Like most states, Wyoming has many laws on the books in place to keep you and other drivers safe on the road. These include laws regarding driving while under the influence and driving while distracted.

To make sure you have adequate visibility when driving your vehicle, another law Wyoming maintains sets out maximum requirements for tinting. In Wyoming, you are required to ensure a certain percentage of outdoor lighting must filter into your vehicle. These can be vehicle-specific.

Read more: How to Tint Car Windows

If you drive a sedan:

- Windshield: Non-reflective tint can be placed on only the top five inches

- Front and back side : A minimum of 28 percent of outside lighting must filter into the vehicle and reflection cannot be more than 20 percent reflective

- Rear : A minimum of 28 percent of outside lighting must filter into the vehicle

If you drive an SUV or van:

- Windshield: Non-reflective can be placed on only the top five inches

- Front side : A minimum of 28 percent of outside lighting must filter into the vehicle and reflection cannot be more than 20 percent reflective

- Back side : Any darkness is permitted and reflection cannot be more than 20 percent reflective

- Rear : Any darkness is permitted and reflection cannot be more than 20 percent reflective

Additionally, if any back or rear are tinted, dual side mirrors are required. Red, yellow, and amber tinting are prohibited on the windshield, but all colors of tinting are acceptable for the other on your vehicle.

Keep reading to learn more about driving under the influence and distracted driving laws in Wyoming.

DUI Laws

Have you or someone you know ever driven after having a few drinks? This is dangerous for you, everyone else on the road, and is potentially extremely costly. The blood alcohol (BAC) limit in Wyoming is 0.08, while a high BAC (HBAC) is 0.15. In 2017, 44 people died in alcohol-impaired driving incidents in the state according to Responsibility.org.

Next time you think about taking the risk of driving while under the influence, think about the potential consequences. Not only are you putting others’ lives at risk, but you may also face serious repercussions yourself. This table outlines penalties you may face if you are convicted of DUI.

| 1st DUI | 2nd DUI | 3rd DUI | 4th DUI | |

|---|---|---|---|---|

| Fine | no minimum, but up to $750 | $250-$750 | $250-$3000 | up to $10000 |

| Jail Time | no minimum, but up to 6 months | 7 days - 6 months | 30 days - 6 months | up to 2 years |

| License Revoked | 90 days | 1 year | 3 years | 3 years |

| Mandatory Ignition Interlock Device | Required for up to 6 months if HBAC | 1 year | 2 years | For life, but may apply for removal after 5 years |

| Other | Substance abuse assessment required | Substance abuse assessment required | Substance abuse assessment required |

Your record will show a DUI for 10 years in Wyoming.

If you are caught drinking and driving in Wyoming, not only will you face the consequences described in the above table, but it is likely your insurance premiums will also dramatically increase.

If you plan to let loose and have some drinks, be prepared. Designate someone to be the sober driver or make use of the ridesharing services now available in Wyoming. You have options. Use them, because drinking and driving is just not worth the risk.

Marijuana-Impaired Driving Laws

Marijuana is completely illegal in Wyoming, including for medical use. Additionally, there are no laws specifically related to driving while under the influence of marijuana in the state.

Distracted Driving Laws

Wyoming has banned texting while driving. However, unlike many states, they do not currently have any bans related to handheld usage. Texting while driving is considered a primary offense, however, which means a law enforcement officer can pull you over specifically for texting while driving and cite you for that.